Contracting US Economy to Hit Corporate Earnings

Stock-Markets / Financial Markets Apr 06, 2008 - 04:47 PM GMT A sense of relative calm descended upon financial markets over the past week. Although fears about the outlook for the US economy persisted, a perception crept into markets that much of the bad news related to the credit crisis was now out in the open, with the result that the equity bulls had reason to feel rather pleased with their performance by the close of the week.

A sense of relative calm descended upon financial markets over the past week. Although fears about the outlook for the US economy persisted, a perception crept into markets that much of the bad news related to the credit crisis was now out in the open, with the result that the equity bulls had reason to feel rather pleased with their performance by the close of the week.

In his testimony on the economic outlook on Wednesday Fed chairman Ben Bernanke told the Joint Economic Committee he thought the US economy would not grow much, if at all, and could even contract slightly in the first half of 2008. Market participants took Bernanke's testimony in their stride, cognizant that he was not telling them anything they had not already feared.

Earlier in the week, Treasury Secretary Hank Paulson unveiled a 218-page plan to overhaul the US regulatory system and essentially to give the Fed more power to oversee the entire financial system. “Nothing I saw will help all that much in the current crisis. It's more like re-arranging the deck chairs as the ship is going down. It seems like most of it is being proposed to prevent another crisis like the one we are in from occurring in the future,” said John Mauldin ( Thoughts from the Frontline ).

Earlier in the week, Treasury Secretary Hank Paulson unveiled a 218-page plan to overhaul the US regulatory system and essentially to give the Fed more power to oversee the entire financial system. “Nothing I saw will help all that much in the current crisis. It's more like re-arranging the deck chairs as the ship is going down. It seems like most of it is being proposed to prevent another crisis like the one we are in from occurring in the future,” said John Mauldin ( Thoughts from the Frontline ).

Bernanke made his second appearance on Capitol Hill when he and several top officials appeared before the Senate Committee on Banking, Housing and Urban Affairs to discuss their respective organizations' roles in the sale of Bear Stearns. No real new facts were revealed beyond that Bear Stearns (BSC) had needed to be bailed out by JPMorgan Chase (JPM) and the Fed in order to prevent broader market damage and a potential collapse of the entire financial system.

With all kinds of measures to stem the sub-prime fallout being announced virtually continuously, David Fuller ( Fullermoney ) said: “… officials at both the US Fed and Treasury now recognize the need to manage expectations during a crisis. The best way to accomplish this is by being seen to be proactive. Ideally, on a daily basis with comments, often repeated, proposals and actions as required. During a crisis, the crowd becomes emotional and infantilized. However one is less likely to panic when leadership and reassurances are provided. This is as important for the stock market as it is with a frightened child, because both are inclined to overreact.”

I am braving the long-haul flight from Cape Town to La Jolla, San Diego tomorrow (34 hours from doorstep to doorstep) and will be away for eight days. Blog posts will unfortunately be rather slow during this period and, specifically, “Words from the Wise” will take a break next Sunday as I will not have access to my usual research sources.

I am braving the long-haul flight from Cape Town to La Jolla, San Diego tomorrow (34 hours from doorstep to doorstep) and will be away for eight days. Blog posts will unfortunately be rather slow during this period and, specifically, “Words from the Wise” will take a break next Sunday as I will not have access to my usual research sources.

Before highlighting some thought-provoking news items and quotes from market commentators, firstly a brief review of the financial markets' movements on the basis of economic statistics and a performance roundup.

Economy

US business confidence slipped to a new record low during the last week of March, according to Moody's Economy.com . The past week's US economic reports were generally negative and provided support to the recession arguments.

In a surprise move, initial jobless claims jumped by 38,000 to 407,000, well above expectations. March payroll data also provided further confirmation of a contracting economy. Payroll employment tumbled by 80,000 in March, while losses for the previous two months were revised downward. The US labor market shed 232,000 jobs during the quarter and the jobless rate increased by 30 basis points to 5.1% – the highest level since September 2005.

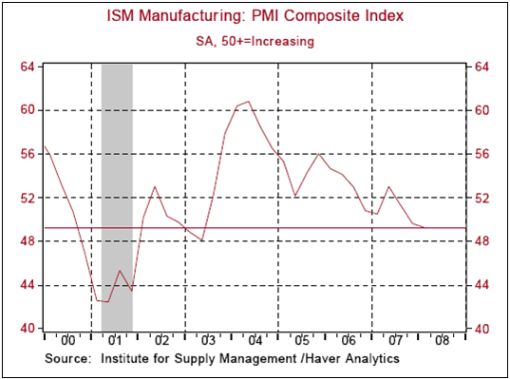

Factory activity was weak, with the ISM Manufacturing Index coming in at 48.6 in March, compared with February's 48.3. Although it is encouraging that the Index did not deteriorate substantially, it has remained below the neutral threshold of 50 for two consecutive months, suggesting that manufacturing was contracting. Similarly, the ISM Services Index was also again below 50 for March.

John Mauldin summarized the situation as follows: “Buried in the data is a picture of a squeezed consumer. Inflation is now running ahead of the growth in wages. Average hourly earnings were up just 3.6%, but inflation was 4.5% higher. That means consumers must struggle to maintain their standard of living. No wonder retail stores shed 12,000 jobs last month. Light vehicle retail sales are down by 20% from last year. This all paints a picture of a very challenged consumer.”

It comes as no surprise that a poll by the New York Times/CBS News reported that 81% of Americans felt the country was heading in the wrong direction.

The economic situation argues for the Fed funds rate to be lowered by at least 25 basis points to 2.0% at the April 29 to 30 FOMC meeting. Not surprisingly, interest rate futures moved to price in a 38% chance of a 50 basis points cut to 1.75%.

Elsewhere in the world, UK consumer confidence continued to deteriorate, Eurozone retail sales fell unexpectedly in February, a survey suggested growth in the Eurozone services sector slowed in March, and the Japanese Tankan Survey pointed to confidence among Japanese businesses plummeting in the first quarter.

