US Bonds Yield Curve is not currently an inflationist’s friend

Interest-Rates / US Bonds Dec 07, 2021 - 02:25 PM GMTBy: Gary_Tanashian

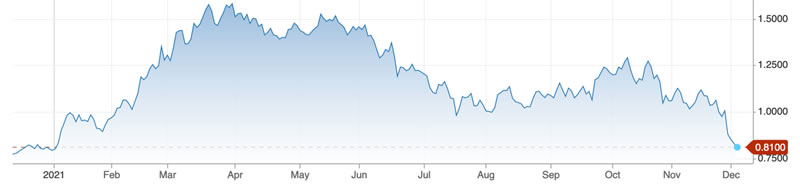

The yield curve is flattening

I don’t cheer-lead a given view, but if I were to do that I’d be cheering for a yield curve flattener to put a correction to inflationist dogmatists quoting von Mises to the herds and otherwise sloganeering about inflation and a “commodity super cycle” (that term is pure promo).

Well, the curve is flattening.

Which means one of three things.

- It’s on a grind prior to a new inflationary steepener…

- A grind prior to a new deflationary steepener…

- A Goldilocks flattener, as a not too hot and not too cool boom results after shedding the initial inflationary inputs from which it was born…

Do you want to guess or do you want to interpret along the way and be right when it will be most important? I want to be right and so the first thing I will do is to remind myself not to swallow anybody’s dogma. No sir. In 2020 we were tasked with getting bullish, not just on stocks but the entire cyclical, inflation-sensitive world of assets due to the Fed’s actions in Q1 amid the COVID hysteria.

In hindsight it was like shooting fish in a barrel, although in real time we simply developed and carried the narrative each week in NFTRH. It’s all you can do in the markets; refine, adjust and move forward.

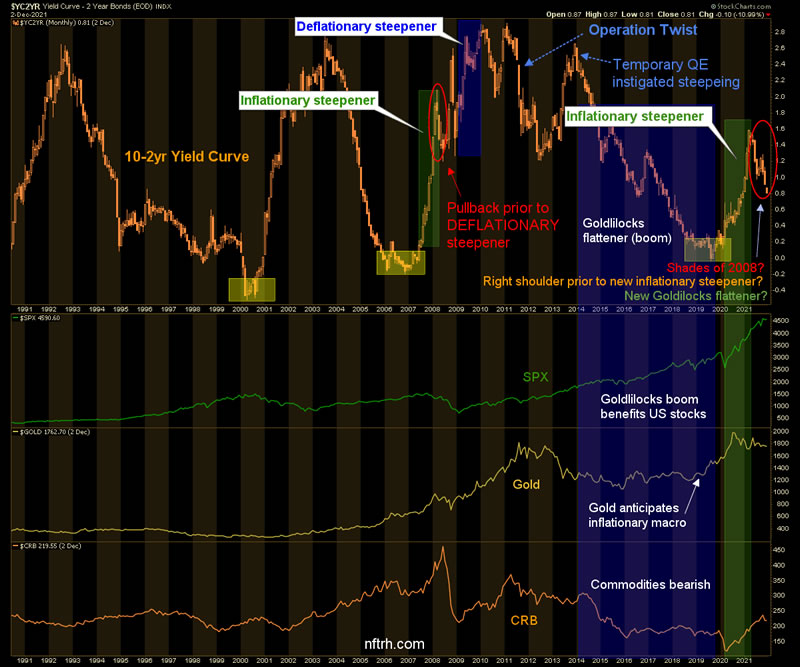

Moving on, and with regard to the yield curve’s short-term flattening trend noted above, once again we unearth the busy monthly chart macro view of the yield curve that begs patience and perspective as the macro grinds out what will be ahead.

If the current short-term flattening proves to be a shakeout within the ongoing inflationary regime, then as you were inflation traders, the curve would steepen again and you’ll eventually get bailed out. Lots of inflation sensitive, cyclical stuff can recover into a ‘next phase’ (CRB target: 270+).

If it is to resolve into a new deflationary steepener (the reminder being that the yield curve can steepen under inflationary or deflationary pressure) I’ll prepare to buy gold and gold stocks on the crash, but before that hopefully have the opportunity to short stocks on proper setups.

If it is a Goldilocks flattener, well, you know the drill. Stocks, baby. Stocks with a bias toward technology and growth and away from cyclical and inflation-sensitive. As it stands now , my view of the Semiconductor sector is already positive, fundamentally at least. In 2013 a positive NFTRH view of the Semis happened to lead and then coincide with the massive yield curve flattener from 2014 to 2019. Coincidence?

The above is an attempt to provide views of the three main possibilities and to bust peoples’ preconceived notions if at all possible. There is a lot of ‘auto pilot’ type analysis out there, much of it for free. It is free for a reason. Hell, even premium analysis is often on auto pilot. That is why we need to have a capacity to think for ourselves. Trust certain sources but ultimately know why we do what we do in the financial markets.

As humans, we are generally taught to respect authority and those of more expert origins than we the lowly individual may be. But in the financial markets that has proven wrong, even tragic thinking all too often. There are grifters and well meaning sources alike. But only the market will decide what is ahead, which is why it is best to dig down and understand the market’s roots; understand what makes it tick in the era of over-stimulation and leverage by policy.

As an interlude, the above is why it is always good to have gold as a ‘value’ asset, even when it is price-bearish. It is not a play in the casino, but all too many people see it as just that. Gold simply is; a heavy lump of retained value amid the inflated and deflated assets around it. It’s not a ‘play’.

Try to think independently going forward and use good tools. There are inflationists, deflationists, gold bugs, commodity super cyclers, bulls, bears and every other flavor of market opinion out there. But per the above view, the macro is undecided by one of my primary tools, the yield curve. So why not avoid the dogma and stay open minded while the macro sorts itself out?

There will be opportunity to position as the picture clears and the macro resolves.

Subscribe to NFTRH Premium (monthly at USD $33.50 or a 14% discounted yearly at USD $345.00) for an in-depth weekly market report, interim market updates and NFTRH+ chart and trade setup ideas, all archived/posted at the site and delivered to your inbox.

You can also keep up to date with plenty of actionable public content at NFTRH.com by using the email form on the right sidebar and get even more by joining our free eLetter. Or follow via Twitter ;@BiiwiiNFTRH, StockTwits or RSS. Also check out the quality market writers at Biiwii.com.

By Gary Tanashian

© 2021 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.