The Best Time in History to Buy a House

Housing-Market / US Housing Jan 28, 2011 - 10:32 AM GMTBy: DailyWealth

Dr. Steve Sjuggerud writes: Right now, is the best time in history to buy a house in America.

Dr. Steve Sjuggerud writes: Right now, is the best time in history to buy a house in America.

Today, I'll show you why… based on a few cold, hard facts.

First off, mortgage rates are lower than they've ever been in American history…

Most investors have only seen a couple decades of mortgages rates on a chart. But my friends at Global Financial Data have databases – including real estate data – that literally go back centuries.

I had dinner with the Global Financial Data team over the weekend. And they told me about their "Winans International" real estate indexes, with housing prices back to the 1800s and mortgage rates going back over a century. I had to share it with you…

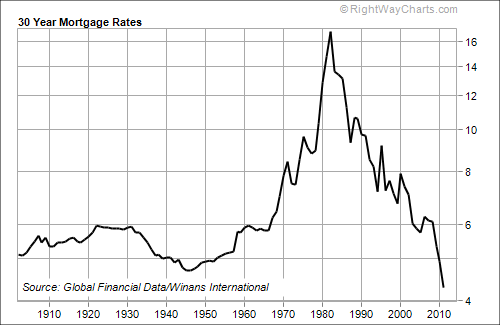

Take a look at this chart of mortgage interest rates since 1900:

As you can see, current mortgage rates are the lowest in U.S. history.

When were mortgage rates even close to this low in the past? Just after World War II…

And what happened, just after World War II, when mortgage rates were this low? The greatest postwar boom in housing prices – by far.

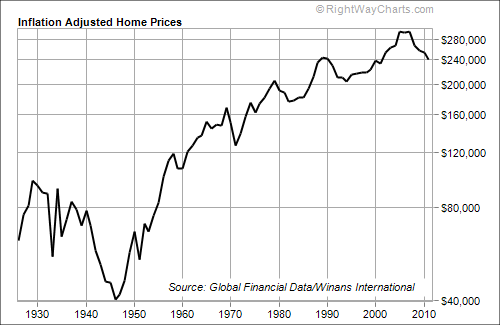

Take a look. Mortgage rates bottomed in the mid-1950s, and house prices bottomed about the same time. Then the greatest boom in home prices in our lifetimes started.

Today we have record-low mortgage rates. And we have another thing in our favor…

Homes are more affordable than ever.

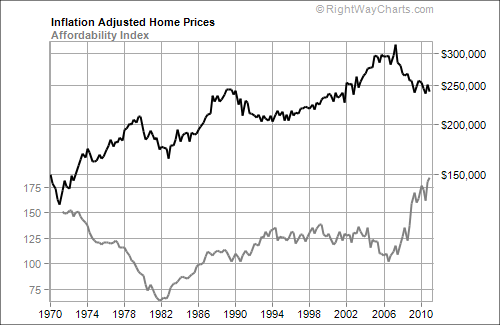

Based on the 40-year history of the Housing Affordability Index… houses are more affordable than they've ever been. Take a look…

"Affordability" takes three factors into account: home prices, your income, and mortgage rates.

Home prices have crashed. And mortgage rates are at record lows. But incomes (nationwide) haven't fallen nearly as much… So homes are now more affordable than ever.

"Most people" out there will only tell you the bad news about housing… That's the way it goes in a bear market. People drive looking in the rearview mirror.

Meanwhile, we have some darn compelling facts out there…

Home prices have fallen by a third… and mortgage rates are the lowest in history. Therefore, U.S. homes are more affordable than they've ever been.

You can listen to "most people." Or you can choose to ignore them and stick to these facts.

Based on these facts alone, now may be one of the best times in American history – even the very best time – to buy a house.

Good investing,

Steve

P.S. If you need long-term data like I showed in the charts above, talk to my friends at Global Financial Data. You can find them at www.globalfinancialdata.com.

Good investing,Steve

The DailyWealth Investment Philosophy: In a nutshell, my investment philosophy is this: Buy things of extraordinary value at a time when nobody else wants them. Then sell when people are willing to pay any price. You see, at DailyWealth, we believe most investors take way too much risk. Our mission is to show you how to avoid risky investments, and how to avoid what the average investor is doing. I believe that you can make a lot of money – and do it safely – by simply doing the opposite of what is most popular.

Customer Service: 1-888-261-2693 – Copyright 2011 Stansberry & Associates Investment Research. All Rights Reserved. Protected by copyright laws of the United States and international treaties. This e-letter may only be used pursuant to the subscription agreement and any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), in whole or in part, is strictly prohibited without the express written permission of Stansberry & Associates Investment Research, LLC. 1217 Saint Paul Street, Baltimore MD 21202

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Daily Wealth Archive

|

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.