Gold and Dollar Rise as Euro and Equities Under Pressure Again

Commodities / Gold and Silver 2010 May 24, 2010 - 06:36 AM GMTBy: GoldCore

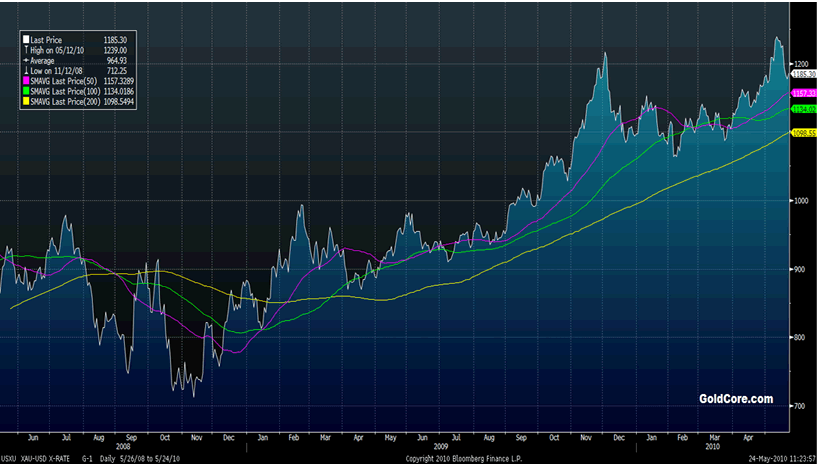

Gold fell 1% on Friday to finish the week with a 4% loss. It rose from $1,179/oz to $1,191/oz in Asian and early European trading this morning before giving up some of those gains. Gold is currently trading at $1,186/oz and in euro and GBP terms, at €955/oz and £822/oz respectively. While gold was down by 4% against the dollar it was down by less against most other currencies and was down by less than most equity indices with the S&P 500 down 4.3% and the Nasdaq down 5%.

Gold fell 1% on Friday to finish the week with a 4% loss. It rose from $1,179/oz to $1,191/oz in Asian and early European trading this morning before giving up some of those gains. Gold is currently trading at $1,186/oz and in euro and GBP terms, at €955/oz and £822/oz respectively. While gold was down by 4% against the dollar it was down by less against most other currencies and was down by less than most equity indices with the S&P 500 down 4.3% and the Nasdaq down 5%.

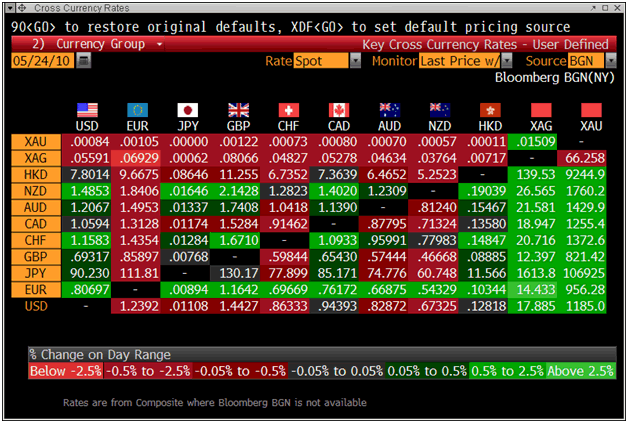

The euro has fallen against all currencies this morning and this has seen gold and the dollar get a safe haven bid (see Cross Currency Chart). However, with the dollar being the currency of the largest debtor nation in the world, the dollar's safe haven status may be questioned in the coming months.

Gold fell 5 days in a row and the recent correction is again being used by investors to buy on the tip. Gold's decline was due primarily to profit taking and liquidation due to a tentative stabilisation in the eurozone debt crisis. However, the eurozone sovereign debt crisis and the risks to the euro itself remain and will remain for the foreseeable future which will see gold stay an important diversification.

There is not much in the way of financial or economic data today but traders await the US new home sales figure this afternoon which is expected to show an improvement for a second consecutive month. Should the data be worse than expected - we could see increased risk aversion - especially due to the surprisingly poor economic data of last week.

