Gold Stocks Secondary Bottom Soon, Bullish Trend 2013

Commodities / Gold and Silver Stocks 2013 Dec 07, 2012 - 06:51 AM GMTBy: Jordan_Roy_Byrne

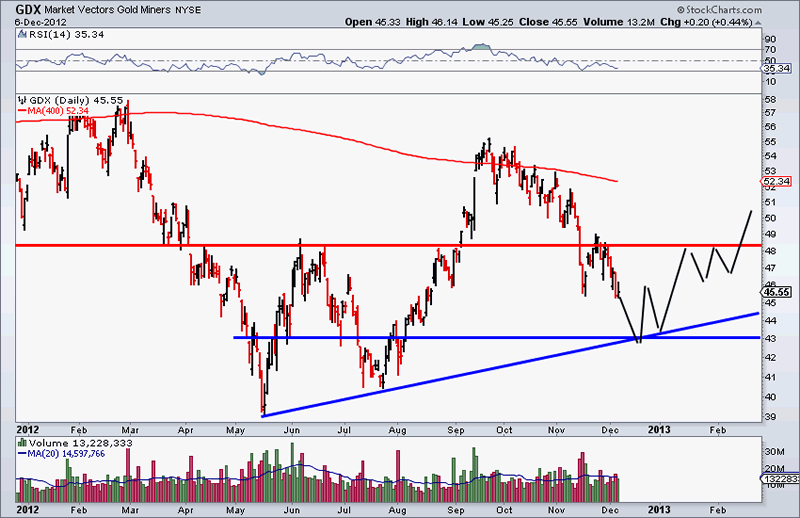

I have to admit, I never saw the gold stocks correcting this much. After making a textbook double bottom and registering very strong momentum readings, I expected a relatively tame October correction to be followed by another leg higher into year end. I thought GDX would bottom at $49. Obviously I was wrong on all counts. It’s difficult to make predictions when they are about the future. Kidding aside, forecasts are only a guide or a potential road-map. No one can predict the future. However, we can assess risk, reward and probabilities. We think the current probabilities favor a secondary bottom in the gold stocks and very soon the risk/reward dynamic will be heavily in favor of longs.

I have to admit, I never saw the gold stocks correcting this much. After making a textbook double bottom and registering very strong momentum readings, I expected a relatively tame October correction to be followed by another leg higher into year end. I thought GDX would bottom at $49. Obviously I was wrong on all counts. It’s difficult to make predictions when they are about the future. Kidding aside, forecasts are only a guide or a potential road-map. No one can predict the future. However, we can assess risk, reward and probabilities. We think the current probabilities favor a secondary bottom in the gold stocks and very soon the risk/reward dynamic will be heavily in favor of longs.

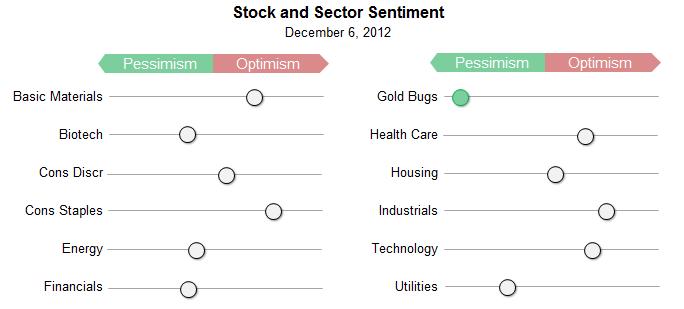

Posted is a chart from sentimentrader.com. Their sector sentiment indicator is a combination of short interest and put-call ratios. It can’t get much worse for the gold stocks. (Well, perhaps just a bit).

Next, we want to look at the breadth of the gold stocks. Breadth is a measurement of participation. I wanted to look at a large group of stocks and measure their breadth at major bottoms and at secondary bottoms. For simplicity, I looked at the number of stocks trading above their 200-day moving average. The results are in the chart.

I wanted to compare the current breadth to the breadth seen at the secondary bottoms in 2005 and 2009. Note that at the major lows, breadth is usually at or near zero. At the secondary low in 2005, breadth was 41%. The market was in a stronger technical position then as the cyclical bear market was tame. In 2009, the breadth at the secondary low was 20%. Go back to 2002-2003 and you’ll notice a triple bottom. Unlike the present there was no major technical damage.

At the third and final bottom breadth was 10%. Presently, breadth is at 38%. It can fall to 20% and that would be in line with the most recent secondary bottom (following a major bottom). The conclusion is that following a major bottom long-term breadth should remain healthy. It still is.

Moving from the complicated to the simple, here is one thought as to how this secondary bottom could play out. We are watching $43 as it is both lateral and trendline support.

Less than three weeks ago we wrote:

If we are indeed correct that the metals and shares will remain range bound then your task is simple. Prepare yourself for further consolidation by having your buy list ready and then be ready to act when the time comes. A wise friend once told me that in a bull market the goal is to accumulate positions at the lowest prices possible.

It is always easy to say buy later or buy on a correction. How often do we hear that? Rick Rule says that when investing in the resource sector you are either a contrarian or a victim. Consider the present sentiment and technical construct and it is difficult to ignore this emerging contrarian opportunity. Oh and by the way, the Fed is meeting next week. With gold stocks tanking into the meeting, it provides the setup for a bottom and rebound into January. Now is the time to be vigilant as the time to be a contrarian could be only days away.

If you'd be interested in professional guidance in this endeavor, then we invite you to learn more about our service.

Good Luck!

Bio: Jordan Roy-Byrne, CMT is a Chartered Market Technician, a member of the Market Technicians Association and from 2010-2011 an official contributor to the CME Group, the largest futures exchange in the world. He is the publisher and editor of TheDailyGold Premium, a publication which emphaszies market timing and stock selection for the sophisticated investor. Jordan's work has been featured in CNBC, Barrons, Financial Times Alphaville, and his editorials are regularly published in 321gold, Gold-Eagle, FinancialSense, GoldSeek, Kitco and Yahoo Finance. He is quoted regularly in Barrons. Jordan was a speaker at PDAC 2012, the largest mining conference in the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.