Jobless Economic Recovery, Drowning in Debt, Austerity Suffering Working Class

Economics / Economic Austerity Apr 02, 2011 - 10:32 AM GMTBy: John_Mauldin

Can You Say Jobless Recovery?

Can You Say Jobless Recovery?- Drowning in Debt but Getting No Growth

- The Cancer of Debt

Clowns to the left of me, Jokers to the right,

Here I am, stuck in the Muddle Through Middle with you! –With thanks to Stealers Wheel

I get a lot of email from readers. I recently got an impassioned letter from very-long-time reader Bill K., who asks some very pointed questions about austerity and spending cuts. It is a rather lengthy letter, so I will only quote part of it and use it is the launching pad for this week's letter, where we look at today's employment report, but from a little different slant. This letter will no doubt anger a few other long-time readers. I argue this week for the middle, but do so as a survivalist.

While Bill starts out by saying some very nice things about me (thanks), let's jump to the meat of the letter:

".... I would like to get something off my chest. I would like to know why you seem to side with those analysts who keep telling us that the only way we can sort out Western economies is by making the average guy suffer through austerity programs... You are a very intelligent guy - obviously. You can see how things work and what is broken. You can also see through the greed and excesses of Wall Street, and you can read the economic data which clearly shows that the wealthy continue to get more wealthy in America whilst the average Joe continues to see his standard of living going in the opposite direction. Capitalism today only works for the 'have gots'. It's been going in that direction for more than 30 years now. You saw the senseless and stupid greed of the derivative scheme which fueled the housing bubble which led to the meltdown which never melted because Bush/Obama handed out a huge welfare check to financial institutions that should have been allowed to fail.

"In the aftermath of all this, politicians in DC, you, and your guest pundits warn us that the world as we know it will end if we don't somehow reduce the average Joe's Social Security, pension, Medicare and Medicaid benefits. Oh and let's not forget the budget, which is being argued in Washington as I type this. The line is that we have to make drastic reductions to spending on domestic programs, on our schools, on our infrastructure, on unemployment entitlements, on all the things that serve to give working people a chance at a dignified life. You're a smart guy. You can recognize what is fair and what is greed and excess. When the nation is as troubled as it is today and yet the wealthy are living even better than they did 30 years ago, what does that say about America? I wonder if we really care about our neighbors anymore? I wonder why such a great country with such great natural resources cannot find a way to be just and generous and a beacon to higher ideals? Ike warned us to be wary of the military-industrial complex. Looks like he was right. We're a nation constantly at war, spending trillions on defense, whilst at home we enrich the already wealthy and tell the average Joe that he has to pay for it. I wonder how you manage to rationalize all this away - if indeed you do?

"Thanks and with respect, Bill"

The Plight of the Working Class

Bill, you ask a very complicated question. There is not a simple black and white answer, but I am going to try and address your concerns. Let's start with today's employment numbers. We got a decent non-farm payroll number of 216,000, and 240,000 new jobs in the private sector (governments everywhere are still shedding jobs). That means over the last two months the private sector has added almost 500,000 jobs. If you take the household survey, that number looks even better. So why did all the consumer sentiment numbers in March come out so awful?

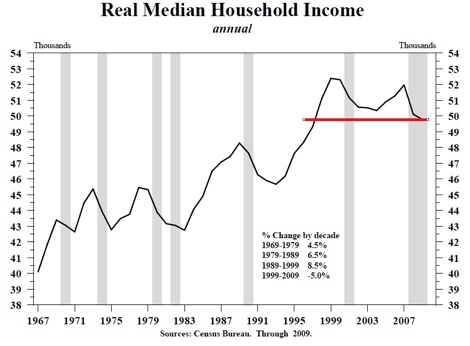

Looking deeper into the data we find that wages were once again flat, for the 4th time in the last five months. We are certainly not keeping up with inflation. The chart below shows real median household income since 1967. It is published in May of each year by the Census Bureau, so we don't have the data for 2010, but it will not be good. Real median income, when the new data comes out, if I read the chart right, will not have grown for almost 14 years.

