U.S. Interest Rates Forecast 2013, Don’t Fight The Fed!

Interest-Rates / US Interest Rates Jan 06, 2013 - 09:13 AM GMT I’ve been watching the Fed for years and like everyone else, I’ve always paid attention to the old saying that, “You don’t fight the Fed.” So it stands to reason that when the Fed says they’ll keep interest rates at zero well into 2015, you would expect rates to stay at or close to zero. They even went so far as to put an exclamation point on this policy two weeks ago when they announced that they were buying as much as 90% of all new issues. In short the US Federal Reserve is now acting as a buyer of last resort. That statement set off all sorts of warning bells in the deep recesses of my mind as my experience tells me that whenever a government is acting as a buyer of last, it’s in deep trouble. It brings back memories of many failed banana republics’!

I’ve been watching the Fed for years and like everyone else, I’ve always paid attention to the old saying that, “You don’t fight the Fed.” So it stands to reason that when the Fed says they’ll keep interest rates at zero well into 2015, you would expect rates to stay at or close to zero. They even went so far as to put an exclamation point on this policy two weeks ago when they announced that they were buying as much as 90% of all new issues. In short the US Federal Reserve is now acting as a buyer of last resort. That statement set off all sorts of warning bells in the deep recesses of my mind as my experience tells me that whenever a government is acting as a buyer of last, it’s in deep trouble. It brings back memories of many failed banana republics’!

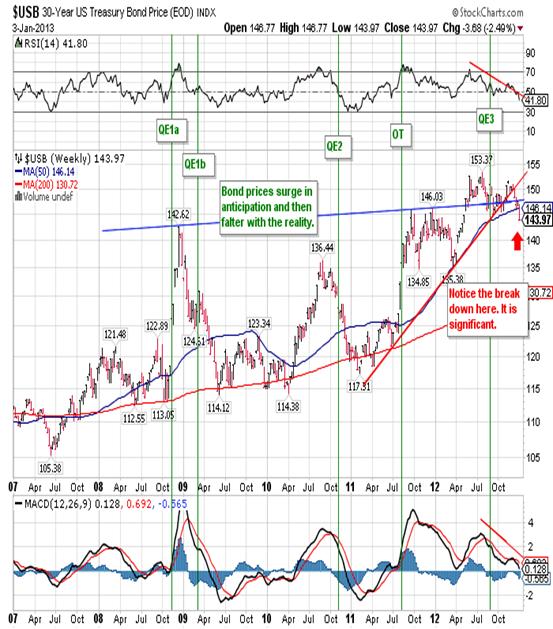

Whenever you analyze bond prices, and inversely interest rates, you need to keep in mind that rates are a function of risk. They always have been, and they always will be. So when the US Federal Reserve comes out and says that they’ll hold rates at zero for three years, they are completely ignoring the risk factor. In essence the Fed has been ignoring risk for several years by injecting money into the market, in the form of quantitative easing, thereby driving bond prices higher (and rates lower):

The quantitative easing policy is where the Fed essentially prints money with nothing to back it and uses it to by bad debt from banks at face value. In other words the Fed created a liquid market where none existed before and then rewards banks for making bad investments. This allowed the bull market in bonds an extended life span of three years.

In September the Fed announced another round of easing, QE3, in an effort to prop up the bond market one more time:

I believe there are only so many times you can go to the same well before it runs dry. You can see in the previous chart that the bonds produced an all-time high in July as part of a larger sideways movement. I’ve labeled this sideways movement distribution, and it lasted six months. I also believe that this distribution period marked the end of a twenty-five year bull market in bonds. That means lower bond prices in spite of the Fed’s maladroit interventions.

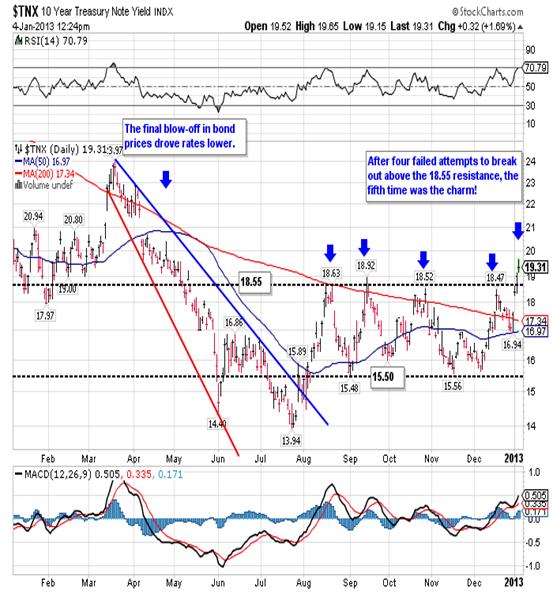

Every action has a reaction so lower bond prices will lead to higher interest rates, and we are already seeing that:

On Thursday we saw rates breakout to new highs after four failed attempts and that breakout is being confirmed today as bonds trade even lower. Interestingly enough there is no mention of this in the media.

If you give it some thought you’d realize that it really couldn’t be any other way. The Fed is printing US $85 billion a month and using that money to buy back debt that otherwise wouldn’t have a market. Supply exceeds demand, especially since China cut back on buying Treasuries, and that means prices must fall and rates must rise. Add to that the fact that the more debt the US creates, the bigger the risk it becomes. The US is printing fiat currency, with nothing to back it but a promise from a debtor nation, and using it to buy bad debt! If that isn’t risky, I don’t know what is. The end result will be that the Fed becomes the only buyer and has to print fiat currency to do it. Bond prices will fall, rates will move a lot higher, and that will make debt at all levels very difficult to service.

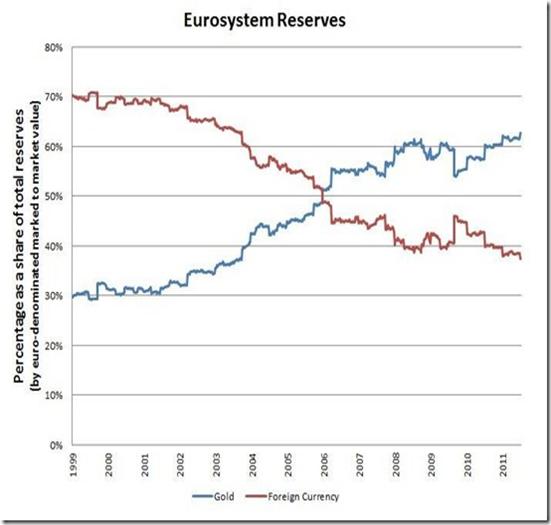

Finally, they published the Fed minutes from the latest FOMC meeting and it was surprising to see that almost all the participants were calling for an end to QE by the end of the year and several were calling for an end in a couple of months. Some analysts were shocked to see rates surge on the news, but it makes perfect sense if you stop to think about it. We can’t get our fiscal house in order and if the Fed ceases to be the buyer of last resort, and that’s what they are, who will buy US debt? China and the EU are liquidating US dollar denominated debt and in the and in the case of the latter, they are opting for gold:

The short answer is that no one will want it so rates will rise even faster than if the Fed were to print indefinitely. It’s a case of damned if you do and damned if you don’t!

Robert M. Williams

St. Andrews Investments, LLC

Nevada, USA

robertmartinwilliams01@gmail.com

Copyright © 2012 Robert M. Williams - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.