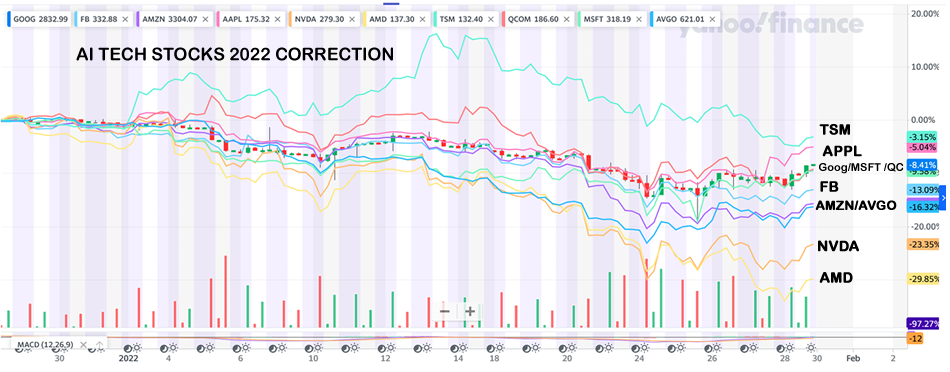

AI Tech Stocks 2022 Correction

Companies / Tech Stocks Feb 11, 2022 - 05:37 PM GMTBy: Nadeem_Walayat

People tend to over complicate investing, looking for that which will give them the exact bottom price to buy at because they cannot cope with draw downs, even though the draw down delivers lower buying prices and thus risk missing out on the golden opportunity of accumulating into some of the best stocks one can ever dream of investing in at deep discounts to their trading highs, virtually all of which traded at least 15% lower during the week with a number such as Nvidia and AMD trading lower by more than 1.3rd of where they were trading barely a month ago!

All one needs is a list of good stocks to own for the long-run. And then wait for opportune moments with list of buying levels to accumulate at the primary purpose of which is so that one does need to THINK in the midst of panic, chaos, NOISE just ACT!

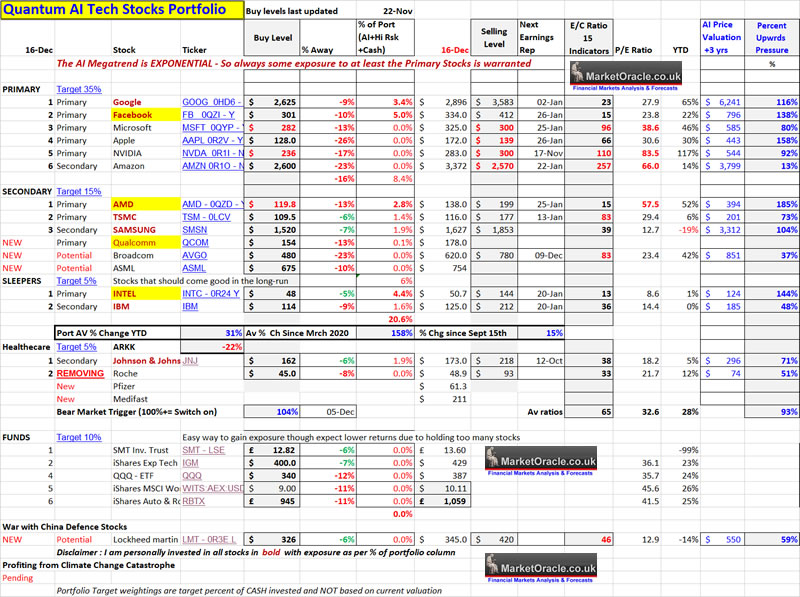

The starting point for investing are my long standing buying levels at valuation levels that no matter what happens should come good in the long-run whilst preventing investors from over paying by FOMO-ing into the highs, i.e. The buying level for Google is $2625 not $3025, Microsoft $282 rather than $342 and Nvidia $236 rather than $336 as some clowns on youtube were publically FOMO-ing into at, as illustrated by my last iteration of the AI stocks table of Mid December.

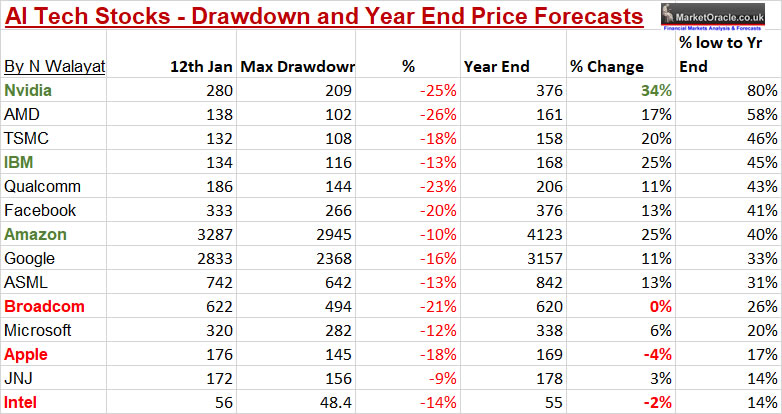

Phase 2 was my timely analysis (HOW TO SUCCESSFULLY INVEST IN STOCKS During 2022 and Beyond) that laid the ground work for how to invest during the anticipated waves of deep deviations from the highs in each of the stocks one by one that concluded in the following table of how low I expected each of the stocks to trade down to as a guide to where to target he bulk of ones planned buying in favour of those stocks that presented the greatest low to high potential price move.

