The Exponential Inflation Mega-trend

Economics / Inflation Nov 01, 2022 - 09:52 PM GMTBy: Nadeem_Walayat

REAL INFLATON and not the BS statistics that the likes of the Fed and Bank of England vomit every month, fake inflation statistics watered down over decades to hide the stealth theft of wealth and purchasing power of wages and savings..

I have been calculating my my own inflation measure for the UK for a couple of decades now which computes to the UK inflation rate currently being at about 20% per annum! In fact it has been in a range of 15% to 20% for over a year!

As for the United States, shadow stats does a good job of calculating the real rate of inflation which ia based on the US governments own 1980 formulae that resolves to 13.5% vs 8.2%.

US Economy Has Been in an Economic Depression Since 2008

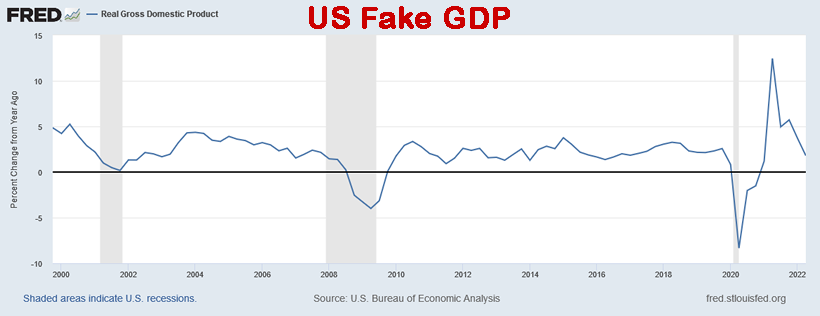

Wait things are even worse than that! You know the US GDP growth rate we are all bombarded with to illustrate the strength or weakness of the US economy, we'll it is just as FAKE as that which vomits out of the likes of the CCP.

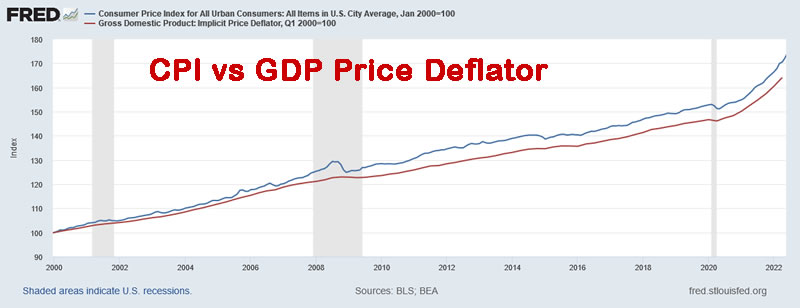

The Fed states US real GDP is currently +1.8% year on year. Now consider this, what inflation measure do you think the Fed is using to calculate these GDP figures? CPI? WRONG! GDP price deflator which tends to consistently under estimate inflation even against CPI as the following graph illustrates.

What's the difference? 172 divided by 164 which means that US GDP has been over reported by 4.8% since 2000.

What about against real shadow stats inflation? We'll if we used that measure than the US has been in an economic depression for the past 2 decades! What's most probable is that the truth lies somewhere between Shadow stats and CPI at around the half way mark of US inflation currently being around 11.5%. That would still suggest that overall the US economy has stagnated since the dot com bust with a growth rate that is about half that which has been reported and even worse performance since the Financial Crisis since when the probable real US growth rate has been ZERO!

So no wonder the Fed has been printing money on an ever escalating scale trying keep a dying economy ticking over, keeps kicking that day or reckoning can down the road for the next Fed President to deal with.

