Rising Treasury Yields, Tight Money Has Already Started

Interest-Rates / US Interest Rates Aug 20, 2013 - 05:42 PM GMTBy: Clif_Droke

Aside from the fact that the 10-Year Treasury Yield Index (TNX) is rising, one reason for the recent equity market sell-off is the uncertainty generated by the Fed's latest announcement concerning the future of QE3.

Aside from the fact that the 10-Year Treasury Yield Index (TNX) is rising, one reason for the recent equity market sell-off is the uncertainty generated by the Fed's latest announcement concerning the future of QE3.

At its latest press conference, Fed Chairman Bernanke indicated the central bank could start winding down its $85 billion/month asset purchase program in September. This has understandably caused a certain amount of consternation on Wall Street, especially given the feeling among many traders that QE has been largely responsible for the stock market's rebound.

What many investors don't realize is that the Fed's monetary stance has already tightened even before the "tapering" begins. Author Ramesh Ponnuru, in his National Review article entitled "Cause for Depression," points out that by merely telegraphing its intentions, the Fed creates expectations for future money conditions. This in turn reverberates through the financial system well ahead of actual changes in Fed money policy.

"When the Fed creates an impression about future spending levels," writes Ponnuru, "it affects the spending that people undertake today in anticipation of that future. So when the Fed suggests that it will pursue a tighter money policy in the future, it is effectively tightening money in the present. Even when it cuts the federal-funds rate, it may be tightening money if markets had projected a sharper cut."

Ponnuru went on to define tight money as "reduced expectations of future spending." That's as concise and as practical a definition of tight money as you'll hear. His explanation of future expectations for money conditions fully explains what's happening right now with the bond market and the stock market.

For the last several weeks the number of equities making new 52-week lows on the NYSE has been dangerously high and in recent days has approached nearly 500. Most of these new lows are interest rate-sensitive stocks and funds, including municipal bond funds, income funds, REITs and homebuilding stocks. This unmitigated dumping of bond-related equities is a testament to investors' expectations of tighter money conditions in the months ahead. The stock market is forward looking and is already beginning to discount the end of quantitative easing (QE). If it continues, it will create a negative backdrop for the market and pave the way for weaker economic growth. By telegraphing its intent to tighten money conditions, the Fed has in essence started tight money already.

Many economists are cheering the rising trend of the 10-year Treasury yield (see chart below) under the assumption that rising rates is a sign of a strengthening economy. Normally that would be true, but these aren't normal times. If the Fed tightens up the liquidity spigot before the long-term Kress cycle bottoms next year, it will only succeed in creating a tougher climate for business. The rationale behind QE was that deflation was a major problem that needed to be vigorously fought, and so far that strategy has been largely successful. By ending QE in the coming months, however, deflation will be allowed to once again rear its ugly head - and at the worst possible time.

Next year is when the long-term deflationary cycle is at its maximum descent and will make its presence known with emphasis if there are no counteracting forces to blunt it. Barring a change in the Fed's stated policy goal we can expect tighter money conditions from here on.

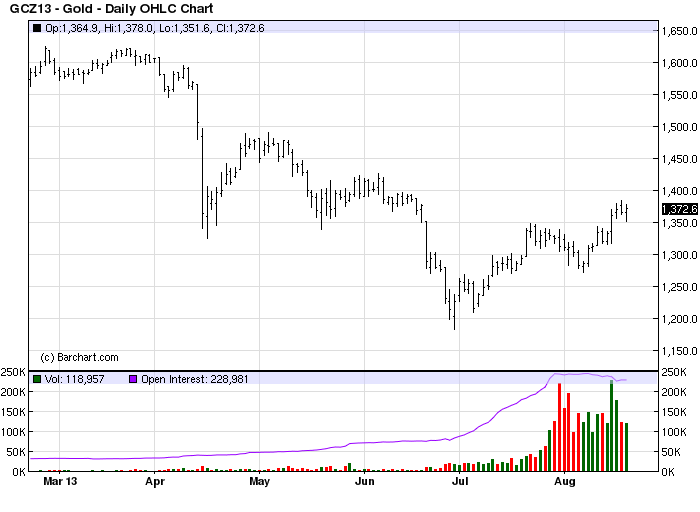

Gold

December gold futures recently closed at $1,372, its highest level in eight weeks. Gold is steadily catching on among investors who see it as a dual play: it's coming off an "oversold" technical extreme and is being rediscovered as the safe haven of choice now that the U.S. stock market is showing weakness once again.

The rumor that China's central bank may soon begin loosening monetary policy is another reason investors are buying gold once again. As Sharps Pixley pointed out, the gold market also likes the news that gold purchases by China have jumped 54 percent in the first half of the year while the SPDR Gold Trust ETF (GLD) saw its first net inflow in two months on August 9. Pixley also points out that as India's annual festival demand soon begins, that country's limited imports will likely lead to an increase in gold smuggling.

Speculators' net combined shorts positions for gold declined by 23,518 contracts in the week ending August 6, a substantial decrease which implies short covering is well underway. By contrast, net non-commercial gold positions increased to its highest number of contracts since August 2012 before the commencement of QE3.

How much of the recent gold rally is due strictly to short covering as opposed to "smart money" purchases is open to question, however. In the immediate-term (1-3 week) outlook we probably won't have to worry about this as a continuation of the short covering trend could push gold and silver prices even higher. Once the benchmark chart resistance levels are approaches - the $1,400-$1,425 area for gold and $24.00-$25.00 for silver - we'll have a much better idea what to expect. For now the speculators have taken control of the market and have the shorts at their mercy.

High Probability Relative Strength Trading

Traders often ask what is the single best strategy to use for selecting stocks in bull and bear markets. Hands down, the best all-around strategy is a relative strength approach. With relative strength you can be assured that you're buying (or selling, depending on the market climate) the stocks that insiders are trading in. The powerful tool of relative strength allows you to see which stocks and ETFs the "smart money" pros are buying and selling before they make their next major move.

Find out how to incorporate a relative strength strategy in your trading system in my latest book, High Probability Relative Strength Analysis. In it you'll discover the best way to identify relative strength and profit from it while avoiding the volatility that comes with other systems of stock picking. Relative strength is probably the single most important, yet widely overlooked, strategies on Wall Street. This book explains to you in easy-to-understand terms all you need to know about it. The book is now available for sale at:

http://www.clifdroke.com/books/hprstrading.html

Order today to receive your autographed copy along with a free booklet on the best strategies for momentum trading. Also receive a FREE 1-month trial subscription to the Momentum Strategies Report newsletter.

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.