2010 The Year of Debt Deleveraging

Economics / Global Debt Crisis Dec 19, 2009 - 11:34 AM GMTBy: John_Mauldin

It's All About Deleveraging

It's All About Deleveraging

Commercial Woes

The Lights Of Myanmar

A Lively 2010 and Buying Stocks

This is the season when pundits feel compelled to make annual forecasts. I will make mine, as I traditionally do, in the first letter of January. But already we have seen a wide range of forecasted outcomes. Are we going to grow at 5-6% or at 1-2% or dip back into recession? Why such disparity? I think part of the reason is a basic disagreement on the nature of the just-lapsed recession. Today we explore that issue. Then I point you to a way to help those who are desperately in need and only wish they had our problems. For those interested, I enclose a picture of my new granddaughter.

And finally, I start the process of getting ready, after ten years, to actually buy some stocks. Yes, it is true. Am I throwing in the towel and becoming a bull, or do I just see an opportunity? Stay tuned.

It's All About Deleveraging

I did a very interesting one-hour show this week with Tom Ashbrook on his National Public Radio syndicated radio show called On Point. About 20 minutes into the show, Professor Jeremy Siegel of Wharton came on, and we had a pleasant debate and lively Q and A with listeners. Jeremy of course was the bull, expecting that next year the US will grow by 5-6%. I was the "bear," expecting growth in the 1-2% range. You can listen in at http://www.onpointradio.org/2009/12/an-economic-warning. It's also available as a podcast on iTunes ("On Point with Tom Ashbrook") for a few more days.

I have liked Jeremy the times we have been on the same platform, and we have traded emails over the past few years. He is a consummate gentleman. He is also the author of Stocks for the Long Run. His thesis is buy and hold. Long-time readers know that I find such thinking to be wrong, if not dangerous. I believe that stocks go in long cycles (an average of 17 years) based on valuations, and that we are still in a long-term secular bear phase. I want to see valuations come way down before I suggest that the index-investing waters are once again safe. That day will come. Just not for a while.

In the meantime, Jeremy has given us the reason for his very bullish call. Paraphrasing, he said, "Look at past recoveries from recessions. They were always strong in the first year. Suggesting 5-6% is not all that aggressive."

And I would agree with him - if the past recession was a typical recession. But we have just gone through a recession that was unlike any other we have experienced since the Great Depression. Typical recessions are inventory-adjustment recessions, caused by businesses getting too optimistic about sales and then having to adjust. You get temporarily higher levels of unemployment as inventories drop, and then you get the rebound. It is not quite as simple as that, but close enough for this letter's purpose.

This recession was caused not by too much inventory but by too much credit and leverage in the system. And now we are in the process of deleveraging. It is a process that is nowhere near complete. While the crisis stage is over (at least for now), there is still a lot of debt to be retired on the consumer side of the equation, and a lot of debt to be written off on the financial-system side. And this is true in Europe as well, and maybe more so; but today we will look at some data in the US.

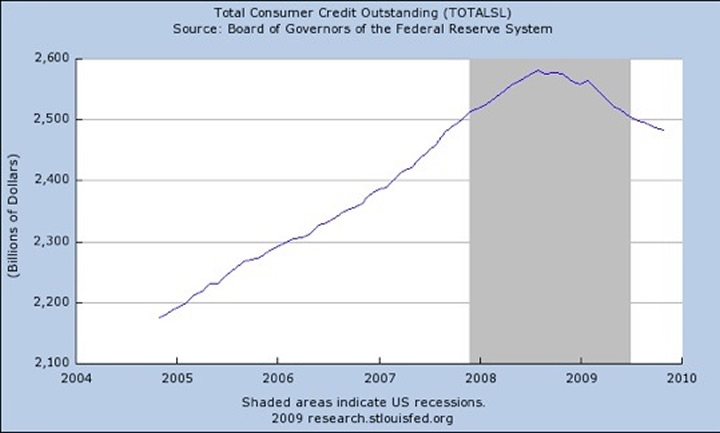

Total consumer debt is shrinking for the first time on 60 years. And the decline shows no sign of abating.

