A Metallurgist's Insights Into the Minneapolis Bridge Disaster

Politics / Social Issues Aug 02, 2007 - 07:44 PM GMTThe incredible collapse of the Minneapolis bridge will send a message to the nation that has been repeatedly sent for decades, but that our political system has refused to effectively respond to. America's physical, engineered infrastructure has been in desperate need for massive spending to repair and replace, but the multi-trillion-dollar cost has been rejected by local, state and federal politicians.

Many academic and professional groups have for many years produced countless reports on mounting unpaid public costs for updating our crucial physical infrastructure, including bridges, but going way beyond those to, for example, roads, water and sewer systems, tunnels and much more. Make no mistake: The deeply researched and totally supported case for a massive national infrastructure spending program could not have been clearer. But spending on infrastructure is not sexy and politicians at ALL levels of government have found countless excuses for not facing the totality of the problem. Instead, public spending is dribbled out, dealing with the most urgent problems or, worse yet, the ones that are the most visible to the public. But unaddressed are massive numbers of problems, such as the Minneapolis bridge and thousands more bridges, that our bureaucratic system has learned to game, postpone, rationalize and, therefore, put the public safety at considerable risk.

As a metallurgist I can pretty much assure you that if there is a technically honest and complete investigation, the ultimate explanation of the Minneapolis bridge failure will be related to fatigue cracking in the metal structure. Already, news reports have revealed some prior observation of a fatigue problem with the bridge and that the bridge had a relatively low rating of four out of a possible nine, showing that it was structurally deficient. The game played by virtually all government agencies is to find excuses for delaying the most costly repair or replacement of bridges and other parts of our physical infrastructure. As just another example, in most older urban areas there are constant repairs of busted underground water pipes. What is really needed, but avoided, is a total replacement of very old underground pipe systems – in many places 100 or more years old!

Government inspection programs have been terribly compromised over many years. The incredible political pressures to minimize spending on infrastructure have filtered down to the people, procedures and technologies used to examine bridges and other things. When it comes to bridges it is also important to admit that many aspects of our automobile addiction have raised risks, including enormously greater numbers of vehicles creating heavy traffic during much of the day in urban regions. Add to this the massive increase in vehicle weight resulting from the incredible increase in monster SUVs, as well as huge increases in large truck traffic.

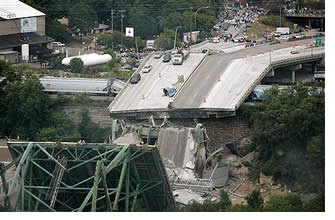

The Minneapolis bridge collapse happened during evening rush hour because that was a period of maximum stress, and that would be the trigger for expanding existing fatigue cracks. Once fatigue cracks get to critical sizes they grow and propagate very rapidly, producing powerful loads and stresses on remaining steel components and creating what appears to be a virtually instantaneous bridge collapse.

The remaining public policy question is clear: Will the nation spend what is necessary? Seven other major bridge collapses in the last 40 years have not done the trick. Inadequate bridge inspection has been a frequent documented problem, as well as some design defects. Many people have already died from bridge failures. But still the nation's elected officials have not bitten the bullet and agreed to spend trillions of dollars over several decades to bring America's physical infrastructure up to the most modern standards.

Think about all this the next time you go over a bridge.

By Joel S. Hirschhorn

http://www.delusionaldemocracy.com/

Joel S. Hirschhorn has been widely published; his previous book is Sprawl Kills - How Blandburbs Steal Your Time, Health and Money - see www.sprawlkills.com . He has published many articles and oped pieces in major newspapers (Washington Post, New York Times, Baltimore Sun, Chicago Tribune) and on progressive web sites such as CommonDreams, The Progress Report, SmirkingChimp and Opednews; Google Joel S. Hirschhorn to see his writings and achievements and see link below. Before becoming a writer and consultant, he was a senior staffer for the U.S. Congress (Office of Technology Assessment), Director of Environment, Energy and Natural Resources at the National Governors Association, a full professor at the University of Wisconsin, Madison, and head of an environmental consulting company.

Joel S. Hirschhorn Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.