The Rule of Gold After the Financial Collapse

Commodities / Gold and Silver 2011 Mar 14, 2011 - 08:14 AM GMTBy: Submissions

James Hunt writes: In a secular world, the operative “Golden Rule” is “He Who Has the Gold Makes the Rules”. The condition of the global financial banking system is untenable. The aggregate amount of debt worldwide is anyone’s guess. The introduction of derivatives and counter claims pushes the chain of obligations into the unknown. All that is left is for central banks to create mountains of uninterrupted counterfeit money to roll over and delay the inevitable. The IMF chart of World Currency Reserve is a skyrocket line to oblivion. It does not reflect a healthy stockpile of treasure, but certainly manifests a new debt machine running to infinity.

James Hunt writes: In a secular world, the operative “Golden Rule” is “He Who Has the Gold Makes the Rules”. The condition of the global financial banking system is untenable. The aggregate amount of debt worldwide is anyone’s guess. The introduction of derivatives and counter claims pushes the chain of obligations into the unknown. All that is left is for central banks to create mountains of uninterrupted counterfeit money to roll over and delay the inevitable. The IMF chart of World Currency Reserve is a skyrocket line to oblivion. It does not reflect a healthy stockpile of treasure, but certainly manifests a new debt machine running to infinity.

The Bullion Vault explains this reality in the following manner.

“Sure, the Fed can create money. But it can't create credit (from the Latin credere, "to trust, have faith"). And it sure as hell can't let America's outstanding debts – both private and public – simply get written off now, neither at home nor abroad. Not after all that crashing and banging in ER from 2007-09.

So never mind the record-large cash pile sitting at non-financial corporates. Never mind that their problem is too much debt, not the $1.8 trillion in cash they've already got. Never mind the 50-fold growth since 2007 to $1 trillion in US banks' cash holdings either. Again, debt is their problem – not a lack of money – but it doesn't matter. New money is the only fix Dr. Ben now has to hand (he's all out of interest-rate cuts). So those foreign reserves, US corporates and domestic banks already drowning in money will get flooded with more”.

Back in 1966 Alan Greenspan wrote in The Objectivist, Gold and Economic Freedom.

“Under a gold standard, the amount of credit that an economy can support is determined by the economy's tangible assets, since every credit instrument is ultimately a claim on some tangible asset. But government bonds are not backed by tangible wealth, only by the government's promise to pay out of future tax revenues, and cannot easily be absorbed by the financial markets”.

Since the gold standard was abandoned worldwide, the banksters have run wild. So who owns all the gold? Part of the answer is that the official sector holds much less, than one might think.

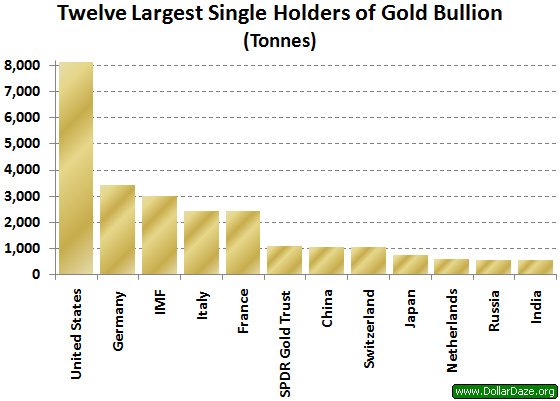

Wealth Daily concurs with the Dollar Daze list of largest holders of bullion - United States, Germany, International Monetary Fund, Italy, France, SPDR Gold Shares, China, Switzerland, Japan and Netherland, rank as the top ten.

“Central banks and multinational organizations (such as the International Monetary Fund) currently hold just under one-fifth of global above-ground stocks of gold as reserve assets (amounting to around 30,500 tonnes, dispersed across 110 organisations). On average, governments hold around 10% of their official reserves as gold, although the proportion varies country-by-country”.

So how much gold is there above ground?

Total 165,600 metric tons above ground stock

1 metric tonne = 32,150.746 Troy ounces

Total 5,324,163,537 Troy ounces

Price Quote at $1,424.00 per ounce

Total value in U.S. Dollars = 7 Trillion, 581 Billion, 608 Million, 876 Thousand and 688 Hundred Dollars of all gold worldwide.

Since the US Mint reports that Fort Knox stores 147.3 million troy ounces, current redemption in U.S. Federal reserve notes would be approximately $366,261,298,432. That is a drop in the bucket against the outstanding Federal obligations, which exceed world GDP. Then there is the question of exactly how much gold remains in government hands or if the bullion is actually good delivery gold. View the video there is no Gold at Fort Knox for an alarming report.

