U.S. March Small Business Survey is Disappointing, Trade Gap Temporary Narrowing

Economics / US Economy Apr 13, 2011 - 05:25 AM GMTBy: Asha_Bangalore

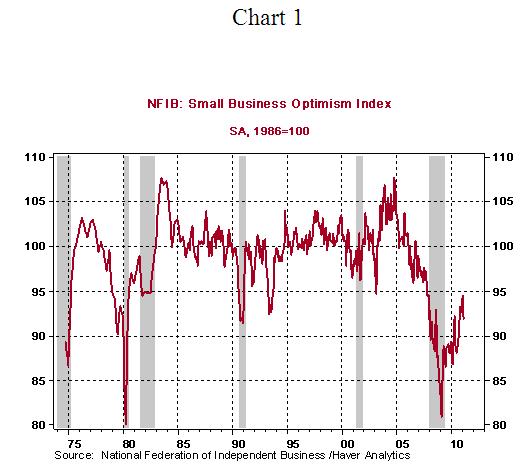

The Small Business Optimism Index dropped 2.6 points to 91.9 from 94.5 in March. The details of the survey are disappointing following an encouraging March employment report of the nation. The composite index registered the second monthly decline in six months.

The Small Business Optimism Index dropped 2.6 points to 91.9 from 94.5 in March. The details of the survey are disappointing following an encouraging March employment report of the nation. The composite index registered the second monthly decline in six months.

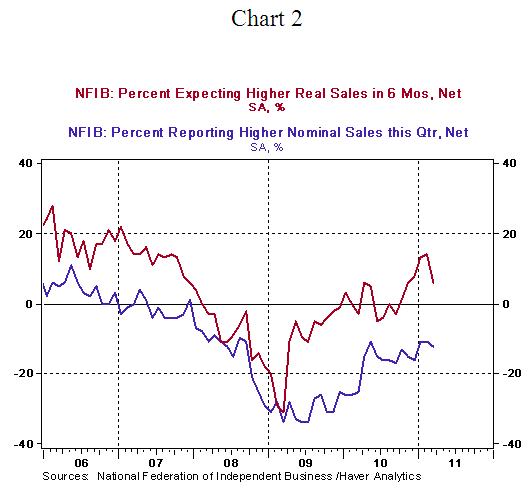

Of the sub-components of the index net responses pertaining to current sales and future sales posted a decline (see Chart 2) which pulled down the composite index.

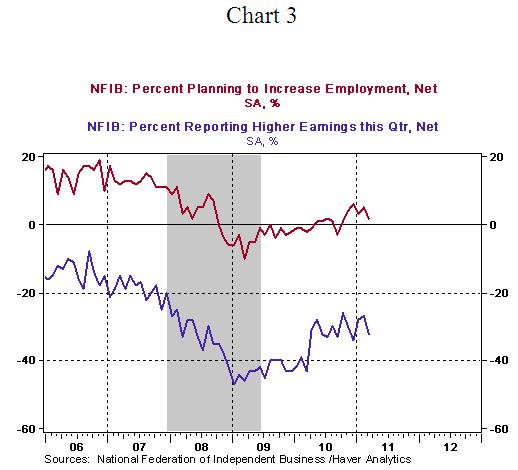

In addition, fewer firms in March reported plans to increase employment (2 vs. 5 in February, Chart 3). The report also indicates that firms experiencing higher earnings had dropped in March compared with February (see Chart 3). The number of small businesses planning to increase capital expenditures in the six months rose in March (24 vs. 22 in February), a piece positive news. The overall tone of the March survey is worrisome given the tinge of optimism that has seeped into market expectations following the 230,000 increase in private sector payrolls and the drop in the unemployment rate during March. The March small business survey results favor the doves of the FOMC in the debate about the future course of monetary policy that is currently underway.

