Obama's Role in the Next Stock Market Breakout Direction

Stock-Markets / Investing 2009 Jan 29, 2009 - 05:02 PM GMTBy: Oxbury_Research

A hunch is a dangerous thing… And nowhere is it more dangerous than in the investment world, where a wrong hunch can get you a one way ticket to poverty bay.

A hunch is a dangerous thing… And nowhere is it more dangerous than in the investment world, where a wrong hunch can get you a one way ticket to poverty bay.

That said, we thought we'd let you know ours anyway. We have a hunch the market is ready for a very sizeable move. That shouldn't surprise you; after all the VIX is still hovering in the stratosphere, and big moves are, by definition, accompanied by elevated levels in volatility.

Yet a few things need explaining. First, why the markets have been moving sideways since the end of September '08 – all the while accompanied by that same massive volatility we just mentioned. Yes, we see 200, 300, 400 daily point moves on the Dow, but nothing is sustained. No cataclysmic drops. No jet-fuel spikes. Just this dreadfully boring sideways snicker of a market that seems to have the last laugh every time we try to make a bet on it, bullish or bear.

So what's going on?

That's where our hunch comes in. There has been a very noteworthy confluence of (non)events this last week that got us thinking. Take a look:

- First, sentiment is still uncomfortably bullish – yet the market has hit no new highs (it hasn't even bettered any retracements highs). Bearish fund managers have dropped from 65% of those surveyed back in October to only 24% now, according to Merrill Lynch.

- We haven't tested “the lows” – something everyone fully expects to happen, but that the market stubbornly refuses to acquiesce to. Have they already been tested?

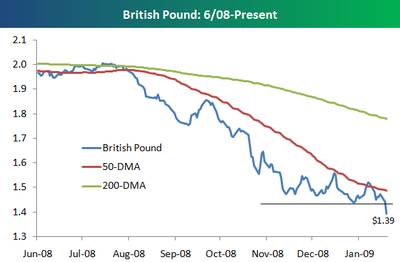

- We have new, back-breaking economic news out on the U.K. – whose currency was last seen making a proud Union Jack of a swan dive into the loo, and regarding whom that crusty old bear Jim Rogers recently stated: “ sell any sterling you might have… the City of London is finished. ” Here's the Pound Sterling, for those who can bear to look:

A recent break below U$1.40 looks ominous. A mere six months trading has wiped 30% of the Old Lady's pompous makeup from her face. Yet the market doesn't break.

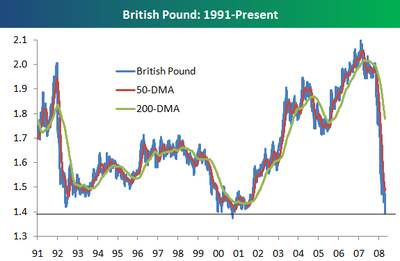

Below is the longer term trade in the Pound: eight years' of gains held down and given a jolly good, soccer hooligan's thumping.

OOOCH!

The United Kingdom Diet: We all Lose a Few Pounds

And while we're at it, who can resist the following:

America is not the only country with the cash spigot flowing Niagara-like over the fires of recession. The British have ramped up money supply at a greater than 20% annual pace in just the last six months. And they wonder why Jimmy Rogers (among others) see a selling opportunity here. NOTE: keep an eye out for the evil Hungarian Count, Vlad Soros – a former partner of Rogers – who may again attempt to suck the lifeblood from the Pound as he did back on Black Wednesday, 1992.

