Financial Service Shares Turned Significantly Lower Today

Stock-Markets / Banking Stocks Feb 07, 2008 - 12:09 PM GMTBy: Richard_Gorton

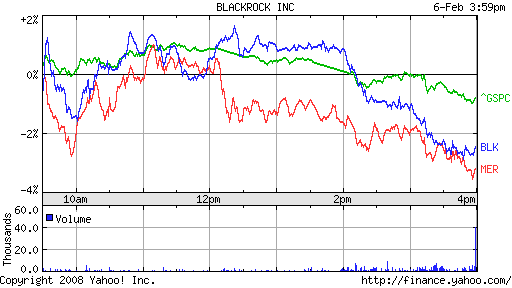

Shares Of Investment Risk Manager Blackrock Fall Significantly Lower

Blackrock, BLK, is one of wall street's premier risk management and financial services companies with over 1.3 trillion dollars in assets under management.

Blackrock turned much lower, in late afternoon trading, falling 2.42%.

Blackrock turned lower on the very day TheStreet.com's Real Money author John Reese wrote: ' BlackRock Looks Solid as a Rock '. He relates: "BlackRock is a major player in the money management field, a market that seems destined to grow as baby boomers acquire assets and need help managing them for their retirement. It has a sterling reputation and is also willing to grow via acquisitions. If you have ever wondered what to do with your money, you can appreciate the potential of BlackRock".

Here is the Yahoo Finance 1 day chart of Blackrock and Merrill Lynch, MER, another Wall Street financial linchpin, plotted against the S&P.

Did insider and/or public concern over financial exposure to the bond insurers AMBAC and MBIA cause Blackrock's And Merril Lynch's fall?

arketWatch's Alistair Barr, Riley McDermid & John Spence, report that Merrill is most at risk for having its credit ratings cut, due to its problems with bond insurers and CDOs, ratings agency Standard & Poor's, said on a conference call, today Wednesday February 6, 2007.

S&P analyst Scott Sprinzen said Merrill's current ratings, which depend heavily on besieged bond insurers to hedge risk in its CDOs, have only a "limited tolerance" for further losses.

Merrill's Fleming said on Wednesday that the firm has about $3.5 billion of exposure to bond insurers if the companies were to go bankrupt.

Are Merrill Lynch's exposure to the bond insurers, and CDOs going to cause a further general stock market sell off?

In other stock market news

Global stocks turned lower , as exemplified by the Vanguard FTSE All World excluding the US, ETF, VEU, manifesting bearish engulfing -- a very significant market reversal sign .

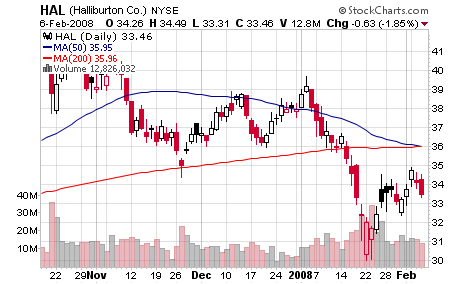

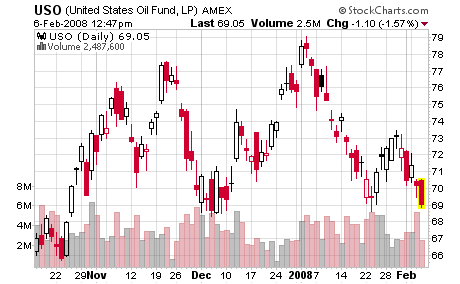

And Halliburton, Schlumberger and many other energy service companies went bearish engulfing too , on the Oil's ETF, USO, bearish engulfing candlestick, which comes at the edge of a massive head and shoulders pattern: a fall in energy service shares, as well as oil is very likely.

Investment Application

I provide the Resourceful Bear Internet Database Listing Of "Bear ETFs" and "ETFs To Sell" , to help one in evaluating bear market investment strategies; one could consider 'put-ting' with these, but, I strongly recommend one be long the Gold ETF, GLD, and use margin credit to sell the municipal bond ETFs VGM, CXE; and purchase the Rydex Mutual Fund RYJUX which is inverse of the 30 Year US Treasury.

I believe that the fall that is coming to the municipal bonds, and the US Treasuries is going to be faster and harder than anything, we have seen so far in stocks; this fall will be awesomely rewarding to those who are short.

The closed end municipal bond funds falling will come on AMBAC's and MBIA's down-writes by Fitch Ratings; and the US Treasuries falling will come given that the bond marketplace, on January 24, 2007, independent of Federal Reserve action, declared a defacto interest rate hike, which means, bonds are now trading lower .

Today's high price, and lack of deterioration in the municipal bonds and the US Treasuries provides a stunning low risk, and high reward, short-selling investment opportunity.

Caveat: I am not an investment professional, I suggest that one consult with an investment professional before making any investment decision.

By Richard Gorton

Richard Gorton

409 York St #908

Bellingham, WA 98225

http://my.opera.com/richardinbellingham/blog/

I'm an investor living in Bellingham, WA. My investment statement is simple: in a bull market be a bull; in a bear market be a bear. In a bull market, one buys on dips; in a bear market, one sells into strength.

Richard Gorton Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.