Gold’s Flash Crash: BUBBLEOMIX Analysis

Commodities / Gold and Silver 2013 Apr 26, 2013 - 10:55 AM GMTBy: Andrew_Butter

There was a letter in the local rag Tuesday about how a couple in Dubai had tried to buy gold bars (physical) at the spot price then about $1,400; the bullion dealer told them he was out of stock. They suspected he was lying…and they were complaining, “Can’t SOMEONE force the scoundrel to sell?”

There was a letter in the local rag Tuesday about how a couple in Dubai had tried to buy gold bars (physical) at the spot price then about $1,400; the bullion dealer told them he was out of stock. They suspected he was lying…and they were complaining, “Can’t SOMEONE force the scoundrel to sell?”

A friend asked me what I thought. I told him if I had some I wouldn’t sell, but I wouldn’t buy either. He said he had bought at $900 and as far as he was concerned gold is the only “safe haven” so he was not selling.

That’s the thing, bottoms happen when the sellers dig their heels in and stick; it doesn’t matter if there are no buyers or hardly any, if no one wants to sell then the price sticks, a bottom is not when the buyers flood in, it’s when the sellers stick.

Of course some potential sellers have to sell because their credit runs out, case in point, Cyprus. The key issue over the next few months may be finding out how many potential sellers bought gold on margin and are going to be forced to sell…unless of course “SOMEONE” extends them credit to prevent a “market disruption” (as in prints money), which, given that gold is the mortal enemy of the QE-Crowd seems somewhat unlikely.

Was $1,800 a bubble as in a touch of mania when conjecture and fairy stories displace reality? If so was $1,350 the expression of a bust, or is there more to come, or was gold “manipulated” down from $1,800 and $1,350 represented the buying opportunity of a life-time?

Some say the trigger for the recent slide was the news that Cyprus might be forced to sell some gold, not that they had very much. The real news behind the news was that the ECB dug their heels in and refused to helicopter-in the necessary. The BIG news there is helicopters seem to be going out of style even Uncle Ben is muttering darkly about retirement. Opinions are divided about whether QX was a good thing but there is pretty much a consensus that, regardless, even if it was, you can always have too much of a good thing.

As usual, opinions are divided about what is the “right price” of gold today, as in its intrinsic or fair value, or what IVS calls other-than-market-value.

[IF] gold was a bubble [AND] the bust is complete [THEN] according to BUBBLEOMIX the total amount of money over-spent buying gold in the bubble should, if the bust is over now, exactly equal the total amount of money “saved” by the smart buyers who bought the dip.

That’s because bubbles and the busts that follow them are zero sum. They create no wealth because the amount of money the winners made buying at the start and selling at the top, by the laws of physics, must exactly equal the amount of money the losers lost buying at the top and selling at the bottom; just like if you throw a brick in a pond…after the waves settle, the level of the pond is unchanged.

But the trick is to understand [IF] there was a bubble, [THEN] when did it start?

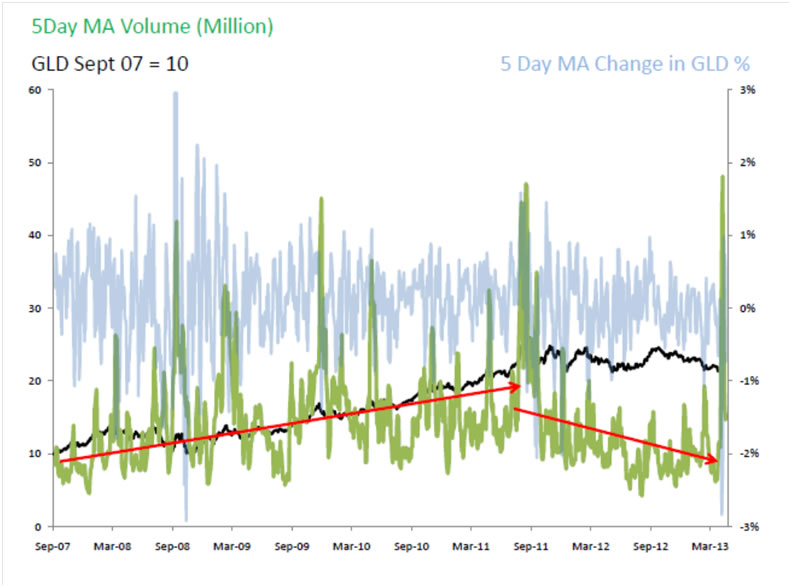

This is the story on the ETF GLD, which may not properly reflect the market, but at least there is data on volumes:

My take on that chart is that from September 2007 to September 2011 the market for gold was logical. Buying interest went up, big falls in price by up to 5% in a week were typically preceded by a previous (recent) jump. In September 2011 transactions started to fall, what that means is the price is sustained by sellers holding, rather than buyers coming to the table, which suggests the action early 2011 might have been the start of a bubble, as in when price departs markedly from the “fundamental”, whatever that is.

Support for that idea is because about that time the price of gold expressed in oil, went ballistic. Personally, I’m coming back to the idea that the best marker for the price of gold IS INDEED the fundamental value of oil, of course one can debate endlessly what that is, personally I reckon it’s about $90 Brent these days.

The recent drop was not preceded by previous recent jump; that has the hallmarks of a bust down from a bubble. One piece of bad news however for anyone with gold is that the volumes still didn’t settle down to below 10-Million a week (on the GLD ETF), until they do what’s happening is a bust-in-progress.

So [IF] early 2011 was the start of a bubble, [THEN] the right price is now about $1,550 which means that at $1,800 gold was 15% too expensive, which means that the bottom of this bust is going to have to come in at about $1,350 according to Farrell’s Second Law.

In other words it looks like my elegant theory linking gold price to U.S. Treasuries outstanding was probably wrong and the best benchmark for the fundamental value of gold is the fundamental value of oil. And sometime in the next year or so gold is going to edge back up to about $1,550.

So, back to my mate; I wouldn‘t sell, but don’t expect a windfall. There again, where else can you get 15% in two years?

By Andrew Butter

Twenty years doing market analysis and valuations for investors in the Middle East, USA, and Europe. Ex-Toxic-Asset assembly-line worker; lives in Dubai.

© 2013 Copyright Andrew Butter- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Andrew Butter Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.