WEEK'S ECONOMIC REPORTS

| Date | Time (ET) | Statistic | For | Actual | Briefing Forecast | Market Expects | Prior |

| Mar 31 | 9:45 AM | Chicago PMI | Mar | 48.2 | 46.0 | 46.0 | 44.5 |

| Apr 1 | 12:00 AM | Auto Sales | Mar | - | 5.0M | 5.1M | 5.0M |

| Apr 1 | 12:00 AM | Truck Sales | Mar | - | 6.5M | 6.6M | 6.6M |

| Apr 1 | 10:00 AM | Construction Spending | Feb | -0.3% | -1.0% | -0.9% | -1.0% |

| Apr 1 | 10:00 AM | ISM Index | Mar | 48.6 | 48.0 | 47.5 | 48.3 |

| Apr 2 | 12:00 AM | Auto Sales | Mar | 5.0M | 5.0M | 5.1M | 5.0M |

| Apr 2 | 12:00 AM | Truck Sales | Mar | 6.2M | 6.5M | 6.6M | 6.6M |

| Apr 2 | 8:15 AM | ADP Employment | Mar | 8K | - | -45K | -18K |

| Apr 2 | 10:00 AM | Factory Orders | Feb | -1.3% | -0.5% | -0.8% | -2.3% |

| Apr 2 | 10:30 AM | Crude Inventories | 03/29 | 7317K | NA | NA | 88K |

| Apr 3 | 8:30 AM | Initial Claims | 03/29 | 407K | 360K | 365K | 369K |

| Apr 3 | 10:00 AM | ISM Services | Mar | 49.6 | 49.0 | 48.5 | 49.3 |

| Apr 4 | 8:30 AM | Nonfarm Payrolls | Mar | -80K | -70K | -50K | -76K |

| Apr 4 | 8:30 AM | Unemployment Rate | Mar | 5.1% | 4.9% | 5.0% | 4.8% |

| Apr 4 | 8:30 AM | Hourly Earnings | Mar | 0.3% | 0.3% | 0.3% | 0.3% |

| Apr 4 | 8:30 AM | Average Workweek | Mar | 33.8 | 33.7 | 33.7 | 33.7 |

Source: Yahoo Finance , April 4, 2008.

In addition to the minutes of the March 18 FOMC meeting being released on Tuesday, April 8, the next week's economic highlights, courtesy of Northern Trust , include the following:

1. International Trade (March 11): The trade deficit is predicted to have widened to $59.5 billion in February from $58.2 billion in January. The important information will be the strength in exports because it is the bright spot among the different components of GDP. Consensus: $57.5 billion

2. Other reports : Consumer Credit (April 7), NFIB Survey, Pending Home Sales (April 8), Wholesale Trade (April 9), Import prices, University of Michigan Consumer Sentiment Index (April 11).

Markets

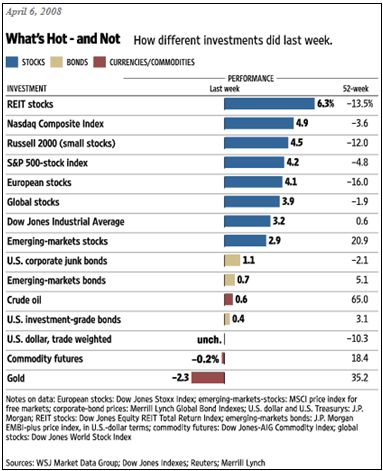

The performance chart obtained from the Wall Street Journal Online shows how different globa l markets fared during the past week.

Source: Wall Street Journal Online , April 6, 2008.

Equities

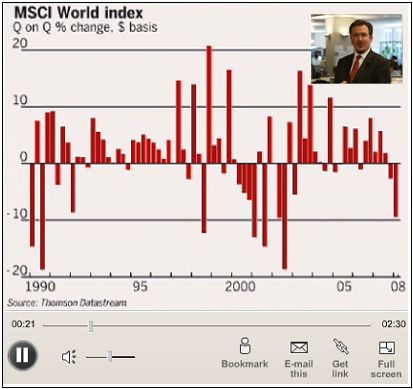

Coming on the heels of the worst quarterly performance since 2002, stock markets across the globe recorded solid gains during the past week with the MSCI World Index up by 3.9%. Emerging markets, however, lagged the mature markets and gained a more modest 0.7%. The Shanghai Stock Exchange Composite Index in particular had a torrid time and fell by 3.7%.

It was especially on Tuesday, April 1, that stock markets surged on the back of “kitchen sink” write-downs and capital-raising announcements by financial companies being interpreted that the worst might be over for the financial sector. The Dow Jones Industrial Index surged by 391 points (3.2%) on the day, spearheaded by financials.

The major US indices put in a stellar performance last week with the Nasdaq Composite Index (+4.9%), the Russell 2000 (+4.5%), the S&P 500 Index (+4.2%) and the Dow Jones Industrial Index (+3.2%) all strongly higher.

Click here for my recent post “Picture du Jour: Watch the stock/bond ratio”.

Fixed-interest instruments

Global government bonds were mixed during the week as the emphasis shifted from buying safe-haven bonds to equities.

In the US the yield on the two-year Treasury Note increased by 17 basis points, whereas the 30-year Treasury Bond yield declined by 2 basis points, resulting in a flattening of the yield curve.

Currencies & commodities

These markets were relatively quiet last week as reflected by the US Dollar Index, which was unchanged by the close of the week, and the Dow Jones-AIG Commodity Index, which was only marginally lower (-0.2%) from the previous week.

Now for a few news items and some words and graphs from the investment wise that will hopefully assist in guiding us in making appropriate investment decisions to keep our portfolios in the black.

No rope in sight

Source: Slate , March 28, 2008.

Paul Kedrosky (Infectious Greed): The great US depression of 2008

“I know, I know, magazine/newspaper contrarian cover indicators are passe, but still … this overdone one from The Independent has to be worth something, doesn't it?”

Source: Paul Kedrosky, Infectious Greed , April 1, 2008.

John Authers (Financial Times): Review of markets – first quarter of 2008

Please click the image below for the video.

Source: John Authers, Financial Times , April 1, 2008.

Forbes: Barry Ritholtz – Mapping out the markets

“Barry Ritholtz, Fusion IQ CEO, expects more bank write-downs and a long-lasting US recession.”

Source: Forbes , March 28, 2008.

GaveKal: Is worst of credit crunch behind us?

