What's Going On In the Precious Metals Sector?

Commodities / Gold & Silver Jun 28, 2007 - 01:18 AM GMTThe past few days of trading in gold and silver are a great example of why we continually stress the importance of keeping the big picture in perspective. It is difficult not to become emotional when dramatic one day drops catch even the most seasoned investors off guard.

In the short term, strong dramatic price drops strike fear and doubt into our trading decisions. In these situations we are likely to sell out of our well considered investments and bury our heads in the sand as we can not bear to watch. Remember, if trading the financial markets was easy, everyone would be home building wealth and nobody would be working.

In this article we will show a series of charts that may help put some perspective on the recent price action in silver and gold.

The following is the three year weekly chart of silver ending June 26, 2007 :

( Chart courtesy of StockCharts.com )

Does this next chart look familiar? (Please carefully compare the two charts)

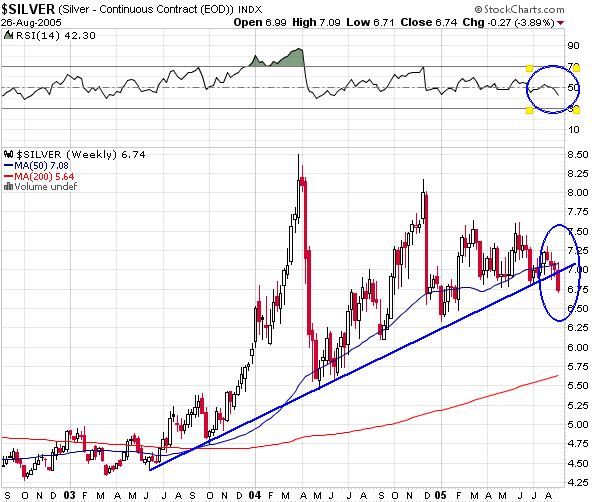

Below is a three year chart of the weekly price of silver ending August 26, 2005 .

( Chart courtesy of StockCharts.com )

You will notice the following similarities in both charts above:

• A major price advance, correction and consolidation climbing on a strong trend line (blue line).

• After many months of consolidation, an aggressive price drop (blue oval) below the blue uptrend line.

• The RSI (top blue circle) breaking below 50.

Please note what happened to the price of silver by April 20, 2006 in the following chart:

( Chart courtesy of StockCharts.com )

Above is a three year chart of the weekly price of silver ending April 20, 2006 .

In the above chart you will notice:

• The dramatic short term correction in August 2005 outlined by the blue oval.

• After a few more weeks of sideways trading action a major price advance followed (outlined in blue box).

The above similarities between August 2005 and June 2007 are remarkable but it does not necessarily mean the same result will transpire. However, this observation does help put into perspective the potential deception of short term market movements. The shocking one day drop in the price of silver and gold on June 26, 2007 may not be as abnormal as it first appears. Following short term trends sometimes results in investors forgetting the bigger, more important picture.

In the big picture, does gold still appear to be in a long term trend? Does Silver still appear to be in a long term trend? Are precious metals over valued relative to other investments? Do we see a massive surplus of silver, base metals, and other commodities inventories? In the big picture could this possibly be a relatively low risk buy point?

We certainly do not mean to imply that we know for certain exactly what will transpire in precious metals in the coming days or weeks. Short term movements are very difficult to predict. We are in a seasonally weak time for precious metals and the price of bullion as well as mining shares could easily head lower. Caution is warranted but when we keep these short term movements in perspective it is easier to keep our emotions and trading decisions under control. We do not plan to sell what we believe are our undervalued positions but instead we will be looking for buying opportunities in precious metals investments. If we are lucky we may even be able to buy at lower prices.

If you found this article useful please watch for our soon to be released “When Is It Time To Worry?” article on this website. You may also subscribe to our free newsletter at www.investmentscore.com . Finally, stop by and check out our unique custom timing charts and investing system when visiting www.invesmentscore.com .

By Michael Kilback

Investmentscore.com

Investmentscore.com is the home of the Investment Scoring & Timing Newsletter. Through our custom built, Scoring and Timing Charts , we offer a one of a kind perspective on the markets.

Our newsletter service was founded on revolutionary insight yet simple principles. Our contrarian views help us remain focused on locating undervalued assets based on major macro market moves. Instead of comparing a single market to a continuously moving currency, we directly compare multiple major markets to one another. We expect this direct market to market comparison will help us locate the beginning and end of major bull markets and thereby capitalize on the largest, most profitable trades. We pride ourselves on cutting through the "noise" of popular opinion, media hype, investing myths, standard over used analysis tools and other distractions and try to offer a unique, clear perspective for investing.

Disclaimer: No content provided as part of the Investment Score Inc. information constitutes a recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. None of the information providers, including the staff of Investment Score Inc. or their affiliates will advise you personally concerning the nature, potential, value or suitability or any particular security, portfolio of securities, transaction, investment strategy or other matter. Investment Score Inc. its officers, directors, employees, affiliates, suppliers, advertisers and agents may or may not own precious metals investments at any given time. To the extent any of the content published as part of the Investment Score Inc. information may be deemed to be investment advice, such information is impersonal and not tailored to the investment needs of any specific person. Investment Score Inc. does not claim any of the information provided is complete, absolute and/or exact. Investment Score Inc. its officers, directors, employees, affiliates, suppliers, advertisers and agents are not qualified investment advisers. It is recommended investors conduct their own due diligence on any investment including seeking professional advice from a certified investment adviser before entering into any transaction. The performance data is supplied by sources believed to be reliable, that the calculations herein are made using such data, and that such calculations are not guaranteed by these sources, the information providers, or any other person or entity, and may not be complete. From time to time, reference may be made in our information materials to prior articles and opinions we have provided. These references may be selective, may reference only a portion of an article or recommendation, and are likely not to be current. As markets change continuously, previously provided information and data may not be current and should not be relied upon.

Investmentscore.com Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.