IEA Study: Global Energy Supplies Remain a Concern

Commodities / Crude Oil Dec 22, 2008 - 04:16 PM GMTBy: Joseph_Dancy

The International Energy Agency (IEA) published a study last month that repeated their warning that excessively low energy prices will discourage investment in exploration and production in light of the steadily rising costs of extracting and processing oil from increasingly difficult places. The lack of sufficient investment has serious implications for future energy supplies once the global economy recovers from its current descent according to the IEA.

The International Energy Agency (IEA) published a study last month that repeated their warning that excessively low energy prices will discourage investment in exploration and production in light of the steadily rising costs of extracting and processing oil from increasingly difficult places. The lack of sufficient investment has serious implications for future energy supplies once the global economy recovers from its current descent according to the IEA.

The crude oil and natural gas sectors are capital-intensive industries, where massive amounts of investment are required just to offset depletion and to maintain production. The ongoing credit issues, with the weak product prices, have further complicated the ability to increase global energy supply.

The crude oil and natural gas sectors are capital-intensive industries, where massive amounts of investment are required just to offset depletion and to maintain production. The ongoing credit issues, with the weak product prices, have further complicated the ability to increase global energy supply.

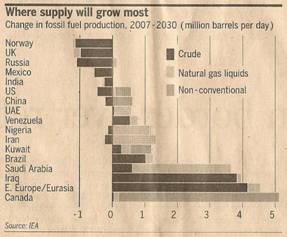

Increases in demand from China, the Middle East, and India over the next two decades will far exceed the decline in consumption expected in developed countries in Europe and North America. These increases will have to be met from production frontiers that are much more difficult and expensive to develop, in areas for the most part controlled by national oil companies (charts from the Financial Times).

The study also found that the current decline rate in existing fields varies with reservoir characteristics and production methods, but on average a field declines around 6.7% per year even with production maintenance operations in place. The IEA found that this decline rate was accelerating.

The IEA expects crude oil demand in 2009 to remain roughly flat due to economic conditions. With a decline rate of 6.7%, and a demand of 85 million barrels per day, the world needs to discover or put online an additional 5 million barrels per day to replace production lost through natural declines.

The IEA expects crude oil demand in 2009 to remain roughly flat due to economic conditions. With a decline rate of 6.7%, and a demand of 85 million barrels per day, the world needs to discover or put online an additional 5 million barrels per day to replace production lost through natural declines.

The study indicates that one of the largest increases in oil production will originate in the Canadian tar sands. Cost of production in the tar sands are estimated at roughly $80 per barrel, well above current market prices.

Due to the current depressed market prices some expansion plans for the tar sands have already been cancelled or delayed. Environmental issues are also a concern, and the cost of labor and equipment for these remote areas has increased substantially over the last few years.

The energy futures market remain in what some have characterized as ‘steep contango'. Contango means that crude oil for future delivery is priced higher than today's futures or spot price. The condition allows operators to shut in their production today and lock in the higher prices by using the futures market (where the price of crude oil for April 2009 delivery is $3.90 higher than today's price). The contango condition has been interpreted as being bullish for prices.

Natural gas in storage ended the fill season roughly 1.6% below last year's level. The heating season has started – space heating is a major market for natural gas. The long term forecasts typically have predicted a winter colder than the last three years. The heavily populated Northeast and North central U.S. are expected to have below average temperatures, which should increase demand.

On the negative side the amount of natural gas demand from the electrical generation and manufacturing sector has declined significantly over the last quarter. Drilling budgets for natural gas prospects have been significantly cut by many companies, so the pace of supply gains should slow in 2009.

By Joseph Dancy,

Adjunct Professor: Oil & Gas Law, SMU School of Law

Advisor, LSGI Market Letter

Email: jdancy@REMOVEsmu.edu

Copyright © 2008 Joseph Dancy - All Rights Reserved

Joseph R. Dancy, is manager of the LSGI Technology Venture Fund LP, a private mutual fund for SEC accredited investors formed to focus on the most inefficient part of the equity market. The goal of the LSGI Fund is to utilize applied financial theory to substantially outperform all the major market indexes over time.

He is a Trustee on the Michigan Tech Foundation, and is on the Finance Committee which oversees the management of that institutions endowment funds. He is also employed as an Adjunct Professor of Law by Southern Methodist University School of Law in Dallas, Texas, teaching Oil & Gas Law, Oil & Gas Environmental Law, and Environmental Law, and coaches ice hockey in the Junior Dallas Stars organization.

He has a B.S. in Metallurgical Engineering from Michigan Technological University, a MBA from the University of Michigan, and a J.D. from Oklahoma City University School of Law. Oklahoma City University named him and his wife as Distinguished Alumni.

Joseph Dancy Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.