Inflation Mutation - This is not your Grandpa’s Inflation problem

Economics / Inflation Jun 04, 2022 - 10:45 PM GMTBy: Gary_Tanashian

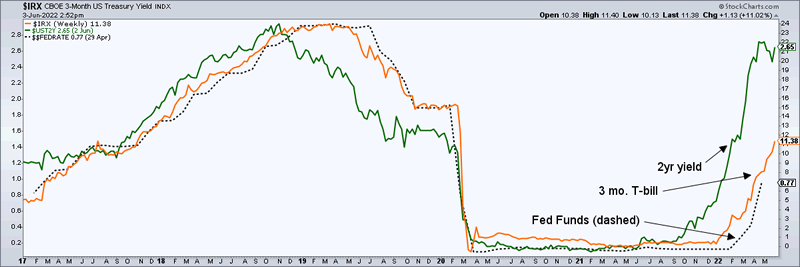

The Fed is starting to play catch-up with inflation signals from the bond market as evidenced by the Fed Funds Rate finally being pulled upward by the implications of the rising 3 month T-bill yield, among other more obvious signals like the long since rising 2yr Treasury yield and ongoing inflation headlines we read about every day.

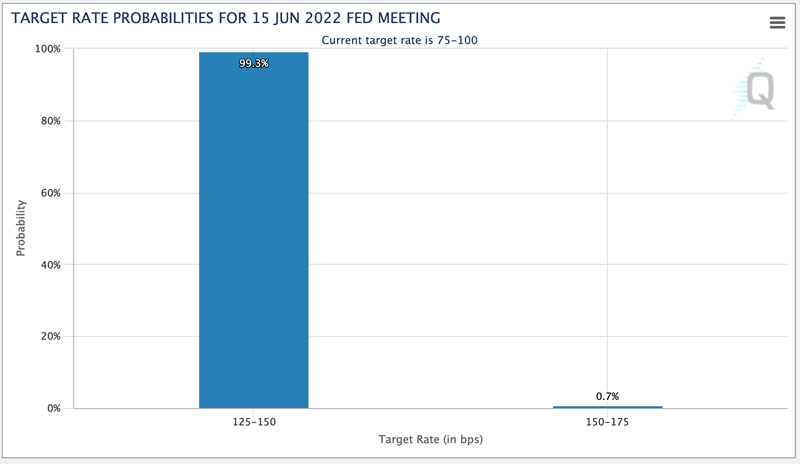

After the June FOMC meeting an additional .5% hike will be in the bag as CME Group traders are forecasting.

But as noted in this post about the May ISM (manufacturing) and Payrolls, supply chains are ever more involved in the narrative. Captain Obvious wants you to know that an economic drag is being caused by the past and present COVID-19 shutdowns, war in Ukraine and increasing global political tensions and sabre rattling.

The point here is that the Fed is finally following bond market signals and mopping up its inflated mess quite logically through QT and rate hikes, but the inflation has mutated due to other non-Fed controlled elements.

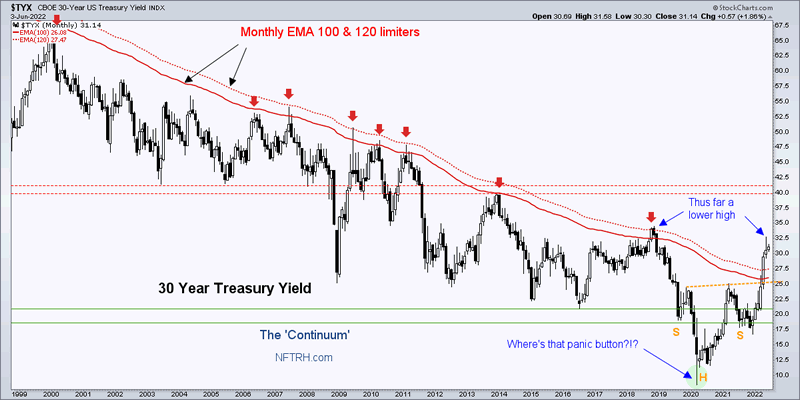

Trying to make logical sense of it will require more than analyzing (as I have for many years) a boom/bust cycle of inflation along the Continuum of depressed (or repressed) Treasury yields; a deflationary Continuum against which the Fed would inflate money supplies at every sign of trouble for the debt-ridden USS Good Ship Lollipop.

Well this time the Continuum’s backbone limiters have been broken and regardless of whether or not the 30yr yield makes a lower high and pulls back near-term, it has set an impulsive marker for the future, opening up the possibility if not probability that the bond bull is over. One path among other options is for the yield to pull back, find support and rise anew, ending the bond continuum against which the Fed has had license to inflate every time yields dropped impulsively.

In short, the Fed has needed deflationary pressure to justify its inflationary policies over the previous decades. If this breakout is a marker for the future, the license has been revoked because the bond market has finally rebelled. The well has been poisoned by toxic policy routinely employed over these decades.

The pollutant was simply too much debt manipulated too many times. If we want to look at it through the lens of the oil market, let’s just say that there is a big oil slick down there. Pigs no longer can drink at the trough.

