Stock Market What's in Store for 2009?

Stock-Markets / US Stock Markets Jan 02, 2009 - 12:56 PM GMTBy: Marty_Chenard

If you have been listening to CNBC or Bloomberg, you have probably picked up on a "growing expectation" that we will come out of the recession in the 3rd. Quarter of this year.

If you have been listening to CNBC or Bloomberg, you have probably picked up on a "growing expectation" that we will come out of the recession in the 3rd. Quarter of this year.

This expectation actually began to show up over two weeks ago. At that time, I was at a Christmas Party with an Investment analyst from one of the top Wall Street firms. His stand was a "committed opinion" that we would see bad news and bad employment reports in the first two Quarters, and then an end to the recession in the third Quarter. He expected the economy to finish getting the bulk of the job losses out of the way in the second Quarter.

A day later, I had a conversation with a key executive at one of the "DOW 30 companies". His opinion was the same. In fact, his wording of what would happen was almost the exact same as what the Wall Street investment analyst had said.

My comments to both of them was that it wasn't going to be that simple, or easy. Part of their assumptions revolves around the thinking that "there are no more shoes to drop".

One of the things I brought up, was the trillions in CDOs/CDSs that have 3 year contracts coming due in 2009 and how presently that could mean over 8 trillion in default write offs. That danger would be a default problem larger than the sub-prime problem.

I asked "Mr. Wall Street", "How will that be solved ... was there a way of rolling over the contracts to a future date so no one saw them in 2009?" "What about the projected closings of 30,000 to 40,000 of our largest retail facilities and their unemployment impact?" He didn't have an answer, and questions like these were upsetting him ... to the point where he abruptly left the room as he said, "Excuse me, I'm going to go into the other room and stick my head in the sand!".

From where we stand now , I see no " empirical evidence " yet that would suggest the "third Quarter turn around" will end up being a fact ... we will need to see home hard core changes in the trends and numbers during the second Quarter. My oldest son asked if this couldn't turn out to be a "self-fulfilling prophecy". I'll grant that it is one of the possibilities, but world wide demand will have to pick up with increased consumer spending which brings me to U.S. output vs. jobs.

For decades, I have watched the "Help Wanted Index" as a sign of when the economy would be seeing an exit out of a recession. Last August, I abandoned using the data in disgust when the historical data was "adjusted" back for all months going back for years (about the same time when AIG and Lehman were in big trouble). The numbers were all increased from 11% to 17% per month ... with July 2008's number being increased the most by 17%. If the data change was about resetting the base line, the monthly reset deviations would have been fairly consistent ... but they weren't. As an analyst, it meant that I could not trust the data any more and represent it as accurate to our subscribers. So, what can we use instead?

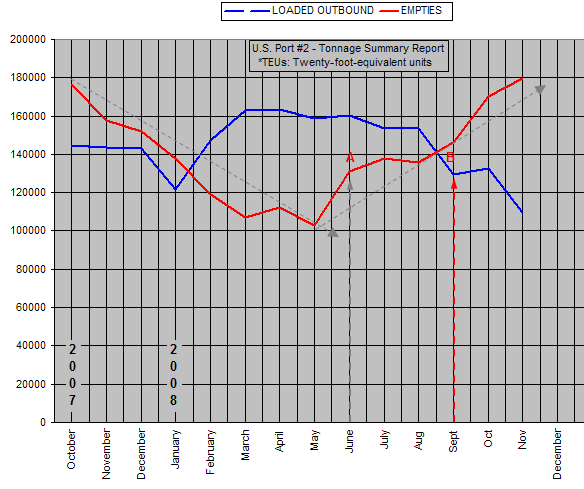

One of the data sets I am now watching is U.S. output leaving our export ports . I watch the total tonnage of "Loaded outbound" and "empty" port containers. Here is my theory: When outgoing tonnage is increasing, then our productivity is increasing and we need more employed people to make that happen. When outgoing tonnage is decreasing with "container empties" increasing, then U.S. productivity or output is decreasing and we need fewer employed people to make that happen ... which translates into cut hours and layoffs. The tonnage reports don't lie ... they are what they are, and they don't get changed or "revised".

The data shows that the "empty cargo containers" reversed a down trend to the upside last June. That said that a new trend of increasing, unused export containers was beginning. Then, last September, the number of "empty containers" sitting on the docks EXCEEDED the number of "Loaded Outbound containers" leaving the U.S.

The current chart is below ... I am now waiting for the December Tonnage Report to come out in the next few days and I will post the updated chart on our paid subscriber site. The chart now shows, that as of November, empty containers were trending higher with outgoing containers falling rapidly. Note how the empty containers signaled a problem in June when the trend started up in the chart below. If we are going to see a third Quarter end to the recession, then we will need to see the evidence with empties declining, and "loaded outbounds" increasing. Without that occurring, you can't get an economic turn-around with less goods being manufactured, bought, and shipped ... it just doesn't work that way.

So, 2009 will be a wait and see proposition relative to whether or not the recession ends or continues. Whether or not Obama's stimulus plan works. Whether or not CDO/CDS defaults bring in another "shoe dropping" surprise to Wall Street ... and whether or not job losses stop AND consumers start spending again. We will monitor what happens during the year, so our paid subscribers can see and understand if the possibility of a third Quarter turn around can become a reality. What happens in the second Quarter will be critical. In late May and June, if adequate improvements are not seen, Mr. Wall Street and his friends will "abandon ship" and sing a new tune.

*** Feel free to share this page with others by using the "Send this Page to a Friend" link below.

By Marty Chenard

http://www.stocktiming.com/

Please Note: We do not issue Buy or Sell timing recommendations on these Free daily update pages . I hope you understand, that in fairness, our Buy/Sell recommendations and advanced market Models are only available to our paid subscribers on a password required basis. Membership information

Marty Chenard is the Author and Teacher of two Seminar Courses on "Advanced Technical Analysis Investing", Mr. Chenard has been investing for over 30 years. In 2001 when the NASDAQ dropped 24.5%, his personal investment performance for the year was a gain of 57.428%. He is an Advanced Stock Market Technical Analyst that has developed his own proprietary analytical tools. As a result, he was out of the market two weeks before the 1987 Crash in the most recent Bear Market he faxed his Members in March 2000 telling them all to SELL. He is an advanced technical analyst and not an investment advisor, nor a securities broker.

Marty Chenard Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.