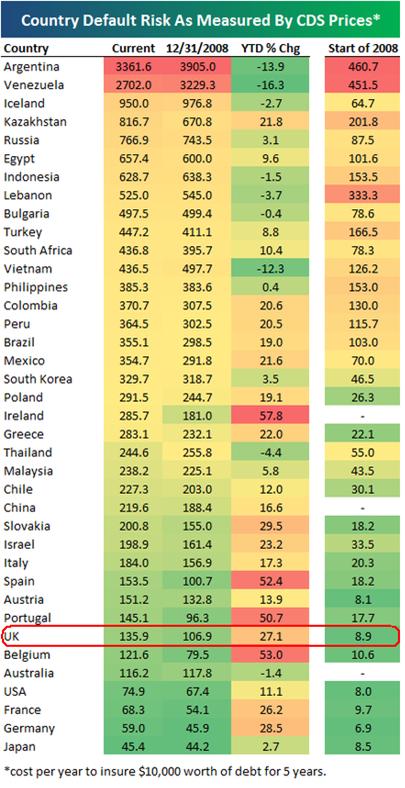

One more: here are CDS prices for selected nations – the UK is listed about three quarters of the way down:

The cost of insuring British sovereign debt has swung higher by a multiple of 15 in a mere year (8.9 to 135.9). Among the industrial western nations only Austria boasts a worse decline. This is a massive vote of non-confidence in Britain 's ability to service its debt.

- The rest of Europe is again up to their ears in the mud of Passchendaele, and the U.S. economy will likely post its worst two consecutive quarters (4 th and 1 st ) that any living man can remember. This is near certain. Still the market doesn't break.

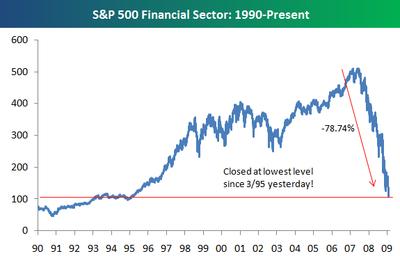

- The entire American financial sector has gone to equity hell, registering losses of 25% in just the last ten trading sessions. Take a look here:

Say it isn't so! And we were told there could be no rally/recovery without the financials.

So why haven't we broken to new lows in the broad market?

Why is it holding up?

What's it waiting for?

Glad you asked. Because most agree that the market is simply waiting for a hero. Er, let us explain. The market is actually waiting for the passage of newly-crowned Messiah – er, President – Obama's spending package before it acts. We're not sure why it needs to see this. We've no doubt the measure will pass. We've no doubt the market knows already what its contents will be. We also believe that everyone is watching and waiting so intently because they want to see how this President, this handsome and undeniably Black orator, whose rise to power has been so unconventional and swift, and who literally took a nation – nay, a planet – by storm, will actually deliver the package that will “save America .”

All the World's a Stage – Even Financial Markets

This is not an everyday occurrence. Only a few short months ago, there was many a respectable journalistic outlet saying that America was not ready to elect a man (or woman) of color as Commander-in-Chief. What will those same outlets/individuals argue now that the future of the nation is literally at stake? What will they say when the President introduces his stimulus package? What sort of reviews will he garner?

We'll shortly find out. And it will be those reviews – immediate and shallow both – that will determine which way this market breaks.

For America is a stage. There is no substance left in her. Real Presidents, who said what they believed and acted with conviction and a sense of what was right, went out with Truman – Democrat bugger that he was. And now even the Financial markets have become a stage. The whole damn thing is theater. And that's precisely why the tension surrounding the current economic situation will bring even greater television audiences and ad revenue than the mighty Superbowl ever could. Bet on it. The Obama economic address will have everything but cheerleaders in miniskirts to give it the flourish and zest it needs as political drama.

Our hunch is that there's too much riding on it, and that Barrack Hussein Obama is too polished a showman not to succeed. The market will break. Upward. Wait for it. Time it. And be long calls in the homebuilders and SPYs just before it happens.

Matt McAbby

Analyst, Oxbury Research

After graduating from Harvard University in 1989, Matt worked as a Financial Advisor at Wood Gundy Private Client Investments (now CIBC World Markets). After several successful years, he moved over to the analysis side of the business and has written extensively for some of corporate Canada's largest financial institutions.

Oxbury Research originally formed as an underground investment club, Oxbury Publishing is comprised of a wide variety of Wall Street professionals - from equity analysts to futures floor traders – all independent thinkers and all capital market veterans.

© 2009 Copyright Oxbury Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Oxbury Research Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.