For instance my target low for Nvidia, the stock that I deemed to have the greatest potential was $209, the actual low point of the current sell off is 208.88. And similarly other stocks such as AMD, Amazon, ASML, Microsoft, and Intel have all reached their target lows and so I bought into all of these stocks to varying extent amongst others.

However, I have noticed from Patreon comments that as prices fell sharply, some were finding reasons why stocks could just keep falling much further, which reinforces the importance of having a plan and sticking to it regardless of what happens else one will just find oneself having bought nothing and sat looking in the rear view mirror at the bottom that has come and gone.

This article is an excerpt from my recent in-depth analysis that mapped out how low AI tech stocks could trade during the stock market panic of 2022.

AI Stocks Multi Buying Levels to Capitalise on the Stock Market Panic of 2022

THE VALUATION RESET

INVESTORS SEDUCED BY STOCK CHARTS COMPLETELY MISS THE THE BIG PICTURE!

QUANTUM COMPUTERS

AI Tech Stocks 2022 Correction

Stock Market Trend Forecast Current State

Dow Max Draw Down 2022

ACCUMULATE DEVIATIONS FROM THE HIGHS IN GOOD STOCKS!

NEW STOCKS

The Fishes that Have So Far Gotten Away

AI Tech Stocks Funds Revision

QUANTUM AI STOCKS MULTI BUYING LEVELS

NEW Investors

NETFLIX - You Cannot Say You Weren't Warned!

ARKK MATHS

Why Putin Wants the WHOLE of Ukraine - World War 3 Untended Consequences

Pandemic Rear View Mirror - Next Potential Catastrophe?

That was first made available to patrons who support my work.So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

Whilst my latest analysis lays out my plan of what to expect and do NEXT as we head towards the first Fed rate hike (hint stocks will bottom BEFORE the first Fed rate hike).

Stock Market in the Eye of the Storm, Visualising AI Tech Stocks Buying Levels

Content:

m = f - Everything is Waving!

How to Invest in Stocks 20202 and Beyond

Stock Market Calm In the Eye of the Storm

Stock Market Forward Guidance

50% DRAWDOWNS ARE THE NORM!

Current State of Draw downs

Quantum AI Stocks Portfolio Current

AI Tech Stocks Buying Levels

Earnings Growth Factor

GOOGLE TO BE SLICIED INTO 20 PIECES!

FACBOOK MISSION ACCOMPLISHED Whilst CNBC Clowns Buy the TOP and SELL the BOTTOM!

MICROSOFT Short and Sharp

Still Waiting to Take a BITE out of APPLE

NVIDIA is ARMless - To Buy or Not to Buy, that is the question.

AMD - The Chip Master

TSMC - The World's Supreme Chip Fabricator

AMAZON the Dark Horse!

ARKK SARK SHORT FUND

And gain access to my recent timely analysis lays out how to invest in during the panic of 2022, to be soon followed by scheduled analysis that continues my trend forecast into the end of 2022.

HOW TO SUCCESSFULLY INVEST IN STOCKS During 2022 and Beyond

CONTENTS:

1. UNDERSTAND WHAT INVESTING IS

2. INVEST IN GOOD COMPANIES

3. UNDERSTAND THAT WHICH ONE IS INVESTING IN

4. STOCK PRICES

5. EARNINGS CATCHUP TRADING RANGE TREND PATTERN

6. EMOTIONAL INVESTING

7. MONITORING AND LIMITING EXPOSURE IS MOST IMPORTANT

8. BUY AND SELL on the Basis of VALUATIONS

9. INVESTORS BIGGEST MISTAKE

10. BEST TIME TO BUY STOCKS

11. WORST TIME TO BUY STOCKS

12. BUY VOLATILITY

13. INVESTING TIME

14. FUND MANAGERS

15. OPTIONS

16 . INFLATION

17. INVEST AND FOREGET

AI Tech Stocks Draw down and End of Year 2022 Price Targets

CATHY WOOD ARK GARBAGE

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

My analysis schedule includes:

- Stock Market Trend Forecast Mid Feb to End 2022

- UK House Prices Trend Analysis, including an update for the US and a quick look at Canada and China - 65% done

- How to Get Rich! - 90% done - This is a good 6 month work in progress nearing completion.

- US Dollar and British Pound analysis

- Gold Price Trend Analysis - 10%

Again for immediate access to all my work do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your analyst capitalising on stock market panic selling

Nadeem Walayat

Copyright © 2005-2022 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 35 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.