Why Quantitative Easing Has NOT Brought Back Inflation

Interest-Rates / Quantitative Easing Mar 25, 2011 - 07:08 PM GMTBy: EWI

Below is an excerpt from the newest free Club EWI investor education resource, The Independent Investor eBook 2011. Inside are some of the most eye-opening research findings by EWI's president Robert Prechter, as published in the recent issues of his monthly Elliott Wave Theorist.

Below is an excerpt from the newest free Club EWI investor education resource, The Independent Investor eBook 2011. Inside are some of the most eye-opening research findings by EWI's president Robert Prechter, as published in the recent issues of his monthly Elliott Wave Theorist.

Enjoy this short excerpt -- and for details on how to read this eBook in full, free, look below.

Club EWI's Free Independent Investor eBook 2011 (excerpt) Chapter 1: Quantitative Easing Has Not Brought Back the Old Inflationary Trend (From Prechter's January 2011 Elliott Wave Theorist)

While long terms rates are rising, Treasury bill rates are stuck near zero. How is it possible?

... During hyperinflation, rates typically rise to double digits per month. Inflationists find it difficult to reconcile the Fed’s massive balance sheet growth over three years beginning in August 2008 with short term rates at zero and long term rates only in the 2-5% range.

Deflationists (all ten of us) understand why investors are willing to hold government paper at such low returns: The total supply of debt is contracting. Most bonds won’t survive. The federal government’s bonds will survive the longest.

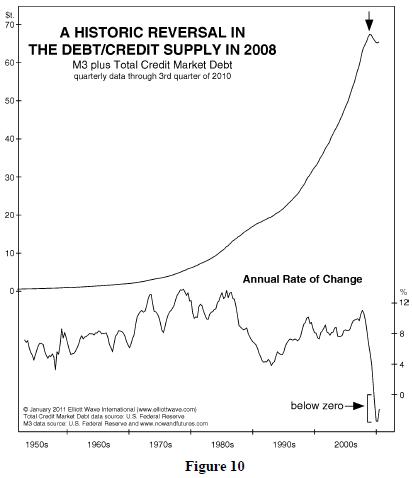

Figure 10 shows that the total supply of “money” plus debt (all of which is in fact debt) peaked in 2008. This decline in overall money and credit is the first on an annual basis since 1929-1933. It is a big deal.

... This graph explains why gold in 2010 was so much lonelier in making an all-time high than stocks, commodities and real estate were in 2006, when everything was making an all-time high simultaneously: The total money + credit supply is down and cannot support new highs in all markets at once.

The Fed’s QE programs are failing to re-ignite inflation. By mid-2011, the Fed will have monetized just over $2 trillion worth of debt since 2008 to bring the value of its total assets to about $3t. This does represent a huge amount of fiat money. But the overall debt load is $65 trillion. Thus, the Fed will have monetized only 5% of the total, meaning that 95% of the outstanding debt is still suffocating the economy like a giant pool of sludge. …The Fed’s degree of monetization in light of these debts is very small.

For more of Robert Prechter’s insights on the markets, including why QE2 was a major tactical error, why rising oil prices are not bearish for stock, and why earnings don’t drive stock prices, read the rest of this FREE 51-page Independent Investor eBook. Download your free eBook NOW.

This article was syndicated by Elliott Wave International and was originally published under the headline Quantitative Easing: Why It Has NOT Brought Back Inflation. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.