Stocks Bear Market Accumulation Strategy

Stock-Markets / Investing 2022 Sep 20, 2022 - 10:27 PM GMTBy: Nadeem_Walayat

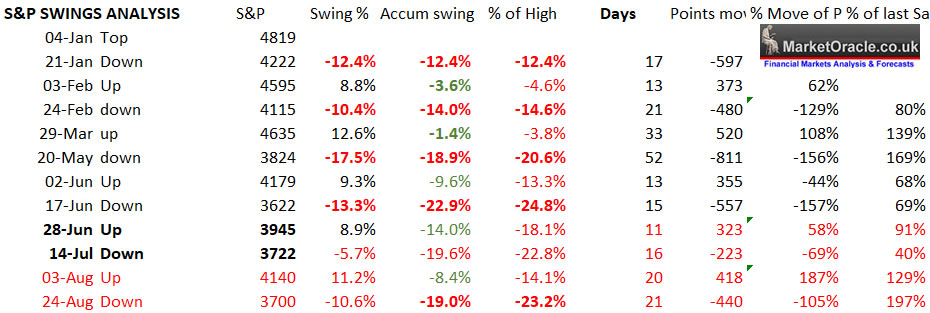

My strategy for this bear market from the outset has been be to accumulate during a volatile trend to a probable Dow target of 29k to 30k where I settled on my best guess of 29.6k, by late August. In the course of which I was expecting volatile swings of between 15% to 30% in either direction that would allow me to BUY big during the DIPs and then SELL a portion of what I bought during the bear market rallies, as well as selective shorting. Unfortunately this bear market has tuned out to be LESS volatile than what I was expecting i.e. swings higher of 9% are just not enough for any significant trimming of positions as the table illustrates.

Then on top of that has been sterling's 15% nose dive from 1.38 to under 1.20! Which means I have not been able to capitalise on the more recent dips to the extent that I would have done if sterling had say not fallen below 1.30 which is a 10% difference in cost terms. On the flip side this makes SELLING the bear rallies easier. So even though I saw this bear coming it has not turned out to be an EASY bear market to profit form due to weak upswings.

However, the mot recent price action measured off the low of 3860 amounts to a substantial 16% move higher, finally enough to trim and to short for the next swing lower, however given that the swing has abnormally strong it also thereof raises the possibility that the stock market could have already bottomed and what we are seeing is the birth of a new bull market. Which means whilst I am continuing with my strategy of trimming and shorting the rallies, the extent to which I am entering shorts during this rally is lighter given that there is a risk I will have to take a loss on the shorts if the market HAS bottomed EARLIER than expected and fails reverse lower..

Therefore as things stand, regardless of what transpires over the coming week, my expectations remain for the bear market to continue to NEW bear market lows, it's just that stocks such as Amazon and Microsoft rallying on BAD EARNINGS, forces me to at least entertain the possibility of an early bottom, i.e. possible but not probable and even if the market has bottomed it's not going to rocket higher to new al time highs THIS YEAR! In fact July's price action acts to further confirm my trend pattern for 2022 as the in the chart above.

The bottom line is that July's strong price action is sending me a signal that the bear market does NOT have much downside left top ut, where any new low will likely only be marginally lower than the bear market low to date, with the risk that the market has already bottomed courtesy of TEN PERCENT CPLIE INFLATION! 20% REAL INFLATION!

And where the stock market is concerned given that August is about to begin does not give this rally much more upside as it tries to fight it's way higher in the TREACLE zone. It really is a tough ask to see this rally break higher and even if it did I would view it as FALSE break higher to run the stops that this bear market has delivered several times before! FALSE BREAKOUTS and BREAKDOWNS to RUN THE STOPS! So yes we could see the S&P climb to above 4180, to trade to say 4200, 4210 to give us that false signal. Furthermore stock market July strength right into the end of the month suggests that the next swing down could terminate during September rather than late August, i.e. to have enough time to complete the move.

For clarification the pink lines are not trendlines but swing projections for where the S&P could trade to.

This anaysis is an excerpt from Stocks Bear Market Rally End Game that was as first made available to patrons who support my work.So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

Most recent analysis includes -

- September the Stock Markets WORST Month of the Year Could Deliver a Buying Opportunity

- Jerome Powell's TRANSITORY DIP in INFLATION, AI and High Risk Stocks Updated Buying Levels

- Answering the Question - Has the Stocks Bear Market Bottomed? Saudi Black Swan

- Stock Market Bear Trap SET!

- Stocks Bear Market Rally End Game

- Qualcom Harbinger, AI Predicts Future Stock Prices 3 Years Ahead, China Bank Runs

Whilst my recent in-depth analysis is - UK House Prices Three Trend Forecast 2022 to 2025, where I pealed away every layer of the UK housing market I could think of to arrive at a high probability of trend forecast, no following of the consensus herd here! Whilst completion of my extensive analysis of the US housing market is imminent.

UK House Prices Trend Forecast 2022 to 2025

THE INFLATION MEGA-TREND

WE HAVE NO CHOICE BUT TO INVEST IN STOCKS AND HOUSING

High Inflation Forecast for Whole of this Decade Due to Rampant Money Printing

Fed Inflation Strategy Revealed

Russian Sanctions Stagflation Driver

RECESSION RISKS 2023

UK Debt Inflation Smoking Gun

Britains' Hyper Housing Market

UK Population Growth Forecast 2010 to 2030

UK House Building and Population Growth Analysis

UK Over Crowding Ratio

Overcrowding Implications for UK House Prices

UK Housing Market Affordability

UK House Prices Real Terms Sustainable Trend

UK House Prices Relative to GDP Growth

UK House Prices Momentum Forecast

UK House Prices and the Inflation Mega-trend

Lets Get Jiggy With UK INTEREST RATES

Is the US Yield Curve Inversion Broken?

UK house Prices and Yield Curve Inversions

Interest Rates How High WIll they Go?

Work From Home Inflationary BOOM?

Formulating a UK House Prices Forecast

UK House Prices 2022 to 2025 Trend Forecast Conclusion

Peering into the Mists of TIme

Risks to the Forecasts

US House Prices Trend Forecast 2022-2024

So if you want immediate access to a high probability trend forecast of UK house prices, with US and global housing markets analysis to follow soon then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

My Main Analysis Schedule

- UK House Prices Trend Forecast - Complete

- US House Prices Trend Forecast - 85%

- Global Housing / Investing Markets - 60%

- US Dollar / British Pound Trend Forecasts - 0%

- Stock Market Trend forecast into End 2022 - 0%

- High Risk Stocks Update - Health / Biotech Focus - 0%

- How to Get Rich - 85%

- Gold and Silver Analysis - 0%

- State of the Crypto Markets

Again for immediate access to all my work do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your watching the British pound burn at the official rate of 9.4% per annum analyst.

By Nadeem Walayat

Copyright © 2005-2022 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.