Silver Bullion Investors Are Being Hoodwinked by the Futures Market

Commodities / Gold and Silver 2011 Apr 26, 2011 - 07:47 AM GMTBy: Dian_L_Chu

The Silver market is in a bubble stage right now. No one really knows how long this will last, whether Silver goes up another $5, 10, 20 doesn`t really matter for investors who are buying the physical metal in the form of coins because when the bubble ends they are going to be sitting on a depreciating asset.

The Silver market is in a bubble stage right now. No one really knows how long this will last, whether Silver goes up another $5, 10, 20 doesn`t really matter for investors who are buying the physical metal in the form of coins because when the bubble ends they are going to be sitting on a depreciating asset.

Sure, long term, Silver will be worth more sometime in the future compared with the average price of the last 30 years in the next 30 year segment. But Silver prices have risen far too fast in to short of a time for this to be sustainable longer term.

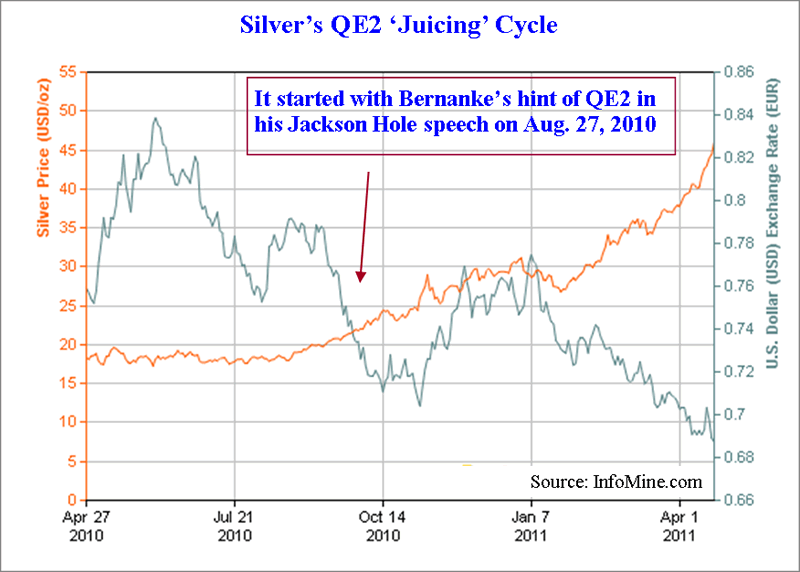

Silver's QE2 Juicing Cycle

For example, wasn`t Silver just $18 an ounce last August 2010? Guess what also corresponded to this same time period, you guessed it--QE2 (See Chart). What happens to Silver prices when QE2 ends? Physical Silver investors have been tricked into buying the physical because of what the speculators are doing in the futures market.

I have news for you, physical buyers, those are not buy and hold investors, and they can go just as quickly as they came. Remember, the futures market is determined by fund flows, and right now there has been a lot of money to be made in a hot commodity market. But markets and especially commodities are very cyclical in nature, and money flows into these instruments during parts of investing cycles, and out during others.

Physcial Buyers Holding The Bag

However, the physical buyers of coins are not looking to flip these investments; they are going to hang onto the physical coins for 5 years or more. Guess what, you have seen how fast Silver can rise, and you probably know that it can fall just as fast. But the one element that physical buyers of Silver are missing is that they are buying at the top of the market at many standard deviations above the average price of the past 30 years.

Miami Condos & Silver

This is a recipe for disaster, and no different than buying Miami condos at the height of the housing bubble. If you’re flipping the condo, and are lucky enough to not get stuck holding the bag is one thing, but to have bought a Miami condo just before prices fell off a cliff is another matter entirely.

Whenever prices of any asset go up this high in such a short time span, it is a bubble, and unsustainable. And no, I am not calling for a top in Silver prices, but what I am saying is that the Silver market is in a bubble, and unsustainable unless a couple of doomsday scenarios happen. Which is always a clue for your investing outcomes, if you need a doomsday scenario to have a long term profitable trade that you’re going to hold for five years, then you really are putting on a low probability trade.

Bought at The Top of The Market

The bigger problem with buying at or near the top of the Physical Silver market is that the US is in an unprecedented low interest rate environment. What happens when interest rates go back to their historical averages? They were just 5.25% less than 5 years ago, what happens in the next 5 years when interest rates go back up? What do you think is going to happen to the value of your physical Silver coins? They are going to depreciate in a steady but sure fashion.

Worse Than the Housing Bubble

In short, because you bought so much above the 30 year average price for the physical market, your asset will depreciate, and be heavily under water once the next rate tightening cycle begins. And we are not talking about a little under water. Your under water will make Miami condos look good by comparison.

You think there was a housing bubble? Compare your asset to a house, and look at the precipitous drop to those assets. You cannot even live in your depreciating asset. My advice to any purchasers of the Physical metal is to sell while prices are still going up, before the futures market busts.

Remember The Past Bubbles

Don`t get tricked by Wall Street momentum traders who will bid up any kind of asset if they think they can profit from it. Remember, how hot housing stocks were? Remember those Nasdaq Dot Com stocks, where every day another new internet company was doing an IPO even though they had no proven revenue streams? Does that sports streaming venture that Mark Cuban sold yahoo come to mind?

