Why I'm buying US stock index and commodities dips; Gold final move is close

Stock-Markets / Financial Markets 2011 Jan 31, 2011 - 10:03 AM GMTBy: John_Hampson

January saw US stock indices advance in the face of persistently overbought indicators and some negative divergences.

January saw US stock indices advance in the face of persistently overbought indicators and some negative divergences.

Investors Intelligence sentiment readings, bullish percent index, ISEE equities only index, distance from 200 day moving average and the VIX volatility ratio all hit readings that historically have meant overbought and a likely market pullback.

Negative divergences formed on NYMO market breadth and on number of stocks above the 50 day moving average. Such weakening internals usually lead to a reversal.

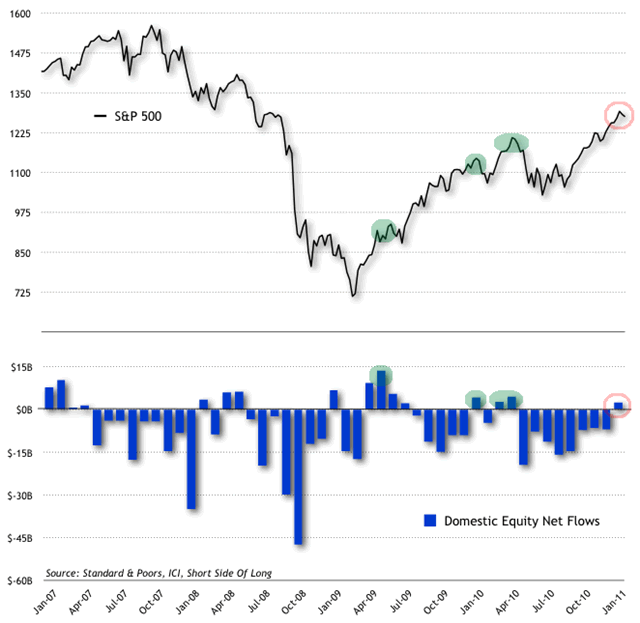

And now the retail investor, typically last to the party, has dipped a toe in again to domestic US equity funds, which may be a contrarian sign:

Source: Shortsideoflong.blogspot.com

The cyclical bull market in stocks off the March 2009 low has so far lasted 99 weeks and made around 92% in gains. Cyclical bulls last around 155 weeks on average and make around 99% gains. If we home in on just those cyclical bulls that occur in secular bears then these averages become 129 weeks and 104% gains. Either way, our current bull is either going to fall short in duration or exceed in gains. So which is likely?

Presidential cycle is still in a historic sweetspot for equities, supportive of further gains, particularly in the first half of this year:

Source: Seasonalcharts.com

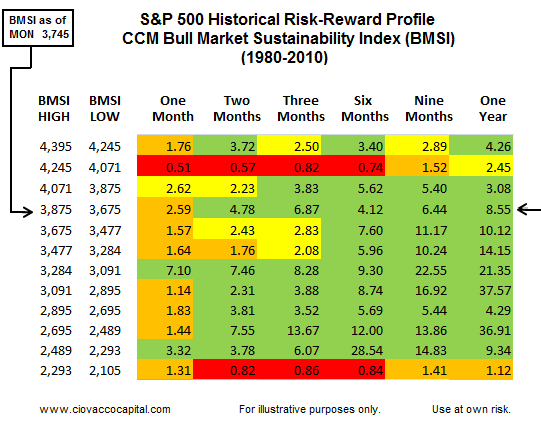

Bull market sustainability index is still positive up to one year out:

Source: Ciovaccocapital.com

Leading indicators are still positive:

Source: Dshort.com

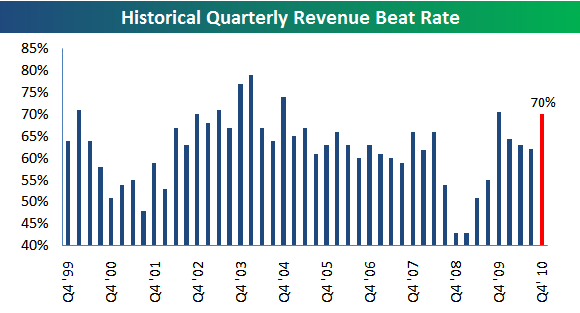

And we are in the midst of a positive earnings season - so far - with a 70% beat rate (exceeding recent earnings seasons) and a significant number of estimates being revised up, both of which are also supportive of further gains ahead:

Source both: Bespoke Investment

QE/Pomo and the relative cheapness of stocks versus bonds also give a tailwind to equities.

If we look at two rhyming bull markets from history - below - one saw a cyclical bull continuation but in a shallower uptrend with a couple of significant pullbacks, and the other saw a gradual topping process. As we don't yet see evidence of a topping process, plus have the above tailwinds, I favour the likelihood of a bull market continuation, at least for the first 6 months of this year, meaning I will be looking to buy any significant pullbacks. NB: This does not apply for emerging market equities which are at a different point in the cycle - tightening against inflation.

Source both: The Big Picture

--------------------------------------------------------------------------------

Commodities

The equally-weighted commodities index shows commodities at a new high for the secular bull, with agricultural commodities having led the gains in recent months.

Source: mrci.com

Rising food prices are creating inflation problems in emerging markets and have been quoted as factors in the uprisings in both Tunisia and Egypt. Climate change and natural disasters played a key role in last year's gains of over 50% for corn, coffee, cotton and rubber. 2010 was the joint hottest year on record since records began in 1880 - a trend which shows no signs of abating - and there were large-scale droughts in areas such as Russia. La Nina brought extreme weather patterns to Asia and the Pacific, and this is forecast to continue into spring 2011. Plus the liquidity injections and negative real interest rates following the 2007-9 economic crisis are serving to drive asset prices upwards. In short, the outlook continues to be positive for agricultural commodity price rises, looking out towards the spring. However, the large recent run up in prices means they may be susceptible to a sharp pullback if weather conditions surprise to the upside. Again, I would be a buyer on pullbacks.

