Fiat Currencies, Debt, Liquidity Become Credit and Credit is Debt

Stock-Markets / Global Debt Crisis 2013 Dec 05, 2013 - 04:40 PM GMTBy: Gordon_T_Long

Perceptions of FLOWS have now taken control of the global financial market. Investors must carefully consider where the Risks are looming and rapidly growing.

Perceptions of FLOWS have now taken control of the global financial market. Investors must carefully consider where the Risks are looming and rapidly growing.

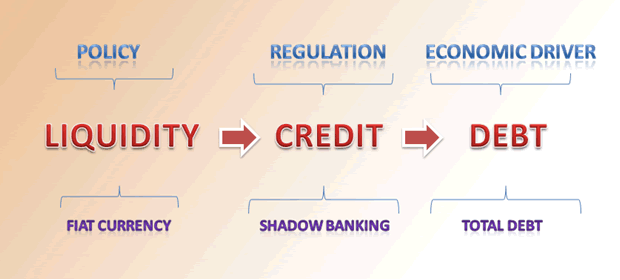

In the new world dominated by Fiat Currencies and Debt, Liquidity has become Credit and Credit is Debt.

Credit and Debt are often used interchangeably as simply the opposite sides of the same coin, but there are important differences and the distinctions are critical to understanding when this game will end and why.

To understand risks and flows properly we need to separately examine 1- Liquidity, 2-Credit and 3- Debt.

"Liquidity is Credit is Debt"

Terminology

LIQUIDITY: This is the DEGREE or EASE with which an asset or security can be bought or sold in the market without affecting the asset's price. Liquidity is characterized by a high level of trading activity. Assets that can be easily bought or sold are known as liquid assets. This ability to convert an asset to cash quickly can also be thought of as "marketability."

CREDIT: The term refers to the borrowing CAPACITY of an individual or company. This is a contractual agreement. The amount of money available to be borrowed by an individual or a company is referred to as credit because it must be paid back to the lender at some point in the future. For example, when you make a purchase at your local mall with your VISA card it is considered a form of credit because you are buying goods with the understanding that you'll need to pay for them LATER.

DEBT: Is the AMOUNT of money borrowed by one party from another.

Flow

LIQUIDITY The DEGREE or EASE with which assets or securities can be bought or sold is about POLICY. It is about Monetary, Fiscal and Public policies set by authorities in control of these policies. These policies no longer have the policing restrictions they once did before governments unilaterally, without a plebiscite of the electorate moved to FIAT Currencies which are backed by nothing other than the credit and good faith of the government or more specifically, the tax payer.

CREDIT Credit as the borrowing CAPACITY of an individual or company has historically been determined by banking REGULATION based on lending requirements such as Capital Ratios, Reserve Ratios, Capital classifications and other enforced controls. Today however we have a $72 Trillion Global Shadow Banking System operating that is basically unregulated and opaque which uses esoteric structures such as SIV (Structured Investment Vehicles), Securitization Instruments such as MBS & ABS (Asset Backed Securities), Offshore and other off balance sheet instruments employing terminologies such as Contingent Liabilities, Repos, Rehypothecation, Collateral Transformations etc. As banks create money out of thin air by means of the fractional reserve banking system, credit is likewise conjured up with even greater ease.

DEBT Debt as the AMOUNT of money actually borrowed by one party from another is determined by the economic capabilities of supporting the debt borrowed. We are talking total debt which includes Public, Private and Household debt. It also includes Off Balance Sheet and Contingent Liability debt (though this is never reported or visible). This is because the economy must support this debt and the liabilities which come with it existing.

Our DEBT BASED ECONOMIC SYSTEM has become FUELED by CREDIT and the LIQUIDITY that allows the degree and easy by which it FLOWS.

