Stocks Analysis Bonanza Trend Forecasts - Tencent, Alibaba, Baidu....

Companies / Investing 2023 Jan 22, 2023 - 10:49 PM GMTBy: Nadeem_Walayat

Dear Reader

Analysis of 10 stocks as requested by Patrons to see where they stand in terms of trend and future prospects as many are still trading at deep discounts to their highs. Plus a bonus 11th stock, plus a deep look and trend forecast for the Bitcoin price for 2023 made right at the peak of the crisis of confidence in the crypto markets following the SCAM that is FTX and SBernieF.

This article is part 2 of 3 of as excerpted form my extensive analysis Stocks Analysis Bonanza - GOOG, QCOM, ASML, TCHEY, BABA, BIDU, TSLA, WDC, RBLX, MGNI, COIN, BITCOIN CAPITULATION! that was was first made available to patrons who support my work.

So to gain immediate access to all of my ahead of the curve analysis as my extensive analysis of the stock market illustrates (Stocks Bear Market Max PAIN - Trend Forecast Analysis to Dec 2023 - Part1), that continues on in the comments section of each posted article, all for just 4 bucks per month which is nothing, if you can't afford 4 bucks for month then what you doing reading this article., if someone did what I am doing then I would gladly pay 4 bucks for it! Signup for 1 month and you will see what I do cannot be beaten by those who charge as much as $100 per month! I am too cheap! As I aim to keep my analysis accessible to all, those willing to learn because where investing is concerned the sooner one gets going the better as portfolios compound over time, 4 dollars is nothing for what one gets access which will soon rise to 5 dollars per month for new patrons so at least give it a try, read the comments, see the depth of my analysis and you won't be sorry because i do do my best by my patrons, go the extra mile which you will soon see, then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat. Lock it in now as $4 per month as this is soon set to rise to $5 per month, your very last chance!

Also access to recent analysis including -

- Stock Market Gasping to Reach 4000 Ahead of Earnings Season, Dow New All Time High 2023?

