These Popular Delusions Could Cost Investors Fortunes in 2013

Stock-Markets / Financial Markets 2013 Jan 22, 2013 - 10:02 AM GMTBy: Graham_Summers

The markets are closed today in observance of Martin Luther King, Jr. day.

The markets are closed today in observance of Martin Luther King, Jr. day.

With that in mind, we’re stepping back from our usual daily analysis of the markets to address the big picture for the investment landscape in 2013.

Popular Delusion #1: The investment world believes China will engage in another massive round of stimulus.

This will not be the case. China’s new ruling party has stated point blank that the country will not be engaging in rampant stimulus (for the obvious reasons of rising inflation):

This may sound like an oxymoron, but China‘s new Communist government is turning away from financial stimulus to help its slow-moving economy.

During the party’s two-day Central Economic Work Conference this weekend, party leader Xi Jinping said the country would essentially not be pursuing high growth rates through stimulus. That doesn’t mean that Beijing has turned sour on fixed asset investments on things like roads, bridges and subways. They’re still going through with major urbanization projects. But whenever the economy is slowing, the new leaders say they will be less likely to prime the pump.

Source: Forbes

China’s market has rallied over 16% in the last month on the belief that China will engage in another large-scale stimulus plan… despite China’s leaders stating they will not. This has the makings of a very nasty correction.

Popular Delusion #2: Japan’s new leadership will be able to kick off an even more aggressive monetary intervention.

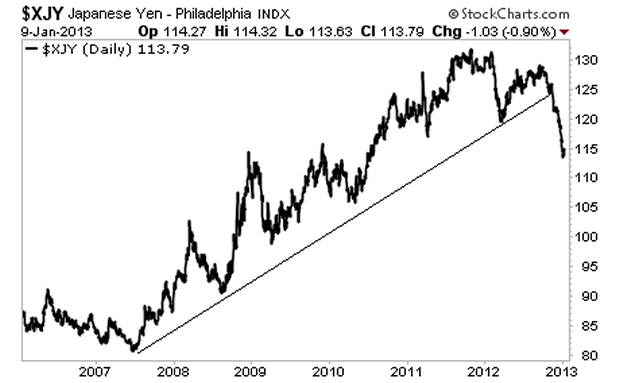

Truth be told, Japan is on the cusp of the mother of all debt implosions. Case in point, Japan’s Yen is thought to be a safe haven. With that in mind, it’s critical to note that when the EU Crisis hit in mid-2012, the Yen fell. Indeed, it has now taken out its trendline:

Indeed, it is interesting to note that political leaders Japan, like those in Europe and the US, have begun to use verbal intervention as a primary tool. Prime Minister Shinzo Abe took office urging the Bank of Japan to act even more aggressively, even threatening to strip the bank of its independence.

Since that time, the Nikkei has erupted higher. The Japanese Government got what it was looking for, and Japanese Economic Minister Amari announced that the Yen was correcting in line with fundamentals.

Take note, this series of events indicate that Japanese leaders will likely engage in verbal intervention to get what they want. It’s worked for the EU and US.

Popular Delusion #3: The US bond bubble will burst in 2013.

It’s become increasingly common to see calls for the US bond bubble to implode this year. To be clear, the US’s financial situation is terrible. But it is nothing compared to the financial situation in Europe, Japan, and China.

Europe has not recapitalized its banks. Many of its countries’ entire banking systems are insolvent. The EU banking system as a whole is leveraged at 26 to 1 (Lehman was at 30 to 1 when it went bust). Even Germany’s banking system is in worse shape than the US’s (the US recapitalized its banks following the 2008 crisis. Europe. including Germany, has not).

China’s true Debt to GDP is over 200%. Already in a hard landing, the country is now facing several major problems, namely looming water and agriculture crises, food inflation and accompanying civil unrest, and the potential of armed conflict with Japan.

Moreover, the belief that China will shift over to a consumer economy is misguided. Consumption has increased by 9% per year in China for 30 years now. The China consumer is not somehow dormant. And as more and more manufacturing firms leave China for more stable markets (Apple, Ford, GE, Bridgestone, have all announced they are moving facilities back to the US), China will be facing rising unemployment.

Finally, and most critically, financial institutions are desperate for high-grade collateral in the form of quality sovereign bonds. Say what you will about the US, it remains the most liquid market for debt in the world. And if you had a choice between lending money to the US, Japanese, any European, or the Chinese Government, the US is the obvious answer.

This is not to say the US is in great shape. Instead, we would argue that the US is the least ugly of the major debt markets. The US bond bubble will burst at some point. But it will likely not do so in 2013.

To conclude, the world Central Banks and EU politicians have done everything imaginable to postpone the EU crisis. They’re now out of options. The EU crisis will very likely erupt anew in the first half of 2013. Meanwhile Japan is waiting in the wings. And China has its own issues to contend with.

If you’re an individual investor (not a day trader) looking for the means of profiting from all of this… particularly the US going over the fiscal cliff… then you NEED to check out my Private Wealth Advisory newsletter.

Graham Sumers

Chief Market Strategist

Good Investing!

PS. If you’re getting worried about the future of the stock market and have yet to take steps to prepare for the Second Round of the Financial Crisis… I highly suggest you download my FREE Special Report specifying exactly how to prepare for what’s to come.

I call it The Financial Crisis “Round Two” Survival Kit. And its 17 pages contain a wealth of information about portfolio protection, which investments to own and how to take out Catastrophe Insurance on the stock market (this “insurance” paid out triple digit gains in the Autumn of 2008).

Again, this is all 100% FREE. To pick up your copy today, got to http://www.gainspainscapital.com and click on FREE REPORTS.

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2013 Copyright Graham Summers - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.