U.S. Trade Deficit Widens on Higher Oil Prices In March

Economics / US Economy May 12, 2011 - 04:28 AM GMTBy: Asha_Bangalore

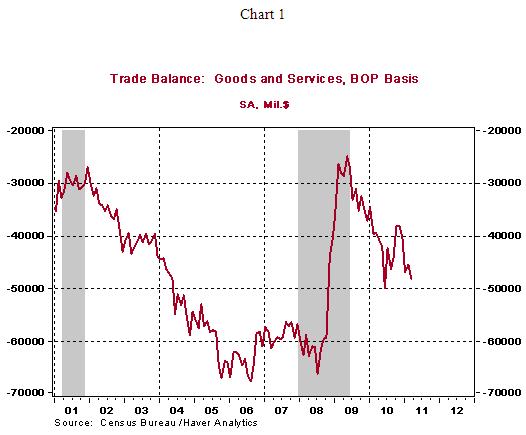

The trade deficit widened to $48.18 billion in March from $45.44 billion in the prior month. Nominal exports (+4.6%) and imports (+4.9%) of goods and services advanced in March. In real terms, exports of goods grew 4.8%, while that of imports moved up 3.7%. Effectively, the real trade deficit of goods widened only slightly (%50.1 billion vs. $49.3 billion in February. For the first quarter, the real trade deficit of goods stands at $49.9 billion compared with $45.5 billion in the fourth quarter. The first quarter trade deficit is slightly smaller than the assumption included in the advance estimate of first quarter GDP, implying a small upward revision. The net impact on GDP will be determined by retail sales and inventories numbers to be published on May 12.

The trade deficit widened to $48.18 billion in March from $45.44 billion in the prior month. Nominal exports (+4.6%) and imports (+4.9%) of goods and services advanced in March. In real terms, exports of goods grew 4.8%, while that of imports moved up 3.7%. Effectively, the real trade deficit of goods widened only slightly (%50.1 billion vs. $49.3 billion in February. For the first quarter, the real trade deficit of goods stands at $49.9 billion compared with $45.5 billion in the fourth quarter. The first quarter trade deficit is slightly smaller than the assumption included in the advance estimate of first quarter GDP, implying a small upward revision. The net impact on GDP will be determined by retail sales and inventories numbers to be published on May 12.

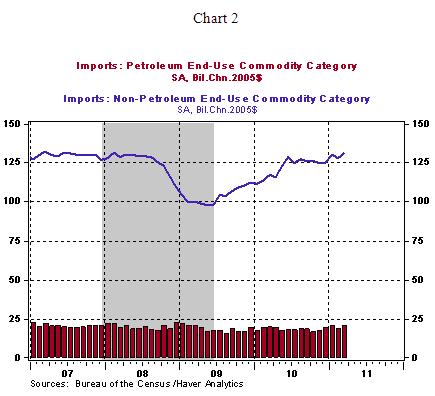

The U.S. purchased $35.7 billion of energy goods in March, up from $27.2 billion in the prior month, which raised overall imports in April. Excluding petroleum items, imports moved up 2.5% in March vs. a 2.0% drop in the prior month. Details of the report show that imports of capital goods excluding autos (+4.1%) and autos (+10.7%) posted noticeable gains, while imports of consumer goods excluding autos (-4.2%) in March. U.S exports of consumer goods excluding autos (+4.8%), capital goods excluding autos (+2.5%), and autos (+15.5%) advanced in March.

The trade deficit with China narrowed to $18.1 billion during March vs. $18.8 billion in February. The trade deficit widened vis-à-vis Mexico, Euro area, and Japan but held steady vis-à-vis Canada.

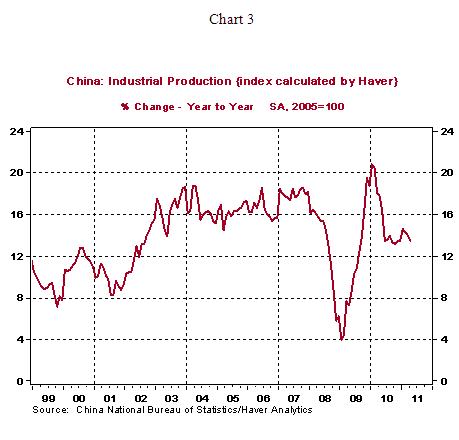

Industrial Production in China: Decelerating Trend Bodes Poorly for Global Economy

Industrial production in China grew 13.4% in April on a year-to-year basis which is part of the decelerating trend seen in the last three months (see Chart 3). Prior to the onset of the global financial crisis, factory production advanced upwards of 16% during 2003-2007. China is the world's largest consumer of copper. The disappointing April industrial production data led to a decline in copper prices today, with intra-day readings close to levels seen in December 2010. Prices of several metals closed at lower levels today compared with prices yesterday following the report from China. Soft growth in China will translate into a headwind for economic growth in the rest of the world.

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.