Central Bankers vs. Natural Stock Market Cycles in 2012

Stock-Markets / Stock Markets 2012 Dec 28, 2011 - 08:24 AM GMT

Government fiscal policy and central bank monetary policy have the specific goal of stamping out the business cycle. Governments have been intervening in the economy and financial markets with fiscal policies for thousands of years. Central banking, at least its current form of the last one-hundred years or so, offers more sophisticated and less transparent methods of intervention including interest rates, quantitative easing (QE), reserve requirements, currency swap lines, bank loans, etc. Use of these tools has risen sharply in recent decades, but they have never really worked. It is time to realize that business cycles and their accompanying market cycles are natural forces that are here to stay.

Government fiscal policy and central bank monetary policy have the specific goal of stamping out the business cycle. Governments have been intervening in the economy and financial markets with fiscal policies for thousands of years. Central banking, at least its current form of the last one-hundred years or so, offers more sophisticated and less transparent methods of intervention including interest rates, quantitative easing (QE), reserve requirements, currency swap lines, bank loans, etc. Use of these tools has risen sharply in recent decades, but they have never really worked. It is time to realize that business cycles and their accompanying market cycles are natural forces that are here to stay.

The global business cycle keeps ebbing and flowing like the ocean tides, or seasons of the year. It is becoming increasingly clear that market cycles are forces of nature, governed by natural law. Unfortunately, if governments could stop the natural winter season they would probably try, and the earth would burn up. It is possible that such efforts to stop the natural business cycles will, in a manner, burn up the global economy. In fact, that is what it looks like is happening.

Since 2008, fiscal and monetary interventions have risen exponentially with trillions in dollars, euro, yuan and other currencies deployed to stop the business cycle. These amounts are growing relative to the size of the global economy and financial markets. The clear objective is to stop the business cycles and prevent GDP from going negative. What is the good of intervention that delivers positive GDP when it is funded with more debt than the GDP it generates? Especially when the debt has to be paid back with interest by those that do not benefit from the borrowed funds? Maybe negative GDP that shakes the tree, like a good winter storm, and knocks down the dead branches will actually save the tree in the end.

The fiscal and monetary authorities have recently upped the intervention ante. Unfortunately, they tend to believe cycles come only in the business cycle size, but cycles come in many shapes and sizes. Politicians and central bankers do not recognize that it is more than just the downturn of the business cycle they are fighting. The unacknowledged long wave decline and long wave winter season, several cycle sizes larger than a regular business cycle, are stunting global growth and thwarting attempted fiscal and monetary interventions.

Intervention does not work for many reasons. Only real profits and losses that are not insured or back stopped by taxpayers provide legitimate feedback and signals for future economic and financial action and the next cycle of sustainable economic and job growth. Intervention raises the stakes and increases systemic risks down the road in the next cycle, or makes the downturn of the larger long wave cycle longer and even more destructive than it has to be.

Cycles provide the success and failure feedback loops that inform investors, bankers, savers, capitalists and entrepreneurs regarding the difference between good ideas and bad ideas. Markets price ideas and tell you what they are really worth. Intervention distorts these critical feedback loops. If bad ideas and bad debt investing are rewarded, and correct thinking is punished, it tends to muck up the gears of business, global economic progress stalls and the true function of markets fail to be realized.

Tracking market cycles for investors and traders has historically presented challenges, even during periods of relative prosperity and free market conditions. When aggressive fiscal and monetary policy intervention seeks to counter or even reverse the natural cyclical forces in play, absorbing larger swaths of global resources and economic activity, they require serious consideration for their role in the expansion and contraction of market cycles.

Fiscal and monetary policies have both been playing larger roles in recent years than they have historically. Intervention appears to have pushed a culmination of the business cycle and long wave into a global 2012-2013 transition period that will set the stage for the future of the global economy and financial markets. It is only fair to point out that even John Maynard Keynes advocated governments running surpluses and salting away a bit of savings when times are good, so that when the inevitable rainy days come the government could provide a bit of demand.

The lack of political backbone has produced perpetual deficits and trillions in stimulus often done in his name would likely be shocking for Keynes. The current stage of unfolding global fiscal and monetary disasters under the guise of government management of economic affairs and financial markets would likely be disturbing for Keynes. Hayek on the other hand would not likely be the least bit surprised by the mess the politicians and their central bank enablers have made of things.

Clearly, over the top fiscal and monetary intervention, such as $645 billion in three-year ECB bank loans replacing one-year loans that were facing imminent contagion and loss, and the $700 billion in TARP program have an impact on the cycles. Such policies temporarily expand the cycles, making them longer. Easing actions by the Bank of China (BOC) have only added to the market cycle distortions. The recent action of the ECB that refinanced over 500 banks no doubt expanded this business cycle, so the low will be pushed out to a later date than it otherwise would have been. It could even have delayed the long wave low, and those lows may be lower than they otherwise would have been, at least on an inflation-adjusted basis.

Fiscal and monetary intervention is a type of risk management that attempts to stop the natural occurrence of business cycles and their accompanying market cycles. It really just rewards failure. The outcome of human action and decision-making and the feedback loops they produce drive prices in the complex system of the global economy and financial markets. It is the dynamic ebb and flow of individual and collective human actions that produces what we recognize globally as market cycles.

Market cycles, large and small, are actually healthy forces of creative destruction, guiding human action and market participants. In the end, intervention makes market cycles worse than they would be if allowed to unfold naturally. Intervention is like an overused pesticide that eventually poisons the fertile soil of human potential. Intervention is Newtonian mechanics applied to quantum fields of dynamic human action. It does not work in the end.

