Stocks Plunge to 11 year Lows Replicating 1930's Bear Market

Stock-Markets / Stocks Bear Market Feb 24, 2009 - 06:06 AM GMTBy: PaddyPowerTrader

So, back to the future, doing the time warp again, as the current market bear took us back to spring 1997 levels yesterday. Worryingly it was the NASDAQ 's big tech names (Apple –4.66%, Intel –5.48%, Microsoft –4.39%) and raw stocks that showed the downside leadership while Alcoa (-7.63%) was the big drag on the Dow . Whispers of more financial follies at the black hole that is AIG(reed) who want another bailout of the bailout of the bailout certainly didn't help either. I'd watch the whole insurance sector on the back of this. Resistance seems futile. By the way, 1997 was the year that the Nobel Prize for Economics is won by Long Term Capital Management stars Robert Merton and Myron Scholes!

So, back to the future, doing the time warp again, as the current market bear took us back to spring 1997 levels yesterday. Worryingly it was the NASDAQ 's big tech names (Apple –4.66%, Intel –5.48%, Microsoft –4.39%) and raw stocks that showed the downside leadership while Alcoa (-7.63%) was the big drag on the Dow . Whispers of more financial follies at the black hole that is AIG(reed) who want another bailout of the bailout of the bailout certainly didn't help either. I'd watch the whole insurance sector on the back of this. Resistance seems futile. By the way, 1997 was the year that the Nobel Prize for Economics is won by Long Term Capital Management stars Robert Merton and Myron Scholes!

Today's Market Moving Stories

- Asian markets slumped overnight in sympathy with sick US stocks. Former financial powerhouse Nomura led the rout (-8.6%) on news of a rights issue and dilution. Note how even former Teflon JP Morgan have had to slash their dividend 87% to retain earnings as “extraordinary times call for extraordinary measures”.

- The ever excitable Ambrose Pritchard Evans has a rather sensationalist piece in the Telegraph saying that the ECB interest rate setting council face a mutiny by central bank governors from the Med countries . They want the ECB to go well beyond conventional monetary policy and to embark on quantitative easing and faster and deeper rate cuts. In the old day's, stories like this would just make the Bundesbank dig their heels in. Recall that the Telegraph is not exactly a bastion of impartial views about the grand European project.

- Gold's pop above $1,000 has inevitably encouraged talk of explosive gains still to come . Gold's greatest weakness is the lack of any intrinsic return – unlike equities, bonds or bank deposits, a holding of gold pays no dividend , coupon, or interest. Any capital gains depend on demand for an inflation hedge or a safe haven against economic and financial meltdown. Given the large amount of spare capacity now opening up in the global economy, inflation is likely to remain subdued despite substantial monetary and fiscal stimulus. The main driver will therefore continue to be safe haven flows and these are likely to remain strong for a while.

Some Scary Numbers On Earnings Estimates

You might want to look away now. 2009 earnings in the widely followed MSCI World Equity Index were downgraded by 11.8% last month, the largest one-month downgrade in 20 years. Over the past 6 months, global earnings have been downgraded by 36%.

In Europe, 2009 estimated earnings were downgraded by 11% last month. The current 6-month downgrade momentum of 33% is way above the maximum 6-month downgrades in previous downturns (18% in 1993, 12% in 2002). 506 of the EuroStoxx 600 companies have seen downgrades, while only 79 companies have been upgraded. The US has seen 14.2% earnings downgrades over the past month. Japan has suffered an earnings crash last month with downgrades of 2009 earnings of 32%. Emerging Europe has seen downgrades of 2009 earnings of 12% last month and of 28% over the past three months.

Adding to the negative sentiment was a Bloomberg article (which made it onto the “most read” list) noting that 228 companies cut or suspended dividends last quarter, the most since records began 54 years ago. Based on current estimates of the dividend payout for 2009, the London Business School believes that the S&P500 would need to fall to 526 before investors were compensated for owning shares - a level that was last seen in mid 1995 and implying 30% more downside from current levels.

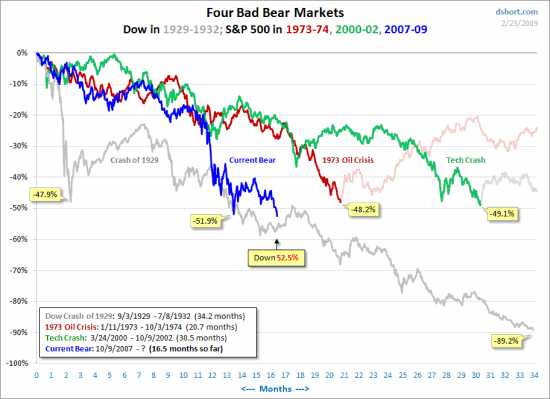

Equity Markets Now On Same Trajectory As 1929-32 Crash

Equities

- BMW have been cut to underweight by Morgan Stanley citing “unattractive valuation”.

- Some good news for a change from UK builder, yes builder, Redrow whose shares are up 6% after saying that it was “mildly encouraged” by an improvement in sales reservations rates in the first 8 weeks of 2009.

- Hertz is down after the car rental giant reported a Q4 2008 loss.

- Akzo Nobel, the worlds largest paint maker, reported a massive €1.2bn loss for Q4 2008 (its first in 8 years) as they talked of harsh and challenging market conditions.

- Irish food group Kerry reported robust results and EPS that were at the very top end of analysts forecasts with a bullish confident outlook. Stock looks in good shape.

Data And Earnings Today

There is no shortage of stuff to keep markets on their toes. The data includes Germany's IFO, which of course is one of the VERY few the indicators the ECB takes seriously. Later on the US Case-Shiller home price index for 20 cities is released (-18.3%).

Fed Chairman Bernanke will be testifying on the economy (this used to be known as the Humphrey Hawkins semi annual testimony) before the Senate Banking Committee at 15:00.

Earnings today include Thomson Reuters (expected EPS $0.43), Target ($0.83), Radioshack ($0.72), Office Depot ($-0.06), Macy's ($1.01) and Home Depot ($0.15).

Disclosures = None

By The Mole

PaddyPowerTrader.com

The Mole is a man in the know. I don’t trade for a living, but instead work for a well-known Irish institution, heading a desk that regularly trades over €100 million a day. I aim to provide top quality, up-to-date and relevant market news and data, so that traders can make more informed decisions”.

© 2009 Copyright PaddyPowerTrader - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PaddyPowerTrader Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.