U.S. Dollar Foreign Currency Pairs Analysis

Currencies / Forex Trading Jan 09, 2012 - 04:28 AM GMTBy: Tony_Caldaro

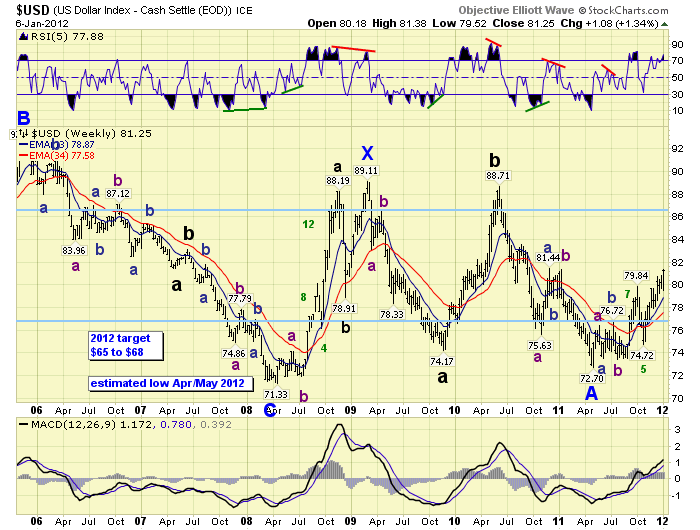

As we noted in the most recent weekend update, there have been some developments in the long term Secular/Supercycle patterns of the currencies. As you are aware, the USD Secular trend, or Supercycle if you will, has been bearish against most foreign currencies since 1985. We have reason to believe this ended at the 2011 price low of 72.70 DXY. The USD should now be in a Secular bull market. Initial estimates suggest the DXY should reach 140 by 2018.

As we noted in the most recent weekend update, there have been some developments in the long term Secular/Supercycle patterns of the currencies. As you are aware, the USD Secular trend, or Supercycle if you will, has been bearish against most foreign currencies since 1985. We have reason to believe this ended at the 2011 price low of 72.70 DXY. The USD should now be in a Secular bull market. Initial estimates suggest the DXY should reach 140 by 2018.

