Stock Market Still More to Come

Stock-Markets / Stock Market 2021 Dec 27, 2021 - 12:02 PM GMTBy: Monica_Kingsley

S&P 500 Santa rally goes on, and risk-on markets rejoice. What a nice sight of market breadth improvement, and confirmation from bonds. Financials and industrials are lagging, but real estate, healthcare and tech are humming smoothly. As I told you yesterday about volatility:

(…) The VIX is calming down, now around 21 with further room to decline still – at least as far as the remainder of 2021 is concerned.

We got the lower values, and today is shaping up to look likewise constructively for the bulls across both paper and real assets. Yesterday‘s dollar decline has helped as much as well bid bonds. Inflation expectations aren‘t yet doubting the Fed, there is no more compressing the yield curve at the moment, so it‘s all quiet on the central bank front. That‘s good, the Santa rally can go on unimpeded.

Precious metals are peeking higher in what looks to be adjustment to the lower yields and dollar, and commodities upswing remains driven by energy, base metals and agrifoods. Cryptos hesitation may hint at slimmer gains today than was the case yesterday when instead of a brief consolidation, we were treated to improving returns.

Merry Christmas if you‘re celebrating – and if not, happy holidays spent with your closest ones. Let the festive season and message of the Prince of Peace permeate our hearts and inspire the best in mankind.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

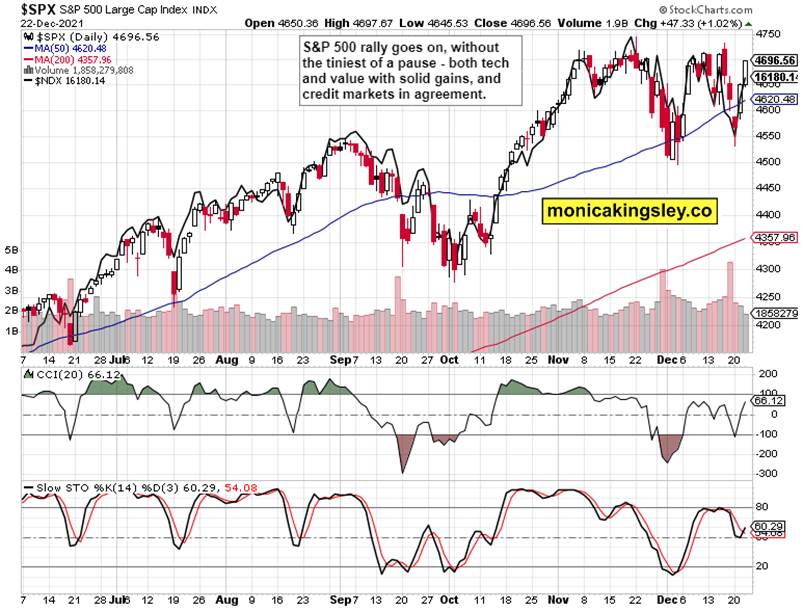

S&P 500 and Nasdaq Outlook

S&P 500 rally goes on, and the 4,720s are again approaching. Market breadth isn‘t miserable in the least, and the riskier end of the bond spectrum looks positive even if larger time frame worries haven‘t gone away. Classic Santa Claus rally.

Credit Markets

HYG keeps jumping higher – the risk-on sentiment is winning this week. A bit more strength from LQD would be welcome, but isn‘t an obstacle to further stock market gains.

Gold, Silver and Miners

Gold downswing indeed weren‘t to be taken at all seriously – solid gains across precious metals followed. I‘m expecting a not too rickety ride ahead as the metals keep appreciating at relatively slow pace.

Crude Oil

Crude oil extended gains, and even if oil stocks paused, downswing in black gold isn‘t looming. Importantly, the $72 area has been overcome – the bulls should be able to hold ground gained.

Copper

Copper keeps tracking the broader commodities rally, and isn‘t outperforming yet. The red metal‘s long consolidation goes on, and a breakout attempt on par with early Oct seems to be a question of quite a few weeks (not days) ahead.

Bitcoin and Ethereum

Bitcoin and Ethereum are still consolidating Tuesday‘s gains – the performance is neither disappointing nor stellar. Both cryptos don‘t look to be in the mood for a break below Dec lows.

Summary

- If not yesterday, then probably today we‘ll get a little consolidation of prior two day‘s steep S&P 500 and commodity gains (copper says) – the positive seasonality hasn‘t spoken its last word. HYG posture has significantly improved, and that bodes well for short-term gains still ahead before we dive into market circumstances turning increasingly volatile towards the end of Q1 2022. For now, let‘s keep celebrating – Merry Christmas once again – and enjoying the relatively smooth ride.

Thank you for having read today‘s free analysis, which is available in full at my homesite. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for both Stock Trading Signals and Gold Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

www.monicakingsley.co

mk@monicakingsley.co

* * * * *

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.