Steps to Take When the Stock Market is Ready to Crash

Stock-Markets / Financial Crash Sep 18, 2013 - 06:25 PM GMTBy: Investment_U

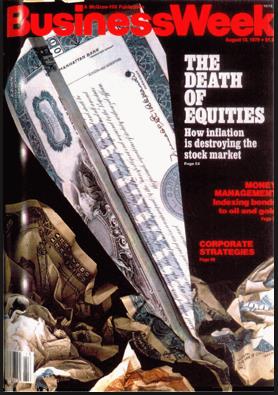

Marc Lichtenfeld writes: It is Wall Street legend that in 1979, BusinessWeek informed readers of “The Death of Equities” right before the biggest run-up in stock prices in history.

Marc Lichtenfeld writes: It is Wall Street legend that in 1979, BusinessWeek informed readers of “The Death of Equities” right before the biggest run-up in stock prices in history.

Since then, many other magazine covers have served as a contrarian signal for where the markets are headed. That’s led to a theory among some investors that the market is about to do the opposite of whatever mainstream magazine covers suggest.

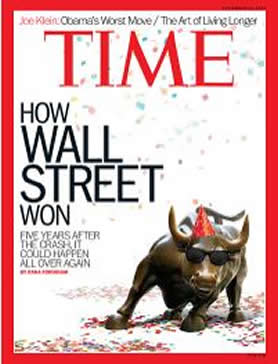

This week, for example, bears are celebrating and bulls are cowering after Time magazine explains “How Wall Street Won” five years after the financial crisis, complete with a bull in a party hat.

However, the cover (and article that goes along with it) can hardly be described as bullish. What the bears are conveniently ignoring is the subhead, which reads “Five Years After the Crash, It Could All Happen Again.”

The article goes on to describe how the big banks have become even larger and the whole too-big-to-fail mess could repeat itself.

So devout followers of the magazine cover theory shouldn’t hit the sell button just yet.

But for the sake of argument, let’s pretend that Time‘s cover is wildly bullish and did send a legitimate bear signal to the world. Or maybe tapering will sink stocks. Or Mercury in retrograde will depress earnings… What would be the proper course of action for investors in a bear market?

Four Steps to Prepare for a Crash

1.Understand your time horizon. If you invested 10 years ago for an event this year, you might seriously consider selling your stocks and converting them to cash – but that’s regardless of where you think the market is going. If you need the money in the short term, it doesn’t belong in the market. If you have longer than a few years to invest, don’t worry about a crash as long as you…

2.Make sure your stops are in place. The Oxford Club recommends a 25% trailing stop loss. The stops protect gains as stocks rise and ensure that no single position results in a devastating loss. Since stocks are up so much over the past four years, even if you do get stopped out, you should get out with a profit. This strategy also ensures that you have plenty of cash to get back into the market at lower prices. During the financial crisis, Oxford Club Members were stopped out of positions in 2008 and took profits on many stocks that had risen during the previous bull. That freed up capital to get back in during the lows of 2008 and 2009, resulting in some huge winners, including Discovery Communications (Nasdaq: DISCA), up 255%, and Diageo (NYSE: DEO), up 171%.

3.Review your portfolio. If you haven’t done so in a while, take a look at the stocks in your portfolio. Make sure the companies are still operating at a high level. If you own Perpetual Dividend Raisers – stocks that raise their dividend every year – examine when the company last raised its dividend. If the company is continuing its streak of annual dividend raises, generally speaking, you should be fine for the long term.

4.Be ready to buy when things are bleak. It takes a lot of guts to buy stocks when it feels like the market is falling apart, but that’s how the biggest gains are made. Whether you’ve raised capital by selling stocks whose stops were hit, or you have money set aside, buy stocks after a market slide. You might not catch the bottom, but since stocks go up over the long haul, getting them at a discount will add significantly to your returns.

Regardless of the predictability of the magazine cover theory or any other signal, long-term investors should not get caught up in the day-to-day market noise. You will make money as long as you don’t panic in the face of a sell-off.

Good investing,

Marc

Copyright © 1999 - 2013 by The Oxford Club, L.L.C All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Investment U, Attn: Member Services , 105 West Monument Street, Baltimore, MD 21201 Email: CustomerService@InvestmentU.com

Disclaimer: Investment U Disclaimer: Nothing published by Investment U should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Investment U should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Investment U Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.