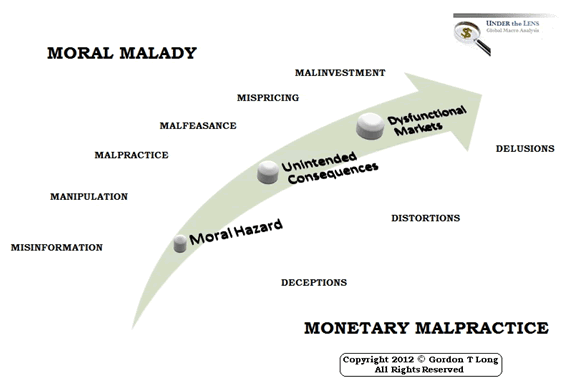

Monetary Malpractice

What few appreciate and must be understood is that it must be extremely tightly controlled or you will get:

- Mispricing,

- Misallocation of Capital and

- Mal-Investment.

You also get

- Moral Hazard and

- Unintended Consequences.

After nearly 9 years of extremely low interest rates and five years of nearly zero interest rates which should expect no less than these elements to be a major concern. They are but no one wants to talk about them because Keynesian Economics has no answers to this and no one knows what else to do. That doesn't mean it doesn't exist with all its consequences as I have outlined extensively in Monetary Malpractice and Moral Malady. But let me not digress!

Players & Dynamics

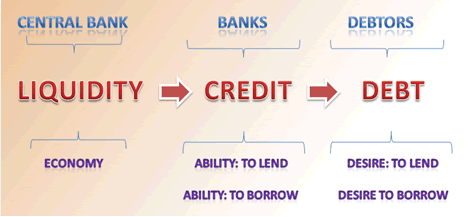

The players and dynamics at play we are familiar with but are worth restating.

CENTRAL BANKS The central banks, which in the case of the Federal Reserve in the US are not government apparatuses. The Fed is a quasi-government structure that is actually owned by the banks. Ben Bernanke's legal boss, are the shareholders, which are the banks. He may be appointed by the President, approved by Congress and give testimony before Senate and House Banking Committees but his job is the about the soundness and protection of the banks. The economy matters only in how it impacts lending and risk. The Fed's dual mandate of Price Stability and Full Employment are really a measure of how risky bank loans are and whether the debt obligations can be carried by the economy.

As big a subject as this is, I want to focus more on CREDIT which is about the Commercial Banks and DEBT which is about Debtors.

Banks & Debtors

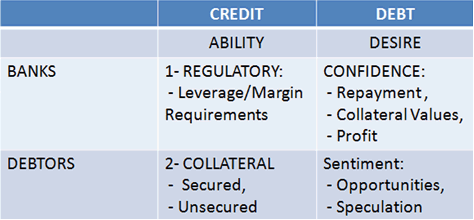

I want to differentiate clearly here about the difference between

- The ABILITY: TO LEND and

- The ABILITY TO BORROW versus

- The DESIRE: TO LEND and

- The DESIRE: TO BORROW.

Each of these has different controllers, metrics and ways of assessing. Obviously they all work together but changes in anyone of these and this LIQUIDITY > CREDIT > DEBT FLOW can suddenly stop or slow precipitously.

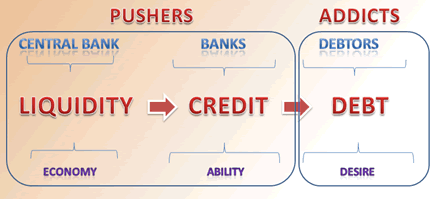

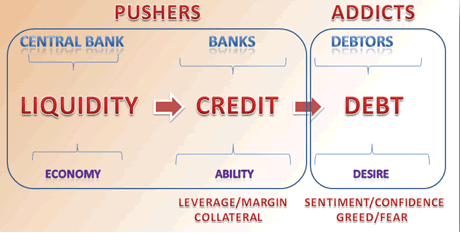

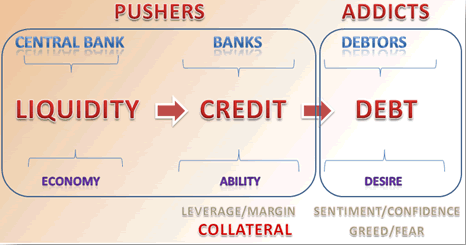

Pushers & Addicts

The banks as we are all aware are in the Business of Trafficking in Debt. We have become so addicted to debt that we might want to think of banks as PUSHERS. The Private, Public and Household sectors have become addicts, completely incapable of stopping.

