Momentous Week for Gold, Did anybody miss the boat?

Commodities / Gold and Silver 2010 Nov 09, 2010 - 07:49 AM GMTBy: Miles_Banner

Last week saw a momentous week for gold. The much touted second round of quantitative easing (QE2) from the US Feds sent stock indices and precious metals higher.

Just a few hours before the FOMC released their statement on Wednesday the gold price was briefly sold off. Then straight after the announcement the gold price took another sharp fall breaking through $1,330 per ounce (troy). From there it gradually regained strength and carried on through Thursday and Friday, ignoring the good US jobs data to reach a new all time high of $1,398.

In Monday’s trading the gold price smashed through $1,400 an ounce.

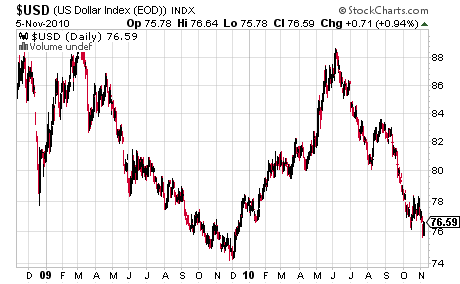

Is the dollar doomed?

The US dollar has slid into dangerously oversold territory once again, but this time there’s no reprieve in sight. So far this year gold has gained over 27.5 percent in dollar terms.

The Financial Times quoted Citigroup’s head of FX strategy, Steven Englander, as he highlighted the problems now facing the dollar…

“We think that reserve managers will contribute to the next stage of dollar weakness as QE2 confirms their worst fears about the Fed’s intentions and the quality of their reserves portfolios.”

“The Fed’s QE2 announcement, whilst not a shock, just serves to remind reserve managers that they will have even more dollars in their portfolio if they do not move aggressively.”

“The historical record suggests that under these circumstances they are very likely to become dollar sellers in coming weeks.”

What will benefit from QE2

As the dollar slides and inflation rises common inflation hedges could see a boost. Rare commodities and precious metals are at the front of inflation hedging methods… The gold price is once again being fuelled from excessive dollars.

In the currencies markets the Euro is also experiencing another bout of weakness as peripheral countries fail to inspire any confidence. But it should come as no surprise that the Chinese are buying up Portuguese debt. The dollar has been seriously undermined by the recent wave of Fed bond purchases. Diversification is the next phase.

David Hale of David Hale Economics in the Financial Times writes…

“The recent gold price rally is the first stage of a multi-year bull market that will drive the gold price to at least $2,000 an ounce by 2015… Potentially the most important new factor in the gold market is China. China now has more than $2,400bn of foreign exchange reserves, but only 1.7 per cent of this is invested in gold. … Some Chinese officials have publicly called for the central bank to purchase 10,000 tonnes of gold. … There is no way to predict the timing of China’s future gold purchases, but there can be little doubt they will create a demand for gold that will dwarf all other factors during the next quarter-century and guarantee large price gains irrespective of what happens to Federal Reserve policy.”

By Miles Banner

Gold Price Today

We leave you this week with a fascinating article forwarded to us by one of our readers, James. It’s a Bloomberg story that reveals the insatiable appetite for gold amongst central banks – Central Bank Gold Holdings Expand at Fastest Pace Since 1964

© 2010 Copyright Gold Price Today - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.