Time to Ditch Stock Market Swinging Cyclicals?

Stock-Markets / Stock Markets 2014 Apr 04, 2014 - 06:25 PM GMT George Leong writes: The stock market appears to be getting somewhat top-heavy. Scanning through my screens, I am quite amazed to find that the majority of S&P 500 stocks are well above their respective 200-day moving averages, which makes opportunities much more difficult to come by for the average investor who might look at their portfolio once a week or month.

George Leong writes: The stock market appears to be getting somewhat top-heavy. Scanning through my screens, I am quite amazed to find that the majority of S&P 500 stocks are well above their respective 200-day moving averages, which makes opportunities much more difficult to come by for the average investor who might look at their portfolio once a week or month.

But the buying in the stock market has still largely been with the technology, growth, and small-cap stocks, due to the higher potential to make quick money versus investing in blue chips or industrial companies.

In 2013, we saw staggering upside moves in some of the momentum stocks, such as Google Inc. (NASDAQ/GOOG), priceline.com Incorporated (NASDAQ/PCLN), Netflix, Inc. (NASDAQ/NFLX), and Chipotle Mexican Grill, Inc. (NYSE/CMG). These are the top players in their respective areas.

But that was then. Now, we are seeing a renewed interest in some of the safer names in the stock market, which is why the Dow Jones and S&P 500 outperformed in March.

My view is that while there will still be money to be made in some of the more speculative and momentum plays in the stock market, we could also see a pause for investors to digest the gains made.

Cyclical stocks, or those companies that swing with the economy, are still worth a look, but should the economic renewal stall and jobs creation dry up, it might be time to look elsewhere. Here I’m talking about those sectors such as auto, furniture, retail, travel, and restaurants.

Everyone is spending when all is good and people are making money on the stock market, but spending will curtail on any signs of slowing and a drop in confidence.

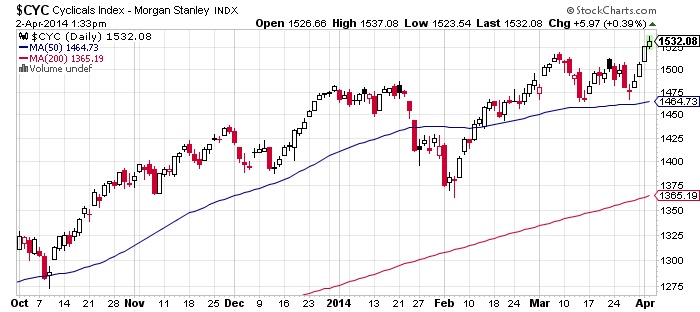

The Morgan Stanley Cyclicals Index shows the uptrend in the cyclical stocks.

Chart courtesy of www.StockCharts.com

The area that will perform best in an economic downturn is the defensive sector—the area that comprises boring companies that make products that are used every day.

When the economy is growing, these stocks manage to produce average returns, though they underperform cyclicals. However, in a downtrending economy, defensive stocks tend to outperform.

The chart of the Consumer Staples Select Sector below shows the rally in defensive stocks since February.

Chart courtesy of www.StockCharts.com

Defensive sectors in the stock market include utilities and consumer staples. Some of the top proven defensive stocks include the likes of Kimberly-Clark Corporation (NYSE/KMB), The Travelers Companies, Inc. (NYSE/TRV), CVS Caremark Corporation (NYSE/CVS), and The Clorox Company (NYSE/CLX). Boring stocks, but they will deliver excellent long-term returns.

So the idea now is to monitor the stock market and look for clues on where the money is going. This year may turn out to be the year for defensive plays with excellent dividend flows and the ability to make some capital gains while seeking capital preservation.

© 2014 Copyright Daily Gains Letter - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.