Gold may be receiving a bid due to the increased geopolitical tension between North Korea and South Korea. South Korea is taking punitive measures against North Korea, after their warship was torpedoed, including trade restrictions and seeking UN action against Kim Jong-il's repressive regime. President Obama has directed the US military to coordinate with South Korea to "ensure readiness" and deter future aggression from North Korea, the White House said today.

Silver

Silver rose from $17.60/oz to $18.03/oz this morning in Asia and Europe. Silver is currently trading at $17.91/oz, €14.40/oz and £12.41/oz.

Platinum Group Metals

Platinum is trading at $1,530/oz and palladium is currently trading at $450/oz. Rhodium is at $2,675/oz.

News

Investor Dennis Gartman, publisher of the widely followed Gartman Letter, said he now favors buying gold in British pound and euro terms again. He had exited from positions and moved to the sidelines earlier in the week, although emphasising at the time he remained longer-term bullish in gold in non-dollar terms (Wall Street Journal).

China is tapping its deep well of foreign reserves for overseas resource loans, benefiting banks through a major policy shift . The State Administration of Foreign Exchange (SAFE) is leading a policy adjustment that taps China's huge stash of foreign reserves for overseas loans through commercial banks. Under an evolving reform project launched in recent months, SAFE has taken initial steps toward giving policy and commercial banks authority to handle loans for intergovernmental cooperation projects. Major loan-for-oil swaps signed in recent months by China and several other countries marked a coming-out for the new policy. The adjustments are designed to help China diversify its foreign currency assets and provide a channel for some of the US$ 2.4 trillion in reserves held by the central bank (Caixin).

Venezuelan President Hugo Chavez says China plans to help with mining projects in the South American country. The president says Beijing has shown interest in Venezuela's deposits of coltan, a mineral used to make cellular phones and other electronics. He says he gave China a sample for analysis, and now the Asian nation hopes to "help Venezuela exploit the coltan mines." Chavez notes the mineral is also valuable for the space industry and for making missiles. He said during his Sunday broadcast that a visiting team of Chinese experts has also been examining large deposits of iron and gold (Bloomberg).

Speculators are buying gold faster than the world's biggest producers can mine it as analysts forecast a 26 percent rally that may extend the longest run of annual gains since at least 1920. Exchange-traded products backed by bullion added 42.5 metric tons in the week to May 14, the most in 14 months, data from UBS AG show. China, Australia and the 16 other largest mining nations averaged weekly output of 42.3 tons last year, researcher GFMS Ltd. estimates. Even though prices have fallen 4.8 percent to $1,189.75 from a record $1,249.40 an ounce May 14, the median in a Bloomberg survey of 23 traders, analysts and investors shows it will reach $1,500 by the end of the year (Bloomberg).

Those who are looking for a dependable investment in the wake of the worldwide economic crisis may be wise to turn to gold, it has been suggested. Jim Cramer, host of CNBC's Mad Money, says that putting money into the precious metal offers investors the best chance to make money, while protecting against inflation and chaos in the financial markets, Benzinga reports. According to the expert, gold is also a remedy which can counteract or neutralise the risk of deflation, while being dependable in terms of the fact that the yellow metal rises in value as worldwide currencies fall. Mr Cramer adds that because gold is becoming an increasingly scarce resource, it is rising in value. "We just can't find it like we used to," he states. Worldwide currency concerns are leading investors to gold as they lose confidence in the ability of governments to control their economies (World Gold Council).

Thomas Kaplan, the chairman and chief investment officer of Tigris Financial Group, fears excessive government spending has failed to stop contagion in the world financial system, and that the downturn is likely to get worse before it gets any better. In light of the situation, gold is his favorite investment...by far. Few individuals stand to benefit as much as low-profile billionaire Thomas Kaplan from rising gold prices. The New York-born commodities magnate who earned a doctorate in British colonial history at Oxford, Mr. Kaplan oversees an empire devoted largely to gold. Many fund managers and high-rollers have allocated small percentages of their portfolios to gold as a hedge against inflation. But Mr. Kaplan is the bull of bullion. He has gone further than perhaps any other major investor, betting the majority of his $2 billion portfolio on gold (Wall Street Journal).

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.