“… we have always believed that, should the current liquidity crisis fail to resolve itself in the markets, policymakers would step in and make sure to stop the rut. And over the last few weeks we have seen an increasing amount of government intervention … :

• Rate cuts. Since last summer, the Fed has cut interest rates by 300bps. As a result, mortgage spreads are narrowing, and refinancing is taking off again.

• The TAF. On December 12, 2007, the Term Auction Facility (TAF) was created, whereby the Fed will auction term funds to depository institutions against a wide variety of collateral that can be used to secure loans at the discount window.

• The TSLF. On March 11, 2008, the Federal Reserve created a $200 billion Term Securities Lending Facility (TSLF), whereby primary dealers could borrow Treasury securities for a period of up to 28 days using as collateral federal agency debt, federal agency residential mortgage backed securities (MBS) and non-agency AAA/Aaa-rated residential MBS.

• Opening of discount window. On March 17, 2008, the Fed opened up the discount window to investment banks, which are not subject to the same regulatory limitations as commercial banks.

• Bear Stearns bailout. The Fed made a US$29 billion line of credit available to JPMorgan Chase in connection with the Bear Stearns bid.

• Easing of FNM and FRE capital requirements. The Office of Federal Housing Enterprise Oversight announced on March 19 that it would reduce excess capital requirements for Fannie Mae and Freddie Mac from 30% to 20%.

• Increasing limits on MBS loans. The Federal Housing Finance Board announced that it would increase the limit on Federal Home Loan Banks' MBS investment authority from 300% of capital to 600% of capital for two years. This is estimated to enable these institutions to purchase another US$200 billion of this paper.

“All in all, it seems abundantly clear to us that the Fed is doing all that it can to get back on the curve. This point was reinforced yesterday, as Bernanke told Congress' joint Economic Committee that GDP “will not grow much, if at all, over the first half of 2008 and could even contract slightly”. In other words, more easing is coming down the pike. Encouragingly, the market has reacted positively to the Fed's resolve. It is starting to feel as if the worst of the credit crunch could be behind us.”

Source: GaveKal – Checking the Boxes , April 3, 2008.

Jeffrey Saut (Raymond James): “There you go again!”

“This morning, we reprise our comments of nearly six years ago because just as we were cautious back then, we are currently short to intermediately bullish. Longer term, we remain cautious as we honor the Dow Theory ‘sell signal' of November 21, 2007. In the near term, however, the sentiment is about as negative as it was bullishly-skewed six years ago!

“Moreover, as the brilliant GaveKal organization notes, ‘The four great momentum trades at the moment are: 1) long US Treasuries; 2) long commodities (including gold); 3) short credit [financials]; and 4) short the US dollar/long the euro. All of these trades are getting rather crowded, and, in our view, the fundamentals argue that they are due for a turnaround.' Plainly, we agree!”

Source: Jeffrey Saut, Raymond James , March 31, 2008.

David Fuller (Fullermoney): Investment strategy for inflationary times

“Currently, inflation is coming mainly from resources prices, most notably food and energy. This cannot be blamed on the Fed or any other central bank, as I have said before. Other forms of inflation are largely dormant in the main developed economies, due to slower economic growth, but clearly evident in developing (progressing) countries. Inflation will pick up again as the global economy strengthens, although we may gain some temporary respite in food prices if crop yields improve, as early reports indicate.

“[We] have been here before and inflation is not a problem to lose sleep over, provided we know what to do about it.

“Long-dated government bonds and money market funds have been temporary safe havens but most of the yields are not competitive and the investments will lose purchasing power over the long term. However high-yielding Asian and resources currencies remain attractive. There is also value in quality corporate bonds, which have been oversold in the general flight from this sector.

“In stock markets, high-yield equity funds are attractive following the shakeout. High-growth progressing markets are very promising, but you can expect a roller coaster ride, so don't pay up and consider taking some profits when accelerating uptrends (yes, they will return) lose momentum. Resources stocks have held up well because they have pricing power. Any multinational company able to pass on production costs is in a strong position. I would be wary of consumer shares in developed economies, for the time being. Although arguably cheap in many instances, they will be late to blossom.

“Gold and most other commodities are likely to remain in long-term uptrends but these will be subject to very large cyclical swings and the bigger setbacks can last for a year or two.”

Source: David Fuller, Fullermoney , April 4, 2008.

Bloomberg: IMF cuts global forecast on worst crisis since 1930s

“The International Monetary Fund cut its forecast for global growth this year and said there's a 25% chance of a world recession, citing the worst financial crisis in the US since the Great Depression.

“The world economy will expand 3.7% in 2008, the slowest pace since 2002, according to a document obtained by Bloomberg News at a meeting of Southeast Asian deputy finance ministers and central bankers in Vietnam. In January the fund projected growth of 4.1%.”

Source: Shamim Adam, Bloomberg , April 2, 2008.

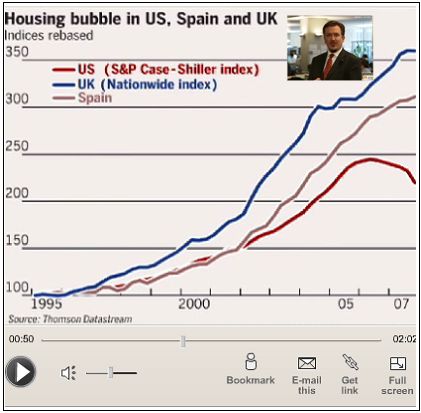

Financial Times: IMF urges greater focus on housing

“Central banks should pay greater attention to housing markets when setting interest rates, the International Monetary Fund said on Thursday, becoming the latest body to challenge the once-dominant view that monetary policy should avoid trying to damp booms and busts in property prices.

“The comments came in an analytical chapter in the latest World Economic Outlook that suggests that many European countries are vulnerable to a substantial housing market correction.

“The IMF estimates that house prices are more than 30% above their fair value in Ireland, almost 30% overvalued in the Netherlands and the United Kingdom, and more than 20% overvalued in France.

“The fund also notes that residential investment has been significantly above its historic trend in Spain, Denmark, Italy, Finland and Belgium. ‘House prices in quite a few countries look overvalued relative to fundamentals,' Simon Johnson, the IMF chief economist, told the FT.

