NHS Baldrick Cunning Plan to Export Best Doctors Abroad to Treat Foreign Patients

Politics / NHS Sep 05, 2012 - 02:49 AM GMTBy: Nadeem_Walayat

The latest cunning plan out of the NHS high command / coalition government is for Britains best and brightest doctors and consultants to set-up 'NHS' hospitals abroad at huge tax payer expense to treat foreign patients under the illusion that this will generate profits that will be reinvested into the UK NHS.

The latest cunning plan out of the NHS high command / coalition government is for Britains best and brightest doctors and consultants to set-up 'NHS' hospitals abroad at huge tax payer expense to treat foreign patients under the illusion that this will generate profits that will be reinvested into the UK NHS.

Leaving aside the fact that the whole point of the NHS is that it is supposedly free at the point of delivery (though in real patient experience that is no longer the case as many patients are being forced to pay for routine GP referrals). However the fundamental flaw in this initiative is that the policy assumes that a uncompetitive, badly managed bloated socialist institution such as the NHS will be able to make any profits at all from treating patients abroad. For some reason those in charge of policy assume that they will be able walk into what are already a highly competitive capitalist market places and apply their doctrine of a socialist tax payer funded bottomless funding black hole insitutional organisation. The NHS track record speaks volumes where countless money saving reforms have been announced in the past all resulting in costing the tax paying public far more for less service as illustrated by the Labour parties disastrous 2002-2003 GP contracts that sent annual GP pay rises soaring into the stratosphere, culminating in pay rises of more than 30% per annum, whilst GP's cut back on hours worked.

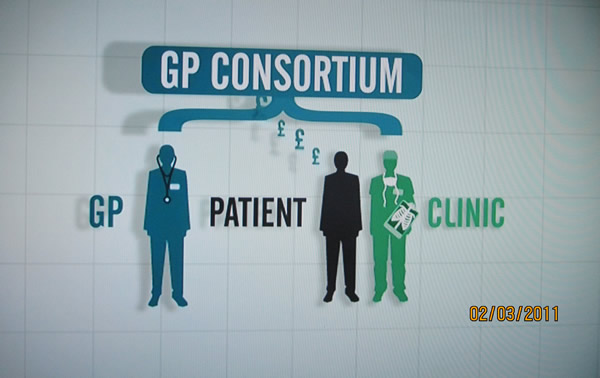

The latest coalition government reforms for GP consortia to take control of the NHS commissioning budgets are also resulting in a similar disastrous outcome of worse service at more cost as the Channel 4 investigation revealed :

NHS GP Doctors Putting Profit Before Patient Care, Channel 4 News Investigation

During 2011 a Channel 4 News investigation charged NHS Doctors with the subversion of the the coalitions governments NHS reforms to result in NHS doctors pocketing all of the cash saved as a consequence of the NHS reforms, which matches my own analysis of a year earlier that the Coalition Governments proposed reforms were fatally flawed in that they allowed GP's to profit from patient care.

"Your doctor making a profit out of your health care, your GP Sending you to a clinic that he or she owns shares in, we are seeing the biggest shake up of the NHS in its history, Channel 4 news can reveal tonight that there is nothing on the legislation currently before parliament to prevent the outcome no one wants, doctors putting profit before the care of patients, in our special report tonight we show how the new arrangements will create fundamental conflicts of interest potentially harming the trust at the very heart of the doctor patient relationship". Channel 4 News

Channel 4 News investigation key points:

- Serious flaws in the Governments NHS reforms legislation, it's failure to protect patients against fundamental conflicts of interest, it allows GP's to put profit before patient care.

- All of the monies saved will go into the pockets of NHS GP's and doctors.

- GP's during patient consultations factoring in the profit they will make on their diagnoses.

- GP's referrals on the basis of how much commission they will earn from the heath institution.

- GP referrals to health clinics that the GP's own shares in.

- New private health clinics being set up with a view to making profits so that they can floated onto the stock market at huge profit for share holding GP's

- GP's get access to dip their hands into the annual £80 billion pot of money meant for patient care.

- GP's draw up the rules themselves on the conflict of interest, akin to writing 100 times, "I promise, I will not fiddle the patients"

Under the previous Labour government patients were treated as credit cards to swipe in and out of door ways as fast as possible to maximise profits. Under the Coalition government patients will now become cash cows to milk to the fullest extent possible, what's best for the health of patients won't even factor into the thought process during GP consultations - "If I send Patient X to Clinic Y for Operation Z, my consortia will earn a commission of £2,000".

Sheffield NHS GP Consortia's Example

The city of Sheffield illustrates how the implementation of Coalition government reforms is proving to result in the exact opposite anti-competitive consortia's, as virtually all of the Sheffield NHS 92 GP Practices have signed up with one of of 4 geographically located GP Consortia's.

- Central Sheffield Consortium

- HASC ( Hallam & South Consortium)

- North Sheffield Consortium for Health

- Sheffield West Consortium

The NHS GP reforms being implemented are pushing towards the worst of both worlds, i.e. no market competition and unprecedented GP control over NHS funds that in significant part will be funneled into the back pockets of NHS GP's via Consortia profits being paid out as dividend to GP partners and eventual huge windfall profits as consortia's are floated onto the stock market.

Socialist NHS Cannot Compete Against Capitalist Multi-nationals

The new initiate amounts to Britain's best doctors being allowed to market their skills to foreign institutions with a view to being head hunted by foreign health service providers all at tax payers expense, and it is only those that foreign health services don't want that will return to NHS UK. The net result is for an officially sanctioned NHS brain drain that tax payers are funding, just as incompetent politicians in the past and present have already been duped by highly intelligent doctors into programmes that financial benefit GP's to the detriment of patient's as the above examples illustrate.

Therefore the NHS is virtually guaranteed NOT to make a single penny in profit but incur huge additional costs for entering new markets and all without any expertise of running profitable competitive businesses, but also in the few instances where the NHS is seen to succeed then the far more competitive private sector multinationals will soon head hunt whole units of high achievers and incorporate them into their own enterprises, leaving behind second rate NHS institutions that will be further undermined and thus result in making ever increasing losses right upto the point where a future government scraps the loss making NHS export programme and brings home those that no one wants to employ, back to work in the UK. Meanwhile the UK NHS patients will find that they will be on ever expanding waiting lists and seen by less able and competent remaining UK doctors, just as patients of NHS GP's are increasingly experiencing being seen by what amount to worthless Locum GP's as privately contracted GP healthcare centres operating as local monopolies cut costs to maximise profits at expense of patient healthcare.

Source and comments - http://www.marketoracle.co.uk/Article36354.html

By Nadeem Walayat

Copyright © 2005-2012 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 25 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of three ebook's - The Inflation Mega-Trend; The Interest Rate Mega-Trend and The Stocks Stealth Bull Market Update 2011 that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 600 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.