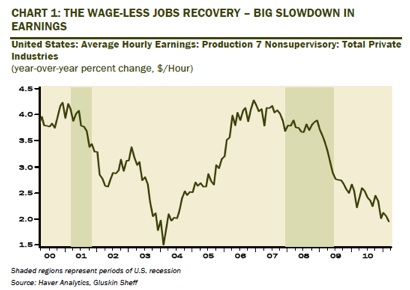

But all this has led to what David Rosenberg calls the "Wageless Recovery." Wage growth just continues to fall.

And given the rise in food and fuel costs (which are now about 23% of the average person's income), the recent lack of wage growth is even more frustrating.

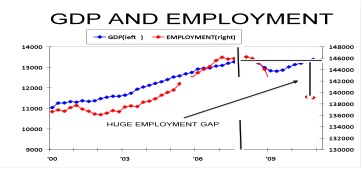

Although the economy in the US is now producing more "stuff" than it did at its peak in 2007 (fact), we are doing it with 6.8 million fewer people. That means the productivity of the workforce is much better, which is good for corporate profits, but this has not yet translated into higher wages, although in past cycles higher profits have given way to higher wages (eventually, at least).

Can You Say Jobless Recovery?

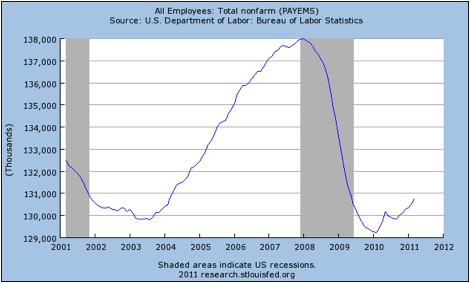

The following chart is from the St. Louis Fed. It shows the spectacular fall in jobs in the last recession and the painfully slow recovery.

And note that we have gained 30,000,000 more people in the US over the last decade! And negative job growth!

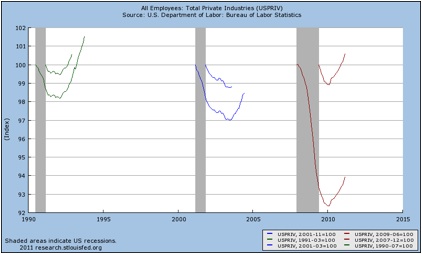

And this next chart is courtesy of my friend Barry Ritholtz of The Big Picture. It is also from the Fed, but it's one I have never seen.

That is a graph of the last three recessions, with employment indexed at 100, and it shows what employment did from the beginning of the recession, and then from the end of the recession. As Barry said, we don't want to think about what the next recession will look like, if this is a trend.

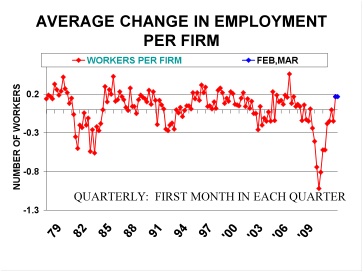

The most recent survey from the National Federation of Independent Business shows that small businesses are indeed once again hiring. "The positive job creation observed in February was repeated again in March [sigh of relief here], confirming that the number of net new jobs reported on Main Street was decidedly positive. The March net increase in jobs per firm was .17 workers, a repeat of the February performance. Employment gains have not been this good since 2007."

But that still begs the question of why wage growth has been so poor. And why do we now have such structural unemployment? Although the headline unemployment number went down to 8.8%, the only way you can get to that number is by not counting the millions who have dropped out of the employment pool, too discouraged to look, but who will take a job if they can get one. If you go back and take the number of people in the labor force just two years ago, the unemployment picture is back over 10% (back-of-my-napkin math).

GDP has recovered, but jobs haven't. This chart from the NFIB shows the disparity.

Bill, I get it. The average guy is getting squeezed. You can see it in the numbers. For a while, it was masked by growing credit.

Drowning in Debt but Getting No Growth

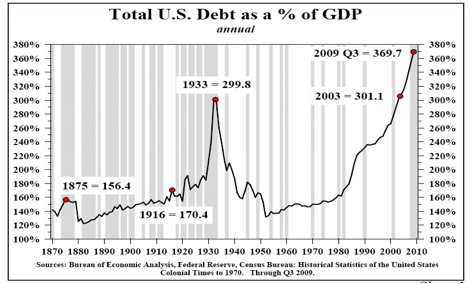

This is an older chart, but it is relevant. We grew debt in this county in all forms by over 100% of GDP in the last decade. $14 trillion. And what did we get for it? No real job increases, no increase in wages. It was an illusion. In fact, my friend Rob Arnott pointed out to me today that a piece he is working on (which I hope to be able to give you soon!) shows that the only way you can show a positive GDP for the last decade is with government spending.

