Gold and Silver The Only Game in Town 2010-2011

Commodities / Gold and Silver 2010 May 12, 2010 - 08:09 AM GMTBy: Jordan_Roy_Byrne

There are numerous reasons both fundamental and technical as to why the precious metals complex will surge over the next 18 months. The sector’s surge will be reinforced by the lack of an obvious trend in most other markets. Gold, Silver and the mining stocks will surge while other markets languish.

There are numerous reasons both fundamental and technical as to why the precious metals complex will surge over the next 18 months. The sector’s surge will be reinforced by the lack of an obvious trend in most other markets. Gold, Silver and the mining stocks will surge while other markets languish.

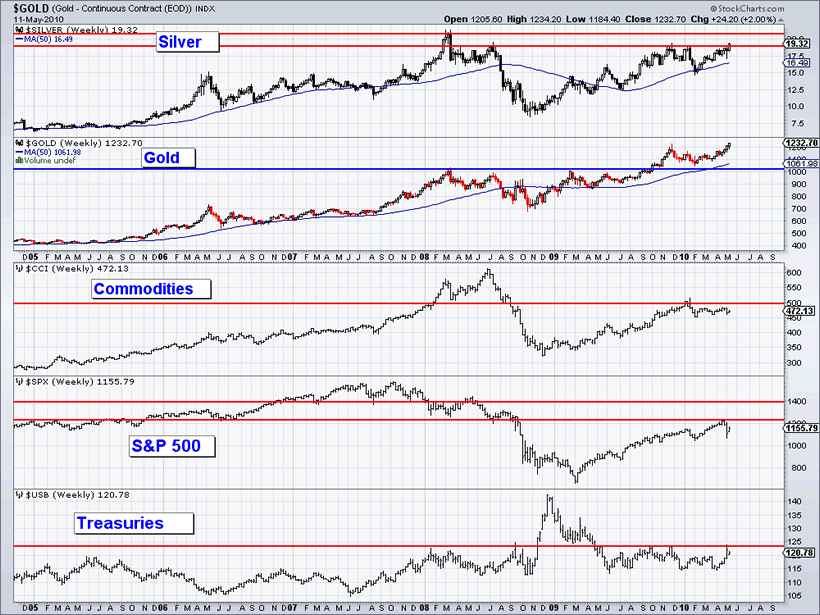

First let us look at a chart of Gold and Silver along with the major asset classes. Before I analyze it, what do you notice?

We see that the other asset classes (Commodities, Stocks, Gov Bonds) have run into significant resistance. The CCI index (and I prefer to use this instead of the CRB) has major resistance at 500, which is about 20% below the all time high. The S&P 500 has heavy resistance at 1250 to 1400, a zone that lies below the all-time high. Meanwhile, Treasuries are encountering heavy resistance. Even if US T-Bonds break to the upside, its hard to see them continuing that much higher.

Meanwhile, Gold has broken out to a new high and has no major resistance in its way until $2100. Silver will soon test resistance at $21 (which dates back to 1980) for the fifth time in the last several years. It should breakout by the end of the third quarter.

The charts show that Gold and Silver are in position for significant moves. Momentum is already building and overhead resistance is slim to none. Meanwhile, the other asset classes still have tons of supply to work through before they can reach their old highs. In other words, don’t expect to see them gain much anytime soon. Furthermore, as Gold and Silver continue to head higher, more and more will dump their conventional investments in favor of the precious metals. This will reinforce the distinction that is starting to develop.

Fundamentally, it is not hard to see why these markets will play out as we expect. There is an important difference between reflation and hyperinflation and this is what is driving Gold and Silver. Printing money in order to prevent interest rates from rising because your debt load is already too great is a precursor to hyperinflation. Severe inflation never occurs when there is economic demand. If the banks were lending and velocity of money was rising, then we’d have reflation.

Unlike 30 years ago, policy makers cannot pop inflation with high interest rates. Higher rates will only hasten sovereign bankruptcy. At this point, the only answer is currency reform and we all know that is not coming until fiat currencies are thoroughly debased. Amazingly, there is still a lot of debasement ahead of us and huge gains ahead of us in the precious metals complex. I am going to repost something I wrote in a previous commentary.

Note that Gold rose about six-fold the first eight years into the 1970s bull market (it began in 1970). Ultimately it rose 25-fold. The Nasdaq from 1982 to 1992 advanced about four fold. Ultimately it rose over 30-fold. The Nikkei advanced less than three fold from 1970 to 1978. From 1970 to 1990 it gained 19-fold.

Gold is nine years into its bull market and has advanced about five fold. Silver has advanced less than five fold in the past nine years. The Dow Jones Precious Metals Index of large-cap gold stocks has advanced only four fold. See a pattern here?

While one protects their self and family with physical they can prosper through the coming bubble and mania in the mining stocks. In that area we offer professional research, analysis and guidance in our premium service.

Good luck ahead!

Jordan Roy-Byrne, CMT

http://www.trendsman.com

http://www.thedailygold.com

trendsmanresearch@gmail.com

Trendsman” is an affiliate member of the Market Technicians Association (MTA) and is enrolled in their CMT Program, which certifies professionals in the field of technical analysis. He will be taking the final exam in Spring 07. Trendsman focuses on technical analysis but analyzes fundamentals and investor psychology in tandem with the charts. He credits his success to an immense love of the markets and an insatiable thirst for knowledge and profits.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.