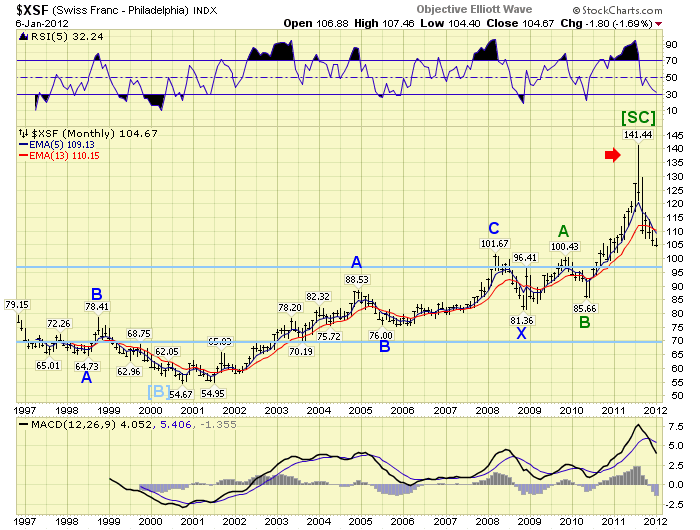

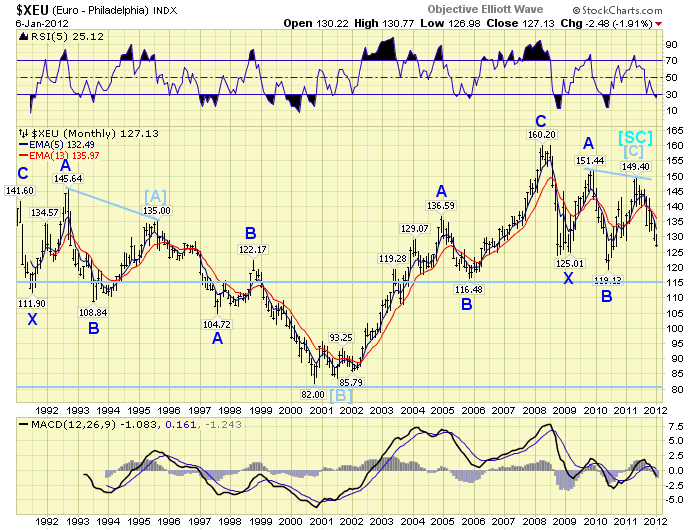

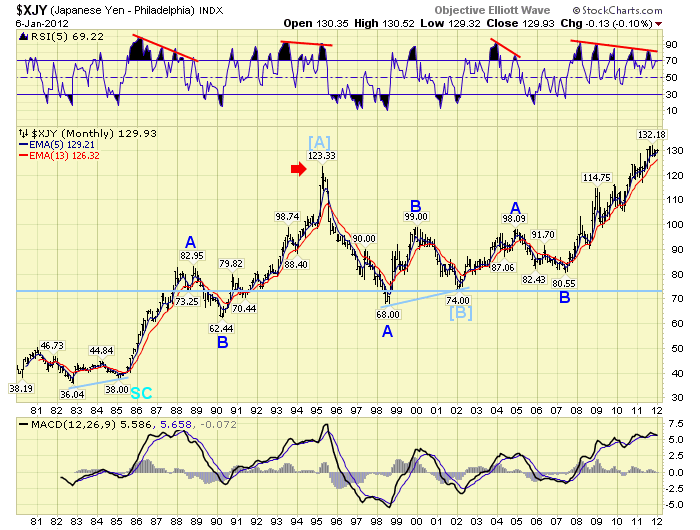

In our last report, we detailed how the 17 year cycle appeared to be peaking with a blowoff top in the CHFUSD pair. The CHFUSD is our bellwether for the currency cycles. We also illustrated the CADUSD was peaking right at our targeted zone of 1.06, and the JPYUSD pair was nearing our targeted zone of 1.33. The CHFUSD blowoff looked similar to the JPYUSD blowoff top in 1995, which also ended a Cycle wave. 1995 completed a Cycle wave [A], and 2011 completes a Cycle wave [C] and the total Supercycle wave since 1985. See EURUSD chart below. Long term currency waves move in ABC’s.

In the past few weeks the USD has confirmed an OEW long term uptrend, and the EURUSD an OEW long term downtrend. This confirms our previous analysis and we expect most foreign currencies will be declining against the USD for the next seven years. Now to the specifics.

The CHFUSD pair peaked in 2011 at 141.44. Since then it has declined steadily and is currently around 105. With the Supercycle top completed, as noted on the chart, we expect the CHFUSD to continue to decline until it hits around 96 this year. Then we should see a bear market rally to around 118-120 during 2013. After that a decline to around 70, or lower, into 2018. These two support levels are noted on the monthly chart by blue lines.

The EURUSD pair peaked in 2008 at 160.20. Since then it completed another set of ABC Primary waves with lower and lower highs. This is somewhat similar to the price action in the 1990′s. With a long term downtrend now confirmed in this pair, we expect the current decline to continue until it hits around 116. A bear market rally should follow at that point into the 129-133 range by 2013. After that a decline to around 82, or more, into 2018.

The USD/DXY bottomed in a Primary wave A in 2011 at 72.70. With the long term uptrend now confirmed we expect the DXY to rally to around 87 in 2012. After that it should decline, with the bear market rallies in the CHF and EUR, to around 77 in 2013. Then we expect a massive shift out of all foreign currencies and commodities into the USD. This USD bull market should continue for about five years as the DXY hits 140, or more, in 2018. During this 2013-2018 time period there could be a reorganization in the Eurozone, and/or a resetting of the world’s currencies. The USD, and then USD denominated assets should be in great demand between 2013-2018.

The JPYUSD pair appears to have topped at the recent 132.18 high. Thus far, it has not declined much while the CHF and EUR have headed lower. This appears somewhat similar to the early bull market waves after the last Supercycle low in the USD in 1978. Then the JPY and CHF were declining while the DMK and GBP held steady. The USD/DXY rose during the first year after the low, but the rally was kept in check by the DMK and GBP. This time around, it appears, the JPY, GBP and CAD are keeping the DXY in check during its first rally. In 2011 the CHFUSD appeared to be the most overvalued currency in the world. In 2012 the JPYUSD appears to have that distinction. When this pair does start to breakdown we’re expecting a price low of around 74, or lower, before 2018.

CHARTS: http://stockcharts.com/...

http://caldaroew.spaces.live.com

After about 40 years of investing in the markets one learns that the markets are constantly changing, not only in price, but in what drives the markets. In the 1960s, the Nifty Fifty were the leaders of the stock market. In the 1970s, stock selection using Technical Analysis was important, as the market stayed with a trading range for the entire decade. In the 1980s, the market finally broke out of it doldrums, as the DOW broke through 1100 in 1982, and launched the greatest bull market on record.

Sharing is an important aspect of a life. Over 100 people have joined our group, from all walks of life, covering twenty three countries across the globe. It's been the most fun I have ever had in the market. Sharing uncommon knowledge, with investors. In hope of aiding them in finding their financial independence.

Copyright © 2012 Tony Caldaro - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.