Beware Another U.S. Recession is Lurking

Economics / Recession 2014 Apr 11, 2014 - 05:11 PM GMTBy: Clif_Droke

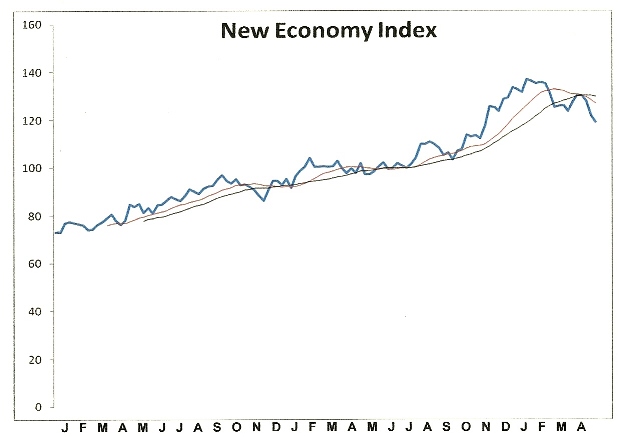

The New Economy Index (NEI) is on the brink of sending its first confirmed “sell” signal in four years.

The New Economy Index (NEI) is on the brink of sending its first confirmed “sell” signal in four years.

The index is a blend of the leading U.S. retail and business service stocks. NEI is based on the concept that these component stocks are accurate reflections of changes within the real-time U.S. economy (as opposed to the lagging economic statistics favored by the Labor Bureau).

Except for a brief period in the spring of 2010, NEI has confirmed a firming economic picture for U.S. retailers since 2009. As you can see in the following graph, though, the index has made a series of lower highs and lows – the first in well over two years. Moreover, the important 12-week moving average (red line) has crossed below the 20-week MA (black line) and both moving averages are in the process of decisively turning down.

The weakness reflected in the NEI suggests that U.S. retailers are experiencing what could be the early throes of spillover weakness from the uncertainty and economic weakness in China and the emerging markets. Economists this year have persistently played down the slowing economy in China, but there’s no ignoring the fact that China’s stock market is now in its fifth year of a bear market. That’s a negative sign for China’s economic outlook and there’s no glossing over it. Equity markets always reflect future business conditions in the interim to longer-term outlook. What the Shanghai Composite Index suggests is that China is in for some increasing economic head winds.

Meanwhile in China, it was announced that the country’s exports fell -6.6% in March versus the year-ago period. This frustrated Wall Street’s expectations of positive growth for China. Imports also declined -11.3% in March, which follows the -18% drop in exports February. As Shiraz Mian, research director at Zacks puts it: “This is bad news, but interpreting Chinese economic data is never straight forward. The widespread perception among economists who closely follow the Chinese economy is that the export data from the year-earlier period was artificially boosted by over-invoicing, an illegal practice that Chinese exporters use to dodge tough capital controls and bring capital into the country.”

China’s industrial production in the first two months of 2014 increased at its slowest pace in two years and retails sales have also been declining. Chinese authorities recently announced a stimulus package in response to this slowdown. Experts believe this may not be enough to nudge growth higher since bank lending remains restricted.

Another looming problem for China is the possibility that the country’s housing market could crack. Tighter lending and homeownership restriction’s by China’s government in recent years could lead to defaults among China’s 90,000 developers, according to a recent Bloomberg report. China’s central bank initiated a liquidity injection on Thursday, the first in more than two months. The rally in China’s stock market in recent days was likely in anticipation of this action. We’ll find out in the next few days how helpful this action really was for China’s economy once March bank lending data is released.

China isn’t the only region of the globe experiencing deflationary headwinds. An article appearing in Reuters suggested that U.S. stock market weakness is spreading to Asian markets. Actually, the opposite is the case. The Japanese Nikkei Index has been a notable laggard since the start of the year, as the following chart shows. Moreover, recent upward pressure in the Japanese yen has caused financial institutions to react by unwinding the yen carry trade. This in turn puts downward pressure on equities owing to the general need to raise cash.

Back to the U.S. economic front, if the NEI continues to weaken we’ll likely have a confirmed “sell” signal later this month. That in turn would serve as a warning for investors and business owners to beware a retail sales slowdown in the coming months. The implications of this would presumably be bullish for gold as it would underscore the metal’s safe haven status for defensive-minded investors.

Kress Cycles

Cycle analysis is essential to successful long-term financial planning. While stock selection begins with fundamental analysis and technical analysis is crucial for short-term market timing, cycles provide the context for the market’s intermediate- and longer-term trends.

While cycles are important, having the right set of cycles is absolutely critical to an investor’s success. They can make all the difference between a winning year and a losing one. One of the best cycle methods for capturing stock market turning points is the set of weekly and yearly rhythms known as the Kress cycles. This series of weekly cycles has been used with excellent long-term results for over 20 years after having been perfected by the late Samuel J. Kress.

In my latest book “Kress Cycles,” the third and final installment in the series, I explain the weekly cycles which are paramount to understanding Kress cycle methodology. Never before have the weekly cycles been revealed which Mr. Kress himself used to great effect in trading the SPX and OEX. If you have ever wanted to learn the Kress cycles in their entirety, now is your chance. The book is now available for sale at:

http://www.clifdroke.com/books/kresscycles.html

Order today to receive your autographed copy along with a free booklet on the best strategies for momentum trading. Also receive a FREE 1-month trial subscription to the Momentum Strategies Report newsletter.

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.