Detroit the Epicentre of the U.S. Death Spiral of Debt?

Interest-Rates / US Debt Jun 20, 2013 - 04:50 PM GMT George Leong writes: Debt is deadly, and it’s made even worse with rising interest rates that prevent you from eliminating the debt load. What happens with rising interest rates is that payments mostly go toward the interest and less to the principal. In fact, it’s what I call a death spiral of debt that worsens as rates move higher.

George Leong writes: Debt is deadly, and it’s made even worse with rising interest rates that prevent you from eliminating the debt load. What happens with rising interest rates is that payments mostly go toward the interest and less to the principal. In fact, it’s what I call a death spiral of debt that worsens as rates move higher.

When individuals face excessive debt, often the solution is to pare down on spending and adhere to a strict debt repayment program.

When corporations face excessive debt, they tend to streamline; but they must be careful when they do so, because any cost-cutting could impact the company’s growth. What generally happens is more debt or credit is issued.

But when governments build up massive debt loads, there is no definitive solution, and it becomes problematic. The national debt is estimated to reach $17.55 trillion by the end of this year, while the country’s total debt, including federal, state, and municipal debt, is earmarked at $20.54 trillion. (Source: USGovernmentDebt.us, June 18, 2013.)

Congress and Obama must resolve the national debt limit.

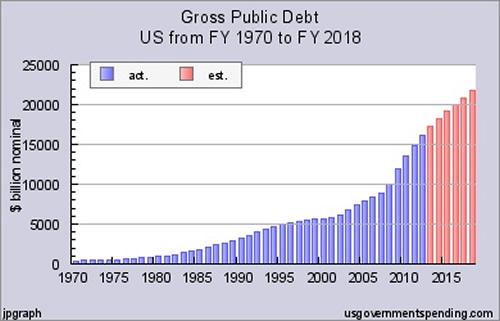

Take a look at the chart below of the national debt from 1970 to today (blue bars), and the projected national debt to 2018 (red bars). What’s made clear from this chart is not only the steady buildup of national debt but the rate of the buildup since early 2000, especially following the Great Recession in 2008. It’s obvious that the national debt is spiraling out of control.

Chart courtesy of www.USGovernmentSpending.com

Despite the popular adage “a picture is worth a thousand words,” this chart of the national debt can be defined by one word: debt.

That’s why the Federal Reserve and the U.S. government must deal with the country’s massive national debt load—and how it’s getting out of hand.

But not only is the national debt an issue, the debt buildup at the state and municipal level is also a major concern that needs to be addressed. By the end of this year, the debt amassed by the state governments is estimated to reach $1.19 trillion. (Source: Ibid.)

What’s alarming is that the municipal, state, and federal governments will inevitably be subject to a cash crunch when yields and interest rates ratchet higher.

As I recently mentioned in these pages, we’re seeing debt issues in many states that are vulnerable to rising interest rates, and not only with the federal debt.

Recall that California and its municipalities have accumulated a debt load of about $848 billion, which could eventually be eclipsed by $1.1 trillion, according to The California Public Policy Center. (Source: “Report: California’s Actual Debt At Least $848B; Could Pass $1.1T,” CBS web site, May 1, 2013.)

And then this past Monday, we found out that the city of Detroit, which has been ravaged by decades of slow growth and major population decline, has run out of money after defaulting on roughly $2.5 billion in unsecured debt. The city is trying to convince its creditors to accept $0.10 on the dollar to eliminate this debt. (Source: Williams, C., “Emergency manager: Detroit won’t pay $2.5B it owes,” Associated Press, June 14, 2013.)

But the problem won’t stop there, because Detroit will need new funds to survive, and based on the city’s default and low credit rating, the cost of the loan would likely be significant.

So, while the stock market rises to new records and new millionaires surface each day, the real problem will be when rates move higher and debt payments become unmanageable.

I would start to take some profits off the table, or move funds into more defensive sectors.

This article Detroit the Start of the U.S. Death Spiral of Debt? was originally published at Investment Contrarians

By George Leong, BA, B. Comm.

www.investmentcontrarians.com

Investment Contrarians is our daily financial e-letter dedicated to helping investors make money by going against the “herd mentality.”

George Leong, B. Comm. is a Senior Editor at Lombardi Financial, and has been involved in analyzing the stock markets for two decades where he employs both fundamental and technical analysis. His overall market timing and trading knowledge is extensive in the areas of small-cap research and option trading. George is the editor of several of Lombardi’s popular financial newsletters, including The China Letter, Special Situations, and Obscene Profits, among others. He has written technical and fundamental columns for numerous stock market news web sites, and he is the author of Quick Wealth Options Strategy and Mastering 7 Proven Options Strategies. Prior to starting with Lombardi Financial, George was employed as a financial analyst with Globe Information Services. See George Leong Article Archives

Copyright © 2013 Investment Contrarians- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Investment Contrarians Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.