“He said the IMF was not forecasting a house price crash in any of these countries. But he said, ‘Asset price correction remains a risk.' The tightening of global credit conditions ‘would affect all housing markets where households were highly leveraged'.

“The IMF estimates that US house prices were only a little more than 10% overvalued – less than house prices in Japan. However, Mr Johnson said the US market was vulnerable to credit conditions and could overshoot on the way down.

“The report said, ‘Policy makers may need to respond more aggressively to developments in the housing sector.'”

Source: Chris Giles and Krishna Guha, Financial Times , April 3, 2008.

Peter Schiff (SafeHaven): Bail me out Bennie

“Now that the Fed and the Treasury Department have clumsily come to the rescue of the financial titans of Wall Street, it is now politically dangerous to resist similar pleas from just about everybody else. Populism is emerging as a dominant theme in this election year, and with so much largesse showered on Bear Stearns and JPMorgan Chase, politicians are demanding even more generous terms for consumers.

“In the first place, the current mess did not result from a failure of the free market, but from too much government interference. The real estate bubble, and the shaky securitized products it spawned, resulted from the Fed artificially setting interest rates too low.

“So the Fed fixed the price of credit (interest rates) well below the rate that would have been set by the free market. This sent false economic signals to the market that more savings were available than actually existed, leading to an over-investment in housing. Also, by keeping the rate of interest below the rate of inflation, rampant speculation was encouraged, and the foundation was laid for the very type of mortgage financing that has now come back to bite us.

“In the second place, no one on Wall Street should be bailed out. The effects of the bursting of the housing bubble should be dealt with by the market, despite the fact that the underlying bubble itself was a byproduct of government intervention.

“Apart from the problems created by interfering with the market's attempts to restore balance and reallocate resources, bailouts create all sorts of moral hazards. After all, why should bailouts be limited to investment banks or overstretched homeowners?”

Source: Peter Schiff, SafeHaven , March 28, 2008.

Financial Times: Paulson says regulatory overhaul could take years

“Hank Paulson, US Treasury secretary, conceded on Monday it could take ‘many years' to overhaul US financial regulation as congressional critics took aim at his new plan to revamp a system dating back to the Great Depression.

“The Bush administration issued its blueprint for regulatory reform following criticism that the fragmented system of US financial oversight contributed to the meltdown in the US subprime mortgage business and the resulting global market turmoil.

“But the plan – which envisions expanding the reach of the Federal Reserve to prevent future crises while reducing the role of some other regulators – would ‘require a great deal of discussion and many years to complete', Mr Paulson said.

“Many of the proposals outlined on Monday would require legislation. In a sign of the difficulties the Bush administration may face in Congress, Chris Dodd, Democratic chairman of the Senate Banking Committee, said the Treasury plan had ‘serious flaws'.

“He said it ‘fails to realize that the Fed helped create this crisis by ignoring the red flags as far back as five years ago. It does not make sense to give a bigger shovel to the very people who helped dig us into this hole'.

“Wall Street executives said privately on Monday that they feared the regulatory shake-up might limit their ability to invest in higher-risk, higher-return products.

“The Treasury envisions giving the Fed broader powers to maintain financial market stability, including some oversight of investment banks and hedge funds. It also calls for a ‘prudential financial regulator' to supervise banking institutions and a ‘business conduct regulator' to protect consumers.”

Source: Joanna Chung, James Politi and Francesco Guerrera, Financial Times , March 31, 2008.

CNN: Ron Paul – Giving more power to Fed is no reform

“CNN talk show host Glenn Beck yesterday interviewed US Rep. Ron Paul about inflation and the great defect of the Bush administration's market regulation plans: the award of more power to a much too secretive and unaccountable agency, the Federal Reserve.”

Source: CNN (via YouTube ) ), April 4, 2008.

MarketWatch: US economy in ‘very difficult period,' Bernah nke says

“The outlook for US growth has worsened since January and the possibility of a recession can't be ruled out, Federal Reserve Chairman Ben Bernanke said Wednesday.

“‘It not appears likely that real gross domestic product will not grow much, if at all, over the first half of 2008 and could even contract slightly,' Bernanke said in testimony prepared for the Joint Economic Committee of Congress. ‘Clearly, the US economy is going through a very difficult period.'

“His testimony supports the view that the Fed is not done cutting interest rates. The central bank has lowered its target overnight lending rate to 2.25% from 5.25% last fall, the largest percentage decline on record. Bernanke suggested the central bank is slowing down the pace of its rate cuts. ‘Much necessary economic and financial adjustment has already taken place, and monetary and fiscal policies are in train that should support a return to growth in the second half of this year and next year,' he said.

“Inflation remains a concern, he noted, and some signs indicate that the public expects prices to continue rising.”

Source: Greg Robb, MarketWatch , April 2, 2008.

CNBC: Ron Paul versus Ben Bernanke

Source: CNBC (via YouTube ), April 2, 2008.

Paul Kasriel (Northern Trust): “Sounds a lot like a recession to me”

“It was only last August that the Fed's principal concern was preventing higher inflation. But, after 300 basis points of reductions in its Federal funds rate target, a 75 basis point reduction in its discount rate ‘penalty', the creation of various alphabet soup new liquidity ‘facilities' and the hastily-arranged assumption of Bear Stearns by JPMorgan, Fed Chairman Bernanke told the Joint Economic Committee of Congress that it ‘now appears likely that real gross domestic product (GDP) will not grow much, if at all, over the first half of 2008 and could even contract slightly'.

“Sounds a lot like a recession to me, but I will leave the formal call to the hindsighters at the NBER. In the spring, hope is eternal. So, in his next breath, Chairman Bernanke went on to say that the Fed expects ‘economic activity to strengthen in the second half of the year, in part as the result of stimulative monetary and fiscal policies; and growth is expected to proceed at or a little above its sustainable pace in 2009.'

“No disrespect intended, sir, but the Fed's GDP forecasts have about as much credibility as ADP/Macroeconomic Advisers nonfarm payroll forecasts. The bottom line: Another funds rate cut at the end of this month, probably 25 basis points.”

Source: Paul Kasriel, Northern Trust - Daily Global Commentary , April 2, 2008.