Trade Gap Narrows in February, Widening Likely in March

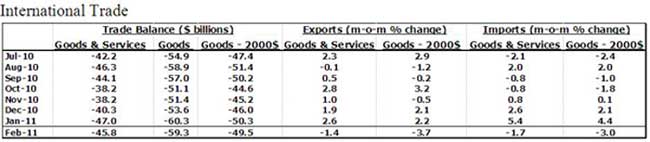

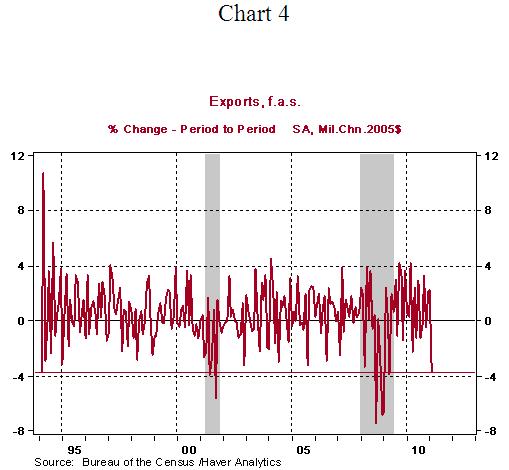

The trade deficit narrowed to $45.8 billion in February from $47.0 billion in the prior month. Exports and imports of goods and services fell in February, with imports posting the larger decline. Exports of goods plunged 3.7% in February, the largest monthly decline (see Chart 4), excluding those recorded during recessions. The January-February trade gap points to a widening of the trade deficit in the first quarter compared with the fourth quarter of 2010. There is a "Chinese New Year" impact (fewer imports due to shutdowns related to the New Year) embedded in this report which implies that a wider gap is likely in March. On net, the trade gap will hold down the headline real GDP reading of the first quarter.

Imports of petroleum fell 7.5% in February, after three consecutive monthly gains. Higher prices for crude oil during March imply a larger imported oil bill for the month and possibly a bigger trade gap if exports fail to provide an offset.

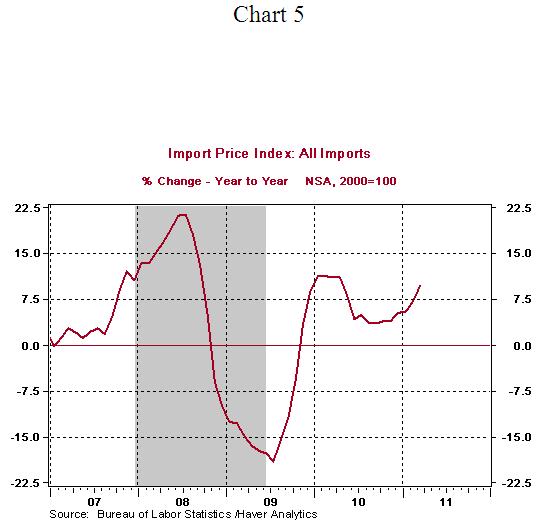

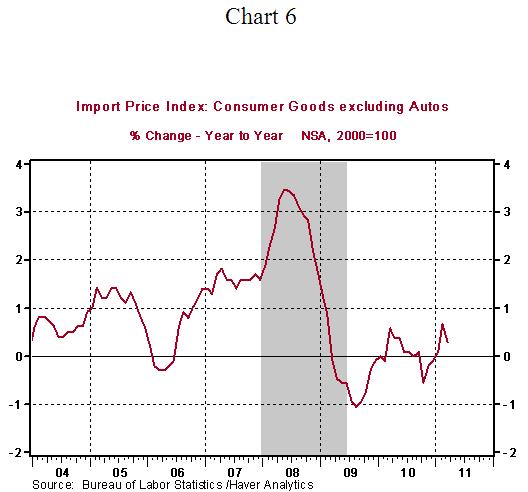

In related news, import prices moved up 2.7% in March, the largest since June 2009 and it reflects a 10.5% jump in prices of petroleum products. There is a great deal of concern about the impact of higher energy prices on core inflation (overall price index excluding food and energy). Fed Chairman Bernanke and Vice Chairman Janet Yellen have both indicated that they view recent higher commodity prices as a "transitory" event. In other words, they will be compelled to tighten monetary policy if higher energy price spillover into prices of non-energy goods and services. Although, the headline import price index (see Chart 5) shows an accelerating trend, prices of imported consumer goods excluding autos fell 0.2% from the prior month and rose only 0.3% from a year ago (see Chart 6), which represents a decelerating trend. These numbers are supportive of the view that import prices excluding energy are contained, for now.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.