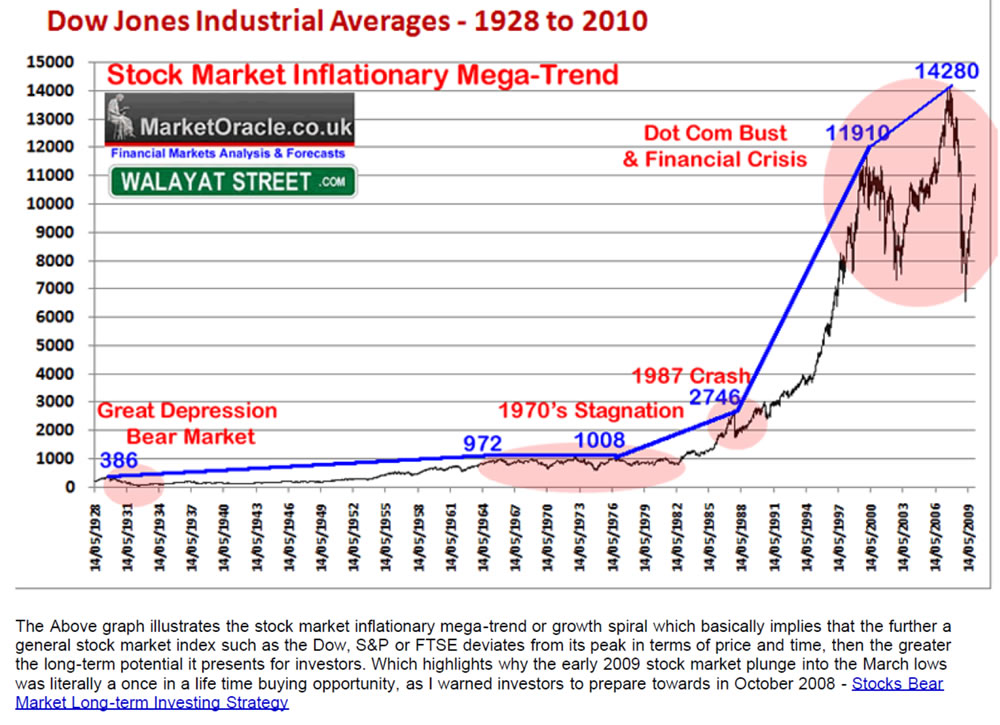

In terms of asset prices such as stocks and housing, the Fed cannot allow for any sustained drop in asset prices for it will literally bring the whole house of cards crashing down to reveal the true extent of the economic stagnation that the Fed has so far successfully masked by means of the inflation stealth tax. It's a case of printing money to infinity and beyond hence to remain invested in assets that are LEVERAGED to INFLATION and why this stocks bull market will just keep chugging long until the point when the Fed loses control of the QE monster that it has created. This is why I have been banging the Inflation Mega-trend drum for OVER A DECADE! QE4-EVER, QUANTITATIVE INFLATION, because there IS NO FREE LUNCH! You cannot bail out the banking crime syndicate without paying a price and that is loss of purchasing power by means of REAL INFLATION. as illustrated by my January 2010 Inflation Mega-trend ebook (free download)

And a 12 year long mantra of buying the deviation from the high -

I have been monitoring this Inflation train wreck for well over a decade, and warned we were definitely heading for very high inflation that HAS materialised.

And you know what's funny are the deflation fools out there that populate the mainstream press and blogosFear, regurgitating their deflation thesis despite it having been wrong for DECADES! As we have always been on the path towards to real HIGH inflation! You only get deflation right at the very end when everything collapses into a debt deflationary black hole! Which is why whilst most asset classes experience some pain from time to time as the Fed basically has fired most of it's bullets so is forced to adopt painful measures to correct the excesses then yes asset prices can fall (temporarily), but what is certain holding fiat currency is a going to be an even bigger loser than it has been for the past 10 years!

It's a case of trying to limit the damage done so that one can hold onto as much of ones wealth in real terms as possible.

This article is an excerpt form my extensive analysis that concludes in detailed stock market trend forecast into the end of 2023 Stocks Bear Market Max PAIN - Trend Forecast Analysis to Dec 2023 - Part1 was was first made available to patrons who support my work.So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

Recent analysis includes -

- Intel Empire Strikes Back! The IMPOSSIBLE Stocks Bull Market Begins!

- Stock Market White Swan - Why Fed Could PAUSE Rate Hikes at Nov 2nd Meeting, Q4 Earnings

- Stocks Bear Market Max PAIN - Trend Forecast Analysis to Dec 2023 - Part1

- Stock Market Analysis and Trend Forecast Oct 2022 to Dec 2023

- Can the Stock Market Hold June Lows Despite Spiking Yields and Dollar Panic Buying?

So for immediate first access to to all of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

My Main Analysis Schedule:

- UK House Prices Trend Forecast - Complete

- Stock Market Trend Forecast to December 2023 - Complete

- US House Prices Trend Forecast - 80%

- Global Housing / Investing Markets - 50%

- US Dollar / British Pound Trend Forecasts - 0%

- High Risk Stocks Update - Health / Biotech Focus - 0%

- State of the Crypto Markets

- Gold and Silver Analysis - 0%

- How to Get Rich - 85%

Again for immediate access to all my work do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your watching the British pound burn at the official rate of 10.1% per annum analyst.

By Nadeem Walayat

Copyright © 2005-2022 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.