Never has that age old adage been truer:

"Gold is the Currency of Kings, Silver the Currency of Merchants and Debt the Currency of the Poor."

Motivations

The Motivations need to be considered carefully. The PRICING of the DRUG is like heroin. The stronger the desire and need for the drug, the higher will be the price and profit.

This will continue until the inevitable happens where the addict simply is unable to PAY and must resort to unsavory means to support the addiction. What does this mean to Credit and Debt? Let's look more closely.

Understanding the Levers

ABILITY TO CREATE CREDIT is about the CAPACITY. This capacity is about:

- Margin or Leverage and

- Collateral.

THE DESIRE TO CREATE DEBT is about the LEVELS which are driven by:

- Sentiment or Confidence and

- Greed and Fear or Speculation.

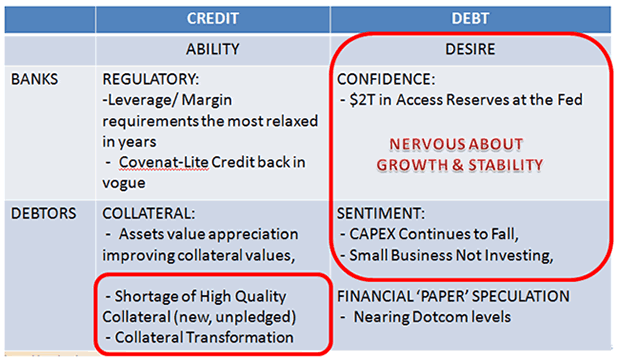

What is critical to appreciate is the Transformation of Liquidity to Credit to Debt The Transformation of Credit to Debt is Breaking Down in a couple of key areas.

First: The Desire to lend by the banks is decidedly muted as demonstrated by the fact they have $2T of access reserves at the Federal Reserve. They can't find the loans that have satisfactory lending profiles.

Additionally, Corporations are not investing in CAPEX and are using cash flows to fund investment or cheap commercial paper.

Secondly: Those trading or wildly speculating in "Paper" investments can't find sufficient low risk collateral that they are now resorting to strategies such as collateral transformation with the banks to make this happen.

Credit is flowing only to the Financial Intermediaries that are trading in paper claims on wealth - not on to the Economy that actually creates the wealth. It isn't that the banks don't want to lend.

The growth and opportunities are not seen to be there. Simply put, there is too much mispricing, excessive mal-investment and distorted allocation of capital.

It is showing up with a collateral shortage.

... and this is what we need to understand:

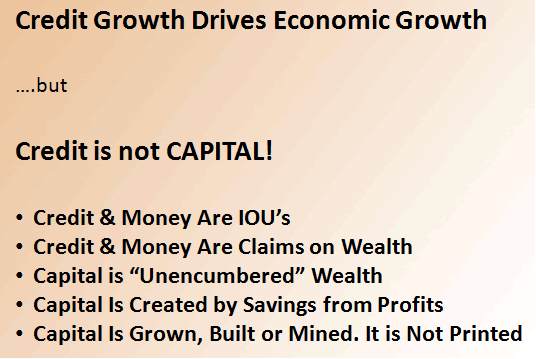

Credit Is Not Capital

Credit may be Money. But Money is not Capital!

Credit and currency are IOUs.

