Stock Market Fomo Mania Into October Controlled Demolition

Stock-Markets / Stock Market 2025 Sep 19, 2025 - 07:20 AM GMTBy: Nadeem_Walayat

Dear Reader

2025 was always expected to be a good year as I wrote at the start of the year and during 2024, it's 2026 when the sh** was expected to hit the fan.....

The gains of the past 3 years have been extraordinary akin to the years that preceded the dot com bubble top.

Today's Magic Number is 54! I am now 54% cash, definitely smells like 2021 because I am at near exactly the same percent cash as I was in Sept 2021 where by the end of 2021 I was 60% cash.

I am getting a strong case of Dejavu, I could literally go back to Sept 2021 and copy and paste replies to today's comments and from the articles of the day as the following excerpt from 4 years ago illustrates.

AI Stocks Portfolio Buying and Selling Levels, Bubble Valuations 2000 vs 2021

Tech Stocks in a Bubble today?

US GDP in 2000 was $10 trillion with Microsoft at 5.65% of US GDP, today's largest stock is Apple on a market cap $2.4 trillion which is 10.5% of US GDP of $22.7 trillion!

Yep sorry to burst your bubble but we are in a bubble!

And remember I am not looking at the loss making junk stocks of that age but the tech giants. Hence why I de-risked by selling out of Nvidia, Apple, Microsoft and Amazon. Whilst I will cling onto Google at 50% and Facebook at 30% as they are the best of the best.

Amazon to the MOON 2021! Then what?

YES, Apple, Amazon, Facebook, Google and Nvidia all have highly compelling reasons for why they should all continue keep going to the MOON! But so did all of the tech giants in 2000!

So I hope this acts as a wake up call for my Patrons who think investing is just a case of dollar cost averaging as one really does need mechanisms to disinvest from over valued stocks even though it is is extremely hard to do so, after all no one wanted to sell any of the tech giants in March 2000 given the amount of too the moon cool aid that was sloshing around at the time, but within a few short months many wish they had!

For instance, it was painful for me to hit the SELL button on Microsoft, a stock that I have been accumulating from when it was trading in the $20's! With my intention to buy back some day soon, but as what has happened to chinese stocks illustrates one just does not know what is around the corner that could trigger a collapse in stock prices by 50% or more to a level where most are then too afraid to buy.

So in a few months time we may be living in a completely different world where the likes of Microsoft, Amazon and Apple after a plunge in price have most investors who were happy to pile in at all time highs with their dollar cost averaging mantra are then too scared to either buy or sell as they watch in fear stock market armageddon take place all whilst the MSM, blogosFear and Youtubers reinforce their state of paralysis acting as echo chambers just regurgitating that which others have posted.

As for what I will be doing ? BUYING the PANIC! Even if I turn out to be early because during the mayhem most of the pieces of the puzzle will be unknown.

So PATRONS Its once more time to WAKE UP AND SMELL THE COFFEE!

But folk should not fear a bear market, look at the April crash that virtually everyone has now forgotten about. That's what folk need to be prepared for opps such as that REPEATING! Violent Crashes and Violent Recoveries, there's going to a lot more violence in the stock market then in places like Whitby!

So what should folk continue to do ?

Keep Calm and carry on buying the dips in Quantum AI tech stocks WHEN CHEAP! It's all there on the spreadsheet! In Columns AC and Q where the greater the deviation from the highs then the greater the buying opportunity, how cheap? You got that too in column R. AMD today -30%, target buys -50% to -70% off it's high is doable

Wednesday 7pm UK Time - Fed Rate Decision - 0.25% cut, Powell to signal at least one more rate cut this year, all baked in.

Friday - Approx 3.15am UK Time - BOJ Rate Decision.

So there is the expected US rate cut today, a sell the news event because this and the next rate cuts have already been priced into the market, it would take expectations for 3 rate cuts THIS year to ignite further upside. And then we have the lurking black swan of a Japanese rate hike yen carry trade unwind event that accelerates selling during Fridays session.

US Unemployment has made it's final bottom, AI ensures that real unemployment will keep going up, 5%, 7%, 10%, 15%, 20%.....99%.

The antichrist promised Americans that getting the illegal's out they will have more jobs, putting tariffs on imports then americans will have more jobs. Reality is the EXACT OPPOSITE! Demand destruction does NOT RESULT IN MORE JOBS It results in JOB LOSSES! Same with prices, promised LOWER prices, delivering HIGHER prices!