- S&P500, Gold, Silver and Crypto's Trend Forecasts 2023

- Santa Battles Grinch to Deliver Stock Market Last Gasp Rally into the New Year

- Santa Sledge on the Launch Pad for Stock Market Post CPI To the Moon Rally

- Stocks Bear Market Max PAIN - Trend Forecast Analysis to Dec 2023 - Part1

- Stock Market Analysis and Trend Forecast Oct 2022 to Dec 2023 - Part 2

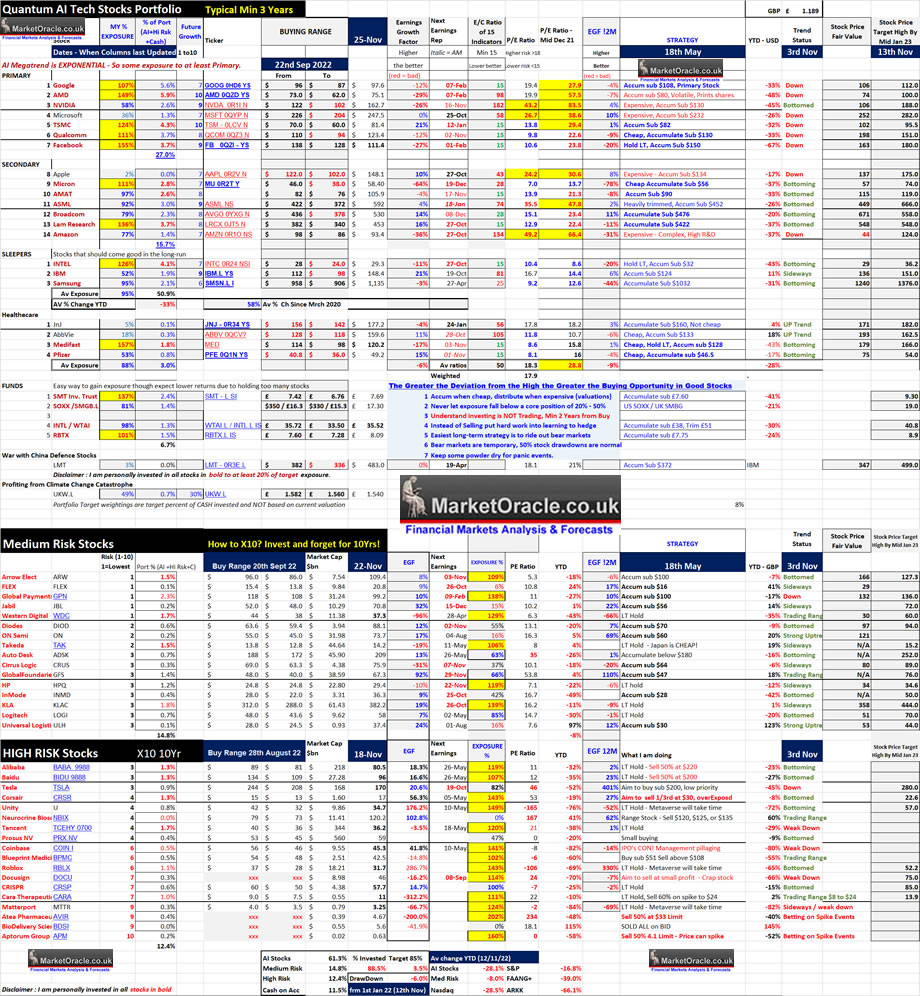

Ai Stocks Portfolio

A quick look at the current state of my portfolio which is now 88.5% invested after arrival of approx 5% of fresh cash and after I sold all of my NBIX holding given that it earlier retreated from a multi year high, and that it tends to trade within a range of $125 to $76. I have update the table to indicate when columns were last updated. I have also replaced the beta column with something more useful called Future Growth (1-10), which is basically how I see the COMPANY doing in terms of future growth potential where 10 is the highest and 1 is the lowest, note this does not mean that the stock prices will match growth potential due to a myriad of factors such as sentiment, valuation and politics, but it gives insight into the underlying prospects for the businesses where the two stocks that score 10 are AMD and TSMC which is why I am heavily invested in both and don't fret about stock price drops in either as recently experienced because the underlying businesses have huge long-term future growth potential. Stocks that score 9 are Nvidia, Facebook, ASML and IBM, which again means I am not too phased by what we recently witnessed with the likes of META and and Nvidia, stock prices rarely reflect the actual state of the underlying business as they oscillate between extreme fear and extreme FOMO as illustrated when one watches the Cartoon Network (CNBC).

Table Big Image - https://www.marketoracle.co.uk/images/2022/Nov/AI-stocks-portfolio-25th.jpg

Tencent - TCHEY $36 - EGF -3.5%, +1%, P/E 21

China's META that operates the Chinese market dominant Wechat, a year ago was trading at $69 on a P/E of 25.5, since which time it has near halved in price to $36 whilst the P/E has only moderated to 21. A year ago META was trading at X24, today 11. So why buy Tencent when one can get META much cheaper! Perhaps to bet on the Chinese social media market though we all paid a painful price to learn the lesson that China is NOT a western market where the CCP literally dictates what corporations can and can't do unlike in the West where the Tech giants buy politicians like trading cards, which means a lower multiple was warranted. What's my average price paid? $49. Would I buy more? No, 120% invested is more than enough exposure especially given that earnings growth rate remains low with EGF -3.5% / +1%. Still it could have turned out a lot worse! Another plus for Tencent is that they are very savvy long-term investors in other tech stocks at an early stage so tend to get get in very cheap.

You often here talk about how stocks tend to bottom when they capitulate well Tencent spiking down to $25 near 1/4 it's 2021 high definitely fits the capitulation bill by trading to BELOW the previous bear markets low of $31. Back when it seemed like a done deal that $40 would hold the line but broke and now acts as heavy overhead resistance. So whilst Tencent has probably bottomed it's going to take time to build a base to break above $40, and then it will need to do the same for $50 and so on all the way towards the $55 to $65 zone within which are a lot of investors nursing deep wounds eager to exit near break even. Time wise it could take another whole year to base build before Tencent starts tentatively trending higher.

(Charts courtesy of stockcharts.com)

The bottom line is Tencent is down but not out and some years down the road will be testing it's $97 all time high on break of which a new FOMO will begin towards $200 likely resulting in a similar outcome to what followed the early 2021 high. My objective will be to reduce my exposure to about 2/3rds at a small profit in the $50 to $60 chop zone.

Alibaba - BABA 9988 $80.50, EGF 18%, 2% P/E 11

If you thought holding Tencent was painful that's nothing compared to BABA draw down pain. BABA a clone of Amazon a year ago trading at 1/3rd the valuation of Amazon on a P/E of 22. It was a GOOD buy, what could go wrong? CCP! Jack Mae opened his big mouth and we all paid the price! CCP are control freaks and Crushed all of the Chinese Tek giants to send a message of who is in charge. There is a limit to what investors can perceive in terms of future prospects especially for corporations operating in a foreign land and given where we were at the time I don't see how I could have done anything different other than to start accumulating BABA at $200.

