Rhodium Commodity Trading Thoughts

Commodities / Rhodium Dec 26, 2010 - 05:05 AM GMTBy: Ned_W_Schmidt

RHODIUM TRADING THOUGHTS is about timely and profitable trading of precious metals. We do not believe every turn in the market can be called. Our goal is that our recommendations should be profitable. Profits are the goals, not trades. Do not expect all recommendations to be profitable. No system can achieve that lofty goal. Our goal is simply to state whether conditions for a metal are favorable or not. Buy signals are issued when appropriate. These signals are generally speaking for day they are issued. If price remains below signal price, buying can be done.

RHODIUM TRADING THOUGHTS is about timely and profitable trading of precious metals. We do not believe every turn in the market can be called. Our goal is that our recommendations should be profitable. Profits are the goals, not trades. Do not expect all recommendations to be profitable. No system can achieve that lofty goal. Our goal is simply to state whether conditions for a metal are favorable or not. Buy signals are issued when appropriate. These signals are generally speaking for day they are issued. If price remains below signal price, buying can be done.

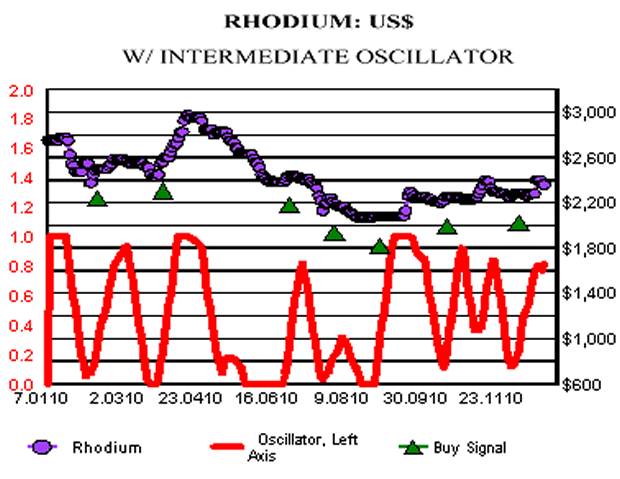

Do Not Buy signals are given when market is over bought, and buying is unwise. Blue triangles indicate an over bought condition. These would not be good times to buy, so they are labeled Do Not Buy. Software is not showing complete legend, for some reason.

Rhodium is not one of the topics sexy enough to hear much about. For one, not a lot of it exists. Another reason is that with Silver in a speculative burst writing about that is more fun for journalists. That said, we do now seem to read comments more often on Rh. That occurrence has gone from none to some, a large percentage increase.

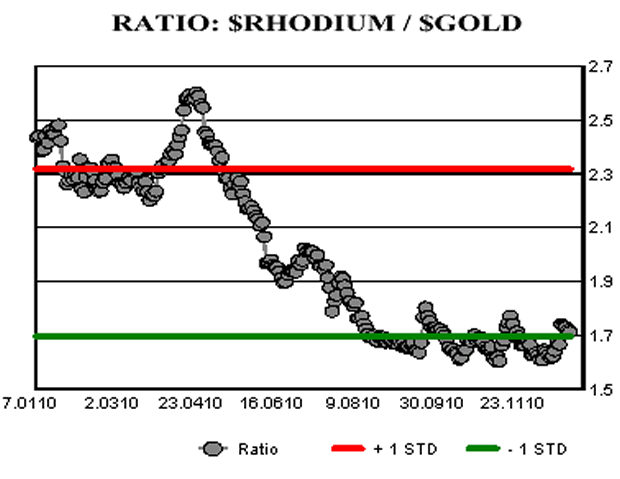

In top chart is plotted the ratio of $Rh / $Gold. When that ratio is declining, $Gold is performing better. When it is moving sideways the metals are performing together. That condition has persisted since late Summer. A move upward, meaning Rh is stronger than Au, in this ratio above the range in which it has been moving would suggest that the absolute price of $Rh is about to move upward. Does not guarantee it, but does suggest it.

In the bottom chart, the stochastic gave another buy signal about a week ago. We now have in place two higher lows. Should Rh move above US$2,400 we would have a second higher high. All of this, combined with more confidence in economic growth, suggests that Rh should move higher.

OPINION:

Given the continued under valuation of Rh in both absolute terms and relative to $Gold, investors should be considering adding Rh to their metals' portfolio. Economic growth in China and India is supportive of Rh as it will be used in those millions of catalytic converters to be used in those nations, for example. Additionally, Rh does not correlate well with Au, which should reduce the volatility in the value of your portfolio. Low correlation means they do not go up and down together.

Ned W Schmidt CFA, CEBS

To subscribe to The Value View Gold Report use this link: www.valueviewgoldreport.com

RHODIUM TRADING THOUGHTS is published presently on an irregular basis, and is available only at our web site: www.valueviewgoldreport.com

To receive THE VALUE VIEW GOLD REPORT click on a link at bottom of one of pages, or send check(US$149) or credit card information to: Schmidt Management Company, 13364 Beach Blvd. Suite 812, Jacksonville FL 32224. Fax orders can be sent to 215-243-7161. Our phone number to place an order is 352-409-1785. Subscriptions cannot be cancelled or refunded.

Copyright © 2010 Ned W. Schmidt - All Rights Reserved

Ned W Schmidt Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.