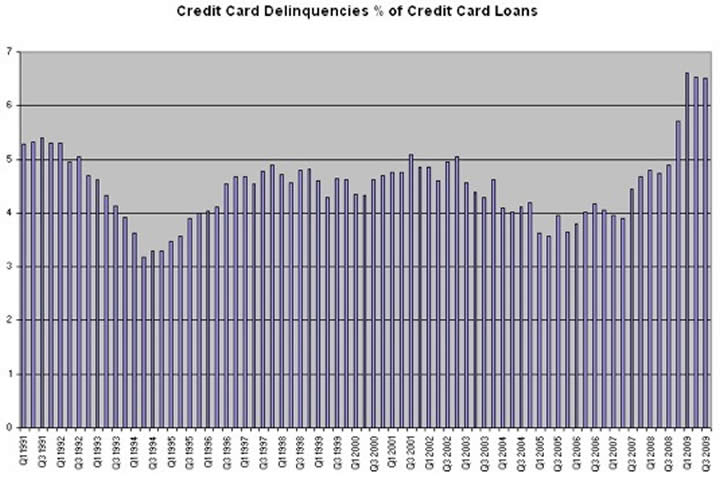

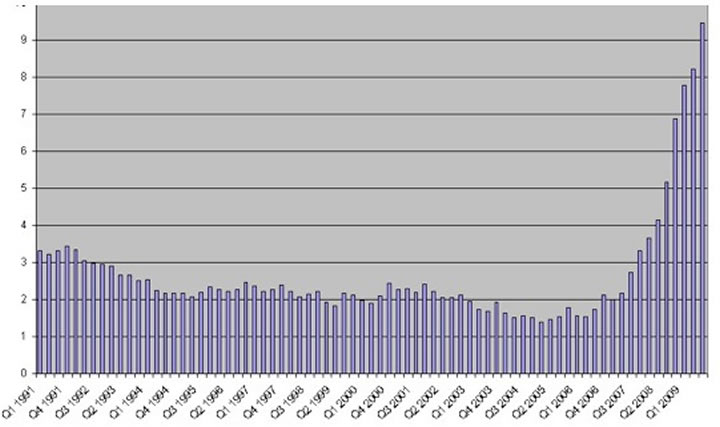

Credit card companies have reduced available credit by $1.6 trillion dollars. And for good reason. My friend and London partner Niels Jensen sent me the following charts from UrbanDigs.com. Credit card delinquencies are hovering near all-time highs. Bank charge-offs for credit cards are going to rise as the unemployment numbers get worse:

And the strain is also in the housing sector. Residential delinquencies are up 1.2% just in the last quarter, and now stand at a stunning 9%. (For whatever reason the heading did not copy, but this is residential delinquencies.)

Frank Veneroso noticed something unusual in the latest Federal Reserve Flow of Funds report. They changed their methodology for analyzing housing prices to a model more like the Case-Shiller index, which most believe to be more accurate. That meant they deducted another $2 trillion from household net worth than in the previous quarter. They just caught up with reality, so no big news there. But there is some big news if you look closely.

About one-third of the homes in the US have no mortgages. Typically, these are nicer homes, as the "rich" have paid off their homes. So you can estimate that to be somewhere between 35-40% of the total value of US homes. Writes Frank:

"So now the flow of funds accounts tell us that the total value of residential real estate is $16.53 trillion. The share owned by households with a mortgage is probably $10 trillion to $11 trillion. Total mortgage household debt now stands at $10.3 trillion. In effect, for all households with a mortgage taken in the aggregate, their loan-to-value ratio is now close to 100% and perhaps close to half of them have a zero to negative equity."

The biggest single factor in foreclosures is negative equity coupled with unemployment. That makes sense, because if you could sell your house and get some equity, you would.

As I have written in past letters, we are going to see a significant increase in mortgage resets in 2010, which will result in even more foreclosures. There is a lot more pain to come. This is not an environment that is typical of past recessions. There is a lot of deleveraging to be done, both as banks write off bad debts on homes and as consumers walk away from mortgages badly underwater.

Commercial Woes

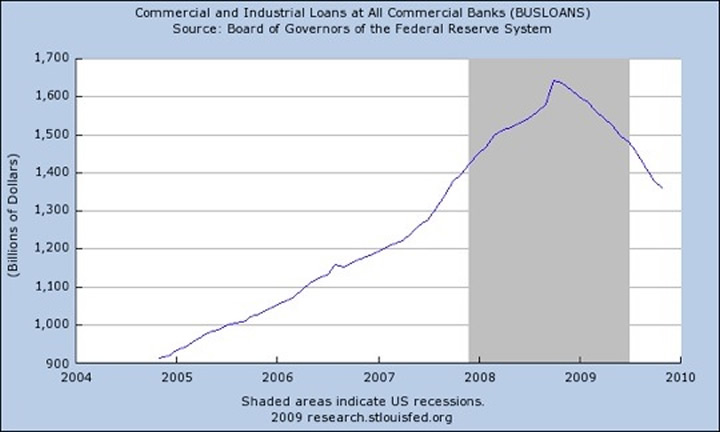

The coming debacle in commercial real estate loans is well-documented. Total loan delinquencies at banks are rising precipitously every month, just as total loans to commercial and industrial customers are falling at an unprecedented rate, over 17% in less than two years!