The stock price has been crushed like a bug in the rug down 75% from it's high, and 62% from when it started to perk my interest at $200. The stock chart looks BAD, There are so many underwater investors (me included) who will be eager to sell on any significant rally that it's going take years to recover. There is a good chance that $58 was the capitulation low. After all it is now trading on a PE of 11 vs 22 a year ago so the drop in the stock price is a valuation reset rather than fundamental to the stock. And EGF's point to earnings growth ahead which implies that BABA 'should' have bottomed, it's less than half the price of a year ago, and near half the valuation with EGF pointing to earnings growth. I am actually tempted to add a little more, a sucker for punishment but unless the CCP wants China to turn full blown communist again, which could happen, I am tempted to up the ante but I would also heavily trim my holdings as the stock price rises to above $120. My average price paid stands at $151 (helped by sterling's bear market), 119% invested. As long as there is earnings growth as implied by EGF then BABA can return from the dead but it will take time.

The bottom line is that fundamentally BABA looks good! Though again we are playing with the Chinese fire breathing Dragon here so could get burned, definitely high risk but I am completely at ZEN with my holding as it's already done the worst it could do by falling to $58, so as Clint Eastwood would say Go ahead punk make my day! The first stage for Baba is to build a base between $90 and $70, the second stage will be to break above $120 which could take several years. Following which BABA will have entered a new bull market that over the course of another couple of years could be trading at new all time highs. So I consider BABA a good long-term play, earnings growth plus cheap valuations the only variable that could damage BABA is sat on the Imperial throne.

Baidu - BIDU - $95, EGF +16%,+23%. P/E 12.

Baidu is China's Mini Google that it is systematically ripping off lock stock and smoking barrell, probably got a Bidudynamics in there making Bidu robot dogs, with a BIduDeepMind playing Alpha Go. But look at those fundamentals, trades on a P/E of 12, and has EGF scores to dream of! Surely these numbers must be reflected in it's stock chart? Currently I am 107% invested so have scope to expand my exposure a little higher to match the other tek giant holdings at about 120% invested.

Bidu BOOMs and BUSTS - the stock went form $82 in March 2020 all the way to $354 February 2021 and 18 months later back down to $80, In fact for good measure set a new low at $74 before the current rally to $95 perched just under major resistance at $100, which when over come I suspect will propel Bidu towards the next resistance area of $155 to$170 which will be a tougher barrier to cross. Looking beyond $155 I cannot see why Bidu could not once more FOMO to a ridiculous price such as $355 or more, Fundamentally it is cheap and unlike it's other two brethren EGF suggests to expect strong earnings growth, so limited downside and large potential upside.

I am 107% invested with my average buy currently at $119 (changes with sterling). So the big question mark is do I buy more before it breaks above $100 or after, as after would be a safer bet, i.e. enters the $100 to $155 range rather than anticipating a break higher which is what a sub $100 buy would be. I am going to buy a little more Bidu with a view to selling at around $150. The risk is Bidu does not break higher.

So of the three Chinese Tek giants Bidu by far looks the best then BABA and then Tencent trailing. Where the fly in the ointment is to what degree can we trust the company stats? And what will the CCP do next? Invade Taiwan? My strategy is to trim at a profit down to about 90% of target exposure, so I still intend on holding most of what I bought and seek to add a little BIDU. And before patrons start listing bad news stories in the comments remember that for stocks to be CHEAP the news has to be BAD!

BAD NEW IS GOOD NEWS FOR BUYING CHEAP STOCKS!

TESLA (TSLA) $170 - EGF +20% / +82%, PE 46

DISCOUNTING THE FUTURE!

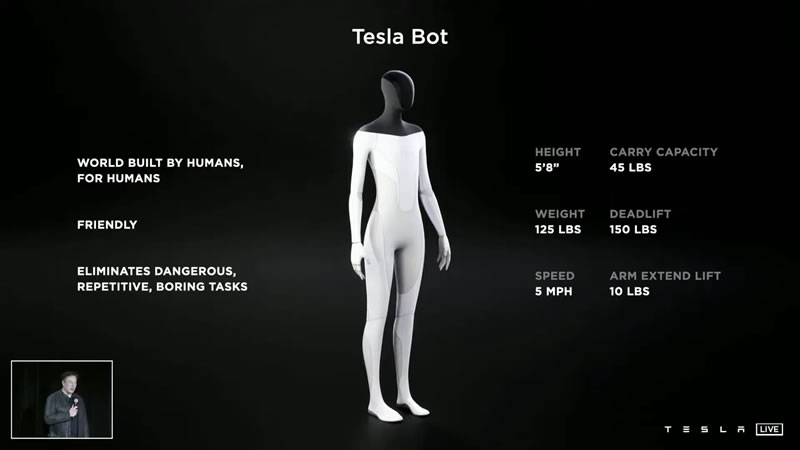

What's Tesla all about? Self Driving Cars? Batteries? Electricity Generation, Storage and Transportation?

