US, UK, Eurozone Banks Face Collapse: Global Banking System Insolvent

Economics / Credit Crisis 2009 Feb 16, 2009 - 02:31 PM GMTBy: Mike_Shedlock

With all the hype from various US dollar bears about the crisis with US banks, few on this side of the Atlantic are paying any attention to happenings in Europe.

With all the hype from various US dollar bears about the crisis with US banks, few on this side of the Atlantic are paying any attention to happenings in Europe.

For those who look, a strong case can be made that European banks are as bad off if not much worse off than their US counterparts.

"The unfolding debt drama in Russia, Ukraine, and the EU states of Eastern Europe has reached acute danger point" says Ambrose Evans-Pritchard in Failure to save East Europe will lead to worldwide meltdown .

Stephen Jen, currency chief at Morgan Stanley, said Eastern Europe has borrowed $1.7 trillion abroad, much on short-term maturities. It must repay – or roll over – $400bn this year, equal to a third of the region's GDP. Good luck. The credit window has slammed shut.

Not even Russia can easily cover the $500bn dollar debts of its oligarchs while oil remains near $33 a barrel. The budget is based on Urals crude at $95. Russia has bled 36pc of its foreign reserves since August defending the rouble.

"This is the largest run on a currency in history," said Mr Jen.

In Poland, 60pc of mortgages are in Swiss francs. The zloty has just halved against the franc. Hungary, the Balkans, the Baltics, and Ukraine are all suffering variants of this story. As an act of collective folly – by lenders and borrowers – it matches America's sub-prime debacle. There is a crucial difference, however. European banks are on the hook for both. US banks are not.

Almost all East bloc debts are owed to West Europe, especially Austrian, Swedish, Greek, Italian, and Belgian banks. En plus, Europeans account for an astonishing 74pc of the entire $4.9 trillion portfolio of loans to emerging markets.

They are five times more exposed to this latest bust than American or Japanese banks, and they are 50pc more leveraged (IMF data).

Spain is up to its neck in Latin America, which has belatedly joined the slump (Mexico's car output fell 51pc in January, and Brazil lost 650,000 jobs in one month). Britain and Switzerland are up to their necks in Asia.

Whether it takes months, or just weeks, the world is going to discover that Europe's financial system is sunk, and that there is no EU Federal Reserve yet ready to act as a lender of last resort or to flood the markets with emergency stimulus.

East Europe that is blowing up right now. Erik Berglof, EBRD's chief economist, told me the region may need €400bn in help to cover loans and prop up the credit system.

Europe's governments are making matters worse. Some are pressuring their banks to pull back, undercutting subsidiaries in East Europe. Athens has ordered Greek banks to pull out of the Balkans.

The sums needed are beyond the limits of the IMF, which has already bailed out Hungary, Ukraine, Latvia, Belarus, Iceland, and Pakistan – and Turkey next – and is fast exhausting its own $200bn (€155bn) reserve. We are nearing the point where the IMF may have to print money for the world, using arcane powers to issue Special Drawing Rights.

Its $16bn rescue of Ukraine has unravelled. The country – facing a 12pc contraction in GDP after the collapse of steel prices – is hurtling towards default, leaving Unicredit, Raffeisen and ING in the lurch. Pakistan wants another $7.6bn. Latvia's central bank governor has declared his economy "clinically dead" after it shrank 10.5pc in the fourth quarter. Protesters have smashed the treasury and stormed parliament.

Somehow the myth persists that the Euro will be the world's reserve currency. The "somehow" usually stems from those who believe in the tooth fairy and global decoupling while staring straight into a magic mirror that only highlights the problems in the US. Here is a better question....

Can The Euro Survive?

John Mauldin explores that question in his latest Outside The Box: Can The Euro Survive?

Milton Friedman famously predicted that the euro would not last past their first economic crisis. This week we look at commentary by Niels Jensen that explores the news from Euroland. Can the euro survive? He explores a number of options which are most definitely not on the radar screen for most investors. It is good to get a perspective from those outside of our own back yard. Note that when he says "our country" he is referring to Great Britain.

Do BRICs (and Germans) Eat PIGS?