Bloomberg: MBIA loses AAA insurer rating from Fitch

“Fitch Ratings cut MBIA's insurance unit to AA from AAA, saying the bond insurer no longer has enough capital to warrant the top ranking.

“MBIA, the world's largest financial guarantor, would need as much as $3.8 billion more in capital to deserve an AAA, New York-based Fitch said today in a report. The outlook is negative, Fitch said.

“‘It will be difficult for MBIA to stabilize its credit trend until the company can more effectively limit the downside risk' from collateralized debt obligations, Fitch said. “The long-term rating of MBIA Inc. was cut to A from AA, Fitch said.

“‘We respectfully disagree with Fitch's conclusions,' MBIA Chief Financial Officer Chuck Chaplin said today in a statement. ‘MBIA has a balance sheet that is among the strongest in the industry with over $17 billion in claims-paying resources, and has a high quality insured portfolio.'”

Source: Christine Richard, Bloomberg , April 4, 2008.

Jim Sinclair (Mineset): MBIA downgrading opens door to $45 billion problem

“MBIA, the issuer of massive amounts of credit default derivatives, has had their bonds downgraded two notches by Fitch.

“This is the most significant event to occur since this entire mess started. It is reasonable now to assume that all the bond issues guaranteed by MBIA will feel the impact of that downgrade.

“I was certain the civil liability the rating companies would face by keeping the credit default derivatives at an AAA rating was high enough to break them.

“This is a very significant development that opens the door to a new $45 trillion dollar derivative problem.”

Source: Jim Sinclair, Mineset , April 4, 2008.

Bill Gross (Pimco): Home price declines have to be halted

“… I've suggested: 1) home price declines have to be halted in order to revive the US economy, 2) the Bear Stearns crisis and its solution will lead to increased government regulation and a higher probability of inflation, 3) J.P. Morgan (the old man) was right – character, not assets, should form the foundation for lending, although a reversion to this old-fashioned model is not likely anytime soon, and 4) whether you know it or not – whether you like it or not – you are bailing out Wall Street.”

Click here for the full report.

Source: Bill Gross, Pimco , April 2008.

Chicago Tribune: As owners default, lenders move in

“Once a relatively obscure slice of the real estate business, foreclosed homes that are now in the possession of lenders loom much larger as the economy flattens and housing sales stagnate.

“Across the country, federally chartered banks held more than $12 billion worth of foreclosed properties at the end of 2007, about 100 percent more than a year earlier. Of those, $6.6 billion are residential properties of one to four units, said Keith Leggett, senior economist at the American Bankers Association.

“One housing data firm said it found the same extraordinary doubling in the Chicago area in what's known as REOs – real estate owned by lenders and investors. First American CoreLogic said it determined that 2.5% of all housing in the region is in this category, though two other firms calculate a lower figure.

“Still, the 100 percent increase carries profound implications for the real estate economy because decisions by individual banks – to wait out the slump or dump properties on a deadened market – almost certainly would affect property values.”

Source: Mary Umberger, Becky Yerak and Tara Malone, Chicago Tribune , March 31, 2008.

Richard Russell (Dow Theory Letters): Government to widen mortgage guarantees

“Treasury Secretary Henry Paulson indicated the Bush administration is willing to consider congressional plans to stem foreclosures by expanding government guarantees for mortgages.

“‘I think you will continue to see flexibility as we learn and go forward,' Paulson said in an interview with Bloomberg Television in Beijing. Paulson's housing comments are a shift from last month, when he said proposals to use government funds were a ‘non- starter' and played down concern about homeowners whose houses are worth less than what they owe on their mortgages. House Financial Services Committee Chairman Barney Frank said yesterday that officials are warming to his plan to widen mortgage guarantees.”

Source: Richard Russell, Dow Theory Letters , April 2, 2008.

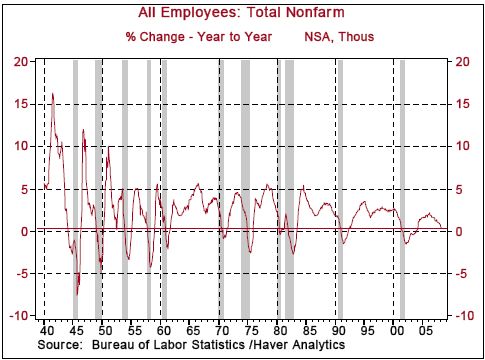

Asha Bangalore (Northern Trust): Employment data confirm recession is underway

“The unemployment rate increased to 5.1% in March from 4.8% in February. The jobless rate has risen noticeably in the past year from a cycle low of 4.4% in March 2007. The number of unemployed in the economy has risen 1.1 million since March 2007.

“Nonfarm payrolls fell 80,000 in March, following losses of 76,000 jobs in each of the prior two months. The year-to-year change in nonfarm payrolls was 0.35% in March. This is noteworthy because historically the economy has been in turning points of a business cycle at readings higher than the change reported for March 2008.

“The March employment data provide sufficient justification to win over the two dissenting hawkish voters to lower the Federal funds rate 25 bps to 2.00% at the April 29-30 FOMC meeting. In addition, the drop in car sales to an annual rate of 15.3 million units in the first quarter from 16.2 million in the fourth quarter, the weakness in new orders reported in the March ISM manufacturing survey, and the sharp drop in consumer confidence measures are other factors supportive of further easing of monetary policy.

“The Fed may need to pause after this to assess the impact of the 325 bps easing of the Federal funds rate, the fiscal stimulus package, and the various programs in place to address liquidity and credit problems in financial markets.”

Source: Asha Bangalore, Northern Trust – Daily Global Commentary , April 4, 2008.

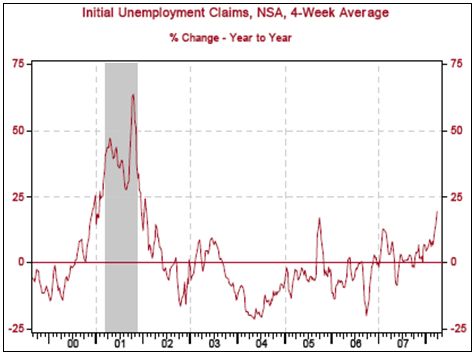

Paul Kasriel (Northern Trust): Jobless claims – if one week does not a trend make, how about 4 weeks?

