One of the Few Great Bargains Left in the Stock Market

Companies / Tech Stocks Mar 01, 2013 - 03:13 PM GMTBy: GrowthStockWire

Frank Curzio writes: Just about every sector has been plucked from the market's bargain bin...

Frank Curzio writes: Just about every sector has been plucked from the market's bargain bin...

Take airlines... In late 2011, the sector was in the trash heap. Concerns over the global economy helped hammer airline stocks. Nobody wanted to own them. Since then, sentiment has improved, and the sector is up about 40%.

We can say the same for bank stocks... or transportation stocks... or homebuilding stocks. A few years ago, things looked like they couldn't get any worse for these sectors. Share prices were badly beaten-down. Sentiment was terrible. But investors who stepped in amidst the pessimism made huge returns.

It's great to make big returns in such a short time. But these big rallies make it tough to find low-risk, high-reward trades in cheap, beaten-down sectors. One sector, however, is still on sale... And it's still ripe with cheap, low-risk stocks that offer huge upside.

Semiconductor ("chip") stocks have been some of the worst performers over the past two years. These companies make the chips that go into computers, smartphones, video-game consoles, and other electronic devices.

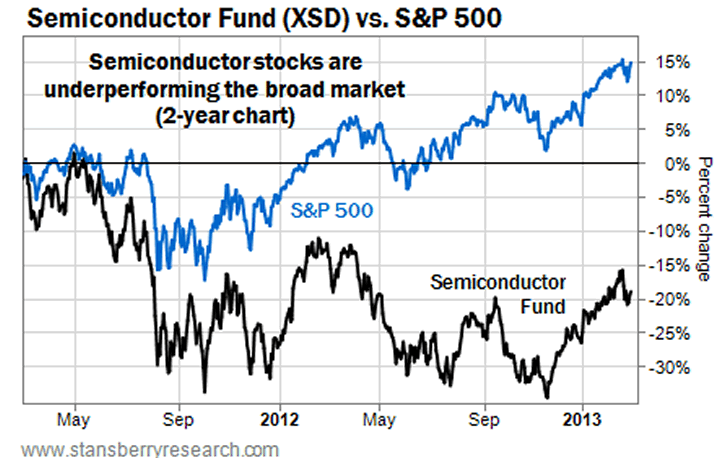

As the chart below shows, semiconductor stocks have underperformed the market by more than 30 percentage points over the past two years. Take a look...

Chip stocks have been hammered. But as we've seen with airlines, homebuilders, and banks... buying beaten-down stocks in a sector just before it "booms" could result in massive short-term gains.

We have this type of low-risk, high-reward opportunity today. Let me explain...

The semiconductor sector regularly goes through huge "booms" and "busts." It enjoyed a huge boom in late 2010/early 2011, but it suffered a massive bust by the end of the year.

What happened?

First, investors were worried about the slowdown developing in PC sales – a trend that continues today.

You see, instead of buying traditional desktops and laptops, consumers are buying tablets, like Apple's iPad and Microsoft's Surface. Many chip companies have transitioned their product lines to keep up with growth in the tablet market (which I expect to grow north of 35% this year). But PC makers haven't been able to keep up. As a result, most chip companies were stuck with inflated inventory levels.

Second, investors have been worried about global economic growth sputtering. Many people were terrified things would get worse. So they dumped chip stocks... especially the sector's smaller players.

But take a look at the right-hand side of the chart above. You'll notice the semiconductor stocks have shown positive price action over the past few months. The sector has stabilized...

Today, chip companies are well-positioned to lead the smartphone boom, another high-growth market. And inventory levels are leaner than ever. According to investment firm Goldman Sachs, inventory for chip companies is down 17%. Plus, Goldman sees a huge jump in demand this year and beyond as China rebounds.

There's also a massive spending spree taking place in the telecom space – one of chip stocks' biggest customers.

For example, AT&T expects to spend $22 billion next year upgrading its network, including $8 billion on its wireless division. Sprint and Verizon will also spend billions on upgrades. We can expect the same from Brazilian carriers. They want to upgrade their wireless capabilities ahead of the 2014 World Cup and 2016 Summer Olympics. Finally, Chinese carriers will also spend billions as the country's smartphone market explodes.

Lean supply coupled with stronger demand this year suggests a cyclical recovery is near. The semiconductor sector is already up 25% since bottoming in late 2012... and the rebound is just getting started.

Plus, chip stocks are cheap. Semiconductor giant Intel (NASDAQ: INTC) trades at just 10 times earnings. And Cypress Semiconductor (NASDAQ: CY) – the "Intel" of small stocks – trades at 12 times earnings. The overall market is trading for around 18 times earnings.

Many chip stocks also pay 3% or more in dividends. With Treasurys, CDs, and savings accounts paying next-to-nothing in interest, a 3% dividend is huge.

In sum, chip stocks have a big picture tailwind working in their favor. Many have been abandoned and "left for dead." Yet, the sector has huge upside potential. That's why I recommend taking a position today.

Good investing,

Frank Curzio

P.S. If you'd like to take advantage of our safe, high-yield semiconductor recommendations, you can come onboard with a 100% risk-free trial to the Small Stock Specialist. If you decide the research isn't for you, we're happy to refund all your money. Click here to learn how to come onboard.

http://www.growthstockwire.com

The Growth Stock Wire is a free daily e-letter that provides readers with a pre-market briefing on the most profitable opportunities in the global stock, currency, and commodity markets. Written by veteran trader Jeff Clark, and featuring expert guest commentaries, Growth Stock Wire is delivered to your inbox each weekday morning before the markets open.

Customer Service: 1-888-261-2693 – Copyright 2009 Stansberry & Associates Investment Research. All Rights Reserved. Protected by copyright laws of the United States and international treaties. This e-letter may only be used pursuant to the subscription agreement and any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), in whole or in part, is strictly prohibited without the express written permission of Stansberry & Associates Investment Research, LLC. 1217 Saint Paul Street, Baltimore MD 21202

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Growth Stock Wire Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.