When the euro was introduced about ten years ago, the pessimists didn't give it much chance of reaching its tenth anniversary. The euro, or so the argument went, was doomed from the outset because of the wide spread in economic performance and discipline amongst the member countries. At one end you had, and still have, the highly disciplined, but also slow growing, economies of Germany and the Netherlands. At the other end you find the faster growing but poorly disciplined countries such as Spain and Greece. As icing on the cake, you also had, and still have, countries that lack in both departments, such as Italy, making it difficult for the union to 'gel' - well, according to sceptics.

What they [the sceptics] failed to realise was that Europe, together with the rest of the world, was about to enter a period of unprecedented prosperity. The good times would not only gloss over the deeper problems, but the euro would actually go from strength to strength to a point where it now threatens to unseat the US dollar as the premier reserve currency of the world. It is therefore perhaps a mystery to some of you, why one should question the longer term viability of the euro. That is nevertheless what I intend to do.

The problem, as I have already alluded to, is poor discipline amongst several of the member states. Ever heard of the four PIGS? This less than flattering acronym stands for Portugal, Italy, Greece and Spain, four members of the euro zone which are all in much deeper trouble than they are prepared to admit.

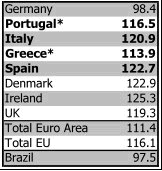

Let's take a closer look at the unit labour cost index for various countries

2007 Unit Labour Cost Index (2000=100)

Since the introduction of the euro, the PIGS have failed miserably to keep up with Germany on this measure of competitiveness. So has Ireland by the way, hence its current predicament.

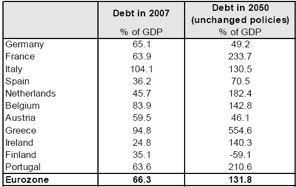

Another issue, which is potentially even more destabilising for the euro longer term, is the massive liabilities facing Europe as its population ages.

Greece is clearly facing the biggest challenge. Public debt, which currently stands at about 95% of GDP, will grow to a whopping 555% of GDP by 2050 if the current pension and social security programme is left unchanged. The Greek government is painfully aware of this and have been working on several new initiatives. It was the passing of one of those new laws which caused the riots in Athens before Christmas.

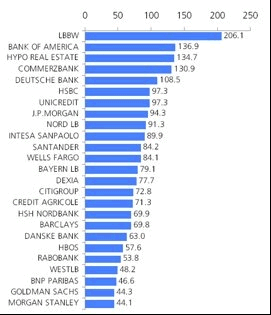

A third problem facing Europe is the sheer scale of the banking crisis. Although this is not just a European problem, European countries are probably worse off than the US because a larger part of European debt has to be financed externally. As you can see from chart 1, more than $2 trillion of European and U.S. bank debt needs to be re-financed before the end of next year. Unless there is a material improvement in market conditions, re-financing at such a massive scale is simply not doable.

Maturing Bank Securities in 2009/10 (USD)

Kenneth Rogoff and Carmen Reinhart published a research paper about a month ago which should be mandatory reading for all investors2. They have studied every single banking crisis of the past 100 years and reach some rather unsettling conclusions. As they point out: "Broadly speaking, financial crises are protracted affairs".

Following a banking crisis, asset prices fall more and for longer than most investors realise. So do output and unemployment. Most importantly, though, the real value of government debt explodes but not for the reasons you might think. Yes, the bailout costs are significant, but the main driver of rising government debt is actually the subsequent collapse of tax income. [Mish note: See article for charts]

So when we are told that the bailout cost, although large, is still manageable, it is only half the story. The loss of tax revenue is another nail in the coffin and could lead to a dramatic - and unpredicted - rise in public debt. Have you heard any mention of that from your government?

In Frankfurt, the 'eurocrats' are currently congratulating themselves that they, through strict monetary discipline, killed inflation in the aftermath of last year's explosion in commodity prices. The reality, however, is that the credit crunch killed inflation - they didn't - and Europe is now at a junction where even the smallest policy mistake could be very expensive indeed.

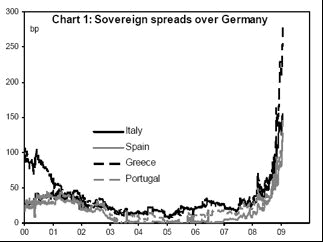

So, could all this lead to the destruction of the euro? Could the currency union actually break up? It is not that the risk to the PIGS has not been recognised by bond investors. As you can see from chart 3 below, investors in long dated Greek government bonds now earn about 2.5% more than they do by investing in correspondent German bunds.

