Will the Real Private Nonfarm Payrolls Please Stand Up?

Economics / US Economy Jun 01, 2007 - 08:43 PM GMTBy: Paul_L_Kasriel

Each month the BLS heroically makes an adjustment to private nonfarm payrolls for the estimated hiring by new businesses not yet included in the BLS survey and the firing by closed-down businesses not captured in the BLS survey. This is called the "birth/death" adjustment. The birth/death adjustment does not take into account cyclical influences on business start-ups and failures.

Each month the BLS heroically makes an adjustment to private nonfarm payrolls for the estimated hiring by new businesses not yet included in the BLS survey and the firing by closed-down businesses not captured in the BLS survey. This is called the "birth/death" adjustment. The birth/death adjustment does not take into account cyclical influences on business start-ups and failures.

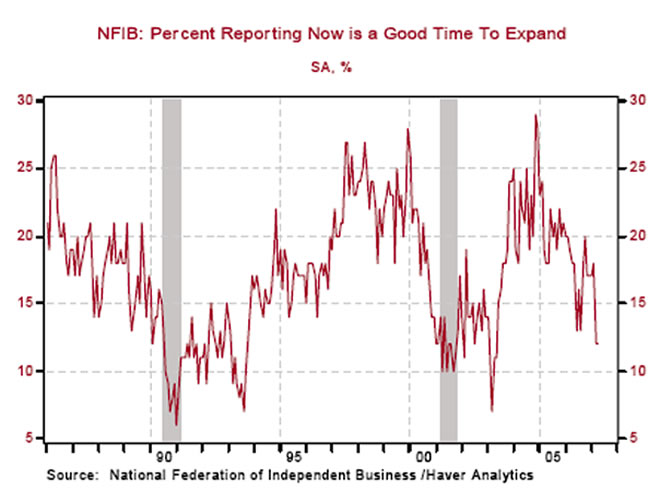

So, at a time when economic growth is slowing, there conceivably could be a slowdown in start-ups and an increase in failures that would not be incorporated in the birth/death adjustment. That is, late in a business cycle, the birth/death adjustment could bias upward the BLS estimate of private nonfarm payrolls. (This is what Justin Lahart was alluding to in his June 1 WSJ column "Sometimes Jobs Numbers Don't Work,"). Chart 1 shows that small businesses currently do not think that now is a good time to be expanding their operations. If now is not a good time to expand the operations of an existing business, it would be reasonable to assume that now would not be a particularly good time to start a business either.

Chart 1

I was curious to see how private nonfarm payrolls excluding the birth/death adjustment compared with the published private nonfarm payrolls. I also was curious to see how the ADP estimate of private nonfarm payrolls, which does not include a birth/death adjustment compared with Establishment Survey private nonfarm payrolls excluding the birth/death adjustment. My curiosity resulted in Chart 2, in which three varieties of seasonally-adjusted private nonfarm payrolls are plotted - the published Establishment Survey payrolls, the Establishment Survey payrolls excluding the birth/death adjustment and the ADP estimate. In order to arrive at the Establishment Survey -ex measure, I had to subtract the birth/death adjustment from the not-seasonally-adjusted total and then apply the seasonal factor to this remainder.

Chart 2

Notice that the ADP estimate begins to diverge more from the official BLS estimate late in 2006 and into 2007. Notice that the payroll estimate using the Establishment Survey excluding the birth/death begins to diverge more from the official BLS estimate and conform more to the ADP estimate beginning early in 2007. The cumulative increase in private nonfarm payrolls in the five months ended May 2007 according to the official BLS estimate, the official BLS estimate excluding the birth/death adjustment and the ADP estimate are 538,000; 400,000; and 442,000, respectively.

The BLS reported that seasonally adjusted, residential construction employment was down only 1,300 in May. Given that home builders have cut back their production and that many are laying off staff, it is curious that such a small number of residential construction jobs were lost in May. The birth/death adjustment might have played a role in limiting this decrease inasmuch as the adjustment added 40,000 construction jobs (both residential and nonresidential) to the total of not-seasonally-adjusted private nonfarm payrolls in May.

I am a big believer in the notion that the private sector can do most things more efficiently than can the government sector. And this extends to measuring economic activity. Perhaps the ADP estimate of payrolls, which is based on actual company payroll data processed by ADP and which is not adjusted for the birth and death of small businesses, presents a more accurate picture of employment growth in America than does the BLS Establishment and Household Surveys.

By Paul L. Kasriel

The Northern Trust Company

Economic Research Department - Daily Global Commentary

Copyright © 2007 Paul Kasriel

Paul joined the economic research unit of The Northern Trust Company in 1986 as Vice President and Economist, being named Senior Vice President and Director of Economic Research in 2000. His economic and interest rate forecasts are used both internally and by clients. The accuracy of the Economic Research Department's forecasts has consistently been highly-ranked in the Blue Chip survey of about 50 forecasters over the years. To that point, Paul received the prestigious 2006 Lawrence R. Klein Award for having the most accurate economic forecast among the Blue Chip survey participants for the years 2002 through 2005.

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.