This brings us back to the original subject of a morphing inflation problem. The inflation originated as usual when central banks did as they have done chronically at every financial and economic meltdown over previous decades. They panicked to inflate in H1 2020. They virtually printed a bull market. But this inflation will not simply be tapered away because it has gotten its claws dug deep into global supply chains, which are subject to a worsening global asset grab.

He who has the resources has the power. As a former manufacturer, I wonder if all those off-shored chickens are coming home to roost. For my former business, it was automate or die. We did the first thing. This pressure has driven great progress. But it has also impaired many regular Americans to very unfair proportions. The American consumption to production ratio was put all out of whack due to the ‘financialized’ economy produced by the Fed and leaders of both major political parties.

Sorry to sound un-woke, but sticking with the oil market and energy in general, restrictive US policy on domestic production is a bad idea in this environment. I am a believer in the positive aspects of manufacturing automation, but even that has limits and some things, like oil and gas production just have to be done the old fashioned way. Although in this country it would be done in ways that are much less environmentally destructive (ah, the irony) than in some 3rd world environs.

Increasingly adversarial global politics are starting to drive the inflated bus now and that’s a genie that is much more rebellious than the trillions of dollars in debt that has been easily manipulated over recent decades in order to ‘manufacture’ financial booms disguised as economic booms (tepid though they’ve been) and then withdrawn as needed. There’s always been the next crisis in which to print another several trillion. Maybe not so going forward.

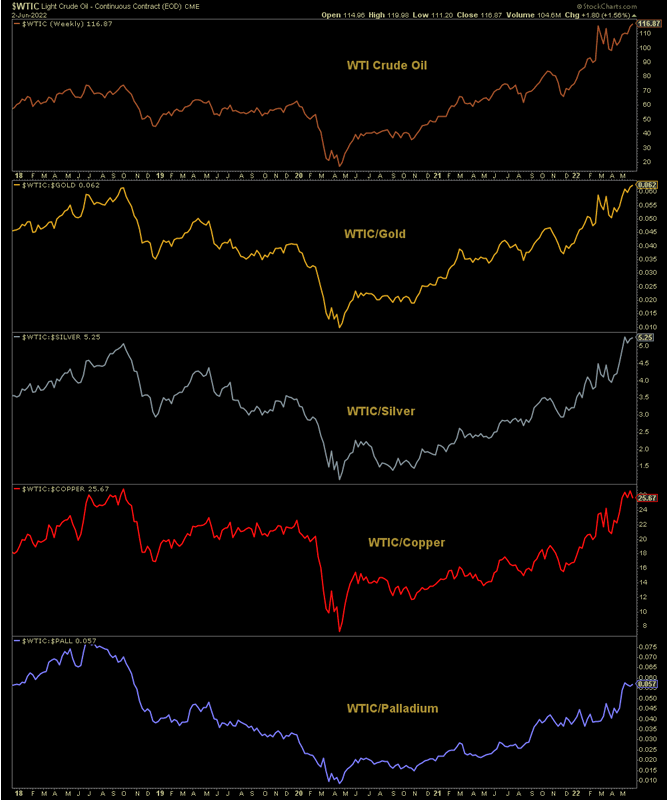

Meanwhile, sticking with the oil theme, many industries, some of which have generally been thought of as benefiting from inflation, are impaired to varying degrees by the morphing inflation problem. Oil is an extreme, as it is rising vs. some other assets and markets also thought to benefit from the global supply/demand situation. I hold USO, a not always historically reliable crude oil tracker that has been more than reliable over the last 2 years.

As a limited gold stock holder (we are tracking a bounce or rally, not yet a new bull phase as the fundamentals are incomplete), I have only quality royalty plays (plus one core developing miner) now. Royalty/streaming companies do not share in the expense side of the burden that the miners do.

Energy is the most obvious wildcard in the new inflation, driven no longer by monetary policy, but taking on a life of its own with too many possibilities (IMO) to quantify. Looking at various metals, precious and commodity alike, you can see that none of them have even nearly kept up with a major mining cost driver, energy. Most of these metals are thought of as inflation protection (including gold, wrongly, by most gold bugs). But the global supply/demand situation in oil has sprung from the central banks’ originally created inflation problem to a whole new ballgame.

I realize that there is a lot to unpack here and frankly, I am still unpacking it myself. But it’s good to set pen to paper (or fingers to keyboard) and continue working at it.

The yield Continuum has done something it has not done in decades, the Fed is shoving its inflationary tools back in the box and the situation is getting off the hook from ‘normal’ inflationary phases. I have not in the least abandoned the idea that the whole mess once again resolves in a deflationary problem, possibly a severe one. But as I tried to show above, there are more and different inputs in play this time.

But the bottom line is that what began as ‘monetary’ inflation as usual, has mutated outside of the monetary and into the real world, which the Fed will find not so friendly a place as the make believe world of ‘debt manipulation on demand’.

To be continued, I am sure. Meanwhile, we will definitely work with the information at hand each week in NFTRH.

For “best of breed” top down analysis of all major markets, subscribe to NFTRH Premium, which includes an in-depth weekly market report, detailed interim market updates and NFTRH+ dynamic updates and chart/trade setup ideas. You can also keep up to date with actionable public content at NFTRH.com by using the email form on the right sidebar. Follow via Twitter ;@NFTRHgt.

By Gary Tanashian

© 2022 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.