Resolving the Stubborn Psychology of Fish

InvestorEducation / Trader Psychology Feb 09, 2011 - 02:56 AM GMT For those unfamiliar with the game of poker, it is essentially a game where players attempt to win money from other players at their table by having the best five-card hand at showdown or by betting their opponents off of the best hand. The most popular form of poker is Texas Hold Em', in which each player is dealt two "hole cards" followed by a round of betting, then a three-card "flop" followed with another round of betting, a one-card "turn" with betting, and finally a one-card "river" with the last round of betting. Each player can, but is not required to, use one or both of their hole cards, and must use 3-5 cards on the board, to construct their best possible five-card hand (from best to worst - straight flush, four of a kind, full house, flush, straight, three of a kind, two-pair, pair, high card).

For those unfamiliar with the game of poker, it is essentially a game where players attempt to win money from other players at their table by having the best five-card hand at showdown or by betting their opponents off of the best hand. The most popular form of poker is Texas Hold Em', in which each player is dealt two "hole cards" followed by a round of betting, then a three-card "flop" followed with another round of betting, a one-card "turn" with betting, and finally a one-card "river" with the last round of betting. Each player can, but is not required to, use one or both of their hole cards, and must use 3-5 cards on the board, to construct their best possible five-card hand (from best to worst - straight flush, four of a kind, full house, flush, straight, three of a kind, two-pair, pair, high card).

What makes poker a profitable venture for "solid" players, unlike blackjack, craps or roulette, is their opportunity to capitalize on the mental mistakes of other players, by accurately "reading" the opponent's potential range of hole cards in any given hand (mostly from betting patterns and style of play), and accurately calculating the "pot odds" they are being laid (money that must be put in on the present and future betting rounds as a percentage of money that could be won from the pot). The pot odds calculation allows the solid player to determine the best course of action (bet, call, raise, fold) by comparing it to the equity his/her hand carries against the opponent's range.

Any course of action offering positive expected value (pot odds > odds of breaking even against opponent's range) should be taken, and ideally the single course of action offering maximum EV is the one that will be chosen. It is not easy to precisely determine the expected value of any given decision, especially when your facing a new opponent, but the toughest part of playing a solid game is remaining disciplined, unemotional and objective throughout an entire hours or days-long session . The solid player can never let the play or words of weaker opponents introduce any elements of self-doubt into his mind, since these self -deprecating thoughts will eventually snowball into a situation where the once-solid player no longer has any reason to believe that he/she is playing any better than his/her opponents.

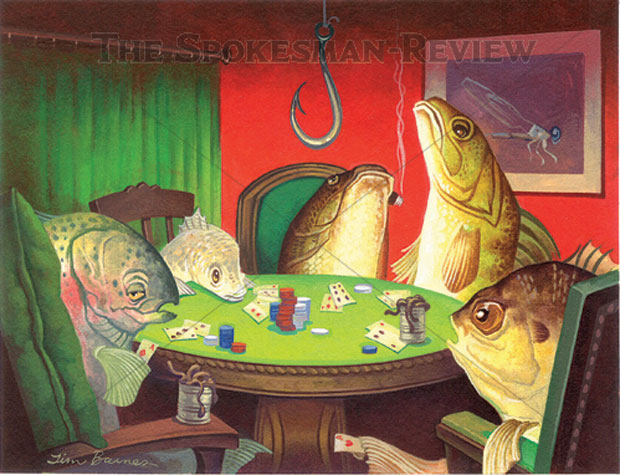

The opponents every solid player wants to find at his/her table are called "fish" (aka "calling stations"), because they play a large range of hands before the flop and tend to call large bets (as a % of the pot) after the flop with weak hands (high card, single pair) or draws (to a straight or flush). These players are typically very passive, meaning they almost always prefer to just call with their hands (weak and strong) rather than raise, making them an ideal opponent. When you make a decent five-card hand, you keep betting it for value against the fish, and if the fish raises your bet, then you fold everything but the strongest hands.