“Initial jobless claims soared upward by 38 000 in the week ended March 29. Maybe the moveable feast of Easter played havoc with the seasonal adjustment factor. So, lets look at 4-week moving averages of not-seasonally-adjusted initial claims and compare them with year-ago data. The chart shows that the year-over-year rate of increase in initial jobless claims is picking up speed – hitting 19.5% in the four weeks ended March 29.

“Obviously, the latest observation is affected by the surge in the latest one-week tally. But if we rewind the tape a little, we still see double digit year-over-year percentage increases in the 4 weeks ended March 15 (13.13%) and March 22 (14.35%). In the words of Alfred Kahn, President Carter's Council of Economic Advisers chairman – the economy has entered a ‘banana'.”

Source: Paul Kasriel, Northern Trust - Daily Global Commentary , , April 3, 2008.

Asha Bangalore (Northern Trust): ISM manufacturing survey – details point to growing loss of momentum

“The ISM manufacturing survey results for March present a grim picture of the factory sector. The composite index rose slightly to 48.6 from 48.3 in February. The sharp drop in production and new orders indexes send an important signal that underlying conditions in the factory sector are weak. On a quarterly basis, the ISM composite index (49.2 in 2008:Q1) is the lowest since the second quarter of 2003.”

Source: Asha Bangalore, Northern Trust - Daily Global Commentary , April 1, 2008.

Ambrose Evans-Pritchard (Telegraph): Bear market rallies only delay day of reckoning

“Every slump is punctuated by exuberant bursts of optimism, known to traders as ‘bear market rallies'. Japan had four false dawns during its long slide into the abyss. Each lifted Tokyo's Nikkei index by an average of 53%. Such bounces can be intoxicating.

“Teun Draaisma, Morgan Stanley's stock guru, expects the current rally to boost Europe's MSCI 600 index by 21% from its trough in late January, with similar moves on the S&P 500. The battered shares do best: builders and banks this time.

“There have been nine bear rallies since 1970. The average length is four months. The surge misleads investors into believing that sunlit uplands lie ahead. Then the sucker punch hits.

“‘The Federal Reserve's actions have averted financial Armageddon, but they cannot avert an earnings recession. We don't expect a new bull market until early 2009,' he said. Morgan Stanley says earnings will fall 16% this year as debt leverage kicks into reverse.

“‘Bear markets are terrible for the human psyche. You get one profit warning after another. People see their hopes dashed so many times that they stop believing,' said Mr Draaisma. ‘You have got to be very disciplined and not buy shares too early just because they look cheap. Things can go down further than you ever dare believe,' he said. He is not predicting a bloodbath along the lines of 1929-1933 (-88%) or 2001-2003 (-49%): just a long slog, with failed rallies.

“For now, the markets are flashing a tactical buy signal. Mr Draaisma's ‘capitulation indicator' has crashed to the lowest level since the 1998 LTCM crisis: the share ‘valuation indicator' is near an all-time low.”

Source: Ambrose Evans-Pritchard, Telegraph , April 1, 2008.

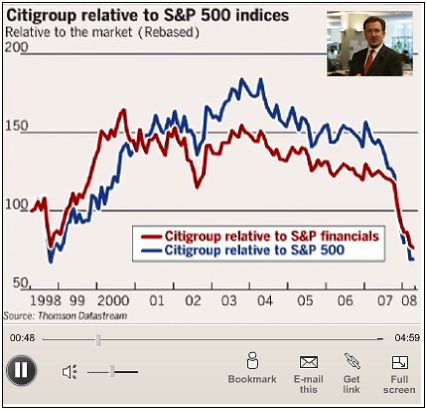

John Authers (Financial Times): Earnings downgrades have further to go

Please click on the image below for the video.

Source: John Authers, Financial Times , March 31, 2008.

David Fuller (Fullermoney): Where are we in stock market's psychological stages?

“I believe we are in the first psychological perception stage of a stock market recovery … This presumes that the January – March lows hold, or thereabouts. I will continue to give this hypothesis the benefit of the doubt, unless events prove otherwise.

“The first psychological perception phase of a significant recovery or new bull market is characterised by widespread disbelief. Although people see the firmer action, including upward dynamics off the lows, they have been psychologically conditioned to expect another downturn.

“One reason for this disbelief is that investors have raised their cash levels significantly – the first (of three) structural phases in terms of liquidity – so they have been preparing for weaker markets. Also, there will be plenty of overconfident short sellers near lows, who will understandably ‘talk their book'.

“The paradox at market lows is that risk is perceived to be highest by the crowd, when it is actually lowest. Think about it – markets have already discounted plenty of bad news, monetary authorities have slashed interest rates and / or pumped in additional liquidity, and investors who are likely to sell near the bottom have already done so.

“All that is missing is confidence, which is why markets often bumble along in a largely sideways support building phase at important lows, with small rallies capped by short selling and stale bull liquidation, before investors are eventually emboldened to fuel the next uptrend.”

Source: David Fuller, Fullermoney , April 4, 2008.

Richard Russell (Dow Theory Letters): Stock market is looking more promising

“As I see it, the market is looking a lot more promising than it did a month ago. Consider the following:

“We've had a stubborn and continuing non-confirmation on the part of the Transports.

“We've had two 90% up days, one on March 18 and a second one soon after – on March 31.

“We've seen the new lows on the NYSE collapse from 1,114 on January 22 to just 10 yesterday. On April 1 we finally saw new highs on the NYSE outnumber new lows.

“We've seen the market's technical action improve in the face of frighteningly bad news along with an avalanche of bearish opinions and forecasts, many from some of the nation's leading economists.

“We've seen the short interest on the NYSE build up to a record 16 million shares sold short. The higher the short interest within a market that's working higher, the more bullish the situation.”

Source: Richard Russell, Dow Theory Letters , April 4, 2008.

Barron's: Are you ready for Dow 20,000?

“Despite the Bear Stearns bailout and the Fed's rate cuts, a sense of foreboding is still abroad on Wall and Main Streets. Few investors feel good with an economic slowdown gathering force, the dollar in the dumps and contagion threatening to hit financial sectors previously unscathed or not even suspected of being at risk.