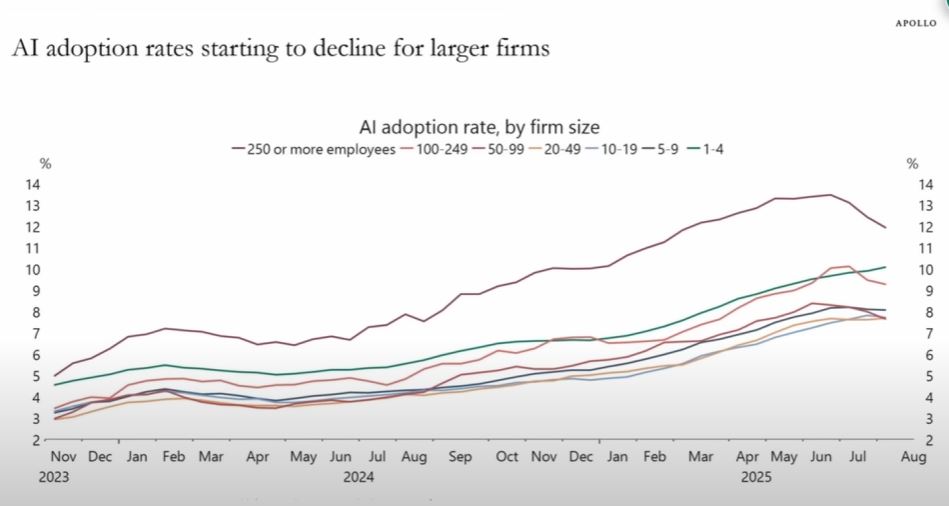

Apparently according to the US Census Bureau AI bubble is popping as AI adoption amongst companies with more than 2560 employees is dropping, a leading indicator?

Looks like the bubble is starting to pop, again confirming we are in the AI end game where stock prices are concerned.

CONTENTS

US Rate Cut vs the 10 Year Yield and S&P500

Stock Market Setup for a Controlled Demolition

S&P September Seasonal Trend

Stock Market Correction Window Into End October

AI is Coming for All of your Jobs!

Musk Pumps TSLA to $430, My Response?

The Nvidia Revenue Bubble

AMD Doubles before Nvidia

AI Stocks Bubble Valuations

AI Stocks Portfolio Two Stocks Replaced

Bear Market Correction Fears

China Stocks to the MOON!

The rest of this extensive analysis was first made available to patrons who support my work on 17th September.

Stock Market Fomo Mania Into US Rate Cut Controlled Demolition Event

For immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $9 per month, lock it in now at $9 before it rises to $12 per month for new sign-up's. https://www.patreon.com/Nadeem_Walayat.

Recent analysis -

Jackson's Black Hole, Will Nvidia Earnings Spark Panic Event in Correction Window?

Stock Market Smells like 2021, US Housing Market Analysis

AI Tech Stock Earnings Into Stock Market Correction Window

This Time It's Different! AI Tech Stocks Q2 Blow Off Top Earnings Season

For immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $7 per month, lock it in now at $7 before it rises to $10 per month for new sign-up's. https://www.patreon.com/Nadeem_Walayat.

And access to my exclusive to patron's only content such as the How to Really Get Rich 3 part series.

Change the Way You THINK! How to Really Get RICH Guide

Learn to Use the FORCE! How to Really Get Rich Part 2 of 3

The Investing Assets Spectrum - How to Really Get RICH

It's simple, you pay $9 and you get FULL access to ALL of my content -

※ Patrons Get FIRST access to all of my In-depth analysis and high probability Trend Forecasts, usually 2 full months before the rest of the world. Notified by Patreon by email as well as posted on my patreon page and I also send a short message in case the time extensive email does not make it to your inbox.

※Access to my carefully constructed and maintained AI Tech Stocks Portfolio that is updated on an ongoing basis, that includes on going commentary and a comprehensive spreadsheet that features unique innovations such as the remarkably useful EGF's.

※A concise to the point Investing Guide that explains my key strategies and rules for successful investing.

※ Regular content on How to Trade & Invest incorporated into most articles so as to keep patrons eyes on the big picture and not get too sucked into the noise of price swings.

※ Access to my comprehensive How to Really Get Rich series of articles and 3 part guide, clear concise steps that I may eventually form a Patrons only ebook.

※ Access to conclusions from my ongoing market studies from a total of over 200 conducted studies over the decades. updated whenever the market poses a question to be answered. Also enjoy the fruits of R&D into machine learning such as the CI18 Crash indicator that correctly called both the pandemic crash (Feb 2020) and the 2022 bear market (Dec 2021) well before the fact.

※Join our community where I reply to comments and engage with patrons in discussions on a daily basis.

※ I will also keep my Patrons informed of what I am currently working on each month.

※ Influence over my analysis schedule.

My objective is to provide on average 2 pieces of in-depth analysis per month and regular interim pieces of analysis as market briefs. So over a 12 month period expect to receive 24 pieces of in-depth analysis. Though my focus is on providing quality over quantity as you can see from the extent and depth of each analysis which I deem necessary so as to arrive at that which is the most probable market outcome.

For immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $9 per month, lock it in now at $9 before it rises to $12 per month for new sign-up's. https://www.patreon.com/Nadeem_Walayat.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your buy the dips and sell the rips analyst.

By Nadeem Walayat

Copyright © 2005-2025 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 35 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.