So you were first to act pre-flop and raised to 3x the big blind? Well I have a pretty-looking 9♦T♦ on the button, so I call to see a flop.

So you bet 3/4ths the pot on a 5♦ 5♠ 9♠ flop? Well, I have top pair and a backdoor flush draw, so I call.

So you again bet 3/4ths the pot after the turn produced the 2♣? Well, my draw has vanished but I still have top pair, so I will call again.

So you fired a third large round at the pot after the river brings the 5♣, representing a big pair such as AA or KK?? Well I don't really care what you are representing or actually thinking, because I have a full house, so I call!!The fish never stop to think what your strong bets out of position imply about your hand, especially given the fact that you most likely know that they are fish. If the fish do stop to think about these factors, then they most likely dismiss the thought before it has any chance to settle, since it would be too disruptive to their goal of never folding a potential winner. While the solid players are constantly engaged in several different layers of critical psychoanalysis, the fish are forever stuck in a one-track mindset. This linear form of thinking should sound eerily familiar to the collective psychology that has traditionally encompassed millions of people in the developed world, and continues to do so currently.

After all, poker is essentially a simplified representation of financial investment in a capitalist society, and the fish are the reckless "speculators" in the broadest sense of that term, which includes most people who adhere to mainstream beliefs about "proper" lifestyle choices in their society. Those of us who are aware of the deeper and more comprehensive trends in our socioeconomic system are the solid players in the poker game of life, and the facts/data that support these trends are our bets. The broad socioeconomic trends that we are currently experiencing in the developed world are pretty clear and straightforward (leaving aside the critical issues of peak oil and climate change):

The financial model of growth in the developed world has run its course and financial assets will be significantly reduced in value over the next few years.

Systematic deleveraging will lead to persistently high unemployment and widespread poverty.

Societal institutions or systems that rely on financial stability will continue to deteriorate at an accelerating pace (education, healthcare, etc.).

States running large fiscal deficits to support their private economies will quickly slide into insolvency and default on ambitious promises to their citizens.

Housing, food and energy will become unaffordable for millions of people as wealth in the form of revenues, investments and savings is rapidly destroyed, and short-term speculative plays in the commodity space fueled by central bank liquidity will only make this dynamic worse.

Political institutions or systems that have exercised power during the unprecedented financial boom will come under an equally unprecedented societal pressure and will most likely be overhauled or completely dismantled.

Over the last few years, our bets have become larger and more powerful in every way imaginable, yet the fish keep calling and expecting to see a bluff. When the stock market took a nosedive in late 2008 as a result of the sub-prime housing meltdown, the fish were initially flustered by such a strong bet against financial stability in the developed world. However, they quickly shrugged it off and regained their hard-headed "business as usual" mentality, continuing to pour more of their speculative money into the pot (stocks, real estate, bonds, consumer goods, etc.).

When sovereign debt issues emerged from the Eurozone and Greek could no longer roll over its debt at anything close to a reasonable rate of interest, the fish began clamoring to make sense of such a strong bet against the fiscal solvency of states in the developed world. Of course, the bet was quickly dismissed as a pathetic attempt to sell prophecies of "doom and gloom", and the fish kept insisting that Greece was an isolated incident in an otherwise stable and prosperous region. Now that the contagion has spread to other European countries such as Spain, Portugal, Ireland and Italy, the fish almost unbelievably continue to dismiss the trend as a slight road bump on the EU's path to greater wealth and prosperity.

Almost every significant data point that has emerged during and since the events described above has either been dismissed outright or "rationalized" away. You say that new and existing home sales have sharply declined after expiration of the federal tax credit? Well, I say that doesn't matter because housing will always regain its value in due time. You say that there are millions of homes being kept off the market as shadow inventory, and more millions of homes whose legal title has been compromised by rampant banking/investor fraud? Well, I'm confident these are minor problems which can be solved with some retroactive legislation and more state subsidies to banks or homeowners.

