The Destruction of Savings by Inflation

Personal_Finance / Inflation Feb 18, 2012 - 01:23 PM GMTBy: Submissions

Alasdair Macleod writes: In the past, insurance companies and pension funds have been keen to advertise the benefit of compounding arithmetic for savings. Over the last 30 or 40 years the rate has been lifted by inflation, but to understand the cost inflation brings you have to consider the whole savings cycle: not just the accumulation stage, but also annuity values in retirement. Furthermore, the historical experience of a typical working life should be compared with a theoretical sound-money alternative.

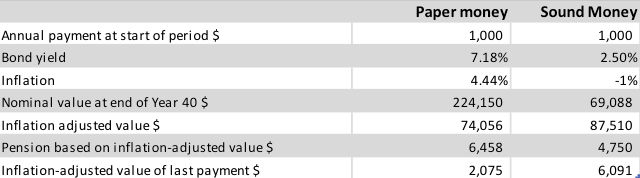

Let us assume a man works for 40 years, during which time he invests a fixed amount annually. This is invested mostly in bonds for a return that gives him a lump sum on retirement. The marketing folk stop at that point, but we shall go on. This lump sum is applied to an annuity to give a fixed income for the retiree’s life expectancy. Let us also assume that $1,000 is invested annually, and we shall use the average return on the 10-year US Treasury bond as our yardstick. The result is shown in the table below under the heading of Paper Money.

The nominal value of our pension-pot on retirement is an attractive $224,150, but during its accumulation price inflation has averaged 4.44%, so its inflation-adjusted value is only $74,056, implying that the difference ($150,094) is a hidden inflation tax, leaving our saver with only one-third of his savings in real terms.

Assuming the lump sum is then turned into an annuity at a continuing bond yield of 7.18% for a retirement of 25 years, this inflation-adjusted figure gives an annual income of $6,458, and if inflation continues to average the historic rate, the final payment will only be worth $2,075 in inflation-adjusted terms. Note how the purchasing power of the annuity falls over time while our retiree’s health and care expenses can be expected to increase when he can least afford them.

The reason for taking inflation out of the equation is so we can compare the inflationary past with a sound-money alternative. This calculation is dramatically different under the reasonable assumptions in the table’s last column: an average bond yield of 2.5% and price deflation of 1% annually. The deflation-adjusted outcome is significantly better than the paper-money example. Furthermore, the purchasing power of the annuity increases, in tune with the health and care needs of an aging retiree.

Our example is simplistic: bond yields have varied hugely since 1971, and we have ignored management fees and taxes. We have not considered bond yields that are exceptionally low today, so annuities taken out now will yield considerably less than our example shows.

The bottom line is the saver is impoverished by inflation to a greater extent than generally realised. The state has benefited from the transfer of wealth from its citizens’ savings, the result of monetary inflation, but at considerable future cost. The state is left with the welfare, health and care costs for an aging population unable to support itself and with an increasing life expectancy.

The cost of looking after growing numbers of impoverished retirees will become apparent in coming years, increasing government deficits more rapidly than expected. What we don’t know is when the markets will reflect the enormity of these future obligations.

Alasdair Macleod runs FinanceAndEconomics.org, a website dedicated to sound money and demystifying finance and economics. Alasdair has a background as a stockbroker, banker and economist. He is a Senior Fellow at the GoldMoney Foundation.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.