Above all Tesla is an AI company, Tesla's four wheel robots will soon morph into bipedal general purpose androids as all of the jigsaw pieces are slotting into place. All of the tech giants will be marketing their own robot's but Tesla has first mover advantage in this soon to be emerging huge market for slave labour.

I held off buying ANY Tesla stock due to the extreme over valuation that carried the risk of a deep draw down, where I have often voiced that we could see the stock price trade to below $130, hence anything anyone buys needs to allow for such a draw down. Recently the Tesla nut finally cracked and the stock price has subsequently tumbled to well below $200 as it eyes sub $130.

Tesla at $170 trades on PE of 46, EGF +20% and +82% so has come a long way down and finally is trading at a valuation vs future growth that allows for significant exposure regardless of the risks for a temporary draw down as we mark time for earnings to play catchup. I quickly accumulated 82% from zero during the recent sell off and I will continue to accumulate at fresh bear market lows. In terms of trend, Tesla is probably entering a year long wide trading range of between $300 to $150.

Western Digital - WDC - $37.3, P/E 6.3, EGF -96%, -43%

Western Digital the storage devices giant was on fire during June for no apparent reason given that EGF at the time was warning to expect earnings contraction, well that surge to above $62 did not last long with the stock crumbing on break below $41 to a deep bear market low of $32, the which prompted me to accumulate all the way down to $32, lifting my exposure to 129% invested. The rally since has proven to be pretty weak resulting in a sharp sell off from $40 so the stock is under performing the market in terms of trend, very weak rally. Technically WDC's bear market remains in tact with heavy resistance in the zone of $51 to $41 with recent price action suggesting it is going to be tough to break above $41.

EGF's of -96% and -43% forecast BAD earnings ahead, a rough 2023. So at best WDC trades within a range of $41 to $33. for some time, only being lifted higher due to general market strength as a rising tide lifts all boats. So I would definitely take a rally towards $50 to trim holdings from my over extended 129% invested so that I have an opportunity to accumulate once more sub $34,. The bottom line is that WDC is probably going to be sleeping for most of 2023 by at best trading in a range of $41 to $33 and at worst could see new lows down to sub $24. On the plus side when this stock gets going it tends to move fast i.e. triple within a year as a function of its small market cap and thus low volume of trading, it's just that I am not expecting such a move this side of 2024.

Roblox - RBLX $31.7

Roblox for playing the METAVERSE long-game, no earnings this year nor next as following the pandemic revenue surge that saw the stock soar to $140, revenues are stagnating though no collapse. Still a company that makes no profits was trading on a ridiculous valuation of $77 billion vs $17.5bn today, so I have no expectations of Roblox getting to anywhere near it's $140 high any time soon, at best the stock will target $52 and most likely fail to break higher to remain in a range of between $52 and $28 for most of 2023. So a case of accumulating towards the bottom of the range with a view to trimming towards the top of the range.

Magnite - MGNI - $10.3, EGF 9%, 21%, P/E 15.6

MGNI - Not in my public portfolios but I covered this in my February 50 stocks analysis and some patrons took a shine to it as did I and often comes up in the comments section. I am 86% invested of target after trimming down from 100% invested on its recent price spike.

Back in February the stock was down 80% form it's high at $12.6, trading on a PE of 26 with a positive EGF of +19% with a risk rating of 3. A small cap online advertising firm that was showing steady growth. Today the stock is trading at $10.27 which is near double its bear market low, trades on a P/E of 15.6, EGF's of +9% and +21%. Which means the market has effectively thrown out the baby with the bath water! Magnite is GROWING EARNINGS else the P/E would not have fallen from 25 to 15. So on a fundamental earnings basis the stock is moving in the right direction, furthermore despite all that spouts from the talking heads the EGF's are strongly bullish implying to expect EARNINGS SURPRISES so I am not surprised that the stock spiked because THIS STOCK IS under valued and has HUGE UPSDE POTENTIAL because it is growing.

The spike we experienced that the weak hands sold into could repeat at the next earnings report when it is highly probable that the stock will break above $15. The stock will likely experience tougher resistance at about $30 as I am sure the management will start printing more shares as they were doing during 2021. So the stock will probably settle into a $35 to $25 trading range, that is X3 from here! With the potential to X10 which is what it did from October 2020 to February 2021. NO I don't expect a similar move but it could within the next 4 to 5 years because as I identified back in February it has the prerequisites to X10 i.e. growing earnings, small market cap, but is extremely volatile so one to trim as the stock price rises. I am currently 87% invested and I will up my target exposure by about 15% as I look to add this stock my high risk stocks portfolio on it's next update on risk rating of 3.