While Obama is urging banks to lend, bank regulators are telling banks to raise capital and shore up their balance sheets. One way they do that is to lend less to consumers and businesses and invest in US government bonds.

Given the high rate of delinquencies and charge-offs of all sorts of debt, it is unlikely that we are going to see growth in loans in 2010. Further, the surveys I read suggest that consumers are working hard to reduce their debt. The New Frugal is part of the New Normal.

Past post-recession expansions have been built on growing credit and leverage. That will not be the case this time. We are going to see reduced lending and borrowing. Even though the federal government is running massive deficits, the stimulus portion of the debt will be running down in the latter half of 2010. There will be little political will to continue with massive stimulus and deficits. While this is good in the long run, in the short run it will reduce GDP.

All of this suggest to me that while there will be growth in 2010, it will be tepid by past post-recession standards. And with that thought, I will end my 2009 writing about the economy. When I next write in 2010, we will look at what the year may bring us. But right now, let me once again highlight my friends Ed Artis and Walt Ratterman, two intrepid knights who literally risk their lives to help others. As you are contemplating your own personal situation, think about these guys who are saving lives at great personal risk. First let's look in on Ed, who has moved his base to the Philippines.

Long-time readers are familiar with Ed Artis and Knightsbridge. They walked into jungles in Rwanda to rescue nuns at the height of the craziness there. They took food into Afghanistan months before our soldiers were there. Sri Lanka? They took drugs into Tamil Tiger territory after the tsunami, when no other aid agency would go. They went to Burma (and figured out how to get in with relief supplies after the last typhoon, when other agencies couldn't). Ed is one of the really good (if somewhat crazy) guys. He and his friends like to get an adrenalin rush as they do their good deeds, which generally means going places where others will not. Thankfully, they keep coming back.

They take no salaries. They pay their own way. And there are people all over the world who are alive today because of their work. I am totally behind their work.

Now, let me give you an update on some of their various humanitarian and medical relief missions, which I have been sharing with you for many years now.

Since September they have been able to solicit and deliver more than three million dollars worth of food, clothing, shelter, medical supplies, and equipment to many devastated areas in the Philippines.

So far they have solicited, shipped, and delivered five 40' cargo containers in partnership with various other international and local NGOs, which contained more than 600,000 individual meals, and enough equipment and supplies to re-outfit four emergency rooms with enough basic equipment to function again after having been totally destroyed by the floods and mudslides that hit in September and October.

BUT...

They still have three 40' cargo containers committed and ready to ship and still need funding for the costs of shipping, at approximately $18,500.00 each. The containers hold a total value in excess of $ 850,000.00 in supplies and equipment, PLUS they now have an incredible opportunity to obtain nearly 2.5 million dollars in urgently needed medicines, which will have at least two years of life left upon arrival in the Philippines, for only $ 50,000, which includes the costs of shipping from Europe. This is a HUGE deal and can no doubt save many lives in the post-typhoon Philippines, where they are still digging out from the series of killer storms that hit in September and October and even as late as November, and where medicines are still in very short supply.

And you can bet that they are keeping an eye on the volcano that appears ready to blow there, too. If there is a need, Ed will find a way to help. You can make donations either by sending your checks made out to "Steps for Recovery" but clearly marked "FOR KNIGHTSBRIDGE" to:

Steps For Recovery P.O. Box 67522 Century City, CA 90067 (A California 501(c)3, federal ID # 95.4472343)

or

You can make immediate online donations via PayPal by going to their website, located at www.kbi.org and hitting the "Donate" icon near the bottom of the page.

You can also find out more about their some of their recent projects by visiting their "Current Missions Blog" at http://currentmissions.blogspot.com/

Knightsbridge has changed their address to PO Box 4339, West Hills, CA 91308-4339.

The Lights Of Myanmar

I introduced Walt Ratterman to Ed Artis several years ago. Walt had got the "bug" of international relief. A successful entrepreneur and one of the world's true experts on solar power, Walt shifted his focus to helping develop solar power in remote locations. While he has been in some very rough places, the hardest and most dangerous is Myanmar. He has helped provide solar power for clinics for the Karin tribe, who are targeted for systematic "ethnic cleansing" by the military junta there.

Walt does not sit back and send his equipment. They pack it in on their backs over serious mountains to remote villages. If he gets caught, there will be no consulate to help him. It is very dangerous. Why does he do it?

"John, when you see a doctor doing a leg amputation on a small child, holding a flashlight in his mouth (because of land mines), the need for power becomes quite clear."

