Stocks Bull Market Killers

Stock-Markets / Stocks Bear Market Feb 19, 2009 - 01:35 PM GMT Sean Brodrick writes: I'm very bullish on gold and silver. And at the same time, my target on the S&P 500 is 600 — a 24% drop from recent levels and 62% down from its October 2007 peak.

Sean Brodrick writes: I'm very bullish on gold and silver. And at the same time, my target on the S&P 500 is 600 — a 24% drop from recent levels and 62% down from its October 2007 peak.

As far as the economy goes, I'm not looking for it to bottom before 2012 … if we're lucky. While the market could bottom before that, I'm not seeing the light at the end of the tunnel.

The good news is there are some trades and investments that will do well, even in these worst of times. Before I get into those, let me tell you about the …

5 “Rally Killers” That Will Strangle Any New Bull

Rally Killer #1 — Banking Crisis Will Likely Get Much Worse

Our biggest banks are fundamentally bankrupt; and Treasury Secretary Timothy Geithner's “new deal” is to basically do the same thing Hank Paulson did.

|

| Geithner's “new deal” is to basically do the same thing Hank Paulson did. And U.S. taxpayers will be stuck holding the bag. |

Two important parts of Geithner's plan:

- “Stress testing” banks by poring over their books to separate viable institutions from bankrupt ones

- Establishing an investment fund with private and public money to purchase bad assets

The problem with this is that bank books are increasingly revealed to be shams and lies; and you can be sure that an investment fund is going to cherry-pick assets and leave U.S. taxpayers holding the bag.

The International Monetary Fund (IMF) did a study of financial crises from 1970 to 2007. When it came to forbearance, or delaying foreclosures and delaying writing off bad loans, the IMF said:

“Providing assistance to banks and their borrowers can be counterproductive, resulting in increased losses to banks, which often … take unproductive risks at government expense. The typical result … is a deeper hole in the net worth of banks, crippling tax burdens to finance bank bailouts, and even more severe credit supply contraction and economic decline.”

In other words, the kind of approach Paulson and Geithner have taken with the big banks is more harmful than helpful.

And the banking crisis continues to worsen …

A staggering 2.3 million homeowners faced foreclosure proceedings last year, up more than 80% from 2007. Analysts say that number could soar to as high as 10 million in the coming years.

Already 1 million residences have been foreclosed on since 2006. What's more, the problem should get worse through 2012, as the next wave of adjustable rate mortgages reset at much higher rates.

Rally Killer #2 — Real Estate Is Nowhere Near a Bottom

Home prices follow income. And we are in a deflationary spiral now, so incomes are going down. I expect we'll see both incomes and home prices fall until 2012.

The S&P/Case-Schiller Composite Index, which tracks home prices across the nation, says that home prices are off about 25% since the peak. The big problem is that the slide is ongoing and seems to be accelerating.

The National Association of Home Builders expects that home prices, on average, will fall 29% in 2009 alone. And remember, they're supposed to be the optimists.

How bad could it get? We could go into a decade-long deflation like Japan. Prices can overshoot to the downside as well as to the upside. And it should be bad news for any attempts at a sustained bull market.

Rally Killer #3 — The Great Unwinding

A government report showed that U.S. consumer spending fell in December for a record sixth consecutive month.

Since consumer spending accounts for about 70% of total economic activity, these cutbacks are battering the economy. This trend is probably going to become more pronounced in the months ahead because consumers have a lot of debt to unwind and an average unwinding of debt would suck about $300 billion out of the economy.

The debt of households has climbed much faster than their net worth in the last 50 years, according to data compiled by the Federal Reserve.

Take a look at this chart …

Four rounds of debt reduction (the circles on the bottom part of the chart) took place during that period, and they lasted for about 10 quarters on average. That means we have a long, long way to go.

To make bad matters worse …

Americans are becoming savers just at the time when the government wants them to go out and spend. While I applaud the return to individual responsibility, this is really going to put the brakes on any government-led scheme to jump-start the economy.

Keep in mind that the personal savings rate dropped from 9% in the 1980s to just 0.6% from 2005 to 2007. If we just return to historical norms — around 6.8% — there will be a huge hit to consumer spending.

Rally Killer #4 — State Budgets Are Going Bust

According to the Center on Budget and Policy Priorities (CBPP), at least 46 states from Maine to California faced or are facing shortfalls in their budgets for this and/or next year, and severe fiscal problems are highly likely to continue into the following year as well.

The CBPP has this dire warning on its Web site: “Combined budget gaps for the remainder of this fiscal year and state fiscal years 2010 and 2011 are estimated to total more than $350 billion.”

Unlike the federal government, states cannot run deficits when the economy turns down; they must cut expenditures, raise taxes, or draw down reserve funds to balance their budgets. Reducing services and payrolls becomes urgently necessary.

|

| The situation has gotten so bad in California that its government is trying to get around the problem by issuing IOUs. |

At least 36 states and the District of Columbia have proposed or implemented reductions to their state workforce. California, with a $35.9 billion budget gap in 2009, is trying to get around the problem by issuing IOUs.

Workforce reductions add to states' economic woes. This, in turn, adds another twist to the vicious downward spiral in consumer spending.

Rally Killer #5 — Slump Is Truly Global

Just look at some recent news on the global economic scene …

- Europe's quarterly GDP fell by 1.5%, or 6% annualized. Germany contracted at an 8% annual rate.