Coinbase - COIN $45 - EGF -140%, -14%, P/E -8

Crypto bear market aside what's the big problem with Coinbase? The problem is the management are pillaging the coffers to reward themselves for doing a bad job as I have been warning of for the whole of this year! CONBASE!

A huge mistake investing in this Cathy Wood turd stock that produced fake financials which hid their true intentions in the run up to the IPO! I should have stuck to my rule of avoiding IPO's! CONBASE! Now like most stuck waiting for a minor miracle, crypto mania FOMO that is likely several years down the road to exit on. I supposed it could be worse we could have been hoodwinked into investing in FTX stock!

The fundamentals remain dire, CONBASE is reporting losses quarter on quarter all whilst the management reward themselves by printing more shares. It's gong to take FOMO mania to exit from this stock at even a small profit. Each time one thinks the stock has made a bottom off it goes lower, did this at $200, $156, and $100, current low is $45, will break that was well? This is the problem with BAD MANAGEMENT, they could not care less about the stock price because they just keep printing and selling more shares to reward themselves. Now we eye $45 as support and break above $100 for the slow climb back to over $200. It's going to take crypto FOMO to see this stock recover and even then it will probably be met with huge amounts of selling by insiders after all it's free money for them as they never PAID a penny for any of the stock they are selling. Hopefully clueless investors such as Cathy Crypto Wood can help FOMO the stock price on hype but I have no faith in the long-term prospects for CONBASE. My average buy is $192, I'll be seeking $200 to start reducing exposure which given the state of the crypto markets is a good couple of years down the road. Which given the fact that I am investing rather then trading is not much of a big deal as I do see myself eventually reducing exposure to Conbase by at least 50% AT A PROFIT! That's the thing about investing one can be WRONG and STILL get out with a profit. Time will tell!

The bottom line is that whilst it is bad it could be worse as we await the return of the crypto FOMO lemmings to lift all crypto boats higher.

Bitcoin FTX Crime Scene CAPITULATION!

.....

This article is part 2 of 3 of as excerpted form my extensive analysis Stocks Analysis Bonanza - GOOG, QCOM, ASML, TCHEY, BABA, BIDU, TSLA, WDC, RBLX, MGNI, COIN, BITCOIN CAPITULATION! that was was first made available to patrons who support my work.

So to gain immediate access to all of my ahead of the curve analysis as my extensive analysis of the stock market illustrates (Stocks Bear Market Max PAIN - Trend Forecast Analysis to Dec 2023 - Part1), that continues on in the comments section of each posted article, all for just 4 bucks per month which is nothing, if you can't afford 4 bucks for month then what you doing reading this article., if someone did what I am doing then I would gladly pay 4 bucks for it! Signup for 1 month and you will see what I do cannot be beaten by those who charge as much as $100 per month! I am too cheap! As I aim to keep my analysis accessible to all, those willing to learn because where investing is concerned the sooner one gets going the better as portfolios compound over time, 4 dollars is nothing for what one gets access which will soon rise to 5 dollars per month for new patrons so at least give it a try, read the comments, see the depth of my analysis and you won't be sorry because i do do my best by my patrons, go the extra mile which you will soon see, then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat. Lock it in now as $4 per month as this is soon set to rise to $5 per month, your very last chance!

Also access to recent analysis including -

- Stock Market Gasping to Reach 4000 Ahead of Earnings Season, Dow New All Time High 2023?

- S&P500, Gold, Silver and Crypto's Trend Forecasts 2023

- Santa Battles Grinch to Deliver Stock Market Last Gasp Rally into the New Year

- Santa Sledge on the Launch Pad for Stock Market Post CPI To the Moon Rally

- Stocks Bear Market Max PAIN - Trend Forecast Analysis to Dec 2023 - Part1

- Stock Market Analysis and Trend Forecast Oct 2022 to Dec 2023 - Part 2

Apart form regular AI Tech stocks and stock market updates, my schedule includes:

- US House Prices Trend Forecast - 80%

- Global Housing / Investing Markets - 50%

- US Dollar / British Pound Trend Forecasts - 0%

- High Risk Stocks Update - Health / Biotech Focus - 0%

- State of the Crypto Markets

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your trim the rally analyst.

By Nadeem Walayat

Copyright © 2005-2022 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.