Gold and silver - this is where it gets interesting, as I believe we are close to a parabolic and completing move in precious metals.

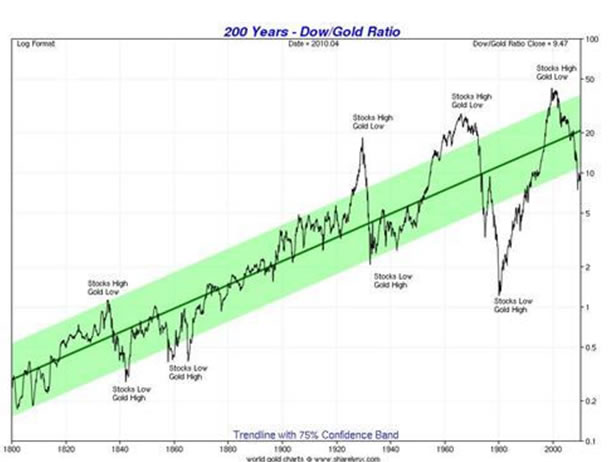

First of all, gold bugs need to understand that relative value lies now with stocks and not with gold and commodities, as shown here in 10 year rolling returns for commodities and stocks and the Dow-Gold ratio:

Source: Barry Bannister, Stifel Nicholaus

Source: Data from Prof.Schiller via Traders Narrative

Source: Sharelynx.com

In fact you could make a case based on the above 3 charts that it was time to buy stocks and ditch precious metals (although the Dow-Gold channel may need revising since the abolition of the gold standard). However, although relative value is with stocks, momentum is with commodities and particularly precious metals, as this is a Kondratieff winter in which gold is the leading asset class. As such we should expect a parabolic "mania" move in gold before the secular baton is handed over from commodities to stocks, something like that which occurred in 1979:

Source: Zealllc

If we view gold's secular performance since 2000 it has not yet made a parabolic final phase move comparative to other examples, such as the dotcom or US housing bulls:

The secular gold top to date of Q4 2010 was not accompanied by technical indicators at historic extremes, nor sentiment indicators, which we would expect with a completing move, and nor was the rate of ascent steep enough, such as witnessed with oil in 2008. Fundamentally, we still have negligible interest rates which make gold attractive relative to cash and bonds, we have accelerating global inflation against which gold is a hedge, and it is still attractive as a flight to safety given ongoing Euro debt and US Muni debt issues. Whatsmore, Puplava's proprietary indicator suggests we are close to a buying point for another major leg up:

Source: Chris Puplava

So why do I think a terminal move is close?

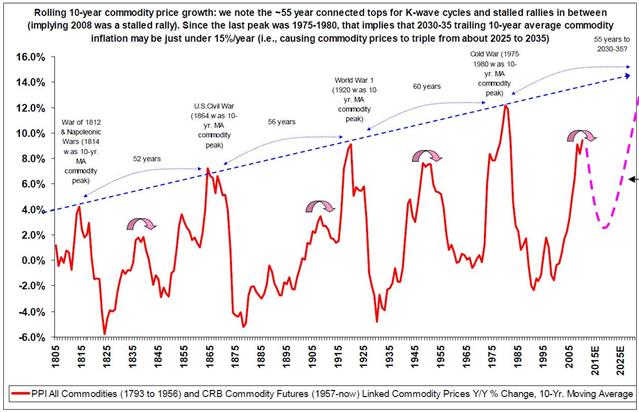

In the previous secular commodity bulls of the last 100 years prices peaked 2-3 years before the end of the secular cycle, came off some but stayed elevated. So we should not expect a peak right at the end of this secular bull but 2-3 years before. Clearly we want to catch the big move up, not the period of elevated prices.

Previous secular commodity bulls:

1906-1923 (16 years)

1933-1953 (21 years)

1968-1982 (15 years)

Previous secular commodity bull price peaks:

April 1920

Jan 1951 (30 years and 9 months after the last)

Nov 1980 (29 years and 10 months after the last)

Note the 30 year cycle between commodity price peaks, which would give us a peak in this cycle around 2011.

And looking back up the page at the dotcom and US housing bulls comparison, a similar parabolic completing move should take place within the next 2 years.

Also, solar cycles suggest accelerating inflation into 2013 then a recession. This would also support an up-move in gold in 2011-2012 before a period of remaining elevated.

Finally, the general lag in supply of commodities means that new projects initiated since commodity prices took off from around 2000 are projected to come on stream in a couple of years to deliver increases in supply that have been short since underinvestment in the 80s and 90s, which is also supportive of a move up ahead of that and perhaps not thereafter.

In short, I expect a parabolic and completing move in precious metals in 2011-2012, and right now represents a good buying opportunity (3 months of consolidation and close to buying indicator (above)). Just be aware that some such historic mania examples show a wash-out decline can precede a final parabolic move, a last shake-out of weak hands. But this is not always the case.

Ultimately, a de-railing of China or a sustained move to positive real interest rates in the West may end gold's secular bull, but lagged additional supply and an excessive extreme of relative value for stocks and housing compared to gold and precious metals may suffice and one more big relative move up in gold would take us there.

John Hampson

John Hampson, UK / Self-taught full-time trading at the global macro level / Future Studies

www.amalgamator.co.uk / Forecasting By Amalgamation / Site launch 1st Feb 2011

© 2011 Copyright John Hampson - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.