- Japan's economy is falling at its fastest pace in 35 years — 3.3% or 12.7% annualized.

- China is officially growing at 6.8%, unofficially probably contracting.

- Brazil's economy is falling off a cliff. Ditto for Mexico.

- Eastern Europe borders on bankruptcy … They may drag European banks down with them.

- Almost all East bloc debts are owed to Western Europe. European banks hold 74% of the entire $4.9 trillion portfolio of loans to emerging markets.

This tumult in overseas markets should help the U.S. dollar remain strong against the euro and other currencies.

The bad news is there is no growth engine — at the present time — to pull the U.S. or global economies out of their slumps. When Japan went into its “lost decade”, the downside was cushioned by the global economic boom.

So, Japan's lost decade may look good compared to what we end up with.

Bottom Line: Things Will Get Much Worse Before They Get Better

The combination of the worsening banking crisis, real estate crisis, great unwinding of debt, state budgets imploding, and a global slump — compounded by debt crisis — means more downside. This is not like your father's or grandfather's recession — it could be three times as long and three times as deep … OR WORSE!

That means most stocks are not bargains just because they're cheap compared to previous cycles.

Where to Invest in Troubled Times

When investors get scared — they look for safety. And the ultimate safety play is gold. Despite the fact that gold has enjoyed a monster rally, I still like it and silver too.

In fact, I think gold and silver are in for a prolonged bull market even as most stocks face an extended bear market.

Looking at this monthly chart, you can see that gold consolidated recently and now seems to be poised to break out to the upside.

Why are gold and silver doing well?

- Investors are scared

- The credit default risk on 10-year U.S. Treasuries is rising

- Cracks are developing in the once rock-solid Treasuries auction market.

And I think precious metals, like gold and silver, are about to get a lot more precious. Well-capitalized miners who are leveraged to the price of gold and silver will also do well. Warning: Not all miners will do well. You have to be selective.

An easy way to trade gold and silver are with ETFs that hold physical metal — the SPDR Gold Trust (GLD) and the iShares Silver Trust (SLV).

Just last week, the GLD's holdings rose more than 100 metric tonnes to more than 970 metric tonnes … a new record. This fund is rapidly gaining on the #6 holder of gold in the world, Switzerland. There are other gold ETFs in the world, and total gold ETF holdings are up 200 tonnes this year.

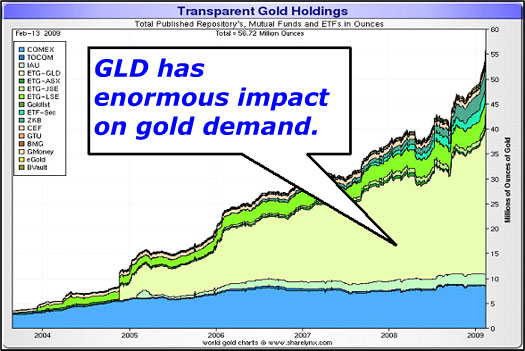

Looking at a chart from Sharelynx.com, you can see that the GLD has had an enormous impact on gold demand over the past five years. But other funds are adding to their gold holdings as well. Is this pushing up the price of gold? Bet on it! And the process seems to be accelerating.

The GLD should be used as a trading vehicle more than an investment vehicle. Remember that big funds will sell in a heartbeat if they think gold is going lower. And I expect big swings in gold — in both directions — as it trends higher this year.

My subscribers have also made money in the DB Gold Double Long ETN (DGP), which aims to track twice the daily movement in gold, and the DB Gold Double Short ETN (DZZ), which aims to track twice the INVERSE of the daily movement in gold. So you can make money on the big corrections in gold. Just be careful — these markets move quickly, and you can get burned.

Want to Meet in Person? Join Me in Phoenix!

I'll be attending and addressing the Cambridge House Resource Investment Conference and Silver Summit in Phoenix, Arizona on February 21 and 22. It should be educational, interesting, and fun. If you want to attend, I have a gift for you — a special code that should get you a discount.

The conference costs $25 at the door, but you can attend for free by signing up in advance at: http://www.cambridgehouse.ca/phoenix.html .

And if you want to attend the Silver Summit Reception and Dinner, use the code PHX09SB to get half off the cost of your ticket.

Yours for trading profits,

Sean

P.S. When trading instruments like the GLD, SLV, DGP and DZZ, it's just as important to know when to get out as it is to know when to get in. That's what my Red-Hot Commodity ETFs service is all about. Subscribers are racking up open gains on the SLV right now, and there's potentially a whole lot more where that came from.

If you want some help trading this fast and furious market, consider joining me in Red-Hot Commodity ETFs. If you sign up for a one-year subscription I'll throw in one month … absolutely free! And if you aren't satisfied in your first 30 days, we'll give you a full refund on the price of the subscription. What do you have to lose?

Here's the important part: I can't keep this kind of offer open for long — Red-Hot Commodity ETFs can fill up fast. So it's good for today only . If you want to climb aboard the profit train before it leaves the station, call 1-800-430-3683 and one of our customer service representatives will set you up.

This investment news is brought to you by Money and Markets . Money and Markets is a free daily investment newsletter from Martin D. Weiss and Weiss Research analysts offering the latest investing news and financial insights for the stock market, including tips and advice on investing in gold, energy and oil. Dr. Weiss is a leader in the fields of investing, interest rates, financial safety and economic forecasting. To view archives or subscribe, visit http://www.moneyandmarkets.com .

Money and Markets Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.