Have you ever wondered why the Federal Reserve and their co-conspirer central banks for decades waged a war against gold? The Paper Empire sums up quite nicely.

“The Federal Reserve is arguably the most powerful institution in the world as it maintains the sole legal right to counterfeit the world’s reserve currency without limit and without oversight. This allows them to bail out the too big to fail banks, manipulate currencies, support foreign central banks and corporations and allow near endless government spending above and beyond what the government can pay for through direct taxation. A true, enforceable gold standard would put an immediate end to all of that”.

Now examine the seamy history of IMF gold sales. The next video, The IMF sold Gold plated tungsten bars to India, illustrates why the international banking system needs to be eliminated. The Gold-plated tungsten bars scandal is about to erupt. Imagine the chaos among banking circles when governments become aware of a bait and switch delivery fraud.

If all the gold in the world has a current value of less than eight trillion dollars, how much could be bought by the Forbes 2011 Billionaires List, which breaks two records: total number of listees (1,210) and combined wealth ($4.5 trillion). How much do they already own?

What is never disclosed in official statistics of wealth ownership are the names of the true underworld bosses of the global controllers. The shadow manipulators conceal the extent of their money hordes. Most public lists painstakingly omit the master criminals. Their plan is to buy real assets with counterfeit notes obtained through illicit profits from rigged markets and phony financial derivative instruments.

When the banking system finally collapses with mathematical certitude from the burden of compound interest, these same crooks will be prepared to provide a specious substitute. The schemes described in IMF Plotting Gold-Backed SDRs?, make the following point.

“The IMF is about as likely to help individual European countries subvert the euro via gold as it is to encourage debtor countries not to honor banking their debts. The IMF is a creature of the power elite, and it will always remain so, in our opinion. But none of this militates against the idea of the IMF backing its OWN currency (SDRs) with gold”.

A most revealing fact is that central banks and governments do not possess the bulk of gold supplies. The World Gold Council publishes an astounding pie chart, 83% of above ground stocks are in the hands of industry, investment and jewelry concerns. This overwhelming percentage points to an alternative to the fiat paper debt created banking tyranny.

Only individual ownership of gold, directly in your own possession can preserve any store of value when the next Draconian level of the Totalitarian Collectivism system is imposed after the financial meltdown hits in earnest.

How much gold is enough?, offers up this solution.

“When individuals acquire gold in mass, politicians will be forced to address the public debt, and the true extent of the unconscionable confiscatory taxation condition that we all suffer. Limited government can be achieved, but must be based upon a currency that has gold convertibility. There lies the answer, keep enough gold to insist that real money will replace phony Fed notes. Nothing less will restore a store of value or a nation of free citizens”.

Remember that tyrannical regimes are always arbitrary. Executive Order 6102 was signed on April 5, 1933, by U.S. President Franklin D. Roosevelt "forbidding the Hoarding of Gold Coin, Gold Bullion, and Gold Certificates" by U.S. citizens. This kind of blatant violation of the U.S. Constitution is routine. Citizen ownership of gold could very well become illegal again. However, if it is, you will already know you are a pawn in a fascist state.

The risk banning gold ownership and government confiscation is always real for individuals. However, the prospects of rounding up gold bullion as contraband from banking institutions or the chosen and privileged financial elite, would require a coup d'état. The establishment will sacrifice hundreds of millions of expendable serfs, before it relinquishes the reins of superiority over the humble taxpayer.

An underground barter economy will thrive, while it is condemned as a black market. Any attempt to substitute new money with a gold component, must allow for unlimited convertibility for it to be a legitimate monetary system. As long as the same globalists retain political rule, you can bank on the scheme proposed to be another sophisticated attempt to rob and enslave you, all over again.

Douglas Herman offers up four possible scenarios, the best of which requires an old currency recall, and replacement with new species money. The other theories feed into the control matrix of the globalists to implement even greater despotic methods of servitude. Intentional civil unrest provides opportunistic excuses to herd the cattle into the pens of slaughter. Just owning private gold will not protect citizens adequately, until the gold hordes of the elite are stripped from their control.

The decisive test remains the same, who has the bullion makes the rules, with one caveat. If you are so foolish to accept the next new-fangled money hoax from the same banksters who brought you their planned global collapse, you deserve to be a slave. Business wealth creators need to lead the charge to abolish the phony debt created money monopoly. Financial Armageddon lays at the feet of humanity. Gold alone will not save you, but it will allow the means for rebuilding a society free of banksters’ tyranny, only, if you have the courage to remove their ilk from all seats of power and government.

Discuss or comment about this essay on the BATR Forum

By James Hunt

© 2011 Copyright BATR - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.