My readers have been very generous the last few years, and there are now clinics all over Burma where the power is on and lives are saved. Let me share with you a letter Walt wrote to me last week:

"Dear John,

"Thanks in large part to donations from your generous readership, we have completed another successful project in the oppressed area of Eastern Burma, along the Thai border. As you know, even though there is far too little worldwide recognition of this, the junta in Burma has been executing a systematic policy of human rights abuse, oppression, and ethnic cleansing in the outlying areas of their country. Largely with your help, we have been doing our small part to help the people in this area by providing electrical energy to their clinics and the hospitals in the Internally Displaced Persons camps within the country.

"In 2008, we were able to provide energy services for a center that trains backpack medics in the jungles of Burma. This was done in conjunction with the Free Burma Rangers. (www.freeburmarangers.org) This year our project included the provision of energy services for two more clinics, and an exciting new project - the provision of energy for a computer training center. Please visit this link to view a thank-you video from Free Burma Rangers to all those who have helped bring power to their facilities: www.sunepi.org/SunEPI/FBR_Thankyou.html [John here - this is a moving YouTube video!]

"The people in this area recognize that despite the continuous oppression and abuse, in order to equip their youth with the skills necessary to help their people, they need to have the educational advantages that come with a computer training center. We provided energy systems to equip the very first such center in the Karen State of Eastern Burma. The energy will support the continuous use of 12 computers that will be used to train upper-level students in a variety of skills that are needed in this area.

"This is no easy task. The equipment was all purchased way in advance and required almost 100 porters to carry it all in to the site. Our team moved into the site after all the equipment was delivered, a trip that took 3 days in and 3 days out - mostly on foot over very steep mountains.

"Photos of this year's work that you supported are posted in our photo gallery at www.sunepi.org/SunEPI/Burma.html.

"For our hoped-for projects in 2010, there are numerous candidates that require energy. All are related to health and education. There are many more clinics that have opened up to the north of where we've been working, where the junta's destructive efforts have been accelerated. Additionally, throughout the area, FBR is now working with at least 20 schools that need lighting at night. There is really no limit to the number of systems that are needed. We just do what we can. Since we do this work modularly, we will be do whatever is possible with the funds that are raised. We are hoping to raise between $75,000 and $90,000 this year to be able to complete both clinics and schools next year. For more information regarding funding needs for Burma in 2010: www.sunepi.org/SunEPI/Funding_Burma.html

"For those inclined to lend a hand, we can receive donations by mail, with checks made out to SunEnergy Power International, 11 Laurel Lane South, Washougal, WA 98671. (We will provide a 501-C3 receipt.) We can also accept donations at our website: www.SunEPI.org via PayPal.

"Thanks again for your continued support of our work in this area that is in so much need.

Walt Ratterman"

John here. Please consider making a very generous donation to these guys. Most of us have no idea how hard it is for many in the rest of the world. Your donations means lives saved and transformed. Thanks for being so generous over the years.

A Lively 2010 and Buying Stocks

I own one stock, which was forced on me about ten years ago in a busted trade. I call it my stupid stock. Long story. However, I got lucky, and it was one of the most profitable deals I have ever done. I now have a small portion of the stock left and will sell it over the next few weeks. Since that time I have invested in funds and with various managers (plus private equity and venture capital). But I have not bought individual stocks. That is going to change in 2010.

Just as some people buy a little gold every month, I am going to start buying stocks in a specific sector, with a very long-term view. Early next year, I am going to write about where I think I see this long-term opportunity. You will want to stay tuned.

I am going to take a break for the next two weeks and recharge my batteries, but I'll be ready to go as 2010 comes around. Let me take this opportunity to wish you the very best for the holidays and the New Year. I am so humbled and amazed at my good fortune, and it is because of you, gentle reader, that I am afforded the luxury of getting to explore the world of finance and economics, travel and speak, and just generally have more fun than I have ever had. I love the internet!

It has been very lonely the last week, as Tiffani is of course taking off for a month or so, and my assistants have been out, and so this big old house is empty. But that will change, as Tiffani and Ryan will be back and we will set up a nursery so she can work near Lively, and I will get to see my granddaughter grow up near me. How cool.

All the kids (7) and spouses (4) and grandkids (3) and my brother and sister and mother (92!) and assorted friends will be around for the holidays. I foresee lots of food and fun (and maybe a few great bottles of wine!). And for those who asked, here is a picture of Tiffani and my new granddaughter Lively:

Is that not awesome or what?

Have a fabulous next few weeks. 2010 is going to be a great year.

Your wondering how it can get any better analyst,

By John Mauldin

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/learnmore

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2008 John Mauldin. All Rights Reserved

John Mauldin is president of Millennium Wave Advisors, LLC, a registered investment advisor. All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors before making any investment decisions. Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staff at Millennium Wave Advisors, LLC may or may not have investments in any funds cited above. Mauldin can be reached at 800-829-7273.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.