Credit and currency are only CLAIMS on wealth. These claims must be enforced by law and hopefully honored. They are NOT wealth in your hand. They are not longer a store of value when currencies can be arbitrarily debased to avoid paying existing claim values.

Capital on the other hand is "Unencumbered" Wealth.

Capital is created not printed.

Capital is created by savings from profits.

Capital can be thought of as only being created by growing it, building it or mining it.

It is never printed!

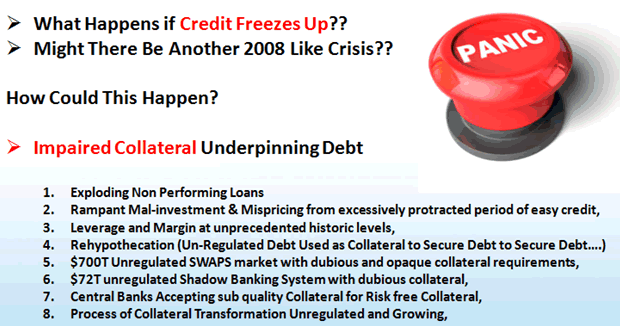

Quality Collateral Is Becoming Impaired and Scarce

Where is the problem?

As I said, we have impaired collateral underpinning debt.

Credit Leads The Way Today - Early Warning Signs

This is not going to end well. We are getting short term signs of this. But these are only small degree indicators.

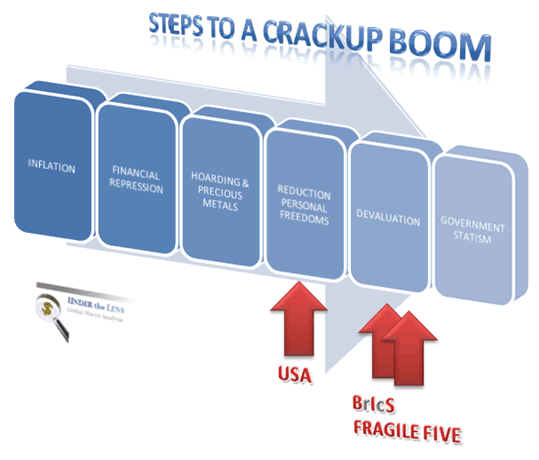

We have more to go in what is appearing more and more to be stages of a von Mises crackup boom.

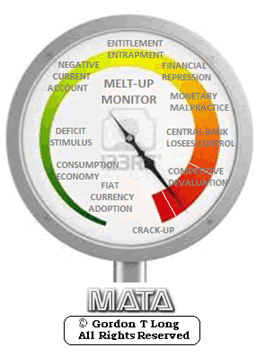

Follow what is to come through our Melt-Up Monitor series.

Signup for notification of the next Melt-Up Monitor Release

Request your FREE TWO MONTH TRIAL subscription of the Market Analytics and Technical Analysis (MATA) Report. No Obligations. No Credit Card.

Gordon T Long Publisher & Editor general@GordonTLong.com

Gordon T Long is not a registered advisor and does not give investment advice. His comments are an expression of opinion only and should not be construed in any manner whatsoever as recommendations to buy or sell a stock, option, future, bond, commodity or any other financial instrument at any time. While he believes his statements to be true, they always depend on the reliability of his own credible sources. Of course, he recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, before making any investment decisions, and barring that you are encouraged to confirm the facts on your own before making important investment commitments. © Copyright 2013 Gordon T Long. The information herein was obtained from sources which Mr. Long believes reliable, but he does not guarantee its accuracy. None of the information, advertisements, website links, or any opinions expressed constitutes a solicitation of the purchase or sale of any securities or commodities. Please note that Mr. Long may already have invested or may from time to time invest in securities that are recommended or otherwise covered on this website. Mr. Long does not intend to disclose the extent of any current holdings or future transactions with respect to any particular security. You should consider this possibility before investing in any security based upon statements and information contained in any report, post, comment or suggestions you receive from him.

Gordon T Long Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.