“This in mind, we contacted James Finucane, a 67-year-old stock strategist who now works as a consultant in West Lafayette, Ind., home of Purdue University.

“He also has been great at calling stock-market lows, including that reached in the week after the October 1987 crash. ‘Lows have always been easier for me to call than tops. I was premature in seeing the 2000 stock market high, for instance,' notes Finucane, who long labored in Chicago at Stifel, Nicolaus.

“To him, we're now at yet another extraordinary low, especially with the unprecedented actions taken by the Fed of late to offer liquidity to investment banks and to commercial banks stuck with mortgage-backed securities of uncertain value. In fact, he foresees an explosive rally, with the Dow rocketing to 18,000 to 20,000 within a year from its current 12,361. The climb, he says, might begin imminently or take a few months of backing and filling before the market takes off.

“Finucane argues that financial crises invariably yield spectacular buy points, especially when they reach crescendos. To him, the Bear Stearns bailout was a crescendo event.

“Why is Finucane bullish? For one thing, he observes that ‘governments and central banks have a clear incentive to promote growth, so to bet on a prolonged slump is to bet against the government, markets and human nature.' He also takes comfort in a host of technical factors, including liquidity. Money-market cash, for example, has soared to $3.45 trillion, versus $2.2 trillion at the market low in March 2003. And US domestic equity funds have seen a record nine consecutive months of net outflows … The previous record was eight months, following the 1987 stock-market crash. The Conference Board Consumer Expectations Index is at a 17-year low. The Reuters-University of Michigan Consumer Confidence Survey is at its worst level since 1992. The American Association of Individual Investors finds small investors more bearish than they've been since 1990. And on and on.”

“In Finucane's estimation, months of stock liquidation and cash buildup, horrible sentiment and a bailout that could alter investor psychology have lit the fuse for an explosive rally. It will be ignited by one of those mercurial shifts in mood from abject fear to tentative confidence and, finally, wanton greed.”

Source: Jonathan R Laing, Barron's , March 24, 2008.

John Hussman (Hussman Funds): Dangerous to start looking for a bottom

“Generally speaking, it is true that the stock market has tended to bottom about 4 to 5 months before the end of a recession. It is quite dangerous, however, to assume that the current downturn in the market or the economy will be of a specific duration, and to start ‘looking for a bottom' on that basis.

“Just as market tops are marked by expectations that economic strength will persist indefinitely, stock markets hit bottom when an economic downturn is taken as full fact, when conditions are widely expected to get substantially worse, and when investors have largely given up on any hope that the economy will improve in the foreseeable future.

“My impression is that the early calls for a bottom ignore a realistic sense of history about how market peaks and troughs are formed. Once an ongoing and worsening recession is taken as a matter of common knowledge, it will be reasonable to talk about durable market lows. Until then, investors should recognize that a standard run-of-the-mill bear market averages a loss of about 30%.

“Historically, bear markets that are associated with economic recessions tend to be deeper than those that occur without a recession. Moreover, as Tim Hayes of Ned Davis Research points out, cyclical bears that emerge in the context of a longer-term ‘secular' bear market also tend to be longer-than-average in duration: ‘Whereas the median cyclical bear has lasted about a year since 1900, the median duration has been 245 days during secular bulls and 525 days during secular bears. In other words, the revaluation process has tended to make cyclical bears last twice as long during secular bears.'”

Source: John Hussman, Hussman Funds , March 31, 2008.

Citigroup: Favor emerging markets

“Emerging Markets have outperformed for seven consecutive years now and we think they can outperform again in 2008. Our bullish view is based on a number of drivers, including (1) relatively resilient economic and earnings growth, (2) valuations that suggest the region is not overly expensive, and (3) Emerging Markets are a likely beneficiary of much of the cheap money being pumped into the financial system right now.

“For 2008, our economists forecast the slowest year of global growth (2.8%) since 2003. In comparison to the past 20 years, this would be a relatively mild downturn. Developed markets have seen the greatest downgrades to expectations. Over the last six months, 2008 GDP forecasts for the US have come down from 2.5% to 0.8%. Similar declines have been seen in Europe – the UK from 2.8% to 1.4% and the Euro zone from 2.3% to 1.3%.

“In comparison, the downgrades to Emerging Market GDP forecasts have been more modest. Six months ago our Emerging Market economists forecasted 2008 real GDP to grow by 6.9%. Now the forecast stands at 6.1%. This is broadly trend growth. While our economists do not subscribe to the decoupling argument, they do believe that Emerging Market economies are far better positioned to deal with a developed market slowdown than in previous cycles.

“The supportive macro backdrop for Emerging Markets should ensure greater earnings resilience than elsewhere. IBES consensus expectations are for 14.8% earnings growth in 2008. While we suspect this will prove to be too high, the likely downgrades should be small compared to the earnings downgrades we forecast elsewhere.”

Click here for the full report.

Source: Citigroup , March 25, 2008.

CNBC: Marc Faber – Bernanke is gold buyers' best friend

Source: CNBC (via YouTube ), March 19, 2008.

Richard Russell (Dow Theory Letters): Bull market in gold not over

“Oh, in case you were wondering, the bull market in gold is not over. This is a correction. Corrections in bull markets tend to be sudden and violent. Declines in bear markets tend to be plodding and dragged out as the item dribbles lower.”

Source: Richard Russell, Dow Theory Letters , April 1, 2008.

James Turk (GoldMoney): Bull market in commodities still going strong

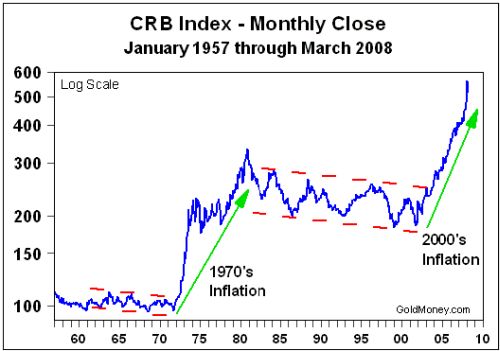

“At the end of each month, one of the first charts I turn to is the Commodity Research Bureau Index. Rather than looking at the ‘Current Index', which is a relatively new index created a couple of years ago, I use the ‘Continuing Index' to provide a fairly consistent long-term picture of commodity prices. Here's the monthly chart of the CRB Continuing Index from 1957 through March 2008.