And that, Bill, is part of the problem. We have become a credit-addicted, credit-fueled economy, which works just fine until you have too much credit driving too little real growth. Without government spending, "real" GDP would be at levels it was over ten years ago. And it is real growth that drives wages and creates jobs.

You write: "The line is that we have to make drastic reductions to spending on domestic programs, on our schools, on our infrastructure, on unemployment entitlements, on all the things that serve to give working people a chance at a dignified life."

That is not my line. My book calls for a large increase in funded infrastructure spending through a fuels tax (none of it going to the federal coffers!). I am not against unemployment insurance, but at some point it needs to become job training and a path to employment. I am a huge proponent of education, having spent a great deal of money on it over the years, with seven kids (and paid even more in taxes!). But does the current system really work? We have double the educational workers per student we had only a few decades ago, but no improvement in outcomes.

Yes, we have to make cuts to government programs. A 33% growth in federal discretionary spending (not including stimulus money) the last three years alone is not reasonable, given the size of the deficit. The last recession was not caused by too little government.

The Cancer of Debt

The problem is that the debt is like a cancer. The bigger it grows the more threatening it is. Pretty soon it consumes its host (think interest expense).

Bill, I am worried about the survival of the country economically. Another crisis caused by the bond market driving up interest rates, because they become concerned about the size of the debt and deficits, will seriously reduce the choices we have - with none of them being good. Ask Ireland or Greece how it feels. They are in what can only be called a depression, and likely to stay there for some time. You think we have it bad now? Avoid dealing with the debt and see what happens.

To think it cannot happen here is to simply ignore reality. Yes, the US can go longer than we might think, but there is a limit. I think that limit will come before the middle of this decade. Perhaps as early as 2013, if the new incoming President and Congress do not deal with the deficit in a realistic manner. Then Bang!, we have our own Greek moment. I want to avoid that.

In my book and on numerous radio and TV shows, I have made the case that we must get the fiscal deficit below the growth rate of nominal GDP. That means we need to cut, over time, about $1 trillion from the current budget deficit.

And that means entitlement spending has to be on the table, as well as tax increases. The polls clearly show that people want to keep Medicare and also are against tax increases (close to 70% in both cases). Those are not compatible objectives.

We have to have a national conversation about how much Medicare we want and how we want to pay for it. Writing the words tax and increase in the same sentence is difficult for me. Tax increases taken from private producers do nothing for economic growth, which is where we get new jobs. But I would rather have higher taxes than for deficits to be at a level where they threaten the economic survival of the republic. (And I make the case that if conservatives give in on tax increases, that means there needs to be a complete structural change to the tax system, gearing it more to encouraging growth, real Medicare reform, and even larger spending cuts, etc., that are linked to real, measurable metrics!)

I am just as frustrated as you about the bailout of banks, that we still have banks too big to fail, that credit default swaps are not on an exchange, that Fannie and Freddie still even exist in their current forms, and a host of other problems you mention. (Frank-Dodd was a disaster! It almost guarantees another crisis.)

I have become all too familiar with cancer of late. It tends to focus the minds of those who are suffering, and their families, on survival. Chemotherapy is nasty. It means putting a toxic drug into your body. That is something you don't want to do under normal circumstances, but when your survival is the issue, you do it.

It is no less than economic survival we are talking about. Oh, the US has been through worse. Civil war, depressions, panics. We will survive as a nation, but the pain we will endure is simply more than most people can comprehend, Bill. Whole generations of savings and investment will be wiped out. Think the cuts I am talking about are serious? Wait until interest payments are eating up 25-30% of revenues in a 12%+ unemployment world. Think the underfunded pension problems are bad now? Let's have a REAL bear market, with inflation.

I have some friends who think that is what it will take to get government smaller. They relish the thought, as they also think their gold portfolios will go through the roof. I am not in that camp. That is not a world I want for my kids and grandkids, Bill, most of whom are (for now) your average person. (Well, except for my exceptional grandkids.)