PIGS Sovereign Debt Spreads over Germany

On the other hand, I may disappoint one or two readers (I will certainly disappoint Ambrose Evans-Pritchard of the Daily Telegraph who appears to have declared war on the euro), but I firmly believe that the euro will almost certainly survive the current crisis. I am much more worried about some of the member countries.

There is nothing in the Maastricht treaty which prevents a member country from leaving the euro, yet the decision to join is effectively irreversible. There are a number of reasons for this, the most important being economic costs. Take Italy which has a history of compensating for lost competitiveness through regular devaluations. If Berlusconi did the unthinkable tomorrow (sorry - nothing is unthinkable in Berlusconi's world), Italy's borrowing costs would explode. My guess is that bond investors would demand double digit returns on a Lira denominated bond to compensate for the dramatically increased devaluation risk. Already in a precarious fiscal position, Italy could quite simply not afford that.

So, if any country were to leave the euro, it would more likely be from a position of strength, and only one country possesses enough strength to pull that off in the current environment. That country is Germany. And, although the euro is not particularly popular in Germany, I believe it is extremely unlikely for Germany to make such a move unilaterally.

At the same time, the fact that the euro has saved the bacon of more than one country in recent months - Ireland being the most obvious example - should not be ignored. For this very reason, the euro membership is actually far more likely to grow than to shrink as a result of the financial and economic crisis engulfing the world. The issue the EU has to deal with is whether the new applicants should actually be welcomed. Most of those who would want to join will bring plenty of baggage.

Another possible outcome, which you hear almost no mention of, is the possibility of a new Transatlantic currency. When I mention this possibility, everyone laughs, but think about it for a second. The economic crisis on both sides of the Atlantic is enormous. Both are resorting to the same formulas - large fiscal stimulus and quantitative easing (a word invented by central bankers because 'printing money' smacks too much of Zimbabwe). There is a real risk that the entire financial and monetary system on either side of the pond needs to be re-designed. If that were to happen, I am pretty confident that the Fed and the ECB would at least sit down and discuss the possibility of a joint currency. That would also allow the UK to join a currency union without too much egg on its battered face.

In the short to medium term, though, there is no such bailout on the horizon. D-day is now firmly on the horizon. As I see things, it is not inconceivable that a member country could be forced to default on its sovereign debt.

Another, and more likely, outcome is the possibility of one or more member countries coming under EU administration. The recent crowd trouble in Greece could very well turn out to be the dry run for much bigger and more organised labour market unrest across Europe as reality begins to bite.

For the time being, though, European governments continue to be in denial. When the IMF recently recommended that Spain implement various structural reforms, the idea was flatly rejected by Prime Minister Zapatero. In the meantime, you can sit back and prepare for the drama to unfold. Very simplistically, it is a choice between Zimbabwe and Japan. Our central bankers can choose to monetize their way out of the current slump and run the risk of much higher interest rates and a rapidly deteriorating currency like Zimbabwe or they can show fiscal discipline and accept perhaps ten years of below par growth a la Japan. Or they can find the delicate balance in between the two and everyone will live happily thereafter. But that requires both skill and luck.

Those are long snips from a very long article that is worth a read in entirety. In aggregate, my take is that the Eurozone, the UK, and the US all face similar problems, and many countries are in far worse shape than the US. And while Italy is likely to do a lot of sabre rattling, none of the PIGS are apt to be so foolish as to leave the European Union.

However, there is going to be increasing pressure on Germany to bailout the other Eurozone countries yet there is no reason to think they will (or should) oblige.

Looking ahead, one of the consequences of the Mad Race to ZIRP (Zero Interest Rate Policy) is that if Japan, the UK, US, and EU are all have interest rates at zero, a big reason to enter carry various carry trades will blow up in smoke.

On the plate now is a meltdown possibility in US banks, UK banks, and Eurozone banks as the entire global banking system is insolvent. Conceivably a framework for a new transatlantic or even global currency could come out of such a meltdown.

However, it is impossible to agree to a solution when Central Bankers do not even understand the problem. The problem is micromanagement of interests rates and currencies by central bankers in conjunction with fractional reserve lending and deficit spending everywhere. Right now, president Obama, Bernanke, and nearly every politician and central bank in the world is focused on curing symptoms instead of curing the disease.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.