Leveraged Gold ETF's Signal the End for Gold Stock Investments?

Commodities / Exchange Traded Funds May 01, 2008 - 03:54 AM GMTBy: Bob_Kirtley

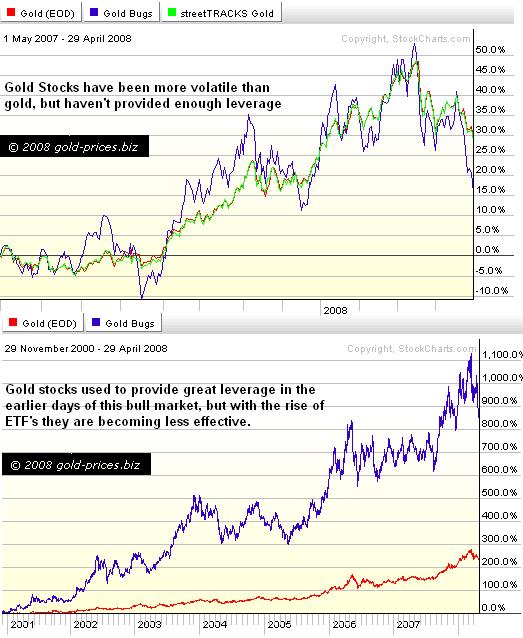

During the last major rally in gold prices, gold stocks made some great gains and investors such as yours truly were happy to take good profits on the gold mining companies we had bought over the summer doldrums . However we should have seen a much better performance.

During the last major rally in gold prices, gold stocks made some great gains and investors such as yours truly were happy to take good profits on the gold mining companies we had bought over the summer doldrums . However we should have seen a much better performance.

Firstly, lets take a look at some of the main investment vehicles.

Physical gold bullion: There are advantages to holding the actual metal in your hand, but there are issues regarding secure storage and liquidity. However this is still a relatively “safe” way to play the gold bull market.

Gold ETF's: These will track the price of gold almost exactly. However, not all ETF's hold physical bullion, so not all are “as good as gold”.

Gold Stocks: These companies will (hopefully) make more money with higher gold prices as they can sell every ounce of gold mined for so much more. Therefore the stock price should rise with rising gold prices at a ratio somewhere between 2 and 4 to 1.

Derivatives : These financial instruments include futures, forwards, options, and swaps and are not for every investor, but provide the greatest leverage to the gold price. However these are usually favoured by traders who have a shorter-term outlook than investors.

Usually the investors will opt for one of the first three vehicles, with derivatives being somewhat of a specialist area.

We have chosen to invest in gold stocks as we wanted to be able to close positions swiftly if necessary and we liked the leverage to the gold price that gold stocks offered.

Although we do hold a small amount of bullion “just in case…” the majority of our capital has been invested in gold stocks as we could buy and sell at the click of a button and gain a decent leverage to rising gold prices. We like the idea of being able to virtually trade gold bullion with an ETF but we didn't see the point in buying a gold ETF when the stocks provided sufficient liquidity and more leverage.

But now the whole investment landscape is changing…

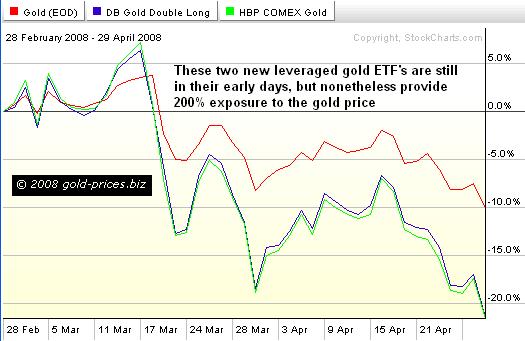

The whole problem that we had with the gold ETF's is that they didn't offer the same leverage as gold stocks. However these new leveraged ETF's may solve this problem.

In the last couple of months we have seen the emergence of some new gold ETF's offering 200% exposure to the gold price. With many gold stocks barely offering 1:1 leverage to gold in the recent rally, these investment vehicles appear very attractive to us, and no doubt other gold bugs.

In fact, with these new leveraged gold ETF's is there actually a need to own gold stocks?

We do not see the reason to own gold stocks if an ETF is going to offer you decent leverage that is actually tied to the gold price, not to a company's press releases. Remember a stock can be affected by rising production costs and political instability in area of mining. In addition to this if one is not investing in mining companies, one does not have to devote time to the analysis of geological results, management teams, balance sheets and company operations. This leaves more time for gold itself, the general market and the economy, which should lead to better investment decisions as one can concentrate on the precious metals bull market, rather than company details.

So we see very little reason to buy positions in gold stocks in the future and we are going to give some serious thought to moving from mining companies to leveraged ETF's over the coming months. If 200% exposure isn't enough, then one can always buy on margin and increase that leverage to 400%. One can also go short by buying an inverse ETF, allowing one to profit from both the ups and downs of the bull. Gold stocks may get a boost in the final leg of the bull market though, as “the herd” stampedes in and forks out cash for anything that glitters. And of course, the gold mining companies will still make a lot of money as gold prices continue to rise, but we feel the ETF's offer a slightly better deal. Also, bear in mind that the 200% leverage offered by ETF's is a mathematical relationship, whereas the leverage from mining stocks is a rough estimate of what might happen, in other words: a hopeful guess.

Aside from taking profits on some of our holdings in late February, we haven't gone out and dumped all our stocks. We still hold a core position but we are considering transferring this to an ETF based portfolio and we will most probably use cash generated by our February profit taking to begin to build positions in leveraged gold ETF's when we feel that this correction has run its course and begun to consolidate

By Bob Kirtley

These are fast changing times and its essential that you stay up to date with what is going on in the market . For our latest commentary and trading signals on gold, click here to subscribe to The FREE Gold Prices Newsletter and click here for The FREE Silver Prices Newsletter.

DISCLAIMER : Gold Prices makes no guarantee or warranty on the accuracy or completeness of the data provided on this site. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This website represents our views and nothing more than that. Always consult your registered advisor to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this website. We may or may not hold a position in these securities at any given time and reserve the right to buy and sell as we think fit.

Bob Kirtley Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.