I want us to find that middle path, to cure the cancer of debt. Yes, I want smaller government and lower taxes, but survival is now my fixation. The cure for too much debt is not more debt. We can get it under control, but it is going to mean compromises, a word that I hate - but I also hate chemotherapy.

I get that we need to do things to make government more efficient. And we need to provide safety nets. We need a lot of things.

But most of all we need an adult conversation about what it is that we need, and what we can afford. The American people have to understand that the path back to a sustainable economy will not be easy. As I have written many times, cutting government spending will mean lower GDP numbers in the short term, but survival in the longer term. This is not a typical business cycle. We cannot simply grow out of our problem. We haven't really grown, except for government spending, for ten years. Yes, there are numerous steps we can take that will make it better and easier and quicker than if we wait until we are forced by a crisis to act. But there are no "Easy" buttons.

Gentle readers, I promise you we get through this, one way or another. The 2020s are going to be a heck of a lot of fun!

New York, Portland, and La Jolla

I worry that I may have to go into hiding after this letter, as the middle is a lonely place. Oh well, I leave Sunday for New York. I had to cancel Utah at the last minute to go on a secret mission, but will be doing the media rounds in NYC next week to promote the book. Fast Money on Monday, Bloomberg on Tuesday morning, a guest host spot with the lovely Liz Claman on Fox Business on Wednesday, and videos with Yahoo Tech Ticker, thestreet.com, the Wall Street Journal, and with Steve Forbes himself. Lots of meetings with cool people, so should be a fast and fun week.

Korea has been postponed, which gives me more time at home in May, which I need. I am already starting to work on my presentation for my Strategic Investment Conference, April 28-30. There are only a few spots left. Best speaker line-up of any conference anywhere. You can learn more at https://hedge-fund-conference.com/2011/invitation.aspx?ref=mauldin.

Endgame has now been on the New York Times best-seller list for three weeks. And this week, if you have not yet bought your copy, let me commend you to my friends at Laissez Faire Books. I have been buying books from them for nearly 30 years. They are the best source for Austrian economics and libertarian books, along with the usual offering of investment books current in the market. They have matched the Amazon price for Endgame; but if you are interested, move around their website and pick up a few other things along with my book. http://www.lfb.org/product_info.php?products_id=1014&PromoCode=L401M301

It is time to hit the send button. Daughter Amanda and her husband are in town. I didn't know it when I gave him permission to marry my daughter, but he is a Red Sox fan, and as they open the year with the Texas Rangers at the Ballpark, he finally decided to bring my daughter back to Dallas for a long overdue visit. At least we won the opener today. I see margaritas and talk of baseball and family for the next few hours, with no mention of the worries of the Endgame and deficits. Have a great week!

Your hoping I don't lose too many friends with this letter analyst,

John F. Mauldin

johnmauldin@investorsinsight.com

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/learnmore

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2011 John Mauldin. All Rights Reserved

Note: John Mauldin is the President of Millennium Wave Advisors, LLC (MWA), which is an investment advisory firm registered with multiple states. John Mauldin is a registered representative of Millennium Wave Securities, LLC, (MWS), an FINRA registered broker-dealer. MWS is also a Commodity Pool Operator (CPO) and a Commodity Trading Advisor (CTA) registered with the CFTC, as well as an Introducing Broker (IB). Millennium Wave Investments is a dba of MWA LLC and MWS LLC. Millennium Wave Investments cooperates in the consulting on and marketing of private investment offerings with other independent firms such as Altegris Investments; Absolute Return Partners, LLP; Plexus Asset Management; Fynn Capital; and Nicola Wealth Management. Funds recommended by Mauldin may pay a portion of their fees to these independent firms, who will share 1/3 of those fees with MWS and thus with Mauldin. Any views expressed herein are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest with any CTA, fund, or program mentioned here or elsewhere. Before seeking any advisor's services or making an investment in a fund, investors must read and examine thoroughly the respective disclosure document or offering memorandum. Since these firms and Mauldin receive fees from the funds they recommend/market, they only recommend/market products with which they have been able to negotiate fee arrangements.

Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staffs at Millennium Wave Advisors, LLC and InvestorsInsight Publishing, Inc. ("InvestorsInsight") may or may not have investments in any funds cited above.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.