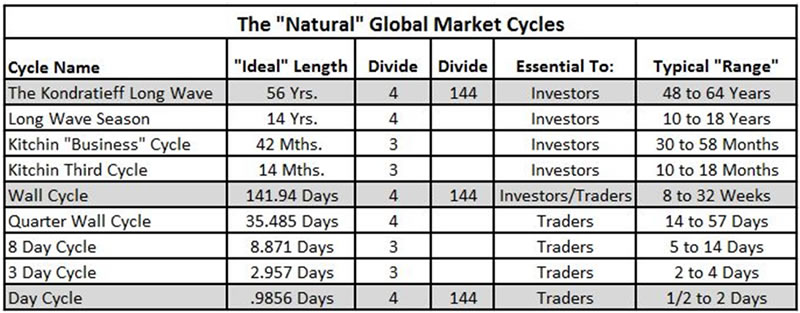

The following table lists the natural cycles in markets discovered by PQ Wall. The natural cycles are produced by human action and are governed by market cycle dynamics. Cycles fluctuate around their ideal lengths, determined partially by the amount of fiscal and monetary intervention that distorts the cycle fields. Fiscal and monetary interventions are attempting to eradicate these cycles. History has demonstrated that they will not succeed, so tracking the natural market cycles is critical for investors and traders.

Price (Fibonacci), time (cycles) and sentiment (stochastics) allow for market cycle tracking. The Wall cycle is the most important global cycle for investors and traders. It is also known as the 20-week trader’s cycle, but it was rechristened the Wall cycle in my 1995 book, The K Wave. There are nine Wall cycles in every Kitchin (aka business) cycle.

The bottom of Wall cycle #6 in the current business cycle is coming up. Intervention in the form of coordinated dollar swap lines from six central banks and ECB bank loans has juiced the current Wall cycle a bit and bought some time. Oversold Wall cycle swing lows provide an opportunity for value and growth investors to buy at better prices. Overbought Wall cycle swing highs provide opportunities to take profits and reallocate portfolios.

Bad risk management, in the form of fiscal and monetary intervention, shifts the cycle risks onto innocent parties and can actually make systemic risks grow larger than it would if natural human interactions in markets were allowed to take their course. In many respects, fiscal and monetary intervention is for the expressed purpose of mitigating, or at least attempting to mitigate, the consequences of bad decisions. It socializes losses in a manner that is not readily apparent.

Intervention that promotes the privatization of profits and socialization of losses cannot go on forever. Intervention transfers risks onto others that did not take the risks and should not have to pay for failure. Typically, intervention transfer risks to those that can least afford to pay for the consequences. This may make the bottom of the cycle lower when it comes, and/or slow down the advance of the next cycle.

By attempting to control and mitigate risks in the present, the risks grow larger from intervention and are magnified in future systemic failure. The artificially low interest rates and aggressive housing lending in the early 2000s, which also sought to counter the risks of an economic slowdown, did not remove any risk from the system. It pushed the risk into the future, creating the housing bubble. It actually greatly increased the risks to the system. The attempt to manage the risks only multiplied the risks and pushed them into the 2008-2009 financial crises and the end of an unusually long business cycle. Now the interventionists have doubled down.

The year 2012 will be a year of important market cycle turns, so do not be caught on the wrong side of the global market cycles. Tracking market cycles keeps you ahead of the market, and aware of how fiscal and monetary intervention distorts the market and postpones the natural outcome. Cycles are global forces of human action. The same cycles in the S&P 500 are evident in the DAX, FTSE, CAC, SMI, SSEC, Nikkei, ASX, etc. Market cycles are natural global forces and represent collective global human action.

A new global long wave spring season is coming. However, all the global fiscal and monetary interventions may delay the next cycle by socializing losses with welfare for Wall Street and bankers around the world. Intervention is training a generation of bankers that there is no such thing as a bad bet or a bad debt. This is a tragic move.

The interventionist in governments and at the Fed, ECB, BOJ, BOC, etc. appear to see it as their role to make bad debts good and transfer the risks of bad debts, investments and decisions onto the backs of pensioners and other innocent parties. This distorts but does not stop the cycles.

Intervention has shifted a great many risks to the end of the current business cycle and long wave in late 2012-2013. Investors and traders have to mange the cycle risks, and the risks of fiscal and monetary intervention that does not recognize nor understand the natural forces they are attempting to control. The natural cycles will have their way in 2012, one way or another, even if the politicians and central bankers try to mask them with inflationary interventionist policies.

David Knox Barker is a long wave analyst, technical market analyst, world-systems analyst and author of Jubilee on Wall Street; An Optimistic Look at the Global Financial Crash, Updated and Expanded Edition (2009). He is the founder of LongWaveDynamics.com, and the publisher and editor of The Long Wave Dynamics Letter and the LWD Weekly Update Blog. Barker has studied and researched the Kondratieff long wave “Jubilee” cycle for over 25 years. He is one of the world’s foremost experts on the economic long wave. Barker was also founder and CEO for ten years from 1997 to 2007 of a successful life sciences research and marketing services company, serving a majority of the top 20 global life science companies. Barker holds a bachelor’s degree in finance and a master’s degree in political science. He enjoys reading, running and discussing big ideas with family and friends.

© 2011 Copyright David Knox Barker - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.