You are claiming that the banks responsible for most of the secured lending in this country would be bankrupt if forced to mark their assets to fair market value? Well, I don't believe you because the WSJ reported that major Wall St. banks took in record revenues in 2010 and therefore rewarded themselves with record bonuses. In the mind of a fish, long-term solvency is simply not as important as winning a few pots in the short-term. There are numerous other economic/financial data points (bets) that the fish refuse to accept as an accurate representation of reality's underlying hand (re: unemployment, food stamps, pension shortfalls, stock market losses, private and public debt burdens, etc.). However, the irrational denial of fish is perhaps even more stark in the realm of sociopolitical trends.

Since early 2010, there have been many acts of politically-motivated violence across the world, ranging from individual acts and modest protests to full-blown riots and revolutions. The fish may tell you that there have "always" been people who snap and go on a killing spree, or groups that decide to protest a specific state policy, or third-world nations that spontaneously erupt in revolution, and so these events have no special systemic significance. It is true that these types of events have occurred in many places throughout the latter half of the 20th century, but they are only beginning to exhibit such strength, frequency and widespread influence after the global financial crisis.

Part of this dynamic is a reflection of how we were unable to connect the dots back then, when we were paying less attention to betting patterns and more attention to the stacks of chips sitting in front of us. The more significant factor is that systemic flaws in the global financial system have been fully exposed to the world's population, and much of this population has been forced to absorb the drastic costs of these flaws for the benefit of a few. No amount of political window-dressing by politicians, academics or pundits in a financially-dependent state can hide the ugly reality now facing its citizens.

This new reality is best evidenced by the spread of sociopolitical unrest from "peripheral" countries to the heart of our global society. Member countries of the EU are not economically or politically "insignificant" states, and their frequent protests, strikes and riots evidence a rapidly increasing frustration with both the national and regional institutions currently determining economic policy. Egypt and Saudi Arabia are not Tunisia or the Gaza Strip, and the instability of their corrupt, authoritarian political systems is fundamentally the same as that of their sponsors. Speaking of whom, the U.S., U.K., Japan and China have also witnessed their fair share of sociopolitical tumult over the last few years, and all signs point towards an intensification of this popular animosity in the near future.

In an actual poker game, the solid players derive most of their profits from the fish, so where do we find our profits in the poker game of life? It may seem counter-intuitive to say that the irrational beliefs of mainstream society have benefited us in any significant way, but there can be no doubt that we have profited. Asset prices have not collapsed yet because the fish refuse to accept reality, and this denial gives the rest of us a chance to sell what we have before realizing too many losses. Our political and social institutions remain functioning at a reasonable level, which gives us ample opportunity to physically and financially prepare for the inevitable future. The suspended reality created by the fish gives us a chance to continuously communicate our views to others, with the hope that some semblance of reason eventually gets through.

It's only when the school of fish stream towards the exits in unison that the "game" becomes wholly unprofitable for solid players. Until that tipping point arrives, our bets will continue to scream "I have a monster!" at the top of their lungs, and the fish will continue to make crying calls in stubborn disbelief. The psychology of fish always carries them from a state of comfortable wealth to one of utter destitution over time, as they incessantly chase their losses, throwing bad money after money even worse. As the total amount of capital sunk into the pot exponentially increases along with net losses, the fish find it that much more difficult to cut their losses and walk away from the game. In the long-run, however, every fish goes for broke and is simply unable to purchase any more chips to play with. The solid players are then left with a minimal or non-existent edge at their tables, as the game begins to consume itself, and that's when you know it's time to get up from your seat, exit the casino and begin the long journey back home.

Ashvin Pandurangi, third year law student at George Mason University

Website: "Simple Planet" - peakcomplexity.blogspot.com (provides unique analysis of economics, finance, politics and social dynamics in the context of Complexity Theory)

© 2011 Copyright Ashvin Pandurangi to - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

andI think u know that

09 Feb 11, 10:25 |

fish

u r a fish |