Bubbles exist in markets; traders take advantage of them, while bag holders pay the price. I bet yahoo wishes they could undo that trade, Time Warner wishes they could have a “do-over” on that AOL partnership.

US Is No Greece or Japan

Yes, there are a couple of scenarios where holding the physical Silver might be profitable 5 years from now. If the US goes into default, a very unlikely scenario, given our incredible resources, and the fact that when we get serious about cutting the budget, with even a modicum of discipline we will be fine. We spend like drunken sailors, and that can be fixed.

The real problem is if you can`t produce revenue, and the US has only scratched the surface of producing technological innovation, which means we have a lot of revenue generating capabilities. A lot of countries cannot say the same, the US isn`t Greece. The US doesn`t have an aging demographics problem like Japan either.

The US has a spending problem, if worse comes to worse the US will just have to cut back on military spending, and with how far we are ahead of every other country in terms of military spending and expertise, there is a lot of budget tightening room to spare in that area and many other areas. When push comes to shove the US will get their fiscal house in order.

Dollar Devaluation Will Be Limited

Now, on to the other commonly referred to doomsday reason for holding physical Silver. The age old Dollar devaluation argument. Well, I have news for you Silver bugs, all currencies around the world are devalued with time. But the US Dollar is not going to be any more devalued than it was last year when QE1 ended, and the Dollar Index was in the 80s.

US Is No Zimbabwe Eithter

The currency fluctuates depending upon several factors, but Silver investors are taking a very low period in the dollar, and extrapolating this level of detioration pace forward for the next 5 years. It doesn`t work that way, unless you are Zimbabwe. The US may be a lot of things, but it isn`t Zimbabwe, and you shouldn`t base investment decisions comparing the most successful Business Country in the world to a country the size of Zimbabwe.

Carry Trade Unwind

Remember, the US Dollar is temporarily being used by the "Risk On" Carry Traders to go long assets, and short the dollar, thus artificially making the dollar weaker than it really is. When they unwind this trade guess what the US Dollar will start rising again. Remember last summer, what do you think will happen to Silver prices when Gold starts selling off because the US Dollar is getting stronger?

Yes, the US Dollar will lose its value to some degree, this is why a coke used to cost 35 cents at one time, and now it is over a dollar. But this is a normal rate of depreciation over several decades. And not the rate of depreciation being currently priced into the physical Silver market.

Physical Silver - Pros & Cons

Just remember the pressures pro and con for the physical Silver trade:

- A low interest rate environment – Not going to be this way in 5 years

- The 30 year average price of Silver versus the current price of Silver

- Investment fund flows now versus a portion of these same funds being applied to different markets, say real estate in 5 years

- The US Fed versus Global Monetary Policies: What happens when the US starts tightening, and China and India are done tightening? The monetary policy gap starts to narrow.

- These high Silver prices will bring a lot of the “precious metal” online; will there be a glut of physical Silver on the market once prices start to drop?

- Do assets that have this meteoric rise in price? Is it usually sustainable longer term?

- Do our financial markets have a long and storied history of unsustainable prices, i.e., bubbles?

- Are there more attractive markets for value at this point then buying Physical Silver from a valuation standpoint?

There's Time To Buys

It makes no rational investing sense to buy Physical Silver during a low rate environment, because the investor will be stuck with a well under water investment in a 5% rate environment. The time to buy Physical Silver was when the Fed Funds Rate was 5.25%, and the time to sell Physical Silver is now during the last vestiges of an equivalent Zero Fed Funds Rate.

QE2 Induced Irrational Investing

This irrational investing in the Silver Market, based upon concerns regarding the long term stability and security of the US Dollar, is one of the unintended consequences of the QE2 Initiative. And much of this irrational investing in the Silver Market will reverse itself once QE2 is finished, and the US Dollar strengthens.

Silver & Subprime - No Difference To Wall Street

I am not trying to rain on anybody`s Silver parade. And who knows where the top is in Silver. But don`t get caught up in the hysteria of another Wall Street trade. Remember, the Silver market is just another trade for Wall Street. They don`t have any special affinity for this shiny metal, any more than they had for subprime mortgages, and when the writing was on the wall, they packaged these assets up, and pawned them off to other bag holders.

The Silver market will be no different, when they are done with this trade, they will run from this market faster than they came. And if you bought physical Silver based upon the meteoric price rise occurring in the futures market, you may end up having an asset that declines in value by more than half what you originally bought it for. So you can buy a Silver American Eagle for over $50 today, and have it be worth less than $20 in the future.

This is the epitome of a bad investment. You’re supposed to buy low and sell high, not the other way around. Remember, you are an investor not a trader if you’re buying the Physical Silver Coins. Thus you have to be a “Value Investor”. And I am here to tell you there are no ‘Values’ in the Physical Silver Market, or any other Silver Market for that matter.

Dian L. Chu, M.B.A., C.P.M. and Chartered Economist, is a market analyst and financial writer regularly contributing to Seeking Alpha, Zero Hedge, and other major investment websites. Ms. Chu has been syndicated to Reuters, USA Today, NPR, and BusinessWeek. She blogs at http://www.econmatters.com/.

© 2011 Copyright Dian L. Chu - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.