Massive Debt Levels Will Push Silver Price To Beyond $150

Commodities / Gold and Silver 2013 Sep 02, 2013 - 10:50 AM GMTBy: Hubert_Moolman

The massive debt bubble created by our monetary system is about to burst. The demonetization of gold and silver, has over the years diverted value from these metals, to all paper assets (such as bonds) linked to the debt-based monetary system.

The process of the devaluation of gold and silver, started by the demonetization of gold and silver, is about to reverse at a greater speed than ever before. This is similar to what happened during the late 70s, when the gold and silver price increased significantly. However, what happened in the 70’s was just a prelude to this coming rally. The 70’s was the end of a cycle, this is likely the end of a major cycle; an end of an era of the debt-based monetary system (dishonest money).

This era of dishonest money, has filled the economic world with many promises that will never be fulfilled. There will be a massive flight out of paper promises, into the ideal safe haven assets that would offer protection. In my opinion, silver will be the leading asset when this flight out of paper promises happens. This fraud started with the demonetization of silver and it will end with silver taking its place as money - the most marketable commodity.

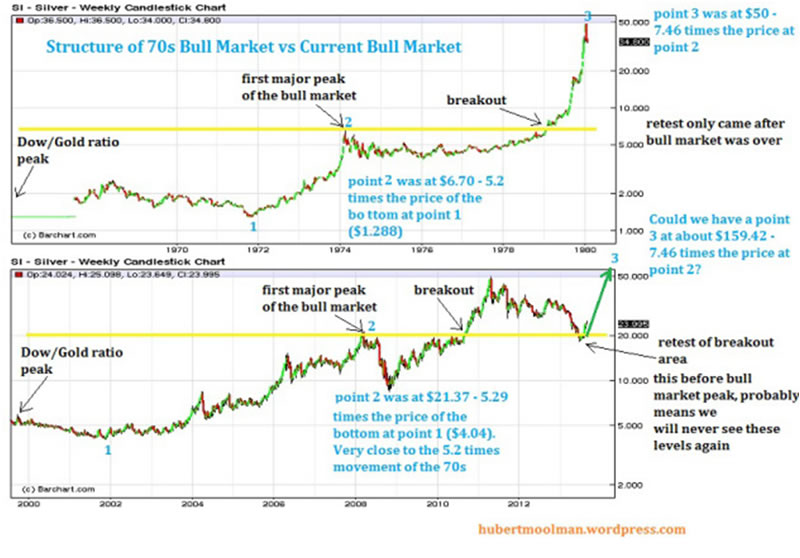

If silver only equals the performance of the 70s, it will reach $150. However, this cycle will only be over when silver and gold are not quoted in the current fiat currencies or any other fiat currency. Instead, most goods would be quoted in terms of silver and gold.

Below, is a self-explanatory comparison of the current silver bull market and the 70s bull market:

For more silver and gold analysis and guidance, see my Long-term Silver Fractal Report or subscribe to my Premium Service.

Warm regards and God bless,

Hubert

http://hubertmoolman.wordpress.com/

You can email any comments to hubert@hgmandassociates.co.za

© 2013 Copyright Hubert Moolman - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.