“The above chart is important. There have been dozens of reports the past couple of weeks that the bull market in commodities has ended. Those reports conflict with the message of the above chart. One can only reasonably conclude from any objective view of this chart that the bull market in commodities in still going strong.

“The CRB Index did drop -8.7% in March, but that is after gaining 5.7% in January and a further 12.4% in February. What's more, the CRB Index had risen in eight of the previous ten months ending February 2008. So after a run like that, a correction can be expected. But even after dropping in March, the CRB Index is still up 8.5% for the first three months of this year, which by any measure is a spectacular result.”

Source: James Turk, GoldMoney , April 1, 2008.

Financial Times: Rush to restrict trade in basic foods

“Governments across the developing world are scrambling to boost farm imports and restrict exports in an attempt to forestall rising food prices and social unrest.

“Saudi Arabia cut import taxes across a range of food products on Tuesday, slashing its wheat tariff from 25% to zero and reducing tariffs on poultry, dairy produce and vegetable oils.

“On Monday, India scrapped tariffs on edible oil and maize and banned exports of all rice except the high-value basmati variety, while Vietnam, the world's third biggest rice exporter, said it would cut rice exports by 11% this year.

“The moves mark a rapid shift away from protecting farmers, who are generally the beneficiaries of food import tariffs, towards cushioning consumers from food shortages and rising prices.

“But economists warned that such actions risked provoking an upward spiral in global food prices, which have already been pushed higher by rising demand from emerging markets like China and India and pressure on land from the growing production of bio-fuels.

“‘There are so many speculators in the market that when something happens to affect supply, there is an immediate reaction,' said Paul Braks, commodities analyst at Rabobank, one of the largest agribusiness lenders. ‘Markets are very tight, and when you see net exporters imposing these export restrictions to stabilise domestic food prices, it makes the market nervous.'”

Source: Alan Beattie, Financial Times , April 1, 2008.

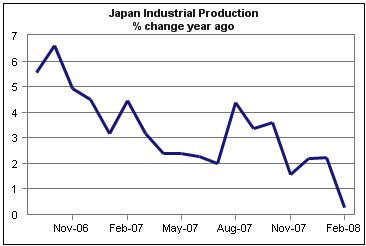

Moody's Economy.com: Slump in Japanese industrial production

“Japan's industrial production index recorded its second consecutive month-on-month contraction, falling 1.2% m/m in February after falling 2.2% in January. A subdued domestic environment, weak external demand and an appreciating currency are undermining manufacturing activity in the Land of the Rising Sun.”

Source: Moody's Economy.com , March 31, 2008.

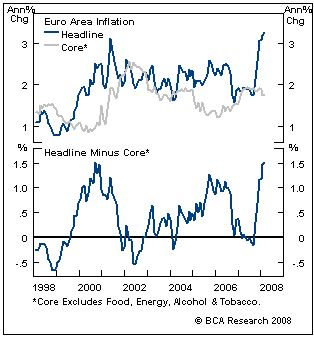

BCA Research: Euro area inflation is peaking

“… concerns about an upward spiral in consumer price inflation within the euro area are premature.

“The gap between euro area headline and core CPI is the widest on record: Headline inflation is running at 3.3%, well above the ECB's target of 2%, while core is trending down and is only at 1.8%. However, this gap is set to narrow via a slowing in the headline rate. Despite the angst about energy and food prices, the impact of both on inflation is likely peaking. In fact, even if crude prices remain at around $100/bbl over the next year, the rate of change will slow markedly. Our Models suggest that energy's contribution to euro area headline CPI will drop substantially and implies European central bankers could have a change of heart over the coming months, so long as second round effects do not occur.”

Source: BCA Research , April 2, 2008.

Financial Times: Inflation Asia's biggest risk

“Inflation will reach its highest level in a decade in most of Asia this year, threatening to reverse recent gains in productivity as well as creating fiscal strains for governments that provide massive subsidies for fuel and food, according to the Asian Development Bank.

“In the case of countries such as Vietnam, where the inflation rate is expected to double this year to about 18%, the ADB said the government needed to introduce urgently a blend of monetary and fiscal tightening as well as allow some appreciation of the local currency to avoid stalling its recent stellar economic progress.

“In the case of China, where inflation accelerated to its fastest pace in 11 years, ‘the challenge is now to bring down inflation and at the same time avoid a hard landing,' according to Ifzal Ali, the ADB's chief economist.

“While inflation has been fuelled by soaring world food and energy prices, the ADB also stressed on Wednesday that the problem was in equal part generated by domestic factors, such as skills shortages amid an economic boom. Mr Ali warned that the inflationary threat was much greater than official figures suggest in countries such as India because of fuel and food subsidies.

“‘South Asia is going to be very vulnerable to high commodity prices,' he said. ‘What is happening because of [price] controls is that the inflationary pressures are grossly under the table. But the pressures are there and building.'

“As a result, according to the ADB, several governments are likely to opt for monetary tightening soon, including India where inflation could prove a major political issue in the run-up to elections next year.”

Source: Raphael Minder, Financial Times , April 2, 2008.

John Authers (Financial Times): Grim outlook for UK housing

Please click on the image below for the video.

Source: John Authers, Financial Times , April 2, 2008.

By Dr Prieur du Plessis

Dr Prieur du Plessis is an investment professional with 25 years' experience in investment research and portfolio management.

More than 1200 of his articles on investment-related topics have been published in various regular newspaper, journal and Internet columns (including his blog, Investment Postcards from Cape Town : www.investmentpostcards.com ). He has also published a book, Financial Basics: Investment.

Prieur is chairman and principal shareholder of South African-based Plexus Asset Management , which he founded in 1995. The group conducts investment management, investment consulting, private equity and real estate activities in South Africa and other African countries.

Plexus is the South African partner of John Mauldin , Dallas-based author of the popular Thoughts from the Frontline newsletter, and also has an exclusive licensing agreement with California-based Research Affiliates for managing and distributing its enhanced Fundamental Index™ methodology in the Pan-African area.

Prieur is 53 years old and live with his w

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.